At the Plenary Session held on 29 July 2013 the Parliament discussed an increase of the excise taxes on tobacco. As he was commenting on the draft law, Mikheil Machavariani, Member of the Parliamentary Minority, declared that he held nothing against the draft law although wished to highlight several problems which could arise after its adoption. The MP underlined the necessity of preventing an increased inflow of contraband cigarettes which could be a consequence of the raised excise taxes. He also inquired about the funds, GEL 26 million, which would be channelled to the state budget following the increase of excise taxes and demanded the consumption of those funds to be defined promptly by the Ministry of Finance. In this context Mikheil Machavariani declared that he was reassured in his doubts that the funds acquired through the increase in excise taxes were to be used for covering up the threatening budgetary shortfall of GEL 247 million which was evident in the first six months (two quarters) of 2013.

FactCheck decided to check whether or not, according to the revised numbers, the budgetary shortfall had amounted to GEL 247 million in the last six months (two quarters).

In accordance with the Law of 2013 on State Budget, the budget revenues of the current year are predicted to amount to GEL 7,422,500,000. Of this amount, GEL 6,920,000,000 are coming from taxes (profit tax, value added tax, income tax, etc.). The rest of the revenues are generated through grants and other sources (interest, dividends, rent, administrative fees and taxes, etc.).

It is to be noted that the budgetary plan (of revenues, costs and other articles) is prepared for a period of one year and changes in it can be introduced throughout the year based only upon Parliament’s consent. As for the quarterly plan, it is not included in the Law on State Budget he quarterly plan, it is not included in the Law on State Budget and solely represents an internal document of the Ministry of Finance which undergoes changes and corrections in the course of the whole year according to the current state of affairs. These quarterly plans, before or after being revised by the Ministry, are public and can be acquired upon request. We conducted research and ascertained that the budgetary plan had been revised twice – once at the beginning of 2013, during the first quarter, and the second time during the second quarter.

In order to check the accuracy of Mikheil Machavariani’s statement we looked at (1) the initial quarterly budgetary prognosis of 2013, prior to being revised, (2) figures revised by the Ministry of Finance in the first quarter of 2013 and (3) statistical data on the budget execution over six months. Based on the analysis of this data we tried to determine whether or not the budgetary shortfall had indeed amounted to GEL 247 million according to the revised budget as claimed by the Member of the Parliamentary Minority.

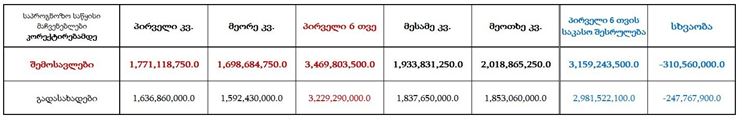

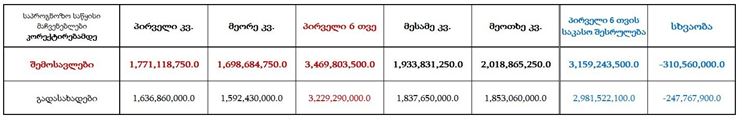

The chart above shows the figures according to the quarterly budgetary plan of the Ministry of Finance worked out at the end of 2012 prior to its revision. In the first two quarters of 2013, GEL 3,469,803,500 were to be generated in total of which GEL 3,229,290,000 were to come from taxes. If we compare these figures with the budget execution (i.e., the actual amount of money accumulated in the budget), we observe a shortfall of GEL 247,767,900 [2,981,522,100 - 3,229,290,000 = -247,767,900] and this is only with regard to the revenues generated through taxes while in the total revenues we witness a shortfall of GEL 310,560,000 [3,159,243,500 - 3,469,803,500 = -310,560,000]. Thus, a shortfall of GEL 247 million can be calculated only in the case of comparing the budget execution to the initial predictions made at the end of 2012.

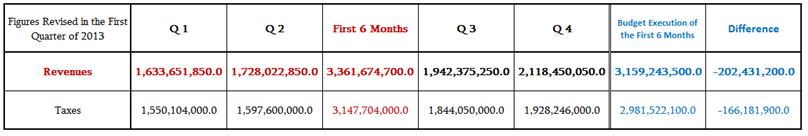

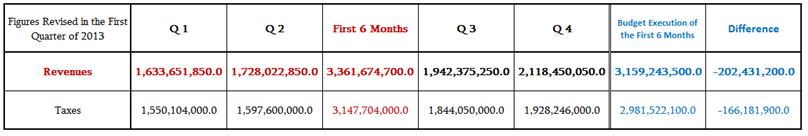

The Ministry of Finance revised the budgetary plan in the first quarter of 2013 and lowered its predicted numbers with regard to the budget revenues, including the revenues generated through taxes. (See chart below.)

The chart above shows the figures according to the quarterly budgetary plan of the Ministry of Finance worked out at the end of 2012 prior to its revision. In the first two quarters of 2013, GEL 3,469,803,500 were to be generated in total of which GEL 3,229,290,000 were to come from taxes. If we compare these figures with the budget execution (i.e., the actual amount of money accumulated in the budget), we observe a shortfall of GEL 247,767,900 [2,981,522,100 - 3,229,290,000 = -247,767,900] and this is only with regard to the revenues generated through taxes while in the total revenues we witness a shortfall of GEL 310,560,000 [3,159,243,500 - 3,469,803,500 = -310,560,000]. Thus, a shortfall of GEL 247 million can be calculated only in the case of comparing the budget execution to the initial predictions made at the end of 2012.

The Ministry of Finance revised the budgetary plan in the first quarter of 2013 and lowered its predicted numbers with regard to the budget revenues, including the revenues generated through taxes. (See chart below.)

After the first revision, the Ministry of Finance predicted the revenues in the first six months of 2013 to amount to GEL 3,361,674,700 which is GEL 108,128,800 less than the figure predicted at the end of 2012 [3,469,803,500 - 3,361,674,700 = 108,128,800]. Based on the revised figures of the first quarter, we observe a shortfall of GEL 202,431,200 in total revenues and GEL 166,181,900 in the revenues acquired through taxes.

Consequently, bearing in mind the revised figures of the first quarter, we can conclude that GEL 202 million less have been channelled to the state budget at the end of the second quarter than predicted. This figure differs from the GEL 247 million named by Mikheil Machavariani, but the fact itself verifies the MP’s correct approach to the matter.

Lastly, we would like to focus upon the figures revised in the second quarter which are shown in the table below.

After the first revision, the Ministry of Finance predicted the revenues in the first six months of 2013 to amount to GEL 3,361,674,700 which is GEL 108,128,800 less than the figure predicted at the end of 2012 [3,469,803,500 - 3,361,674,700 = 108,128,800]. Based on the revised figures of the first quarter, we observe a shortfall of GEL 202,431,200 in total revenues and GEL 166,181,900 in the revenues acquired through taxes.

Consequently, bearing in mind the revised figures of the first quarter, we can conclude that GEL 202 million less have been channelled to the state budget at the end of the second quarter than predicted. This figure differs from the GEL 247 million named by Mikheil Machavariani, but the fact itself verifies the MP’s correct approach to the matter.

Lastly, we would like to focus upon the figures revised in the second quarter which are shown in the table below.

The second column of this table shows the revised predictions for the first six months of 2013 which are even lower than the revised figures from the first quarter. According to this data, the budget execution surpassed the predicted figure by GEL 8,175,000 whereas the revenues acquired through taxes exceeded the predicted figure by GEL 4,505,000. According to the second revised budget, therefore, no shortfall is registered in the first six months of 2013 and, further therefore, if we take into consideration only these figures, Mikheil Machavariani’s statement proves to be incorrect. If we base our judgement upon the predictions made in 2012 or in the first quarter of 2013, however, the statement becomes mostly true.

Conclusion

Based upon all of the abovementioned, we can conclude that if the predictions had not been revised in the first and second quarters, the official documentation would have registered a shortfall in the state budget in the first six months of 2013.

If we compare the budget execution of the first six months of 2013 to the initial predictions made at the end of 2012, we get a shortfall of GEL 247,767,900 in the revenues from taxes which precisely corresponds to the figure named by the MP. If we compare the budget execution of those six months to the predictions revised in the first quarter, we observe a shortfall of GEL 166,181,900 in the revenues from taxes. On the other hand, comparing the budget execution of those two quarters to the figures revised at the end of that period (second revision), we observe not a shortfall but a surplus of GEL 4,505,000.

Based upon our analysis, we conclude that Mikheil Machavariani’s statement: “Budgetary shortfall over the last six months has been GEL 247 million. These are revised figures, with regard to the revised budget,” is MOSTLY TRUE.

The second column of this table shows the revised predictions for the first six months of 2013 which are even lower than the revised figures from the first quarter. According to this data, the budget execution surpassed the predicted figure by GEL 8,175,000 whereas the revenues acquired through taxes exceeded the predicted figure by GEL 4,505,000. According to the second revised budget, therefore, no shortfall is registered in the first six months of 2013 and, further therefore, if we take into consideration only these figures, Mikheil Machavariani’s statement proves to be incorrect. If we base our judgement upon the predictions made in 2012 or in the first quarter of 2013, however, the statement becomes mostly true.

Conclusion

Based upon all of the abovementioned, we can conclude that if the predictions had not been revised in the first and second quarters, the official documentation would have registered a shortfall in the state budget in the first six months of 2013.

If we compare the budget execution of the first six months of 2013 to the initial predictions made at the end of 2012, we get a shortfall of GEL 247,767,900 in the revenues from taxes which precisely corresponds to the figure named by the MP. If we compare the budget execution of those six months to the predictions revised in the first quarter, we observe a shortfall of GEL 166,181,900 in the revenues from taxes. On the other hand, comparing the budget execution of those two quarters to the figures revised at the end of that period (second revision), we observe not a shortfall but a surplus of GEL 4,505,000.

Based upon our analysis, we conclude that Mikheil Machavariani’s statement: “Budgetary shortfall over the last six months has been GEL 247 million. These are revised figures, with regard to the revised budget,” is MOSTLY TRUE.

The chart above shows the figures according to the quarterly budgetary plan of the Ministry of Finance worked out at the end of 2012 prior to its revision. In the first two quarters of 2013, GEL 3,469,803,500 were to be generated in total of which GEL 3,229,290,000 were to come from taxes. If we compare these figures with the budget execution (i.e., the actual amount of money accumulated in the budget), we observe a shortfall of GEL 247,767,900 [2,981,522,100 - 3,229,290,000 = -247,767,900] and this is only with regard to the revenues generated through taxes while in the total revenues we witness a shortfall of GEL 310,560,000 [3,159,243,500 - 3,469,803,500 = -310,560,000]. Thus, a shortfall of GEL 247 million can be calculated only in the case of comparing the budget execution to the initial predictions made at the end of 2012.

The Ministry of Finance revised the budgetary plan in the first quarter of 2013 and lowered its predicted numbers with regard to the budget revenues, including the revenues generated through taxes. (See chart below.)

The chart above shows the figures according to the quarterly budgetary plan of the Ministry of Finance worked out at the end of 2012 prior to its revision. In the first two quarters of 2013, GEL 3,469,803,500 were to be generated in total of which GEL 3,229,290,000 were to come from taxes. If we compare these figures with the budget execution (i.e., the actual amount of money accumulated in the budget), we observe a shortfall of GEL 247,767,900 [2,981,522,100 - 3,229,290,000 = -247,767,900] and this is only with regard to the revenues generated through taxes while in the total revenues we witness a shortfall of GEL 310,560,000 [3,159,243,500 - 3,469,803,500 = -310,560,000]. Thus, a shortfall of GEL 247 million can be calculated only in the case of comparing the budget execution to the initial predictions made at the end of 2012.

The Ministry of Finance revised the budgetary plan in the first quarter of 2013 and lowered its predicted numbers with regard to the budget revenues, including the revenues generated through taxes. (See chart below.)

After the first revision, the Ministry of Finance predicted the revenues in the first six months of 2013 to amount to GEL 3,361,674,700 which is GEL 108,128,800 less than the figure predicted at the end of 2012 [3,469,803,500 - 3,361,674,700 = 108,128,800]. Based on the revised figures of the first quarter, we observe a shortfall of GEL 202,431,200 in total revenues and GEL 166,181,900 in the revenues acquired through taxes.

Consequently, bearing in mind the revised figures of the first quarter, we can conclude that GEL 202 million less have been channelled to the state budget at the end of the second quarter than predicted. This figure differs from the GEL 247 million named by Mikheil Machavariani, but the fact itself verifies the MP’s correct approach to the matter.

Lastly, we would like to focus upon the figures revised in the second quarter which are shown in the table below.

After the first revision, the Ministry of Finance predicted the revenues in the first six months of 2013 to amount to GEL 3,361,674,700 which is GEL 108,128,800 less than the figure predicted at the end of 2012 [3,469,803,500 - 3,361,674,700 = 108,128,800]. Based on the revised figures of the first quarter, we observe a shortfall of GEL 202,431,200 in total revenues and GEL 166,181,900 in the revenues acquired through taxes.

Consequently, bearing in mind the revised figures of the first quarter, we can conclude that GEL 202 million less have been channelled to the state budget at the end of the second quarter than predicted. This figure differs from the GEL 247 million named by Mikheil Machavariani, but the fact itself verifies the MP’s correct approach to the matter.

Lastly, we would like to focus upon the figures revised in the second quarter which are shown in the table below.

The second column of this table shows the revised predictions for the first six months of 2013 which are even lower than the revised figures from the first quarter. According to this data, the budget execution surpassed the predicted figure by GEL 8,175,000 whereas the revenues acquired through taxes exceeded the predicted figure by GEL 4,505,000. According to the second revised budget, therefore, no shortfall is registered in the first six months of 2013 and, further therefore, if we take into consideration only these figures, Mikheil Machavariani’s statement proves to be incorrect. If we base our judgement upon the predictions made in 2012 or in the first quarter of 2013, however, the statement becomes mostly true.

Conclusion

Based upon all of the abovementioned, we can conclude that if the predictions had not been revised in the first and second quarters, the official documentation would have registered a shortfall in the state budget in the first six months of 2013.

If we compare the budget execution of the first six months of 2013 to the initial predictions made at the end of 2012, we get a shortfall of GEL 247,767,900 in the revenues from taxes which precisely corresponds to the figure named by the MP. If we compare the budget execution of those six months to the predictions revised in the first quarter, we observe a shortfall of GEL 166,181,900 in the revenues from taxes. On the other hand, comparing the budget execution of those two quarters to the figures revised at the end of that period (second revision), we observe not a shortfall but a surplus of GEL 4,505,000.

Based upon our analysis, we conclude that Mikheil Machavariani’s statement: “Budgetary shortfall over the last six months has been GEL 247 million. These are revised figures, with regard to the revised budget,” is MOSTLY TRUE.

The second column of this table shows the revised predictions for the first six months of 2013 which are even lower than the revised figures from the first quarter. According to this data, the budget execution surpassed the predicted figure by GEL 8,175,000 whereas the revenues acquired through taxes exceeded the predicted figure by GEL 4,505,000. According to the second revised budget, therefore, no shortfall is registered in the first six months of 2013 and, further therefore, if we take into consideration only these figures, Mikheil Machavariani’s statement proves to be incorrect. If we base our judgement upon the predictions made in 2012 or in the first quarter of 2013, however, the statement becomes mostly true.

Conclusion

Based upon all of the abovementioned, we can conclude that if the predictions had not been revised in the first and second quarters, the official documentation would have registered a shortfall in the state budget in the first six months of 2013.

If we compare the budget execution of the first six months of 2013 to the initial predictions made at the end of 2012, we get a shortfall of GEL 247,767,900 in the revenues from taxes which precisely corresponds to the figure named by the MP. If we compare the budget execution of those six months to the predictions revised in the first quarter, we observe a shortfall of GEL 166,181,900 in the revenues from taxes. On the other hand, comparing the budget execution of those two quarters to the figures revised at the end of that period (second revision), we observe not a shortfall but a surplus of GEL 4,505,000.

Based upon our analysis, we conclude that Mikheil Machavariani’s statement: “Budgetary shortfall over the last six months has been GEL 247 million. These are revised figures, with regard to the revised budget,” is MOSTLY TRUE.