Roman Gotsiridze: “The profits of one Georgian bank exceeded the profits of all Latvian banks.”

Verdict: FactCheck concludes that Roman Gotsiridze’s statement is TRUE.

The profits of the Georgian banking sector reached GEL 2,1 billion with the Bank of Georgia contributing 924 million and TBC Bank at 894 million in 2022.

Identifying the profit margin and/or the amount of assets/capital is also necessary to comprehensively evaluate the profits of any firm. The assets of the Bank of Georgia totalled GEL 28,4 billion and those of TBC Bank amounted to GEL 27,4 billion as of 31 December 2022.

In Latvia, the 2022 profits of the banking sector amounted to EUR 322 million. The EUR-GEL exchange rate was 3.07 in the same year making the Latvian bank profits GEL 989 million then and 915 million now with the average exchange rate of 2.84 in 2023.

The volume of bank assets in Latvia is EUR 27 billion, equivalent to over 80 billion when converted to GEL.

FactCheck will not delve deeper into analysing the target bank profits by percentage or quantitatively nor the desired nature of the monetary policy of the National Bank, whether it should be ‘hard’ or ‘soft.’ However, the fact remains that one Georgian bank has received almost the same profits as the entire Latvian banking sector whilst the total Latvian banking assets were three-fold of its single most successful Georgian counterpart.

The MP’s objective was to emphasise that the bank profits in relation to its assets were higher than in Latvia. Thus, FactCheck concludes that his statement is TRUE.

Analysis:

Roman Gotsiridze, an MP and a member of the Euroskepticists, criticised the soft monetary policy highlighted in the report by the acting president of the National Bank during a parliamentary sitting and stated (from 5:26): “Georgian commercial banks earned unimaginably high profits in 2022, historically high profits” … One commercial bank, out of our primary two commercial banks, received higher profits than the entire Latvian banking system, all whilst the assets of Latvian banks largely exceed the assets of Georgian banks.”

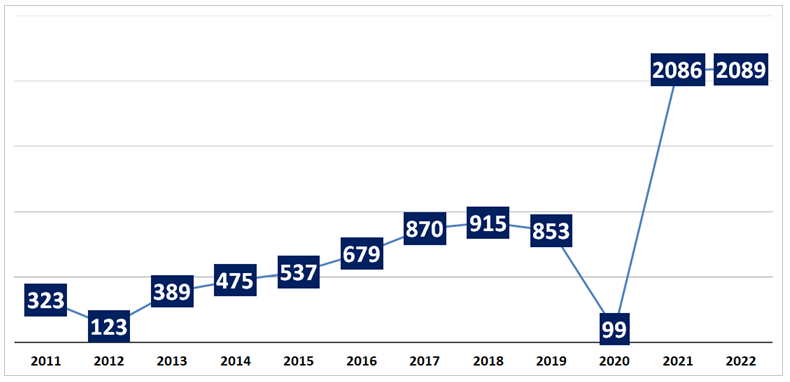

Georgian commercial banks earned a total profit of GEL 2.1 billion in 2022. Nominal profits were nearly identical (less by a mere GEL six million) in 2021, however, the higher profits in 2021 can be attributed to the renewed circulation of the money reserved during the first pandemic wave in 2020. Thus, the 2022 profits of Georgian banks indeed reached their historical maximum.

Graph 1: Net Profits of Commercial Banks (GEL million)

Source: National Bank of Georgia

The latter half of the MP’s statement touched upon the profit margins of Georgian and Latvian banks. The two primary banks in Georgia are the Bank of Georgia and TBC bank, collectively leading 80% of loan and deposit portfolios in the entire sector. Even higher is their share in profits at 93.8%. They earned GEL 924 million and 984 million in 2022, respectively. The total Latvian bank profits was EUR 322 million in the same year. The 2022 EUR-GEL exchange rate averaged at 3.07 making the aforementioned number GEL 989 million and GEL 915 million with respect to the exchange rate in 2023 at 2.84.

Georgian banking assets total GEL 70 billion with the two dominant banks contributing 27 billion and 28 billion, respectively. The Latvian counterpart stands at EUR 27 billion, making it larger than Georgian banking assets collectively, and almost three times as large as the assets of each of the two primary banks. Bank profits are determined not only by return on assets (ROA) but also return on equity (ROE). Typically, the larger the ROA, the higher the ROE but Roman Gotsiridze only compared the asset volumes in his statement.

Some politicians and economists criticise the Georgian banking system for three primary reasons:

1) High interest rates on loans.

2) The dominance of two banks.

3) Possession of non-profit assets.

Owning non-profit assets is illegal for banks. Whilst the law does not specify the upper boundary on any bank’s share, the National Bank has the rights to deny the merging of commercial banks. Furthermore, a yearly effective interest rate ceiling is 50% (Article 64, Part 2). This regulation has led to online lenders leaving the market but this left the banking system nearly untouched. Currently, the interest rate on consumer loans is approximately two and a half times lower than the upper limit, even lower on mortgages but larger on credit cards.

The weighted average interest rate on loans is higher in Georgia as compared to most developed economies. The interest rate on loans was 13.7% in 2022 according to World Bank (the high rate in GEL is more or less offset by the lower rates in foreign exchange). The interest rate is not only lower in developed countries but also in countries such as Haiti, Liberia, Nigeria and Guatemala.

Several factors determine the cost of loans with the most significant influences being the cost of resources, the competitive environment and the legal framework in the country.

Banks do not inherently hold money. They loan out funds that have been borrowed or deposited, essentially making the banks borrowers as well.

The interest rate accumulated on deposits is high similar to its counterpart on credit in Georgia. The interest rate on deposits amounted to 7.5% in 2022 (average of 12 months), including 11.3% on GEL-denominated and 1% on deposits denominated in foreign currency. Respectively, loans were lent out at 16.5% for GEL-denominated loans and 7.1% for foreign currency-denominated loans.

The National Bank refinancing loan stands as an additional source of financing for commercial banks. The refinancing rate amounted to 10.5% in the first quarter of 2022 and 11% for the rest of the year.

The spread (difference between the interest rates on loans and deposits) was five or six percentage points in each case (a little less on unsecured consumer and relatively less on mortgages).

Whether five or six percentage points are high or low is contingent on various factors. Since banks hold the money of others, additional regulations are imposed. Banks have a reserve requirement of 5% for deposits denominated in the national currency whilst the requirement on foreign currency-denominated deposits ranges from 10% to 25%, depending on the dollarisation coefficient on each bank’s deposits. Additionally, a 2% reserve is automatically imposed on loans. This reserve norm increases to 10% on overdue loans, periodically increasing up to 100% until the borrower continues payments. Apart from the regulations listed above, banks must operate according to the Basel III framework.

It is challenging to assess how competitive the environment is. On one hand, the British HSBS, the Ukrainian Privat Bank, and the French Société Générale left the market in 2011-2016, leading to the two dominant banks exceeding 80%. On the other hand, the system is clearly working with depositors not losing their funds in banks since the 1990s. The sector has persevered the war, financial crises and the pandemic. Apart from loans, other banking services (such as card payments, electronic commerce, transfers) are all technically available to the population without complications.

Noteworthy, banks face no liquidity issues or any other financial challenges. Moreover, the ROA coefficient on their assets is not only high but also the profits of one Georgian bank alone are almost equal to (as of 2022) and even slightly higher (as of 2023) than the total profits of the entire Latvian banking sector all whilst the Latvian banking assets being three times larger. Thus, FactCheck concludes that Roman Gotsiridze’s statement is TRUE.