In his special statement about the GEL crisis, the former Prime Minister of Georgia, Bidzina Ivanishvili, said that the inaction or incorrect actions of the President of the National Bank of Georgia, Giorgi Kadagidze, who was appointed by the United National Movement, led the country to the currency crisis. Mr Ivanishvili also pointed out that it is the constitutional duty of the National Bank to stabilise the GEL exchange rate. He said that the central banks of foreign countries sacrificed large portions of their currency reserves in order to maintain the stability of their national currencies. As an example, he talked about Armenia and Moldova which spent 34% and 30% of their currency reserves, respectively, guaranteeing the stability of their national currencies. According to Mr Ivanishvili, the National Bank of Georgia spent only 5% of its foreign currency reserves, or USD 120 million, which was not enough to stabilise the exchange rate. He also pointed out that the GEL exchange rate with regard to USD should not be exceeding 2.0.

FactChecktook interest in this issue and verified the accuracy of Mr Ivanishvili’s statement.

The status of the National Bank of Georgia is determined by the Constitution of Georgia. Point 95, Article 1 of the Constitution says: "The National Bank of Georgia conducts the monetary policy of the country in order to maintain the stability of prices and facilitates the effective functioning of the financial sector." Hence, Mr Ivanishvili’s insistence that the National Bank should fulfill its constitutional duty to maintain the stability of the exchange rate is not correct as the main goal of the National Bank is to maintain the stability of prices in the country. If the depreciation of GEL raises the risks of inflation, only then will the National Bank be obligated to reduce the amount of GEL in the economy which will both slow down the inflation process and have a positive influence upon the exchange rate of the currency. However, it will negatively affect the economic growth of the country.

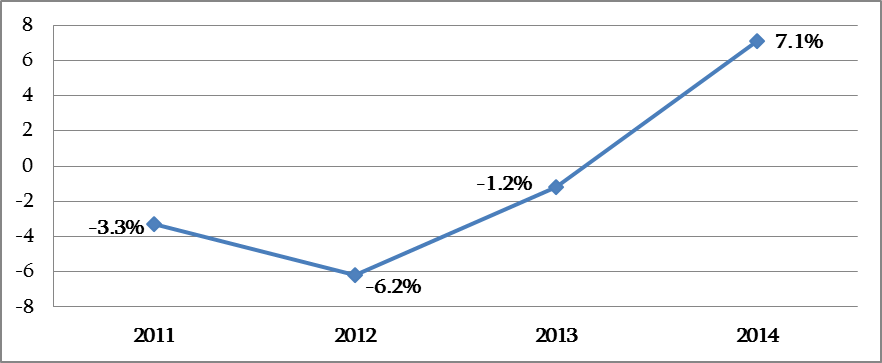

The GEL exchange rate has significantly depreciatedduring the past year.

Chart 1:

GEL Exchange Rate with Regard to USD and EUR

Source: National Bank of Georgia

Source: National Bank of Georgia

It should be noted that in the beginning, Bidzina Ivanishvili did not see a problem in the depreciation of GEL. On 26 January 2015, on air on Imedi TV, he stated that there were no signs of a currency crisis in the country. The exchange rate of GEL with regard to USD was already 2.06 by that time.

The official foreign currency reserves of the National Bank of Georgia amounted to USD 197 million in 2004. This amount had grown to USD 2.96 billion by February 2013. There were numerous internal or external problemsin Georgia from 2004 to 2013. Despite this, the nominal amount of foreign currency reserves grew 15-fold during these years. The foreign currency reserves of the National Bank of Georgia decreased by USD 297 million in the past two years. The National Bank of Georgia acquired a total of USD 200 million on currency auctions and sold USD 480 million from 2014 to 19 March 2015. The net sales of the National Bank by 26 February 2015, when Mr Ivanishvili made his statement, amounted to USD 220 million.

It should also be noted that the amount of GEL in the economy was also influenced by the growth of the refinancing loans. The amount of the national currency in circulation (the most liquid part of the money supply) increased by an unprecedented GEL 241.5 million in December 2014 as compared to November of the same year. However, it decreased again by GEL 197.5 million in January 2015. The amount of money reserves increased by GEL 450 million in December but then decreased by GEL 390 million in January.

As for the countries mentioned by Mr Ivanishvili, the international reserves of Armenia decreased by 34% in 2014 and 10.2% in 2015. The currency reserves of Moldova decreased by 23.5% in 2014 and 16.5% in 2015. Mr Ivanishvili relayed these data almost completely accurately; however, it should be noted that Russia is the main trade partner of the aforementioned countries and the economic crisis there has a direct influence upon them. It should also be pointed out that the planned economic growth of Moldova was 4% in 2014 whilst in Armenia it was 3.5%; however, according to the January 2015 studyof the European Bank for Reconstruction and Development, the forecasts of economic growth in Armenia and Moldova decreased to 0%. According to the National Bank of Armenia, the economic growth forecasts for 2015 vary from 0.4% to 2%. In general when a national bank spends its foreign currency reserves, the amount of the national currency in the economy decreases. Hence, the overall demand decreases as well. This influences the economic growth negatively.

It should be pointed out that from 1 January 2015 MDL (Moldovan Leu) depreciated more (about 21%) than GEL (about 19%). AMD (Armenian Dram) also depreciated. With regard to USD 1 it depreciated from AMD 411 to AMD 482 (about 17.2%) from 1 November 2014 to 15 March 2015.

The exchange rate of a national currency is determined by the internal demand on it and the influx and outflow of foreign currency (international trade, money transfers, tourism, influx of investment and credit capital and factor revenues). Saying that the exchange rate of the currency should not be exceeding 2.0 is economically wrong. The Georgian national currency has a floating exchange rate, not a fixed one. In terms of a fixed exchange rate, a national bank works to maintain the exchange rate at a specific level. The floating exchange rate means that the exchange rate of a national currency is determined by market principles (demand and supply).

Conclusion

The exchange rate of GEL with regard to USD was 1.75 in February 2014. It equalled 2.26 in February 2015 whilst by 31 March 2015 it went down to 2.23.

According to the Constitution of Georgia, the main function of the National Bank of Georgia is to maintain the monetary stability of the country (inflation control). Hence, the part of Bidzina Ivanishvili’s statement where he says that the National Bank of Georgia must fulfil its constitutional duty to maintain the stability of the GEL exchange rate is inaccurate.

From November 2014 to February 2015 the National Bank of Georgia sold a total of USD 200 million on currency auctions. This is USD 80 million more than stated by Bidzina Ivanishvili. The Central Bank of Armenia spent 34% of its currency reserves in 2014 whilst the Central Bank of Moldova spent 23.5%. Despite this fact, their currencies still depreciated with regard to USD – by 21% in Moldova and by 17% in Armenia. Mr Ivanishvili states these numbers more or less accurately but he is incorrect to say that the National Bank of Georgia will hurt the economic stability of the country by not spending as much of its foreign currency reserves as other countries.

It should also be noted that the economic growth rates of Moldova and Armenia decreased significantly in 2015 which, among other things, was influenced by the spending of foreign currency reserves as well.

FactCheck concludes that Bidzina Ivanishvili’s statement is FALSE.

The actions of the National Bank of Georgia led to the currency crisis.

The actions of the National Bank of Georgia led to the currency crisis.