Levan Davitashvili: “Trade turnover achieves record growth for the third consecutive time.”

Verdict: FactCheck concludes that Levan Davitashvili’s statement is MOSTLY TRUE.

The external trade turnover reached USD 21.5 billion in 2023, marking a 12.5% rise as compared to 2022. The analysis period reveals a 9% rise in exports and a 14.1% surge in imports.

Despite both imports and exports, thus trade turnover, reaching historic highs in nominal terms, local exports have, nevertheless, faced a significant decline. Particularly, the last 11 months (12-month data were not yet made available at the time of the Minister’s statement) have displayed a 24.3% decline to 2.6 billion as compared to the same period in the previous year. The aforementioned decrease in exports is attributed to the rise in re-exports, leading to a corresponding rise in imports.

Although re-export also constitutes economic growth, it is crucial to acknowledge that in the case of Georgia, the country simply operates as a trans-shipment hub rather than as a producer. Therefore, overlooking this definition may result in ambiguous interpretations of the statement.

The surge in imports indeed signifies an increased purchasing power, however, the scenario in Georgia differs from the general tendency. A rise in 2022’s imports was mostly driven by rising oil prices on the global market; whereas the surge in 2023 was a response to the need for re-exporting cars.

Considering the aforementioned, the Minister’s failure to concisely clarify the accurately stated data and underlying factors (although acknowledging the challenges but still omitting the specific reasons) may potentially lead to biased interpretations. Thus, FactCheck concludes that Levan Davitashvili’s statement is MOSTLY TRUE.

Analysis:

The Minister of Economics and Sustainable Growth Levan Davitashvili, stated in his discussion regarding external trade: (from 0:13) “From 2021 to today, we have reached record growth in external trade turnover for the third consecutive time. A new maximum has been achieved in external trade. The overall trade turnover increased by 9.1% in 2023 with exports amounting to USD 6.1 billion and imports increasing by 14%, totalling USD 15.4 billion. Trade turnover increased by 12.5% and exceeded USD 21 billion. I think this data give us hope. Despite facing many hardships and obstacles in certain sectors, the collective international external trade data, nonetheless, inspires hope that 2024 will follow the same positive trajectory.”

A declining downward trend in exports has been observed on seven occasions whilst both imports and trade turnover have faced declines six times since the initiation of data recording processes in 1995. Total trade turnover surged 33-fold in this timeframe (with exports increasing 39-fold and imports rising 31-fold). Thus, an increase in trade turnover alone does not unequivocally suggest extraordinary success.

Graph 1: External Trade Turnover (USD million)

Source: National Statistics Office of Georgia

Although only 11-month data were available at the time of the Minister’s statement, they provided sufficient insights into the shifts and underlying factors regarding external trade.

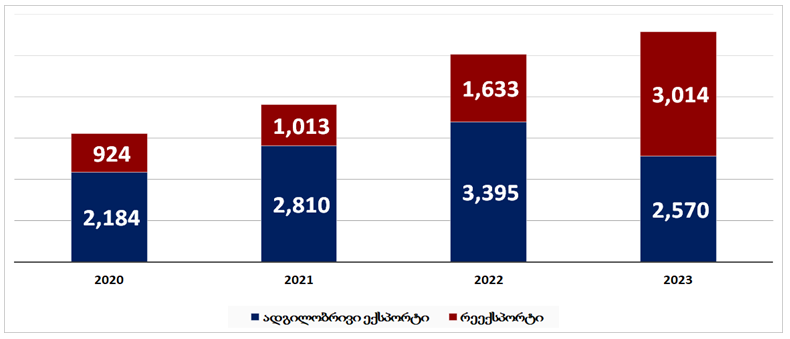

Exports for the January-to-November period displayed a 11.1% surge as compared to the same period in the previous year, totalling USD 5.6 billion. However, local exports reduced by 24.3%, amounting to 2.6 billion.

Georgia sold cars worth GEL 1.9 billion through re-exporting from January to November in 2023. This marked a 155% rise as compared to the 2022 figures and a 365% rise as compared to the corresponding timeframe in 2021.

Imports of cars increase parallel to a rise in re-exports, given that Georgia does not produce cars domestically. The volume of imported cars, which constituted GEL 840 million in the initial 11 months of 2022, surged to USD 2.9 billion in 2023.

Graph 2: Car Trade Dynamics from January to November (USD million)

Source: National Statistics Office of Georgia

The number of re-exported cars increased from 58,000 to 98,000 during the timeframe from January to November in 2021-2023.

Notably, given that the same product, individual cars in this case, has been accounted for in both imports and exports, it has contributed to an accelerated growth trade in trade turnover.

Local exports have showcased a significant downward trend totalling 24%, furthermore, even surpassing the 2021 mark in contrast to the upward tendency in re-exports. As a result, its share in total exports has reduced from 68% to 46%.

Graph 3: Structure of Exports from January to November (USD million)

Source: National Statistics Office of Georgia

Re-exports and raw materials constitute the primary contributors of Georgia’s export structure. However, declining prices and demand for ferroalloys and copper ores have led to a negative impact on their contribution to the trade balance. Over the first 11 months of the last year, the export of copper ores has halved, nitrogen fertilisers faced a 41% reduction and ferroalloys saw a 67% decline. These three reasons collectively contributed to an export reduction totalling USD 860 million, potentially aligning with the issues referenced by the Minister in his discussion.

Exports of certain products, such as wine, alcohol products, mineral waters and electricity have increased, totalling USD 87 million.

Graph 4: Export of Certain Product Categories in January-November (USD million)

Source: National Statistics Office of Georgia

The upward trajectory of imports is typically adversely reflected on the trade balance but is, nonetheless, considered indicative of the increased purchasing power of consumers. Whilst this is generally positive, given the rising imports reflect an expansion in the number, variety and the quality of products, a different scenario unfolded in Georgia in 2022 and 2023. Import in 2022 predominantly surged due to an upward trend in the prices of oil and oil products in the global market (the price of a tonne of imported oil products reached USD 1,004 in 2022, a figure 55% higher as compared to 2021 when the price was USD 647). A surge in 2023 imports was primarily attributed to the rising volume of imported cars meant for re-exports.

Although the figures as stated by Levan Davitashvili reflect the raw statistics, he still omits certain crucial reasons. Particularly, he overlooked the significant contribution of re-exports to the rising trend in exports, especially when local exports were significantly reduced in the same timeframe. Additionally, the statement fails to highlight that imports predominantly increased due to re-exports. The Minister failed to outright name the challenges despite acknowledging their existence, thus, FactCheck concludes that Levan Davitashvili’s statement is MOSTLY TRUE.