Resume:

The GEL exchange rate decrease (depreciation) vis-à-vis USD and EUR has been one of the most problematic issues of the past years. GEL started a sharp depreciation in November 2014 and lost nearly 80% of its value whilst the depreciation equals 90% if compared to 2012. The GEL exchange rate is affected by multiple factors which can conditionally be divided into those internal and those external. Given political motivations, the GEL exchange rate is often linked solely to internal factors or solely to external factors in order to show a half-truth. To avoid speculations, we need to take a look at the full picture.

External factors proved to be problematic both at regional and international levels. Of note is the appreciation of USD which was followed by a depreciation of almost all other currencies vis-à-vis USD. The currencies of Georgia’s neighbour countries have also experienced depreciations to some extent. As compared to 2012, the TRY to USD exchange rate has depreciated by 352%, RUB to USD by 151%, AMD to USD by 32% and AZN to USD by 117%. As a result of a sharp drop in world oil prices, oil-exporting countries became vulnerable both in terms of their economy and their currency exchange rate stability. In contrast to its larger economic partners, Georgia is not an oil-exporting country. However, tumbles in their economies or currency stability also find a reflection here on us. In addition, the aforementioned period has been quite difficult, heavily punctuated by a series of political and economic crises with the results of the pandemic being the most punishing on the world economic conjecture.

On the other hand, the Government of Georgia’s certain actions or inactions as well as a number of mistakes also negatively affected the GEL exchange rate, including the authorities’ response vis-à-vis foreign crises. For instance, there is the tightening of the visa policy, banning the sale of land to foreigners, demonstrating an inconsistent investor policy, the halt/delay of infrastructural projects and unequal budget spending, etc. The GEL’s sharp depreciation followed the so-called Gavrilov Crisis which was a grievous mistake even according to government representatives, let alone the opposition.

Analysis:

European Georgia – Movement for Freedom MP, Zurab Tchiaberashvili, stated in his speech before the Parliament of Georgia: “GEL depreciated twice in the last eight years due to a wrong economy [economic policy].”

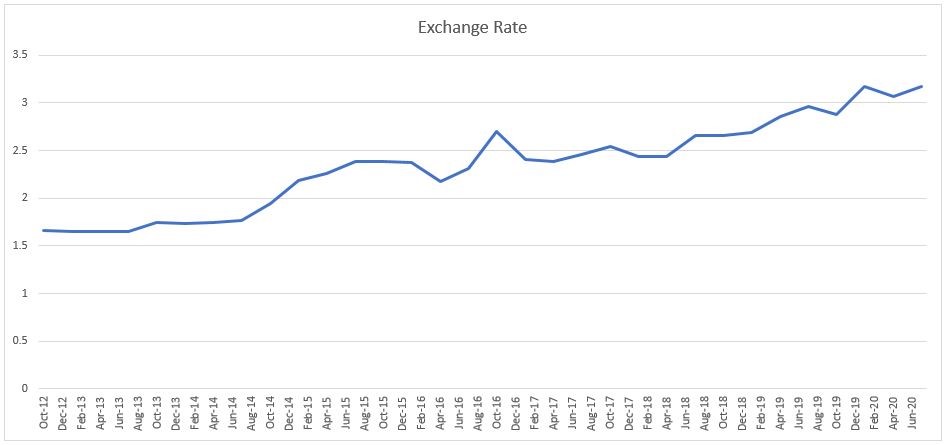

The GEL exchange rate decrease (depreciation) vis-à-vis USD and EUR has been one of the most problematic issues of the past years. GEL started a sharp depreciation in November 2014 and lost nearly 80% of its value whilst depreciation equals 90% if compared to 2012.

Graph 1: USD-to-GEL Average Monthly Exchange Rate in 2012-2020

Source: National Bank of Georgia

GEL has a floating exchange rate; that is, the GEL exchange rate at a specific margin is determined by the supply and demand proportion. In turn, many factors simultaneously do of course affect demand and supply and these factors can conditionally be divided into internal and external factors vis-à-vis the country. Given political motivations, the GEL exchange rate is often linked solely to internal factors or solely to external factors in order to show a half-truth. To avoid speculations, we need to take a look at the full picture.

External factors proved to be problematic both at regional and international levels. Of note is the appreciation of USD which was followed by a depreciation of almost all other currencies vis-à-vis USD. The currencies of Georgia’s neighbour countries have also experienced depreciations to some extent. Graph 2 demonstrates the trend of Dollar Index changes. This index reflects the so-called “strength” of the USD vis-à-vis other currencies and is measurement of the USD foreign exchange value as compared to the US trade partner currency basket as a weighted geometric mean. The currency basket consists of EUR, JPY, GBP, CAD, SEK and CHF. EUR is the largest component of the index. When the Dollar Index rises, all things being equal, the exchange rates of other world currencies vis-à-vis USD drops (depreciates).

Graph 2: Dollar Index in 2012-2020

Source: Tradingview.com

The currencies of Georgia’s neighbour countries have also experienced depreciations to some extent. As compared to 2012, the TRY to USD exchange rate has depreciated by 352%, RUB to USD by 151%, AMD to USD by 32% and AZN to USD by 117%. As a result of a sharp drop in world oil prices, oil-exporting countries became vulnerable both in terms of their economy and their currency exchange rate stability. In contrast to its larger economic partners, Georgia is not an oil-exporting country. However, tumbles in their economies or currency stability also find a reflection here on us. In addition, the aforementioned period has been quite difficult, heavily punctuated by a series of political and economic crises. Of mention is the attempted coup d’état in Turkey, the Russia-Ukraine crisis and the Syrian crisis with the ongoing pandemic being especially damaging. Of course, all of the aforementioned factors would have a negative impact upon Georgia and these countries. In such circumstances, a GEL depreciation was inevitable because otherwise the country’s trade deficit would have been further deepened (since Georgia’s exports would have become expensive whilst imports would be cheaper) and it is highly likely that Georgia would have ended up in an economic crisis. This is precisely the function of a floating exchange rate – to absorb a foreign shock impact in the currency exchange rate and prevent an economic downturn.

Of mention, on the other hand, is that certain actions of the Government of Georgia as well as inactions and a number of mistakes also negatively affected the GEL exchange rate. For instance, the tightening of the visa policy, the ban on the sale of land to foreigners, demonstrating an inconsistent investor policy, the halt/delay of infrastructural projects and unequal budget spending, etc (see link 1, link 2, link 3). The GEL’s sharp depreciation followed the so-called Gavrilov Crisis which was a grievous mistake even according to government representatives, let alone the opposition.

![GEL depreciated twofold in the last eight years due to a wrong economy [economic policy].](https://factcheck.ge/storage/files/320x180/7c2bdb40-0a17-11eb-bb92-47642d236e56.jpg)