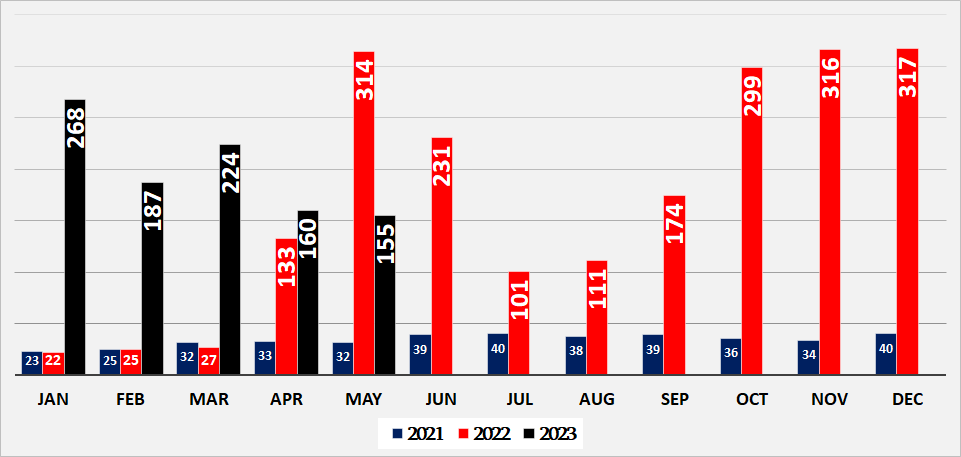

In May 2023, remittances from Russia halved after 13 months of continuous growth as compared to the same period of the previous year and dropped from USD 314 million to USD 155 million. Despite such a sharp decline, the volume of remittances in May is still fivefold higher as compared to pre-war figure.

Before 2014, Russia’s share in total remittances was above the 50% threshold, although the trend was declining. Russia’s share shrank to 34% in 2016, to 29% in 2018, to 18% in 2021 and to 13% in the first quarter of 2022. As a result, Russia moved into the second position whilst Italy became a number one origin of remittances to Georgia. This dynamic, however, has altered drastically since April 2022.

As compared to 2021, remittances from Russia increased by 403% in 2022 from USD 411 million to USD 2.067 billion. If we calculate the figures from only the last three quarters, growth will be 505%. Remittances peaked in the fourth quarter of 2022. The total volume of remittances from Russia in the last three months of 2022 was 2.3 times higher as compared to the total remittances from Russia in 2021.

Graph 1: Remittances from Russia (USD Million)

Source: National Bank of Georgia

This massive growth continued in 2023 as well, albeit only in the first quarter. In January-March 2023, USD 679 million was transferred from Russia to Georgia – 851% more as compared to the same period of the previous year. In April 2023, the growth rate dropped to 20% and it became negative in May.

The base period played a key role in the decrease when measured in percentage. In May 2022, remittances from Russia reached USD 314 million which is one of the highest figures even for 2022. However, there is a second factor – the decline in remittances as compared to the previous months. In March, April and May, remittances from Russia were USD 224 million, USD 160 million and USD 155 million, respectively. It is hard to argue whether or not this decline is a long-term trend. In July-August 2022, remittances from Russia also decreased to USD 100 million, although it rebounded in October to reach USD 300 million and exceeded USD 300 million in November-December.

Remittances from all countries decreased by 24% in May 2023 from USD 506 million to USD 385 million. However, if we exclude Russia, remittances increased from USD 192 million to USD 230 million, including EU countries with a 21% growth from USD 92 million to USD 111 million and the US with a 38% growth from USD 27.7 million to USD 38 million.

Until 2022, the absolute majority of recipients of remittances were Georgian nationals. Since Russia’s invasion of Ukraine, the structure has changed significantly. Apart from everyday needs, Russian nationals take interest in real estate and keep some of their money deposited in commercial banks.

From January 2022 to April 2023, Russian nationals purchased a total of 8,249 flats and 3,958 land plots. The rising demand for real estate contributed to a sharp growth of apartment prices and resulted in skyrocketing rent prices. According to the TBC Capital’s research study, rent for apartments in Tbilisi increased by 120% in October 2022 as compared to the same period of the previous year.

As of December 2022, Russian nationals have GEL 2.420 billion in deposits in Georgia’s commercial banks which is 327% more as compared to December 2021. In order to insure risks, the National Bank of Georgia increased the liquidity requirement on deposits of Russian nationals from 30-40% to 80%.

The growth of financial flows from Russia has become one of the major reasons for the GEL appreciation. Prior to the outbreak of the war in February 2022, the USD to GEL exchange rate was 1 to 3 and it appreciated to 2.6 in June 2023. At the same time, the National Bank of Georgia increased its foreign currency reserves from USD 4 billion to USD 5.130 billion, although this again decreased by USD 130 million in May to USD 5 billion.

In April, apartment sales in Tbilisi dropped by 23.4% and by 10% in as compared to the same periods of the previous year. In both cases, one of the main reasons behind this drop was likely the base period. In turn, the base period was affected by Russian nationals.

Why have remittances from Russia and the economic activity of the Russian nationals decreased? There is no precise answer but some of the possible reasons are as follows. On the one hand, it is possible that those who wanted to run away from Russia or withdraw savings left the country in a few weeks after the outbreak of war or after the announcement of mobilisation and they also took their savings with them. Therefore, there were less people seeking to relocate in 2023. On the other hand, Russia’s economic situation is obviously more difficult as compared to the previous period as a result of the protracted war and the measures taken in response to this war and this negatively affects the earnings of individuals which perhaps also affects the volume of remittances. Another potential assumption is that over time people found other ways to relocate funds which are less discernible. In this case, it is possible that the inflow of Russian money has not decreased and only its observable part shrank to some extent in parallel with a growth in the amounts which are not seen.

What the forthcoming period will bring is even harder to anticipate. Theoretically, the number of migrants may rise again in the case of an announcement of a new wave of mobilisation but it is also possible that Russia will close the borders to men who are eligible to be drafted as well as further complicating the sending of financial resources abroad both in electronic and physical forms. Given the political contexts, the risks related to finances of Russian origin, including the immediate reverse process (the reverse flow of money or its flow to third countries) is high. Therefore, the decision of the National Bank of Georgia’s authorities to raise the liquidity requirement to 80% needs to be welcomed. This decision has already become a matter of criticism for the pro-government “experts” by completely ignoring the existing risk and highlighting the hindrances posed to economic growth. It is possible to assume that these actors are indirectly voicing the position of the Government of Georgia as in previous cases. It is in these types of decisions when the importance of the National Bank of Georgia being independent from the government is shown vividly.