Verdict: FactCheck concludes that Giorgi Kakauridze’s statement is HALF TRUE.

Resume: A budget’s deficit spending implies the amount by which government spending exceeds its revenues from the economy. At the legislative level, the budget deficit is defined as a negative balance of the budget.[1]

According to data of the Ministry of Finance, a negative balance during 2018 was observed in February (-80 million), May (-4 million) and September (-50 million) only. It should be noted that May’s figure is meager and can only be theoretically called a deficit. Therefore, a reference to a budget surplus is largely consistent with reality.

Besides the interconnection between budget revenues and expenses, it is important how the government deals with funds that are accumulated as a result of surplus spending in terms of providing money to the economy. These funds could be transferred to the Treasury and, in this case, the money is taken out of the market. They could also be transferred to commercial banks as deposits and, thus, returned to circulation. The funds, whether or not they are directly supplied to the economy from the budget or indirectly through commercial banks, increase the money supply in the economy.

During the first ten months of the current year, an additional GEL 620 million was transferred from the budget and GEL 210 million was transferred from the autonomous republics and municipalities to deposits in commercial banks which, in fact, is money supplied to the economy and when all things are equal (Ceteris Paribus) could not have a positive influence on the GEL exchange rate. It should be noted that transferring funds to the Treasury is a more costly choice and when all things are equal, abstaining from allocating the funds to bank deposits is not a reasonable decision. However, during the depreciation of the currency rate, it is more appropriate to choose the costly alternative and not supply additional resources to the market until the pressure factors on the currency rate are eliminated.

Analysis

Deputy Minister of Finance, Giorgi Kakauridze, within the context of influences on the GEL exchange rate, stated that budget deficit spending did not occur and a surplus was observed at the end of each month of the current year.

One of the factors affecting the national currency rate is the volume of GEL that is supplied to the economy. If the volume of GEL is increased in the market, the national currency rate is decreased (depreciated) and, on the contrary, if the GEL’s volume is lowered in the economy, its rate is appreciated. Funds raised for the budget implies extracting GEL from the economy whilst costs incurred implies returning money to the economy. If the government extracts more funds from the economy than it returns, it reduces the volume of GEL and contributes to the appreciation of the currency rate. Content-wise, when a government spends more than it takes from the economy, it leads to deficit spending. In contrast, when the government has more revenue from the economy than expenses, it leads to surplus spending. At the legislative level, the terms are defined by the Budget Code of Georgia. In particular, the difference between budget revenue and expenses is the budget’s operation balance. The difference between the budget’s operation balance and the change in non-financial assets is the budget’s total balance. A total positive balance is the budget surplus whilst the total negative balance is the budget deficit. Expenses incurred from the state as well as from the local budgets have an identical impact on the economy. Therefore, in this case, it is relevant to review consolidated[2] budget data.

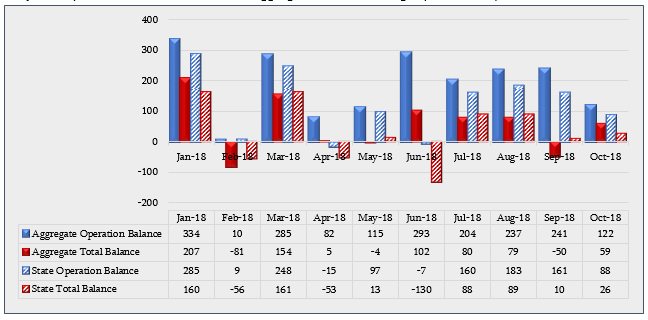

Graph 1: Operation and Total Balance of Aggregate and State Budget (Million GEL)

Source: Ministry of Finance of Georgia

As demonstrated in the graph, the aggregated budget’s operation balance is positive during the entire period. In other words, the budget’s total revenues exceeded total expenses each month. However, the budget deficit is defined against the total balance calculated in consideration with the changes in non-financial assets. The aggregated budget’s total balance is mainly positive, implying a surplus. The figure is negative in February (-81 million), May (-4 million) and September (-50 million) only. It should be noted that the May’s figure is meager and can only be theoretically called a deficit.

Besides the interconnection between the budget revenues and expenses, it is important how the government deals with the funds that are accumulated as a result of surplus spending in terms of providing money to the economy. These funds could be transferred to the Treasury and, in this case, money is taken out of the market. Alternately, they could also be transferred to commercial banks as deposits and, thus, returned to circulation.

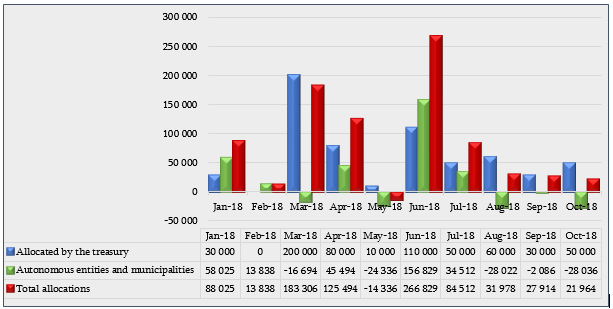

Graph 2 reflects the figures of transferring budget funds to commercial banks.

Graph 2: Funds Allocated to Commercial Banks (Thousand GEL)

Source: State Treasury of Georgia

It is important to explain that whether or not the funds will be supplied to the economy directly from budget spending or indirectly through deposits transferred to a commercial bank (which will be naturally used by commercial banks for current crediting), they both increase the money supply to the economy. According to the State Treasury data, GEL 555 million was transferred from the Treasury and GEL 180 million was transferred from the autonomous republics and municipalities at the beginning of this year to deposits in commercial banks which, in fact, is money supplied to the economy and, when all things are equal, could not have a positive influence on the GEL exchange rate. It should be noted that keeping money in the Treasury is a more costly choice than placing it in deposits. Therefore, abstaining from transferring funds to bank deposits is not appropriate when all things are equal. However, during the depreciation of the currency rate, it is more reasonable to choose the costly alternative and not supply additional resources to the market until the pressure factors on the currency rate are eliminated. It is obvious from the graph that during the August-September period when the GEL exchange rate faced depreciation pressure, the amount of deposits is substantially less which is considered as a desirable scenario.

[1] Difference between the operation balance of the budget and the change in non-financial assets.

[2] The consolidated budget of Georgia, its autonomous republics and local municipalities.