Koba Gvenetadze: “The country took a huge debt but, on the other hand, this is not a number alone. Debt sustainability is more important as compared to the debt’s absolute number. According to the International Monetary Fund’s forecast, the debt level will decrease simultaneously with economic growth.”

Verdict: FactCheck concludes that Koba Gvenetadze’s statement is MOSTLY TRUE.

Resume:

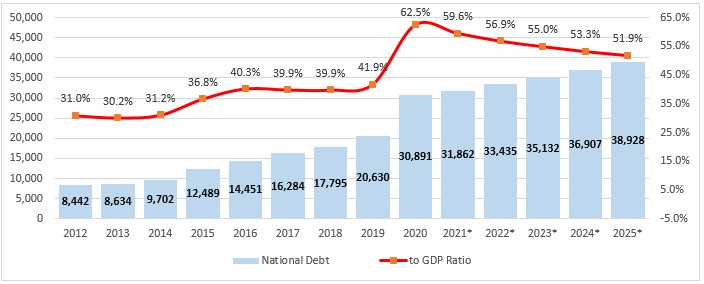

The remark by the president of the National Bank of Georgia in regard to the importance of the debt to the GDP ratio is essentially correct since a specific absolute figure can be very large vis-à-vis a smaller economy and very small vis-à-vis a large economy. For an overarching assessment of the debt burden, a commonly accepted indicator is the total debt to the total GDP ratio. In 2020, the national debt amounted to GEL 30.9 billion [1] which constituted 62.5% of the GDP. The drastic growth of debt in 2020 is largely stipulated by the pandemic-induced crisis and the depreciation of the GEL exchange rate. In 2019, Georgia’s national debt was GEL 20.6 billion which was equal to 41.9% of the GDP. According to the International Monetary Fund’s forecasts, Georgia’s debt to the GDP ratio will fall to 52% in 2021-2025 which will be stipulated by an expected growth of the GDP. On the other hand, the IMF forecasts that the debt’s absolute number will increase annually and reach GEL 39 billion in 2025. However, of note is that the debt to the GDP ratio increased more in 2020 as compared to previous forecasts whilst the GDP decreased more as compared to the forecasted figure.

Together with the unpredictability of the pandemic dynamic, the large share of the foreign currency denominated national debt also significantly contributed to the uncertainty since the debt burden will increase further in the case of a sharp depreciation of GEL even if no new loans are taken. Under the floating currency exchange rate, it is almost impossible to foresee the rate in the future. Therefore, although the statement of the president of the National Bank of Georgia is technically accurate, there are still questions in regard to debt sustainability given Georgia’s vulnerable economic conjecture and the uncertainty of the current processes. These questions were reflected in the 20 December 2020 report of the IMF, although Georgia’s foreign debt was still assessed to be sustainable.

Analysis:

President of the National Bank of Georgia, Koba Gvenetadze, stated: “The country took a huge debt but, on the other hand, this is not a number alone. Debt sustainability is more important as compared to the debt’s absolute number. According to the International Monetary Fund’s forecast, the debt level will decrease simultaneously with economic growth.”

Georgia’s national debt has constantly been a matter of public scrutiny in the past years. The interest has skyrocketed amid the novel coronavirus pandemic which brought a drastic growth of the national debt both in absolute figures and vis-à-vis the GDP. In turn, this sparked questions in regard to debt sustainability both in the public and the political spectrum.

Georgia’s debt comprises domestic debt [2] denominated in the national currency and foreign debt denominated in foreign currency. In 2020, the national debt amounted to GEL 30.9 billion which constituted 62.5% of the GDP. The drastic growth of the debt in 2020 is largely stipulated by the pandemic-induced crisis and the depreciation of the GEL exchange rate. In 2019, Georgia’s national debt was GEL 20.6 billion.

The remark of the president of the National Bank of Georgia in regard to the importance of the debt to the GDP ratio is essentially correct. FactCheck constantly underlines that discussing the debt to the GDP ratio instead of the absolute figure is most appropriate since a specific absolute figure can be very large vis-à-vis a smaller economy and very small vis-à-vis a large economy. For an overarching assessment of the debt burden, a commonly accepted indicator is the total debt to the total GDP ratio.

In 2019, Georgia’s national debt to GDP ratio was 41.9% and increased to 62.5% in 2020. As clarified by the International Monetary Fund, the debt is sustainable if the government is solvent without receiving additional financial aid or making a declaration of default. According to broader international standards (including the Maastricht Treaty’s compatibility criteria), debt which does not exceed 60% of the GDP is considered sustainable. This is also reflected in the Law of Georgia on Economic Liberty which forbids the government debt to the GDP ratio over 60% except in special circumstances which also includes pandemics. However, according to Georgia’s legislation, in the past the sustainability threshold was 60% of the national debt to the GDP ratio instead of the government debt. The legal change allowed the government to take more loans. According to the International Monetary Fund’s forecasts, the debt to the GDP ratio in 2021-2025 will decrease to 52% which is stipulated by the expected GDP growth. On the other hand, the IMF estimates that Georgia’s absolute debt figure will increase annually and reach nearly GEL 39 billion in 2025.

Graph 1: National Debt Statistics and IMF Forecasts, GEL Million, Debt to GDP % (forecasts from 2021)

Source: Ministry of Finance of Georgia, International Monetary Fund

Together with the unpredictability of the pandemic dynamic, the large share of the foreign currency denominated national debt also significantly contributed to the uncertainty since the debt burden will increase further in the case of a sharp depreciation of GEL even if no new loans are taken. Under the floating currency exchange rate, it is almost impossible to foresee the rate in the future. These questions were reflected in the 20 December 2020 report of the IMF which said that Georgia’s debt is sustainable, although the unfavourable dynamic (sharp growth of the debt figure, high dollarization, the exchange rate fluctuation, fiscal consolidation problems, etc.) requires close attention.

[1] This does not include the so-called legacy debt as defined by Georgia’s legislation.

[2] The IMF’s April Outlook includes government debt statistics and the debt figure is in line with the legally allowed threshold. However, FactCheck’s article is based on the statistics available at the time of the statement. The IMF’s April Outlook and latest forecasts are available at: https://www.imf.org/en/Publications/WEO/weo-database/2021/April.