Resume: Since January 2019, the National Bank’s lending regulations have entered into force and requirements for taking loans have become stricter. Therefore, this could possibly have an impact upon this year’s employment and jobs indicators. However, first quarter data of 2019 is not yet available and even if it were, we would be unable to assert whether or not the changes in employment in a certain sector are related to a specific regulation. Therefore, Irakli Abesadze could not base his statement vis-à-vis job losses upon specific figures. FactCheck, however, also lacks the possibility to verify the accuracy of the statement.

In regard to the usury and the so-called “black market” in Irakli Abesadze’s statement, it is practically impossible to measure the latter. However, theoretically it is possible that he made a fair supposition. The author of the statement also does not have respective data.

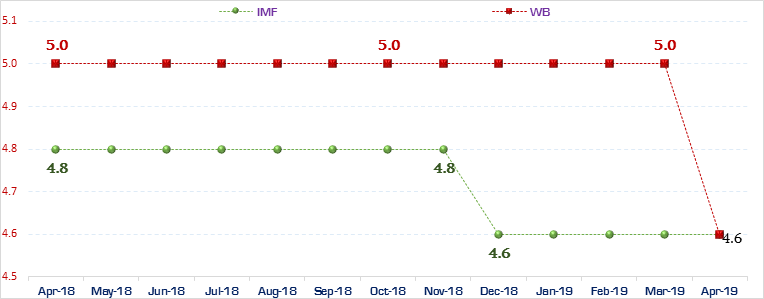

April 2019 was the last time when the International Monetary Fund (IMF) updated estimates for 2019’s economic growth rate and the 4.6% growth estimate for Georgia was kept unchanged. This happened in light of the IMF’s decision to cut estimates for Georgia’s main trade partners. Of note is that in the IMF’s review and when speaking about estimates of economic growth, emphasis is made upon the less favourable external environment and the impact of the slow growth of lending. The latter refers to lending regulations.

As of January 2019, Georgia’s 2019 economic growth rate was 5% in the World Bank’s assessment which was decreased to 4.6% at the beginning of April. A weak external demand and the so-called “responsible lending” – lending regulations – were named as the reasons behind the World Bank’s decision.

At the present moment and in accordance with both the World Bank and the IMF’s assessments, Georgia’s estimated economic growth rate for 2019 is 4.6%. In addition, both of them notes that stricter lending will negatively affect economic growth, although it will have a positive impact upon the sector’s stability and this factor is taken into consideration in their estimates. Therefore, regulations on lending are not the only reason behind the decreased estimates of the IMF and the World Bank. They are just one factor.

Given the aforementioned number of unspecified circumstances, FactCheck leaves Irakli Abesadze’s statement WITHOUT VERDICT.

Analysis

European Georgia Movement for Freedom MP, Irakli Abesadze, in his speech before the Parliament of Georgia, spoke about the outcomes of the lending regulations imposed by the National Bank of Georgia. As stated by Mr Abesadze, the regulations which entered into force from January 2019 resulted in decreased jobs, pushed loans into the “black market” and caused a decrease in the estimates for economic growth.

These regulations impose lending restrictions on commercial banks and micro-finance organisations. This means they are obliged to study and analyse an individual’s solvency. Apart from the necessity of the solvency analysis, the regulations impose additional requirements, including the requirement that the difference between a borrower’s net income and the loan payment should not be less than the subsistence minimum (the subsistence minimum is currently GEL 181). FactCheck also wrote about the regulations introduced by the National Bank in the previous months.

The National Bank’s president issued the aforementioned regulations on 24 December 2018 and they went into force on 1 January 2019. Therefore, the economic regulations will start to affect economic indicators from this year. The National Statistics Office of Georgia produces statistical data about jobs as part of its business sector statistics. However, the latest information about jobs and employment in the business sector for the present moment only includes the fourth quarter data of 2018. In addition, the latest statistical information about employment/unemployment compiled through the research study of workforce also includes the fourth quarter of 2018. In turn, the National Statistics Office of Georgia will publish 2019’s first quarter indicators on 20 May 2019. Therefore, the MP’s talk about this year’s employment figures is groundless in terms of facts and statistics because not such information is available at this moment.

In regard to loans being pushed into the “black market” and a usury problem, there is no factual evidence to support this because information about these activities is not compiled; hence, the term “black market.” Lending money by individuals is not under a legal framework and information about it is not generated and registered.

FactCheck contacted Irakli Abesadze in regard to his statement about the loss of jobs in the business sector and about the so-called “black market” in order to learn whether or not he had some statistical data. In his interview with FactCheck, Mr Abesadze said that he does not have such statistics and made his statement based on information in the media.

In April 2019, the International Monetary Fund updated the 2019 economic review and estimates. In accordance with the updated estimates, Georgia’s economic growth in 2019 is 4.6% and this has not been changed as compared to February estimates. In February 2019, an IMF representative noted that whilst making the 4.6% economic growth estimate, a less favourable external environment and the impact of a slow growth of lending upon the economy was taken into account. However, it is also noted that the growth of the budget’s capital expenditures counter-balances the negative factors. Of further note is that the share of the budget’s capital expenditures increased in 2018 which has an impact in 2019[1] as well whilst these types of expenditures increased further in 2019.

Graph 1: Georgia’s Estimated Economic Growth Rate in 2019, IMF and WB (%)

Source: International Monetary Fund

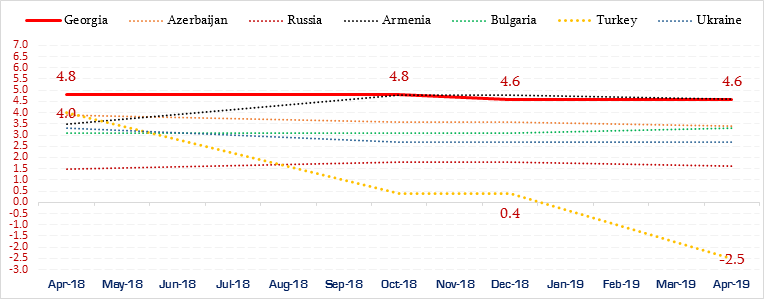

Of additional note is that the International Monetary Fund slashed Georgia’s 2019 economic growth rate estimate from 4.8% to 4.6% in December 2018. The IMF stated that the economic situation in Georgia’s trade partners and in the region was the reason behind the decision. The IMF particularly emphasised economic processes in Turkey and their impact.

Georgia’s main trade partners (in terms of the share in total exports in 2018) are as follows: Azerbaijan (15%), Russia (13%), Armenia (8.3%), Bulgaria (7.7%), Turkey (6.9%) and Ukraine (5.2%). In April 2019, the IMF slashed economic growth estimates for Azerbaijan, Russia and Armenia by 0.2% whilst it increased for Bulgaria by 0.2%. In regard to Turkey, its economic growth rate estimate dropped from 0.4% to -2.9%. Of note is that in light of these factors and the general decrease in regional economic growth after December 2018, the IMF left Georgia’s estimated economic growth rate unchanged at 4.6%.

Graph 2: 2019 Economic Growth Rate Estimates, IMF (%)

Source: International Monetary Fund

At the beginning of April 2019, the World Bank published updated estimates of macroeconomic estimates for European and Central Asian (without high-income) countries. In this document, Georgia’s 2019 economic growth estimate decreased to 4.6% whilst it was 5.0% as of January 2019 (see Graph 1). The World Bank indicates that the decrease is stipulated by a weakening foreign demand which in turn is related to the macroeconomic situation in Georgia’s trade partner countries as well as the National Bank’s responsible lending policy. The latter refers to lending regulations.

[1] A substantial part of budget funds was transferred in the last month. It is expected that these funds will have their impact upon the economy in 2019.