Delivering a speech at the plenary sessions of the Parliament of Georgia on 13 November and 11 December, the Minister of Finance of Georgia, Nodar Khaduri, discussed the economic situation of Georgia and touched upon the matter of the government debt. In his speech the Minister stated: “Even though we are planning to increase the volume of state debt in the following year, in 2013 and 2014 the amount of debt repaid from the budget will exceed the loan taken by the government. This is the legacy which we received from the previous government. During two years (2013 and 2014), we will be compelled to allocate GEL 1,700 million for the repayment of debt which will primarily cover the loans taken in 2008 and 2009. Over the last years, the state has never repaid more than 300 million in a year. This is exclusive of 2012 when the repaid amount totalled GEL 380 million. As for external debt, in 2014, we intend to shrink the principal amount of debt by GEL 500 million and the interest – by around GEL 187.188 million. In the coming year, for instance, we are going to have to return GEL 50 million to Germany, GEL 18 million – Russia, GEL 18 million – France and up to GEL 340 million – to the International Monetary Fund. The volume of external debt rose from 1.5 billion to 4.5 billion during the governance of the United National Movement. Over the year 2013, we decreased the principal of the external debt by GEL 350 million and paid GEL 120 million of interest. In 2013 we also repaid GEL 170 million of the Eurobonds issued by the United National Movement in the amount of EUR 500 million.”

FactCheckinquired about the management of the government debt, the general statistics of the debt and verified the accuracy of the statement voiced by the Minister of Finance.

Table 1: Statistical Data on the Variation of Liabilities

As can be gathered from the table above, the increase of liabilities was varying continually in the period between 2008 and 2011. In 2011 the amount of the taken debt is almost halved as compared to 2010, to be more precise, it decreases by GEL 712 million and then takes an upturn again. In 2014 the volume of debt grows by 1.8 times as compared to 2013 and reaches GEL 1,636 million. The sum of debts taken in 2013 and 2014 equals GEL 2,504 million while the decrease of total liabilities amounts to GEL 1,147 million. It becomes evident from the given figures that the volume of debt to be taken in 2013 and 2014 exceeds the projected decrease of liabilities by GEL 1,357 million. Therefore, the statement of the Minister of Finance: “Even though we are planning to increase the volume of state debt in the following year, in 2013 and 2014 the amount of debt repaid from the budget will exceed the loan taken by the government,” is not accurate.

It is also to be added that in line with the 2013 state budget presented by the previous government, the increase of liabilities was forecast at GEL 816 million which is only GEL 52 million less than the figure presented by the current government – GEL 868 million.

As noted above, in 2013 and 2014 the government is planning to repay a particularly large amount of debt in comparison to the previous years – GEL 1,147 million, but this figure is GEL 553 million less than the number named by the Minister – 1,700 million. The abovedescribed data also reveals that the largest amount of debt (aside from 2014) was taken in 2008, 2009 and 2010. According to the information given in the budget, the debt repayments of 2013 and 2014 are chiefly designated for covering the debts taken in 2008, 2009 and 2010. Consequently, the Minister rightfully claims: “During two years (2013 and 2014), we will be compelled to allocate GEL 1,700 million for the repayment of debt which will primarily cover the loans taken in 2008 and 2009.”

Table 2: Statistical Data on Decrease of Liabilities

As can be seen in the table, the funds earmarked for the decrease of liabilities in the period from 2004 to 2013 varied greatly but never exceeded GEL 300 million with the only exception of 2009 when the allotted sum amounted to GEL 349 million. This fact partially confirms the statement of the Minister of Finance: “Over the last years, the state has never repaid more than 300 million in a year.”

The data given in the table includes the decease of solely the principal amount of the debt as the decrease of liability implies the reduction of the principal and the payment of interest rates. The table also shows that in 2012 liabilities saw a decrease of GEL 139 million and this indicator is almost three (2.7) times less than the figure indicated by the Minister of Finance – GEL 380 million. If we add to the principal GEL 139 million the amount paid in 2012 for covering the charged interest rates, then the total amount allocated for the repayment of government debt will add up to GEL 379 million. This figure precisely corresponds to the number named by Nodar Khaduri. However, as previously noted, given that the decrease of liability includes the reduction of solely the principal amount of the debt, the part of Nodar Khaduri’s statement claiming: “This is exclusive of 2012 when the repaid amount totalled GEL 380 million,” is incorrect.

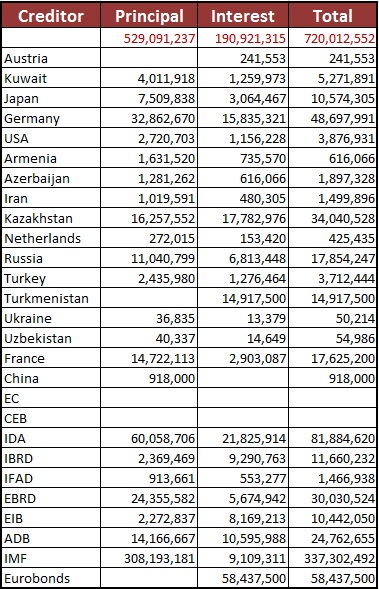

Table 3: Repayment of Foreign State Liabilities in 2014 (GEL)

The table depicted above informs that the government plans to administer a total of GEL 720 million for the repayment of debt of which the principal amount equals GEL 529 million while the interest adds up to GEL 190 million. A total of GEL 49 million is to be repaid to Germany, to Russia and France – GEL 18 million each, the International Monetary Fund – GEL 337 million. The indicated figures confirm that the statement of the Minister of Finance regarding the external debt: “In the coming year, for instance, we are going to have to return GEL 50 million to Germany, GEL 18 million – Russia, GEL 18 million – France and up to GEL 340 million – to the International Monetary Fund,” accurately represents the reality.

In line with the statistical data on the external state debt published on the website of the Ministry of Finance, as of 31.12.2003 the remainder of the government foreign debt amounted to USD 1,852 million, while as of 31.10.2012 the remainder totalled USD 4,373 million. These figures differ only slightly from the assertion made by Nodar Khaduri: “The volume of external debt rose from 1.5 billion to 4.5 billion during the governance of the United National Movement.”

In accordance with the 2013 budget execution report for three quarters, in the nine-month period foreign liabilities saw a reduction of GEL 403 million of which the principal amounts to GEL 316 million and the interest totals GEL 87 million. The liabilities ensued from issuing Eurobonds have also decreased by a total of GEL 139 million; that is, the principal equals GEL 107 million and the interest adds up to GEL 32 million. These indicators mostly diverge from the data given in the statement of the Minister of Finance: “Over the year 2013, we decreased the principal of the external debt by GEL 350 million and paid GEL 120 million of interest. In 2013 we also repaid GEL 170 million of the Eurobonds issued by the United National Movement in the amount of EUR 500 million.”

For the sake of exploring the matter in greater in depth, it is of interest to discuss briefly the purpose of the domestic debt to be taken in 2014 in the amount of GEL 200 million. As is well known, the (net) domestic debt is projected to increase by GEL 600 million in 2014. The government intends to borrow GEL 600 million from commercial banks (through issuing securities) and lend GEL 200 million back to the banks. As reported by the National Bank of Georgia and the Audit Office, the details and the mechanism of how the securities with the total value of GEL 200 million are to be issued and then deposited into the banks are still unknown and being defined in the course of ongoing consultations. In general, however, according to the 2014 state budget its essence can be defined as follows: the said GEL 200 million is to be used for ensuring the supply of long-term resources to the state economy. This entails the emission of state securities with the maturity of two and five years in the preliminarily specified amount and offering them to commercial banks for the same term and at an interest rate which will exceed the initial interest rate of the emission. Consequently, commercial banks will be given long-term resources for crediting the economy and they will have an opportunity to use the securities for satisfying short-term demands.

Table 4: Statistical Data on Government Debt

As can be derived from the above table, the government debt is characterised by the tendency of decrease from 2004 to 2008 while starting from 2008 it takes an upturn (the aftermath of the Russia-Georgia war). In the years 2008, 2009 and 2010, debts are increasing at an average rate of 1.2 as compared to the preceding years. Beginning from 2010 the debt growth rate falls but in 2014 the volume of debts increases again by 1.2 times as compared to the figure of 2013.

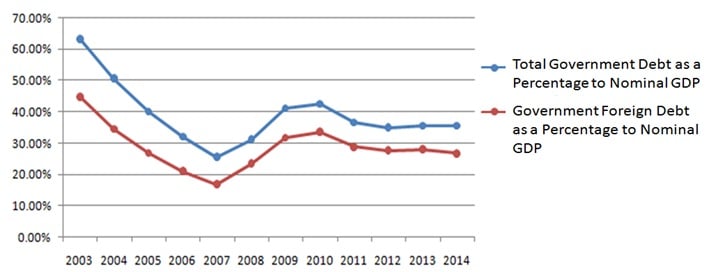

Graph 1: Government Debt in Respect to Nominal GDP

The above graph shows that the percentage of the state foreign debt in respect to the nominal GDP keeps falling throughout several years starting from 2003 until 2007 while from 2007 to 2010 we observe a tendency of increase. Beginning from 2010 until 2012 the percentage starts falling again and in 2012 drops to 34.8%. In line with the forecast of 2013 and 2014 the indicator is to rise to 35.5%. These findings reveal that despite the 1.2-fold growth of the 2014 state debt relative to 2013, it still preserves a stable ratio with the nominal GDP of the country. It should also be mentioned that pursuant to the Economic Freedom Act the total state debt is not to surpass 60% of the country’s GDP. Taking into consideration the given Act, we can reason that the volume of debt projected in the 2014 state budget – GEL 1,636 million and the defined debt limit in the amount of GEL 10,410 million, which comprises 35.5% of the country’s nominal GDP, would not be so alarming. Important is not to allow this tendency of growth to be sustained in the future.

Conclusion

At the plenary sessions held on 13 November and 11 December of 2013, the Minister of Finance of Georgia spoke about the statistics of the government debt and its management. Our research revealed that in 2013 and 2014 the government intends to borrow a total of GEL 2,504 million and repay the debt in the amount of GEL 1,147 million which will primarily cover the loans taken in 2008, 2009 and 2010. The volume of debt repaid in the course of the past years chiefly varied within the limit of GEL 300 million with the only exception being the year 2009 when the repaid debt amounted to GEL 349 million. The volume of debt repaid in 2012 equalled GEL 139 million and the same indicator projected for 2014 stands at GEL 720 million. Of this sum the principal amounts to GEL 529 million while the interest adds up to GEL 192 million. In addition the government intends to repay GEL 49 million to Germany in 2014, to Russia and France – GEL 18 million each and to the IMF – GEL 337 million. As of 31 December 2003, the external government debt amounts to USD 1,852 million and as of 31 October 2012 the volume of debt totals USD 4,373 million. In line with the budget execution report for the three quarters of 2013, foreign liabilities shrank by GEL 403 million of which the principal amount equals GEL 317 million while the interest amount is GEL 87 million. Additionally, according to the data of the nine months, the liabilities ensued from the issuing of Eurobonds have fallen by GEL 139 million of which GEL 107 million represents the principal amount while GEL 32 million is the sum accumulated through charged interest rates.

Accordingly, we conclude that the statement of the Minister of Finance, Nodar Khaduri: “In 2013 and 2014, the amount of debt repaid from the budget will exceed the loan taken by the government. In this period, the government will be compelled to allocate GEL 1,700 million for the repayment of debt while over the last years the state has never repaid more than 300 million in a year. This is exclusive of 2012 when the repaid amount totalled GEL 380 million,” is MOSTLY FALSE.

“In 2013 and 2014, the amount of debt repaid from the budget will exceed the loan taken by the government. In this period, the government will be compelled to allocate GEL 1,700 million for the repayment of debt while over the last years the state has nev

“In 2013 and 2014, the amount of debt repaid from the budget will exceed the loan taken by the government. In this period, the government will be compelled to allocate GEL 1,700 million for the repayment of debt while over the last years the state has nev