Resume: The Organisation for Economic Co-Operation and Development (OECD) publishes its yearly FDI Regulatory Restrictiveness Index. The index provides an assessment of a country’s regulatory policies across 22 sectors and based on four criteria. [1] The index is scored from 0 to 1 and the closer the country’s score is to 0, the freer the country’s investment climate is. According to the Index, Georgia is indeed ranked 8th out of 82 countries with a 0.02 index score. Estonia is ranked seventh whilst Luxembourg and Portugal are ranked as the first and second, respectively.

In the last years, foreign direct investments (FDI) to Georgia dropped both in relative and absolute numbers. The 2019 FDI relative figure of 7.4% is the lowest since 2013. However, in accordance with the World Bank’s data, Georgia is ranked 24th in the world based on 2019’s FDI to GDP ratio, outperforming every neighbour countries and only lagging behind Cyprus, Malta, Hungary, Estonia, Montenegro, Serbia and Albania in Europe.

The figures provided by the Minister of Economy and Sustainable Development of Georgia are more or less realistic. However, of note is that whilst examining any issue, it is possible to separate positive trends and only highlight an incomplete context. There are indeed plenty of positive assessments in regard to Georgia’s investment climate, although one major challenge still persists and both local authoritative organisations as well as international partners unequivocally emphasise that unless improvements are made in in the judiciary and steps are taken to ensure the inviolability of private property, the investment climate cannot be assessed as positive. The fact that Georgia does not burden investors with regulations and taxes does not necessarily mean the creation of a positive investment climate for them. Therefore, the Minister’s statement is a manipulation of facts.

In this case, too, the Minister’s statement is literally in line with actual figures and corresponds to the information of the index she named. However, of importance is to underline that a significant context, pertaining to this quote, is lost. In particular, a country could not be formally opposing investment flow although the index does precisely gauge this particular issue. However, the assessment does not cover [2] a more important aspect which has a substantially negative effect on the investment climate and undermines the fruits of transparency vis-à-vis FDI brought in by the formal legislative framework. Georgia’s existing legal environment and problems associated with the independence of the judiciary are considered as an important restrictive factor.

Analysis

The Minister of Economy and Sustainable Development of Georgia, Natia Turnava, stated: “Based on an investment policy assessment, Georgia was ranked in the OECD FDI Regulatory Restrictiveness Index for the first time and took a leading 8th position in this survey of over 80 countries as one of the most open economies in the world in terms of attracting foreign investments. Based on a 7.5% FDI to GDP ratio, Georgia is one of the most successful countries globally.”

Foreign direct investment (FDI) implies a resident of one country owning a share in a foreign-based enterprise and carrying out different types of economic operations related to that enterprise. An investor is considered to be a direct one if he has at least a 10% ownership stake in a foreign-based enterprise’s shares or the equivalent of such participation.

The Organisation for Economic Co-Operation and Development (OECD) publishes its yearly FDI Regulatory Restrictiveness Index. The Index provides an assessment of a country’s regulatory policies across 22 sectors and based on four criteria. The Index fluctuates from 0 to 1 and the closer the country’s score is to 0, the freer the country’s investment climate is. According to the Index, Georgia is indeed ranked 8th of 82 countries with a 0.02 index position. Estonia is ranked seventh whilst Luxembourg and Portugal are ranked as the first and second, respectively.

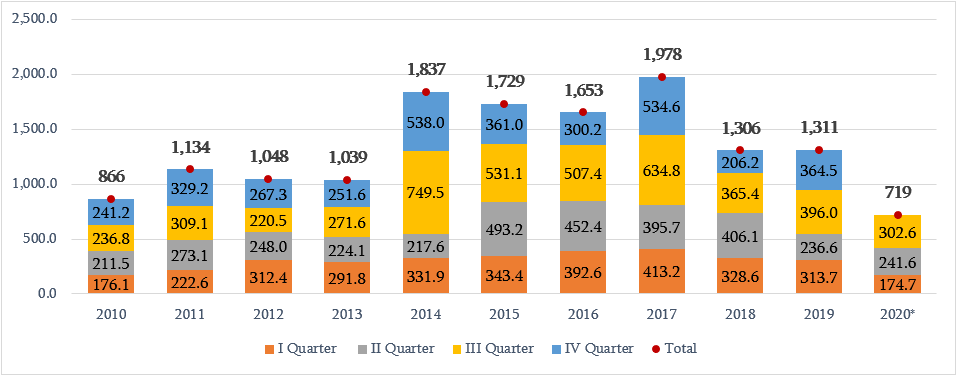

According to the preliminary data of the first three quarters of 2020, the total FDI to Georgia was USD 719 million which is the lowest figure since 2010 in absolute numbers. The pandemic-induced crisis is behind this drop to some extent, although a sharp drop in FDI even before the pandemic has been posing a problem for Georgia.

Graph 1: Foreign Direct Investments in 2010-2020 (Three Quarters)

Source: National Statistics Office of Georgia

Graph 1 shows FDI quarterly statistics. In 2019, FDI amounted to USD 1.3 billion which is only USD 4 million more as compared to 2018. However, together with the absolute figures it is also important to analyse the FDI to the GDP ratio dynamic since this ratio reflects the share of investments in the economy. In 2014-2017, the FDI to the GDP ratio was 11.3% on average whilst it dropped to 7.4% in 2018-2019. The 2019 FDI to GDP ratio is the lowest for Georgia since 2013. However, in accordance with the World Bank’s data, Georgia is ranked 24th in the world based on 2019’s FDI to GDP ratio, outperforming every neighbour countries and only lagging behind Cyprus, Malta, Hungary, Estonia, Montenegro, Serbia and Albania in Europe.

[1] Foreign equity limitations, screening or approval mechanisms, operational restrictions and restrictions on the employment of foreign personnel.

[2] “The FDI Index scores overt regulatory restrictions on FDI, ignoring other aspects of the regulatory framework, such as the nature of corporate governance, the extent of state ownership, and institutional or informal restrictions which may also impinge on the FDI climate. The FDI Index does not combine existing regulations with either perceptions of the investment climate or implementation issues but rather seeks to assess how countries’ policies towards FDI affect their attractiveness to foreign investors” – Blanka Kalinova, Angel Palerm, Stephen Thomsen “OECD's FDI Restrictiveness Index” [Page 6].