Resume: Since 2019, self-governing entities will no longer receive financial assistance in the form of an equalising transfer because the transfer has been abolished. However, 19% of VAT generated income will now be distributed among municipalities in place of the former equalising transfer.

In 2018, municipalities received a total of GEL 705 million as equalising transfers from the state budget and will receive GEL 946.7 million in 2019, as a result of VAT income distribution, which is GEL 241.7 million (34.3%) more. In addition, the self-governing unit income to consolidated budget incomes ratio will increase from 11.3% to 16.6% in 2019 whilst the self-governing unit income to GDP ratio will increase from 3.2% to 4.7%.

Therefore, both the nominal and relative budget figures for self-governing unit income will increase even more from the beginning of 2019 as compared to the numbers provided in Minister Maia Tskitishvili’s statement.

Analysis

The Minister of Regional Development and Infrastructure of Georgia, Maia Tskitishvili, stated at the Local Self-Governance Forum that local self-government funding will increase by more than GEL 100 million in 2019 which constitutes a 13% growth as compared to 2018.

The former equalising transfer has been abolished from the beginning of 2019. This transfer was a form of financial assistance allocated to municipalities from the state budget. It was given to those municipalities whose expenses exceeded their own incomes. The amount of the transfer was determined in accordance with the Budget Code of Georgia and as prescribed by the subordinate normative act within the margins of the difference between revenues and payments.

In the current budget year, the self-governing units will have 19% of the value added tax (VAT) generated income distributed among themselves in lieu of the equalising transfer. The distribution will be carried out in conformity with the criteria as prescribed by law. These criteria include the number of registered people in a municipality, the number of registered children in a municipality under the age of six years, the number of registered children in a municipality between the ages of six and 18 years, the area of municipality and the number of individuals with the status of permanently living in mountainous settlements. Of note is that even if a municipality’s income increases from local taxes, levies or other revenues, its VAT income will not decrease whereas there was a decrease in financial assistance from the state budget in the case of the former equalising transfer. The Minister’s statement is about VAT income distribution in exchange for the equalising transfer and its consequences.

Prior to 2019, self-governing units received financial assistance in the form of equalising, targeted, special and capital transfers from the state budget. Of these, only the equalising transfer was categorised as a municipality’s own income whereas other transfers were not a municipality’s own income (article 92.4).

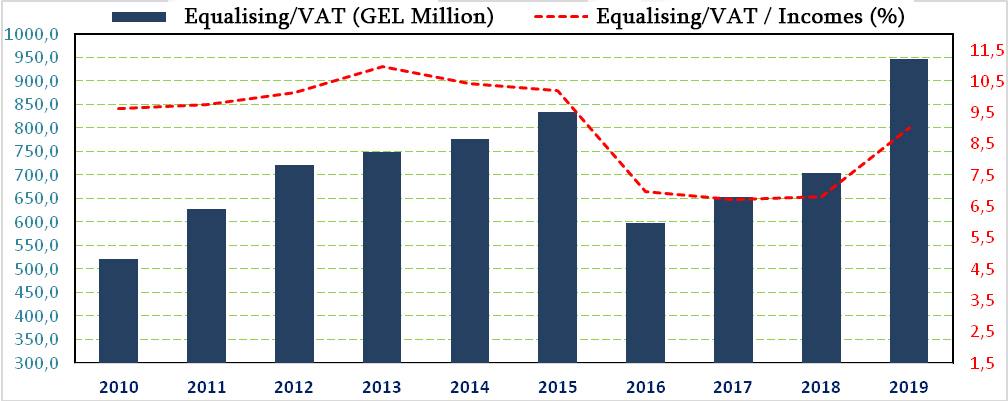

The nominal figures for the equalising transfer from the state budget increased annually between 2010 and 2015. In 2015, the state budget allocated GEL 834.2 million as an equalising transfer to self-governing entities which constituted 10.2% of state budget incomes. After 2015, the volume of equalising transfers dropped substantially as a result of allocating a part of income tax revenues to municipalities. In 2016-2018, the state budget equalising transfer to state budget incomes ratio was 6.8% on average. In regard to 2018, municipalities received GEL 705 million from the state budget as an equalising transfer which constituted 6.8% of state budget incomes.

As mentioned previously, municipalities will receive 19% of VAT generated income beginning in 2019. In 2019, GEL 946.7 million of VAT generated income is planned for distribution which constitutes 9% of state budget incomes. Therefore, municipalities will have GEL 241.7 million (34.3%) more income in 2019 as a result of the changes. Of additional note is that the distribution of VAT income means that the incomes of self-governing units will increase in parallel with economic growth.

Graph 1: State Budget Allocated Funding; Own Income (GEL Million, %)

Source: Ministry of Finance of Georgia

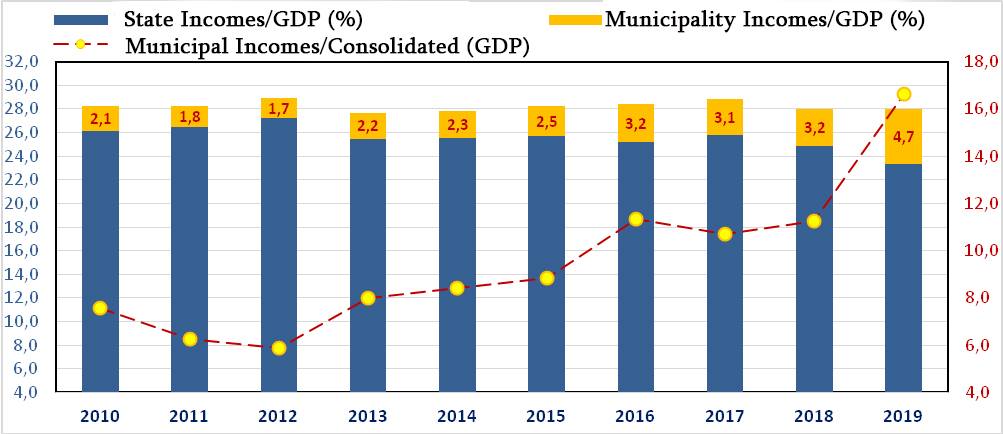

In 2018, the total income of self-governing units was GEL 1,309.8 million which constituted 3.2% of Georgia’s GDP. This figure will increase up to GEL 2,090.3 million in 2019 and constitute 4.7% of the estimated GDP of the same year. Therefore, the budgets of self-governing entities will receive a larger share of government collected financial resources in 2019 as compared to previous years.

Graph 2: Relative Figures of State and Municipal Budget Incomes

Source: Ministry of Finance of Georgia

In addition, the share of self-governing entities in the 2019 consolidated budget incomes increases up to 16.6% whereas this figure was 11.3% in 2018. In 2010-2018, the self-governing entities income to consolidated budget income ratio was 8.7% on average. Therefore, the share of municipal finances in 2019 public finances (income) is projected to grow whilst the share of the state budget decreases.