Presenting a report at the plenary session of the Parliament on 13 November 2013, the Minister of Finance of Georgia, Nodar Khaduri, stated: “We have a quite favourable dynamics in terms of discount rates on securities. The percentage has fallen to 4%-4.1% while in the spring of 2012, the figure was at 7%-7.7%. The dynamics is fairly positive in this regard.”

FactCheck inquired about the truthfulness of the statement and set out to check its accuracy.

In line with the data of the National Bank of Georgia, treasury bills with the maturity of one year had the weighted average discount rate in the amount of 6.17%-6.9% in the spring of 2012 while in February the same indicator was as high as 7.6% (see the table below). As of present, treasury bills with the maturity of one year had a discount rate of 4.1% in October of 2013 whereas in November the figure equalled 4.2% (see the table).

Over the last two years the weighted average discount rate of treasury bills with the maturity of one year saw almost a twofold decrease. The red line on the graph shown below demonstrates the dynamics of falling discount rates in 2012-2013. The blue non-continuous line, on another hand, demonstrates the tendency of decrease by depicting average percentages of the decrease of weighted discount rates for each month of the last two years.

Over the last two years the weighted average discount rate of treasury bills with the maturity of one year saw almost a twofold decrease. The red line on the graph shown below demonstrates the dynamics of falling discount rates in 2012-2013. The blue non-continuous line, on another hand, demonstrates the tendency of decrease by depicting average percentages of the decrease of weighted discount rates for each month of the last two years.

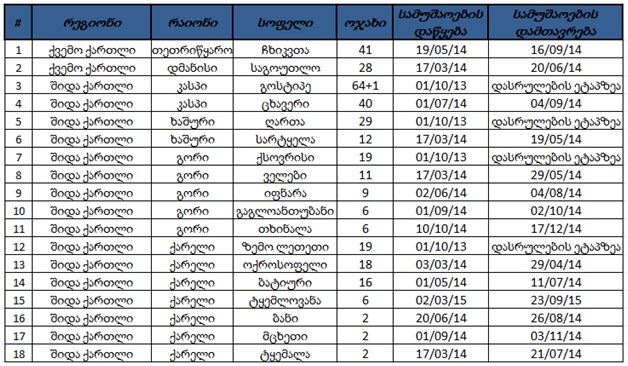

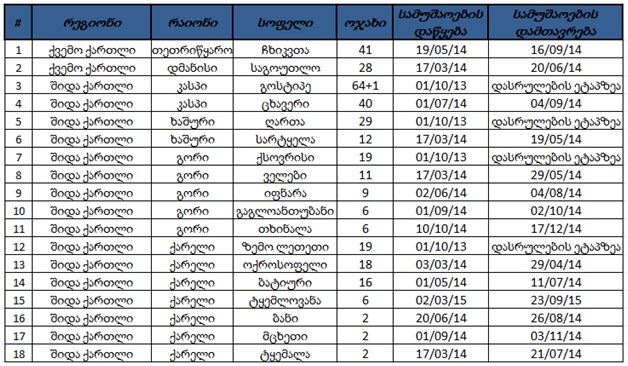

It is to be noted that the government took only 10 million of the total debt by issuing treasury bills with the discount rate of 4.1% (the weighted average discount rate of treasury bills equalled 4.1% only in the month of October). The yearly average of the weighted discount rates of treasury bills with the maturity of one year roughly amounted to 5.2%. The table given below depicts the purchased treasury bills with one year maturity according to the dates when the auction was held with the relevant discount rates indicated in the right column.

It is to be noted that the government took only 10 million of the total debt by issuing treasury bills with the discount rate of 4.1% (the weighted average discount rate of treasury bills equalled 4.1% only in the month of October). The yearly average of the weighted discount rates of treasury bills with the maturity of one year roughly amounted to 5.2%. The table given below depicts the purchased treasury bills with one year maturity according to the dates when the auction was held with the relevant discount rates indicated in the right column.

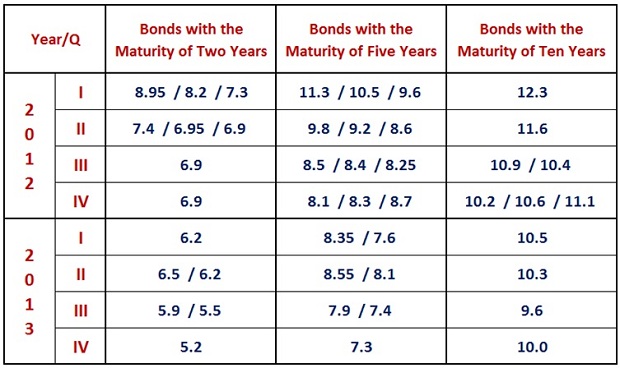

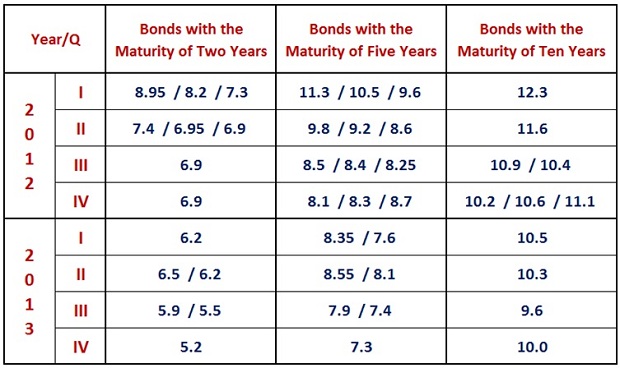

Similar to the bills with one year maturity, discount rates were decreased for the bonds with the maturity of two, five and ten years as well (see the table below).

Similar to the bills with one year maturity, discount rates were decreased for the bonds with the maturity of two, five and ten years as well (see the table below).

Conclusion

The tendency of decrease is indeed apparent in the discount rates of treasury securities. However, in October of 2013, a discount rate of 4.1% was witnessed solely on treasury bills. Even though the weighted average discount rate for treasury bills saw almost a twofold decrease over the last two years, bonds with medium and long-term maturity are not characterised with a similar dynamics of a decrease and their discount rate exceeds 4%.

Consequently, we conclude that Nodar Khaduri’s statement, “We have a quite favourable dynamics in terms of discount rates on securities. The percentage has fallen to 4%-4.1% while in the spring of 2012, the figure was at 7%-7.7%. The dynamics is fairly positive in this regard,” is MOSTLY TRUE.

Conclusion

The tendency of decrease is indeed apparent in the discount rates of treasury securities. However, in October of 2013, a discount rate of 4.1% was witnessed solely on treasury bills. Even though the weighted average discount rate for treasury bills saw almost a twofold decrease over the last two years, bonds with medium and long-term maturity are not characterised with a similar dynamics of a decrease and their discount rate exceeds 4%.

Consequently, we conclude that Nodar Khaduri’s statement, “We have a quite favourable dynamics in terms of discount rates on securities. The percentage has fallen to 4%-4.1% while in the spring of 2012, the figure was at 7%-7.7%. The dynamics is fairly positive in this regard,” is MOSTLY TRUE.

Over the last two years the weighted average discount rate of treasury bills with the maturity of one year saw almost a twofold decrease. The red line on the graph shown below demonstrates the dynamics of falling discount rates in 2012-2013. The blue non-continuous line, on another hand, demonstrates the tendency of decrease by depicting average percentages of the decrease of weighted discount rates for each month of the last two years.

Over the last two years the weighted average discount rate of treasury bills with the maturity of one year saw almost a twofold decrease. The red line on the graph shown below demonstrates the dynamics of falling discount rates in 2012-2013. The blue non-continuous line, on another hand, demonstrates the tendency of decrease by depicting average percentages of the decrease of weighted discount rates for each month of the last two years.

It is to be noted that the government took only 10 million of the total debt by issuing treasury bills with the discount rate of 4.1% (the weighted average discount rate of treasury bills equalled 4.1% only in the month of October). The yearly average of the weighted discount rates of treasury bills with the maturity of one year roughly amounted to 5.2%. The table given below depicts the purchased treasury bills with one year maturity according to the dates when the auction was held with the relevant discount rates indicated in the right column.

It is to be noted that the government took only 10 million of the total debt by issuing treasury bills with the discount rate of 4.1% (the weighted average discount rate of treasury bills equalled 4.1% only in the month of October). The yearly average of the weighted discount rates of treasury bills with the maturity of one year roughly amounted to 5.2%. The table given below depicts the purchased treasury bills with one year maturity according to the dates when the auction was held with the relevant discount rates indicated in the right column.

Similar to the bills with one year maturity, discount rates were decreased for the bonds with the maturity of two, five and ten years as well (see the table below).

Similar to the bills with one year maturity, discount rates were decreased for the bonds with the maturity of two, five and ten years as well (see the table below).

Conclusion

The tendency of decrease is indeed apparent in the discount rates of treasury securities. However, in October of 2013, a discount rate of 4.1% was witnessed solely on treasury bills. Even though the weighted average discount rate for treasury bills saw almost a twofold decrease over the last two years, bonds with medium and long-term maturity are not characterised with a similar dynamics of a decrease and their discount rate exceeds 4%.

Consequently, we conclude that Nodar Khaduri’s statement, “We have a quite favourable dynamics in terms of discount rates on securities. The percentage has fallen to 4%-4.1% while in the spring of 2012, the figure was at 7%-7.7%. The dynamics is fairly positive in this regard,” is MOSTLY TRUE.

Conclusion

The tendency of decrease is indeed apparent in the discount rates of treasury securities. However, in October of 2013, a discount rate of 4.1% was witnessed solely on treasury bills. Even though the weighted average discount rate for treasury bills saw almost a twofold decrease over the last two years, bonds with medium and long-term maturity are not characterised with a similar dynamics of a decrease and their discount rate exceeds 4%.

Consequently, we conclude that Nodar Khaduri’s statement, “We have a quite favourable dynamics in terms of discount rates on securities. The percentage has fallen to 4%-4.1% while in the spring of 2012, the figure was at 7%-7.7%. The dynamics is fairly positive in this regard,” is MOSTLY TRUE.