In July 2023, the volume of the National Bank’s international reserves surpassed the April record and reached USD 5.4 billion. However, instead of quantity, a greater focus is made on the adequacy of the reserves; that is, whether or not the reserves are sufficient to respond to the challenges arising in times of crisis. As of 2022, Georgia’s National Bank’s reserves were meeting the minimal requirements in line with the methodology of the International Monetary Fund. As stated by the acting President of the National Bank, Natia Turnava, foreign reserves remain within the zone of adequacy as of 2023.

In order to avoid external shocks during financial crises, as well as to ensure liquidity and support the Government of Georgia to make unhindered payments in foreign currency, the National Bank has its international reserves denominated in foreign currency. The management of these reserves is one of the functions of the National Bank (Article 3 of the Organic Law of Georgia on the National Bank of Georgia).

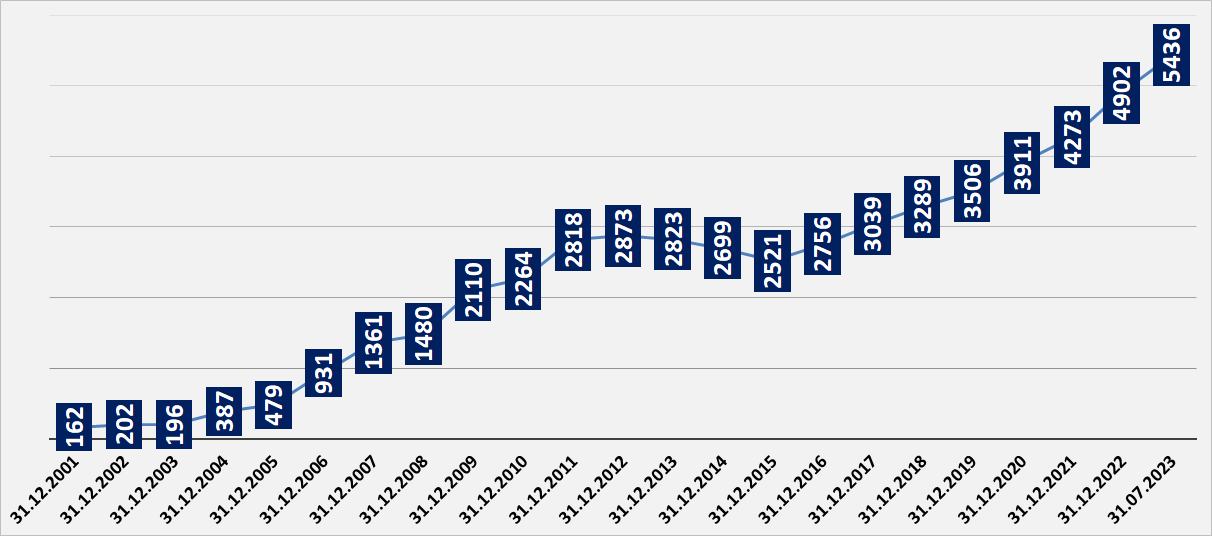

In October 1995, at the time when GEL was put into circulation, the volume of the international reserves was USD 171 million. During the currency crises in 1998-1999, it sometimes dropped below USD 100 million. In 2004-2012, however, international reserves rose sharply from USD 196 million (2003) to USD 2.9 billion.

In 2020, amid the largest economic downturn since the first half of the 1990s, the National Bank had to sell USD 873 million at currency auctions. However, in light of attracted grants and the significant growth of the foreign debt, the volume of the international reserves still increased from USD 3.5 billion to USD 3.9 billion.

At the moment of Russia’s invasion of Ukraine, the volumes of Georgia’s National Bank’s international reserves stood at USD 4 billion. Afterwards, the reserves have been regularly growing and exceeded USD 5.4 billion as of 31 July 2023.

In addition to the currency auction, the National Bank also trades on the BMatch platform where it bought USD 1.06 billion in January-June 2023.

Graph 1: Volume of International Reserves (USD Million)

Source: National Bank of Georgia

The international reserves are at a historic high, although this information alone is insufficient. Georgia’s economy, trade turnover or foreign trade volume are much larger today as compared to 20, ten or even five years ago. Therefore, the amount of reserves that is necessary to ensure the safety cushion has also increased.

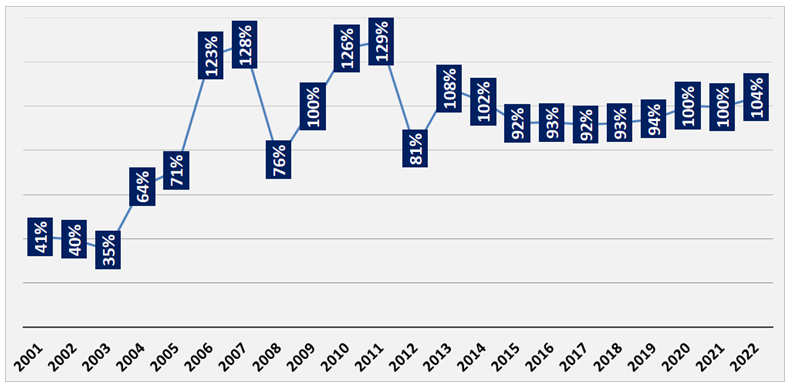

Reserve adequacy is assessed by the International Monetary Fund’s methodology and is measured through the formula: ARA Metric=5% x export + 5% x broad money + 30% x short-term debt + 15% x other obligations. It is better if the adequacy ratio is within the margin of 100%-150%. Georgia’s international reserves were put within these boundaries for the first time in 2006 and remained within the adequacy zone until 2015 except for the years 2008 and 2012. In 2015, the volume of reserves dropped below 100% and it was only possible to bring the reserves back to the adequacy zone in 2020. As of 2022, the reserve adequacy ratio was 104% and requirement was fulfilled.

As stated by the acting President of the National Bank, Natia Turnava, the volume of the reserves remains within the adequacy zone, although there is still a possibility for growth.

Graph 2: Reserve Adequacy Ratio

Source: International Monetary Fund

Another criterion to assess the reserves is the import coverage figure. In other words, reserves should be higher as compared to the volume of estimated imports for the next three months. Therefore, the ratio (the volume of reserves to the volume of estimated imports in the next three months) should be higher than 3. This criterion has always been met since 2009 and was 3.8 as of 2022.

Graph 3: Import Coverage Ratio

Source: International Monetary Fund

In terms of the structure of the reserves, 69% of them are in the form of securities, over 22% are deposited and almost 9% are Special Drawing Rights (SDR). The National Bank of Georgia has never had and does not currently possess any gold reserves.