Resume: One of the National Bank’s main functions is to ensure price stability. Since 2009, the National Bank of Georgia’s monetary policy has been inflation targeting. Currently, the targeted inflation rate is 3% and was 4% in 2017. Inflation can be stipulated by multiple factors and the National Bank lacks the leverage to influence some of them. These factors can be considered as exogenous; that is, external factors.

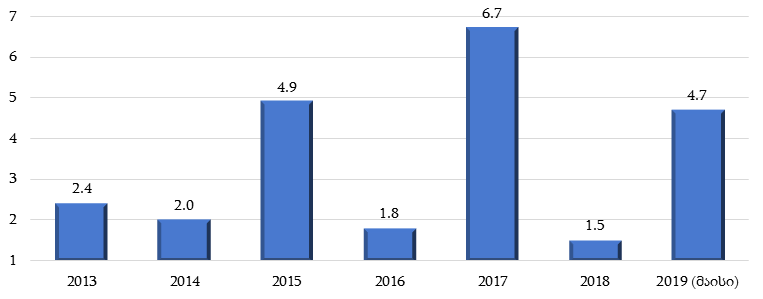

Since January 2017, the excise tax rate has increased on petroleum products and tobacco. In addition to the fact that increased fuel prices directly impact the inflation figure, fuel is an intermediary product for a number of goods and services. Therefore, an increase or decrease in fuel prices are related to the general price level. In 2017, the annual inflation rate was 6.7% which is 2.7 percentage points higher as compared to the respective targeted inflation figure. The share of alcoholic beverages and tobacco was 1.12% in December 2017 as compared to the same month of the previous year whilst the share of the transport category, part of which is fuel prices, was 1.94%. In 2018, the impact of the excise tax rate gradually subsided and annual inflation constituted 1.5%. Therefore, an increase in prices was low in other consumer categories, too.

As of May 2019’s data, the annual inflation rate is 4.7% which is 1.7 percentage points higher as compared to the targeted 3%. Of note is that the increase in the prices of food and non-alcoholic beverages has the largest share in the growth. In accordance with the information of the National Statistics Office of Georgia, prices in this group increased by 7.9% which increased the general price level (in every consumption group); that is, annual inflation by 2.43 percentage points. In the same period, the contribution of alcoholic beverages, tobacco and transport in the total inflation was 1.77%. Therefore, the high rate of inflation is stipulated more by an increase in prices for food and non-alcoholic beverages rather than as a result of the total impact of the increase in prices for fuel and tobacco which the President of the National Bank failed to mention. However, if the excise tax rate had not increased, factual inflation would still not have been significantly different from the targeted inflation figure.

The statement of the President of the National Bank largely corresponds to the truth. However, the increase in prices in the group of food and non-alcoholic beverages has a large share in annual inflation and without pointing this out, the statement cannot be assessed as completely true.

Analysis

At the parliamentary committee hearing, the President of the National Bank of Georgia, Koba Gvenetadze, stated: “In 2017, exogenous (independent from the National Bank’s influence) factors significantly affected inflation figures. At the beginning of 2018, the impact of the increased excise tax on tobacco and tobacco products – enacted in the previous year – subsided and as anticipated, annual inflation figures dropped significantly. We are dealing with the same issue this year when the inflation rate is kept higher than the targeted level owing to increased prices on tobacco and oil.”

Inflation is a process of increase in the general level of prices. If in a certain period of time more money is needed to purchase goods and services as compared to a previous period, then we have inflation. The Consumer Price Index (CPI) is used to measure inflation. The CPI measures changes in the general level of consumer prices in a country. The consumer basket includes 306 goods and services of general consumption which are distributed into 12 groups.

One of the National Bank’s main functions is to ensure price stability. Since 2009, the National Bank of Georgia’s monetary policy regime has been inflation targeting. Under this regime, the targeted inflation level, which has to be maintained in a medium-term period, is determined beforehand. Currently, the targeted inflation rate is 3% and was 4% in 2017. Inflation can be stipulated by multiple factors and the National Bank lacks the leverage to influence some of them. These factors can considered as exogenous; that is, external factors.

Since 1 January 2017, the excise tax rate has increased on petroleum products and tobacco. The aim of the changes was to offset anticipated losses in the budget tax income component after profit tax reform. As a result, income from profit tax increased by GEL 316 million in 2017 whilst income from excise tax increased by GEL 365 million. Therefore, prices have increased on tobacco and petroleum products. In addition to the fact that increased fuel prices directly impact the inflation figure, fuel is an intermediary product for a number of goods and services. Therefore, an increase or decrease in fuel prices are related to the general price level. In 2017, the annual inflation rate was 6.7% which is 2.7 percentage points higher as compared to the respective targeted inflation figure. The share of alcoholic beverages and tobacco was 1.12% in December 2017 as compared to the same month of the previous year whilst the share of the transport category, part of which is fuel prices, was 1.94%.

Graph 1: Annual Inflation in 2013-2019 (%)

Source: National Statistics Office of Georgia

In 2018, the impact of the excise tax rate gradually subsided and annual inflation constituted 1.5%. Therefore, the increase in prices was low in other consumer categories, too.

As of May 2019’s data, the annual inflation rate is 4.7% which is 1.7 percentage points higher as compared to the targeted 3%. Of note is that the increase in prices of food and non-alcoholic beverages has the largest share in this growth. In accordance with the information of the National Statistics Office of Georgia, prices in this group increased by 7.9% which contributed to an increase in annual inflation by 2.43 percentage points. In the same period, the contribution of alcoholic beverages, tobacco and transport to the total inflation was 1.77%. Therefore, the high rate of inflation is stipulated more by an increase in the prices for food and non-alcoholic beverages rather than as a result of the total impact of the increase in prices for fuel and tobacco. However, if the excise tax rate had not increased, factual inflation would still not have been significantly different from the targeted inflation figure.