Koba Gvenetadze: “We had a current account deficit at a historic low in 2019 and we expect the worst in 2020. This very factor created pressure on exchange rate and it was transmitted to inflation”.

Verdict: FactCheck concludes that Koba Gvenetadze’s statement is TRUE.

Resume: Georgia’s current account deficit in 2019 was USD 957 million, constituting 5.5% of the country’s GDP. Historically speaking, the 5.5% deficit is Georgia’s best performance. According to the available data of the first three quarters of 2020, Georgia’s current account deficit amounted to USD 1.4 billion which significantly exceeded the respective figure of the same period of the previous year. Of additional note is that the current account deficit usually deepens in the fourth quarter as compared to the previous quarters. Therefore, there are all reasons to assume that Georgia will have one of the deepest current account deficits in 2020 in years.

Foreign currency inflow causes an appreciation of the GEL exchange rate. Therefore, the deepening of the current account deficit negatively affects the exchange rate. A depreciation of the national currency exchange rate entails a number of negative consequences. In particular, the price growth caused by the GEL depreciation is reflected in the inflation figure since this depreciation renders certain imported goods expensive. The impact of the GEL depreciation on inflation can be offset by various factors although the correlation between these two economic parameters is indirect and is manifested in different scales and in different situations. However, all things being equal, the sharp and long-term depreciation of the GEL exchange rate sparks significant inflationary pressure in spite of the fact that the lockdown-induced drop in aggregate demand limits price growth to a certain extent.

Analysis

The President of the National Bank of Georgia, Koba Gvenetadze, speaking on the ongoing pandemic-induced crisis, stated (from 09:30): “We had a current account deficit at a historic low in 2019 and we expect the worst in 2020. This very factor created pressure on the exchange rate and it was transmitted to inflation.”

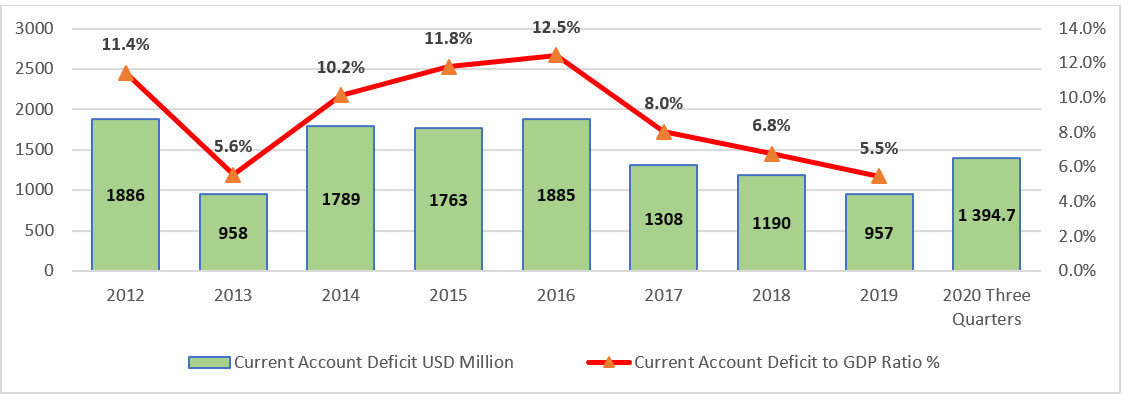

A country’s balance of payments includes comprehensive data about money inflows and outflows. It also illustrates the movement of money between the economy of a specific country and the rest of the world. A country’s balance of payments consists of its current account, capital account and financial account. A current account includes the component of trading with goods and services as well as incomes and transfers. The income component shows inflows of income from abroad (specifically, labour remuneration and investment income) and incomes transferred from Georgia. Transfers include current transfers between the residents and non-residents of a country (for instance grants, financial assistance). Georgia’s current account is shown in Graph 1.

Graph 1: Georgia’s Current Account Deficit Dynamic in 2012-2020

Source: National Bank of Georgia

Georgia’s current account deficit in 2019 was USD 957 million, constituting 5.5% of the country’s GDP. Historically speaking, the 5.5% deficit is Georgia’s best performance. The structure of Georgia’s current account deficit is given in Graph 2. According to the available data for the first three quarters of 2020, Georgia’s current account deficit amounted to USD 1.4 billion which significantly exceeded the respective figure of the same period of the previous year. Of additional note is that the current account deficit usually deepens in the fourth quarter as compared to the previous quarters. Therefore, there are all reasons to assume that Georgia will have one of the deepest current account deficits in 2020 in years.

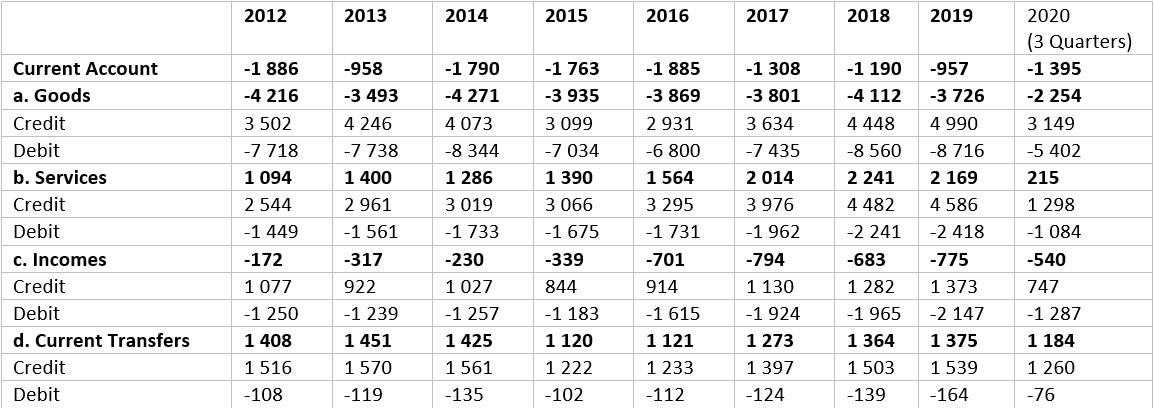

The detailed statistics of the current account deficit in the past years are shown in Graph 2. The credit component refers to the currency income and the debit refers to expenses (these components are balanced in the capital account or the financial account). It is obvious that the current account deficit in 2020 was stipulated by a drop in service export and certainly it was because of the pandemic-induced halt of the tourism industry. In particular, the income balance from the travel component amounted to USD 340 million according to the data of the first three quarters of 2020 which is USD 1.7 billion less as compared to the same period of the previous year.

Graph 2: Detailed Current Account in 2012-2020 (Three Quarters, USD Million)

Source: National Bank of Georgia

As compared to the beginning of 2020, the GEL exchange rate vis-à-vis USD depreciated by almost 14% and by nearly 90% as compared to 2014. Under the floating exchange rate, the currency exchange is determined by supply and demand similar to other market goods. Naturally, foreign currency inflow results in the appreciation of the GEL exchange rate. Therefore, the deepening of the current account deficit negatively affects the GEL exchange rate. The depreciation of the national currency exchange rate entails a number of negative consequences. Certainly, the depreciation of the national currency exchange rate entails a number of negative consequences. This includes a debt service burden for those individuals who have income in GEL and obligations in a foreign currency as well as making some import and foreign travel more expensive. The price growth caused by the GEL depreciation is reflected in the inflation figure since the depreciation of the national currency renders certain imported goods expensive. The impact of the GEL depreciation on inflation can be offset by various factors although the correlation between these two economic parameters is indirect and is manifested in different scales and in different situations. However, all things being equal, the sharp and long-term depreciation of the GEL exchange rate sparks significant inflationary pressure in spite of the fact that the lockdown-induced drop in aggregate demand limits price growth to a certain extent.