Resume: A country’s credit rating gives investors information about risk factors associated with investments in certain countries as well as the reliability of these countries. Dozens of agencies publish credit ratings although Standard & Poor’s (S&P), Moody’s and Fitch are the most influential and famous among them. Each credit rating agency employs its own methodology although basic indicators are the same and include economic indicators as well as a country’s domestic and foreign policies, regional processes and the environment.

Fitch maintained Georgia’s BB rating with negative outlook in August 2020 and left it unchanged at the level given in April 2020. In turn, in April, amid the pandemic, Georgia’s credit outlook was downgraded from stable to negative. Standard & Poor’s kept a BB stable outlook for Georgia whilst Moody’s Ba2 stable assessment was unveiled on 11 September 2019 and has not been updated. Georgia’s assessment grades are in principle the same for each of these companies and, therefore, they conclude that speculative risks persist in the Georgian economy. The Minister’s interpretation that the Georgian economy augurs well for investors is principally wrong and manipulative since historically Georgia’s assessment has always been non-investment grade (see Table 1) and this has not been changed.

According to the Minister’s statement, maintaining the credit rating means rating companies conclude that the novel coronavirus pandemic has not caused a significant worsening of Georgia’s credit conjecture. Of note is that the credit ratings of some of the countries mentioned in the Minister’s statement (for instance, Serbia and Bulgaria) vis-à-vis S&P’s assessments are still higher as compared to Georgia’s even after being downgraded. In particular, Serbia’s sovereign rating is BB+ whilst Bulgaria’s rating is BBB-.

Analysis

As stated by the Minister of Economy and Sustainable Development of Georgia, S&P left Georgia’s sovereign ratings unchanged which indicates that the Georgian economy augurs well for investors in light of the pandemic-induced global challenge. During this year, a number of countries had their ratings downgraded, including Serbia, Bulgaria, Greece and several others.”

Countries compete in the world economy to attract foreign capital. Developing or less developed nations, which have their own limited resources, are particularly dependent upon foreign capital. In turn, creditors and investors make their choices by taking into account the rate of return and stability. In other words, they make calculations vis-à-vis possible profits and risks. The lower the risks (higher reliability), the lower the rate of return for the creditor or investor of the capital in exchange for which he is ready to invest his money in the country.

A country’s credit rating gives investors information about risk factors associated with investments in certain countries as well as the reliability of these countries. Dozens of agencies publish credit ratings although Standard & Poor’s (S&P), Moody’s and Fitch are the most influential and famous among them. Each credit rating agency employs its own methodology although basic indicators are the same and include economic indicators as well as a country’s domestic and foreign policies, regional processes and the environment.

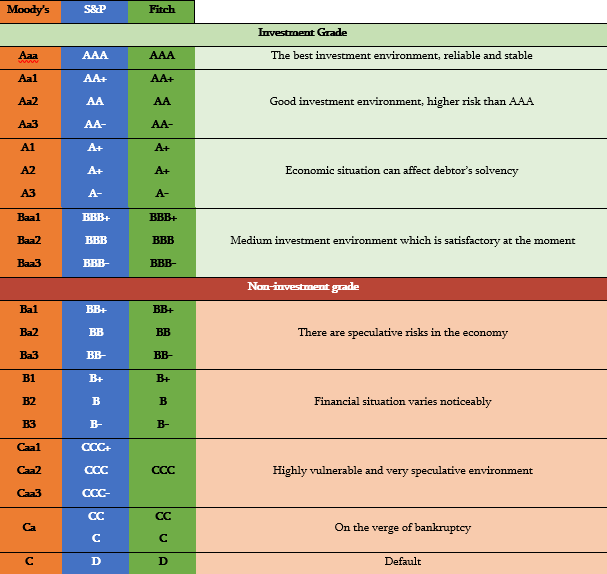

Standard & Poor’s and Fitch employ similar assessment systems: AAA is the highest rating in their assessment which is followed by AA+, AA, AA- above average – A+, A, A-, below average – BBB+, BBB, BBB-, non-investment grade speculative – BB+, BB, BB-, speculative B+, B, B-, highly vulnerable CCC, on the verge of bankruptcy CC and default D. Moody’s assessment is also similar but instead of +/- it uses digitals: Aaa, Aa1, Aa2, Aa3, A1, A2, A3, Baa1, Baa2, Baa4, Ba1, Ba2, Ba3, B1, B2, B43, Caa1, Caa2, Caa3, Ca and C. Assessment levels in turn are divided into investment and non-investment grades. Table 1 shows the economic interpretation of these assessments. Furthermore, on top of their ratings, these companies give outlooks: negative, stable or positive.

Table 1: Assessments of Moody’s, S&P and Fitch and Interpretation of the Assessments

Fitch maintained Georgia’s BB rating with a negative outlook in August 2020 and left it unchanged at the level given in April 2020. In turn, in April, amid the pandemic, Georgia’s credit outlook was downgraded from stable to negative. Standard & Poor’s maintained a BB stable outlook for Georgia whilst Moody’s Ba2 stable outlook was unveiled on 11 September 2019. Georgia’s assessment grades are in principle the same for each of these companies and, therefore, they conclude that speculative risks persist in the Georgian economy.

The interpretation that the Georgian economy augurs well for the investors is principally wrong and manipulative since historically Georgia’s assessment has always been non-investment grade (see Table 1). However, according to the Minister’s statement, maintaining the credit rating means rating companies conclude that the novel coronavirus pandemic has not caused a significant worsening of Georgia’s credit conjecture. Of note is that the credit ratings of some of the countries mentioned in the Minister’s statement (for instance, Serbia and Bulgaria) vis-à-vis S&P’s assessment are still higher as compared to Georgia’s even after being downgraded. In particular, Serbia’s sovereign rating is BB+ whilst Bulgaria’s rating is BBB-.