On 7 April 2017, at the plenary session of the Parliament of Georgia, the Speaker of the Parliament, Irakli Kobakhidze stated: “The volume of Foreign Direct Investments under the previous government was USD 1,024 milllion on average annually. Since 2012, it has been USD 1,477 million per year. In reality, under our government, the volume of investments has been increased by 45% annually.”

FactCheck took interest in the accuracy of Irakli Kobakhidze’s statement.

According to the data of the National Statistics Office of Georgia, the volume of Foreign Direct Investments (FDI) in 2004-2012, was on average USD 1,024 million annully, whilst in 2013-2016, the average annual amount of investments was USD 1,477 million. The comparison of these two figures indicate that average annual amount of FDI is increeased by 44.2% under the new government. However, investment growth rate has dropped under the incumbent government. In 2004-2012, the amount of FDI has been increased by 26% on average per year, whilst in 2013-2013 annual average growth rate constitutes 21%.

Of note is that throughout 2004-2016, the highest annual figure of investments (USD 2,015 million) was registered in 2007, whilst highest growth rate of investments (164%) was registered in 2006. The volume of investments was most sharply reduced in 2008 and 2009, which was caused by Russia-Georgia War and the World Financial Crisis.

Graph 1: The Volume of Foreign Direct Investments and Growth Rate (2004-2016)

In order to measure a real volume of investments, we have to look at the growth rate of investments to country’s economy ratio. In this regard, 2007 was the most successful year, when investments to GDP ratio was 19.8%. The worst figure (investment to GDP ratio was 5.8%) in this regard was registered in 2012 and 2013. After 2008, highest number of investment to GDP ratio (11.5%) was in 2016. However, the fact that USD denominated GDP has decreased in 2015-2016 needs to be taken into account, because it contributed the increase of investment to GDP ratio. For instance in 2015, even though the volume of FDI was decreased, investment to GDP ratio increased. This happened because GDP denominated in USD has dropped as a result of GEL depreciation.

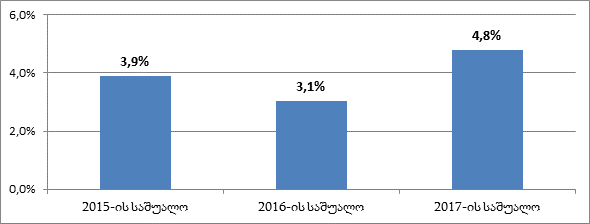

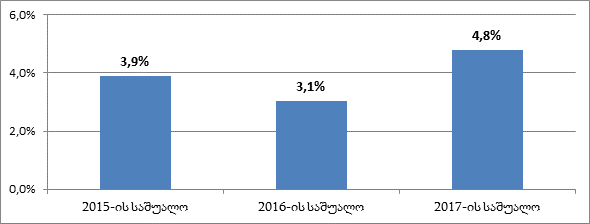

Graph 2: Foreign Direct Investments to GDP Ratio

In order to measure a real volume of investments, we have to look at the growth rate of investments to country’s economy ratio. In this regard, 2007 was the most successful year, when investments to GDP ratio was 19.8%. The worst figure (investment to GDP ratio was 5.8%) in this regard was registered in 2012 and 2013. After 2008, highest number of investment to GDP ratio (11.5%) was in 2016. However, the fact that USD denominated GDP has decreased in 2015-2016 needs to be taken into account, because it contributed the increase of investment to GDP ratio. For instance in 2015, even though the volume of FDI was decreased, investment to GDP ratio increased. This happened because GDP denominated in USD has dropped as a result of GEL depreciation.

Graph 2: Foreign Direct Investments to GDP Ratio

Conclusion

Average annual amount of the Foreign Direct Investments in 2004-2012 was USD 1,024 million, whilst in 2013-2016 that figure rose to USD 1,477 million which constitutes 44.2% growth.

However, under the incumbent government, the investment growth rate has dropped as compared to the nine year period of the previous government. In 2004-2012, FDI has been increased by 26% on average annually, whilst in 2013-2016 annual average growth rate constitutes 21%.

The best performance in terms of investments throughout 2004-2016 was registered in 2007. Afterwards, the volume of investments and growth rate started to decrease, affected by the post-war period and the World Financial Crisis. After 2007, the highest growth rate of FDI was registered in 2014. In 2015, FDI decreased again and in 2016 it increased insignificantly.

FactCheck concludes that Irakli Kobakhidze’s statement is MOSTLY TRUE.

Conclusion

Average annual amount of the Foreign Direct Investments in 2004-2012 was USD 1,024 million, whilst in 2013-2016 that figure rose to USD 1,477 million which constitutes 44.2% growth.

However, under the incumbent government, the investment growth rate has dropped as compared to the nine year period of the previous government. In 2004-2012, FDI has been increased by 26% on average annually, whilst in 2013-2016 annual average growth rate constitutes 21%.

The best performance in terms of investments throughout 2004-2016 was registered in 2007. Afterwards, the volume of investments and growth rate started to decrease, affected by the post-war period and the World Financial Crisis. After 2007, the highest growth rate of FDI was registered in 2014. In 2015, FDI decreased again and in 2016 it increased insignificantly.

FactCheck concludes that Irakli Kobakhidze’s statement is MOSTLY TRUE.

In order to measure a real volume of investments, we have to look at the growth rate of investments to country’s economy ratio. In this regard, 2007 was the most successful year, when investments to GDP ratio was 19.8%. The worst figure (investment to GDP ratio was 5.8%) in this regard was registered in 2012 and 2013. After 2008, highest number of investment to GDP ratio (11.5%) was in 2016. However, the fact that USD denominated GDP has decreased in 2015-2016 needs to be taken into account, because it contributed the increase of investment to GDP ratio. For instance in 2015, even though the volume of FDI was decreased, investment to GDP ratio increased. This happened because GDP denominated in USD has dropped as a result of GEL depreciation.

Graph 2: Foreign Direct Investments to GDP Ratio

In order to measure a real volume of investments, we have to look at the growth rate of investments to country’s economy ratio. In this regard, 2007 was the most successful year, when investments to GDP ratio was 19.8%. The worst figure (investment to GDP ratio was 5.8%) in this regard was registered in 2012 and 2013. After 2008, highest number of investment to GDP ratio (11.5%) was in 2016. However, the fact that USD denominated GDP has decreased in 2015-2016 needs to be taken into account, because it contributed the increase of investment to GDP ratio. For instance in 2015, even though the volume of FDI was decreased, investment to GDP ratio increased. This happened because GDP denominated in USD has dropped as a result of GEL depreciation.

Graph 2: Foreign Direct Investments to GDP Ratio

Conclusion

Average annual amount of the Foreign Direct Investments in 2004-2012 was USD 1,024 million, whilst in 2013-2016 that figure rose to USD 1,477 million which constitutes 44.2% growth.

However, under the incumbent government, the investment growth rate has dropped as compared to the nine year period of the previous government. In 2004-2012, FDI has been increased by 26% on average annually, whilst in 2013-2016 annual average growth rate constitutes 21%.

The best performance in terms of investments throughout 2004-2016 was registered in 2007. Afterwards, the volume of investments and growth rate started to decrease, affected by the post-war period and the World Financial Crisis. After 2007, the highest growth rate of FDI was registered in 2014. In 2015, FDI decreased again and in 2016 it increased insignificantly.

FactCheck concludes that Irakli Kobakhidze’s statement is MOSTLY TRUE.

Conclusion

Average annual amount of the Foreign Direct Investments in 2004-2012 was USD 1,024 million, whilst in 2013-2016 that figure rose to USD 1,477 million which constitutes 44.2% growth.

However, under the incumbent government, the investment growth rate has dropped as compared to the nine year period of the previous government. In 2004-2012, FDI has been increased by 26% on average annually, whilst in 2013-2016 annual average growth rate constitutes 21%.

The best performance in terms of investments throughout 2004-2016 was registered in 2007. Afterwards, the volume of investments and growth rate started to decrease, affected by the post-war period and the World Financial Crisis. After 2007, the highest growth rate of FDI was registered in 2014. In 2015, FDI decreased again and in 2016 it increased insignificantly.

FactCheck concludes that Irakli Kobakhidze’s statement is MOSTLY TRUE.

Tags: