Ivane Machavariani: “Eighty percent of the debt is denominated in foreign currency which makes the [legally allowed limit of a] 60% threshold even more vulnerable.”

Verdict: FactCheck concludes that Ivane Machavariani’s statement is TRUE.

Resume:

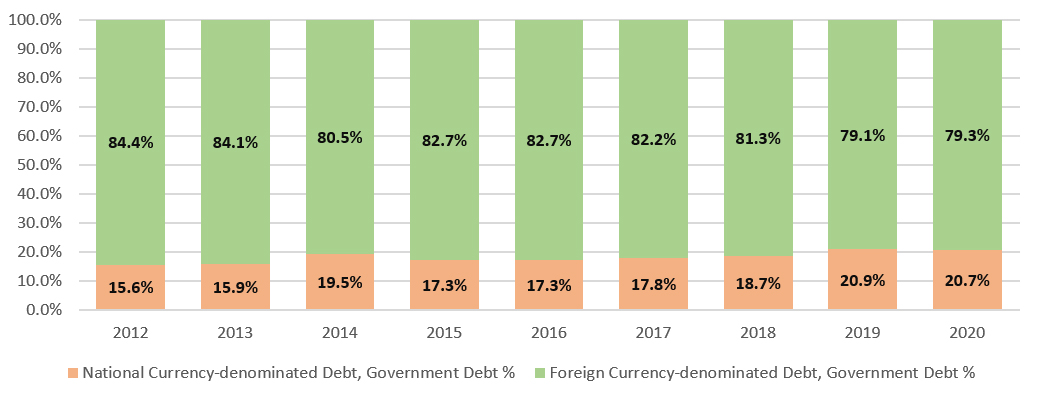

In 2012-2020, the foreign currency-denominated government debt constituted nearly 80% of the debt whilst the national currency-denominated debt was approximately 20%. In addition, the foreign debt to total government debt ratio has been declining over the course of 2012-2020.

According to the Law of Georgia on Economic Freedom, the government debt to GDP ratio should not exceed 60%. At the same time, the imposition of the pandemic-induced state of emergency allows the government to have debt and deficit figures above the legally prescribed thresholds for three years. The Minister of Finance was referring to that threshold. As of November 2020, the government debt constituted 59.4% of the estimated GDP, although it is planned that this ratio will rise above 60%.

The substantial fluctuation of the GEL exchange rate and its depreciation vis-à-vis USD has been a problem in Georgia since 2014. As compared to that year, GEL has depreciated nearly twofold. Therefore, given the large amount of foreign currency-denominated debt, the stability of foreign debt figure will face significant challenges in the case of future currency fluctuation/depreciation and this will theoretically hold true even if the foreign currency-denominated debt does not increase.

Analysis

The Minister of Finance of Georgia, Ivane Machavariani, stated: “Eighty percent of the debt is denominated in foreign currency which makes the [legally allowed limit of a ]60% threshold even more vulnerable.”

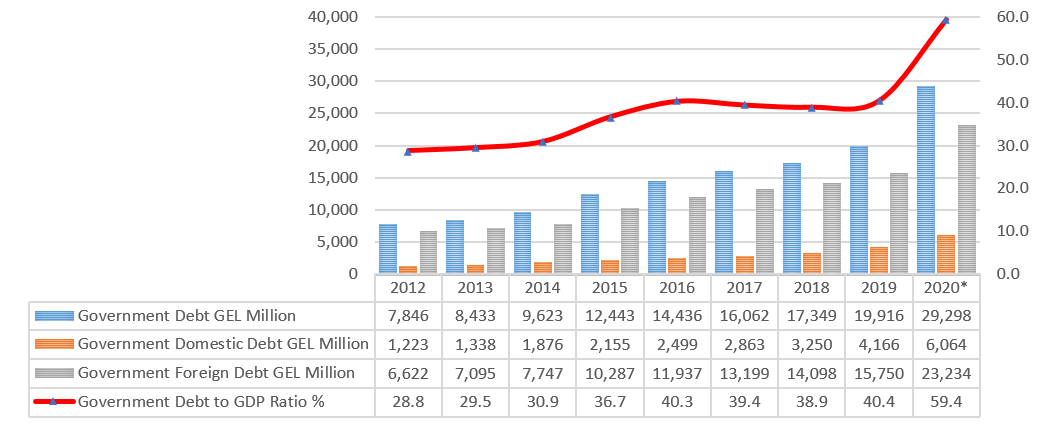

The government debt has always been a pressing issue in the past years and interest in this issue was especially raised amid the novel coronavirus-induced pandemic. The government debt includes the national currency-denominated debt and the foreign debt denominated in foreign currency. As of the available data in 2020 (November), the total government debt constitutes nearly GEL 29.3 billion, including nearly GEL 6 billion in domestic debt and GEL 23.2 billion in foreign debt. Of note is that the government debt in absolute numbers increased by GEL 9.4 billion as compared to 2019 with the domestic debt increasing by GEL 1.9 billion and foreign debt increasing by GEL 7.5 billion.

Graph 1: Government Debt in 2012-2020 (*-November)

Source: Ministry of Finance, National Statistics Office of Georgia

The GEL exchange rate fluctuation vis-à-vis USD has to be taken into account whilst analysing the government debt dynamic. In particular, after changes in the exchange rate the new exchange rate is applied for the calculation of not only the added debt in a period (debt taken in one year) but the balance figure of the debt previously accumulated (the unpaid part of the debt taken in the past). Therefore, the growth of the government debt was largely stipulated by a recalculation of the previously accumulated debt balance in accordance with the new exchange rate. The growth of the total government debt is largely stipulated by the growth of the foreign debt. Graph 2 shows a percentage ratio of the domestic and the foreign debt as part of the total government debt. In accordance with the statement of the Minister of Finance, the foreign currency-denominated government debt constituted nearly 80% of the debt in 2012-2020 whilst the national currency-denominated debt was approximately 20%.

Graph 2: Percentage Ratio of Government Obligations Denominated in National and Foreign Currency (Shown in GEL at Graph) in 2012-2020 (*-November)

Source: Ministry of Finance

According to the Law of Georgia on Economic Freedom, the government debt to GDP ratio should not exceed 60%. At the same time, the imposition of the pandemic-induced state of emergency allows the government to have debt and deficit figures above the legally prescribed thresholds for three years. The Minister of Finance was referring to that threshold. The substantial fluctuation of the GEL exchange rate and its depreciation vis-à-vis USD has been a problem in Georgia since 2014. Therefore, the stability of the foreign currency-denominated debt comes under significant pressure given the large amount foreign currency-denominated debt. As of November 2020, the government debt constituted 59.4% of the estimated GDP, although this ratio is planned to rise above 60%. In accordance with the initial version of the budget adopted prior to the outbreak of the pandemic, the forecasted government debt to GDP ratio was 45%. A further depreciation of the GEL exchange rate in the future may lead to a further growth of the government debt.

![“Eighty percent of the debt is denominated in foreign currency which makes the [legally allowed limit of a] 60% threshold even more vulnerable.”](https://factcheck.ge/storage/files/320x180/696df440-40b5-11e9-a3bf-8938dc76beb2.jpg)