Resume: Inflation is a general growth of consumer prices and is measured by the Consumer Price Index. At the same time, the GEL-USD exchange rate is an indicator of how much GEL is needed to purchase USD 1 on the international market. A currency exchange rated is determined by demand and supply on foreign currency.

Koba Gvenetadze aims to give credence to the argument that there is no direct relation between the GEL-USD exchange rate and the inflation rate. The GEL exchange rate on inflation can indeed be counterbalanced by some other factors and in fact these two economic parameters do have an indirect relation which is manifested at different scales and in different situations. According to the statement of the President of the National Bank of Georgia, in 2004-2016 when GEL exchange rate was stable, the annual inflation rate was 5.6% on average, whilst in 2015-2019 when GEL was in depreciation, the inflation rate is less at 3.9%. Naturally, apart from an indirect relation between the inflation and the currency exchange rates, there are numerous other factors affecting these indicators. These factors also include economic growth since high economic growth generates pressure to increase prices. At the same time, Mr Gvenetadze’s statement is both factually and contextually true.

Analysis

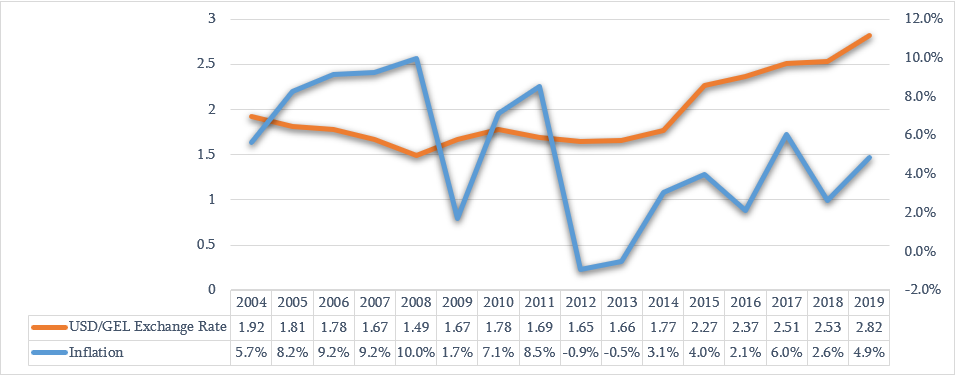

The President of the National Bank of Georgia, Koba Gvenetadze, stated: “In 2004-2016 when the GEL exchange rate was stable, the annual inflation rate was 5.6% on average whilst in 2015-2019 when GEL was in depreciation, the average inflation rate is less at 3.9%. In addition, given the fact that in 2017 the inflation rate exceeded the targeted figure as a result of a one-off increase in excise tax, the real figure would be 3.4%. All things being equal, the population’s purchasing power is determined not by the national currency exchange rate but by the inflation rate.”

The GEL-USD exchange rate is an indicator of how much GEL is needed to purchase USD 1 on the international market. A currency exchange rate is determined by demand and supply on foreign currency. There are numerous factors affecting demand and supply and discussing or quantifying all of them is sometimes even impossible. The important realm for the analysis is the balance of payments and the events which shape economic and political conjecture and, subsequently, expectations. The most commonly accepted indicator of the currency exchange rate is the GEL to USD currency exchange rate.

Inflation is a general growth in consumer prices and is measured by the Consumer Price Index with the National Statistics Office of Georgia doing the measurement. In time, the currency’s purchasing power decreases as a result of inflation and currently one can buy less goods and services with GEL 1 than he could previously. Consumer inflation is measured by the Consumer Price Index which includes prices in 12 large groups of goods. These groups are as follows: 1) food and non-alcoholic beverages, 2) alcoholic beverages and tobacco, 3) garments and footwear, 4) accommodation, water, energy, gas, 5) furniture, household items, house repair, 6) healthcare, 7) transport, 8) communication, 9) vacation, leisure and culture, 10) education, 11) hotels, cafes and restaurants and 12) different goods and services.

GEL started a sharp depreciation in November 2014 which was stipulated by combination of internal and external factors (see FactCheck’s article) and lost nearly 80% of its value vis-à-vis USD if compared to 2012 and 20% if compared to the beginning of 2020. Some politicians and people often equate the GEL depreciation against USD and inflation and make calculations of certain economic data in USD which is a wrong approach. Obviously, the depreciation of the national currency entails many negative consequences which include more expensive debt service for those who have income in GEL and debt obligations in foreign currency as well as more expensive imports, foreign travel, etc. However, in spite of these, it is still wrong to make a conversion to USD whilst analysing people’s incomes since GEL is the only legal tender in Georgia and people’s expenses are mostly denominated in GEL. It needs to be emphasised that since the depreciation of the national currency makes some imported goods more expensive, a price increase caused by the GEL depreciation is reflected on the inflation rate.

Koba Gvenetadze aims to give credence to the argument that there is no direct relation between the GEL-USD exchange rate and the inflation rate. The GEL exchange rate as it affects inflation can indeed be counterbalanced by some other factors and in fact these two economic parameters do have an indirect relation which is manifested at different scales and in different situations.

Graph 1: Annual GEL Exchange Rate (Against USD) and Inflation in 2005-2019

Source: National Statistics Office of Georgia, National Bank of Georgia

According to the statement of the President of the National Bank of Georgia, in 2004-2016 when the GEL exchange rate was stable, the annual inflation rate was 5.6% on average whilst in 2015-2019 when GEL was in depreciation, the inflation rate is less at 3.9%. Naturally, apart from the indirect relation between the inflation and the currency exchange rates, there are numerous other factors affecting these indicators. These factors also include economic growth since high economic growth generates pressure to increase prices. At the same time, Mr Gvenetadze’s statement is both factually and contextually true.