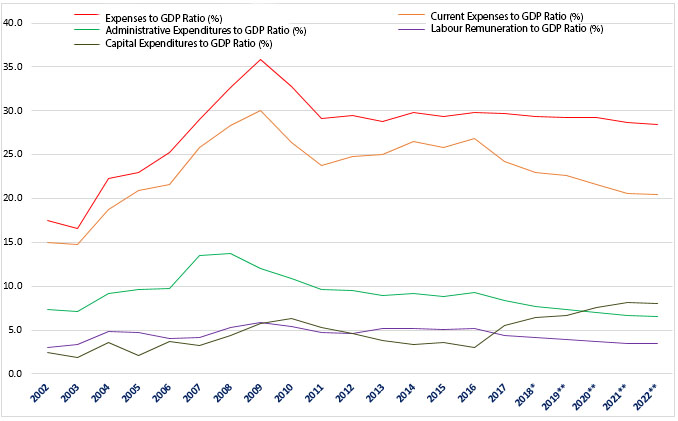

It is estimated that the consolidated budget expenses to GDP ratio will be 29.2% by 2020. Consequently, in 2018-2019, plans are to reduce the size of the government by only 0.2 of a percentage point.

Therefore, the Basic Data and Directions of the Country for 2019-2020 programme, initiated by the Government of Georgia, as well as the 2019 draft budget are not documents aimed at reducing the government’s size. They cannot be considered as a unity of tasks (in terms of fiscal figures) necessary to implement the “small government concept.” This is because reducing the government’s size means decreasing the total budget expenses ratio instead of decreasing any of its separate components – for instance, a decrease in labour remuneration or total current expenses (as is indicated in the government programme).

Analysis One of the chapters of the 2018-2020 government programme

includes the “small government” concept. The programme envisions a decrease in the ratio of labour remuneration as a measure of both the government’s size and scale. In fact, in order to measure the government’s size and scale, it is common to use the share of consolidated budget expenses in the GDP; that is, the expenses to GDP ratio. These data measure the scale of government involvement in the economy and show the amount of resources the government takes from the economy to provide public services. In addition, it also involves employment in the public sector and human resources sufficient in order to deliver public services. When the government’s size decreases, services provided by the government start to reduce as well. Consequently, a decrease in employment in the public sector is a process parallel to decreasing the government’s size because the production of less services requires less human resources. Many authoritative organisations, such as the International Monetary Fund, Organisation for Economic Co-operation and Development and the Fraser Institute, etc., use a similar methodology in their publications to measure a government’s size.

The Parliament of Georgia approved the new cabinet of ministers and the government programme in July 2018. Therefore, they could not have added to the fiscal figures of this budget year. However, FactCheck analysed the government programme at that time and found out that the directions given in the programme were not aimed at reducing the government’s scale. A few days ago, the Government of Georgia submitted the 2019 draft budget to the Parliament of Georgia which also includes basic data and directions (BDD)for the country for 2019-2022.

As already mentioned, the consolidated budget expenses to GDP ratio is used for measuring the government’s size. This reflects the ratio of financial resources necessary to carry out functions at the state, autonomous republic or self-governing unit levels vis-à-vis the economy.

In 2017, consolidated budget expenses amounted to 29.6% of the GDP whilst they equalled 29.4% of the GDP in 2018. In accordance with the Government of Georgia’s estimates, this figure will stand at 29.3% in the next year. It is estimated at a 9.7% growth (5.0% real growth) of the GDP in 2018 and an 8.2% growth (4.5% real growth) of GDP in 2019. Furthermore, it is forecast that the consolidated budget expenses to GDP ratio will be 29.2%. Therefore, the plans are to reduce the government size only by 0.2 of a percentage point in 2018-2019. In regard to the changes in different components constituting the size of the government, consolidated budget expenses include administrative expenses (labour remuneration, goods and services) subsidies and grants, social security and other expenses whilst capital expenses include non-financial assets. It is expected that the consolidated budget expenses to GDP ratio will be 23.0% at the end of 2018. This figure was 24.2% in the last year. In the same years, an increase in the relative figures of net capital expenditures[1]is expected against the backdrop of a decrease in current expenses. The capital expenditures to GDP ratio was 5.5% in 2017 which will presumably increase to 6.4% this year. In accordance with the estimates for 2019, current expenses are planned to decrease to 22.6% whilst capital expenditures are to be increased to 6.7%.

Graph 1:

Consolidated Budget Expenses Relative Figures (%)

Source: Ministry of Finance, National Statistics Office of Georgia, Treasury Service

Source: Ministry of Finance, National Statistics Office of Georgia, Treasury Service

Consolidated budget expenses in terms of separate components are also of interest. Administrative expenses comprise the total sum of labour remuneration and goods and services budget lines. The consolidated budget administrative expenditures to GDP ratio was 8.4% in 2017. This figure is expected to be 7.7% in 2018. In the following year, the administrative expenditures to GDP ratio is estimated to decrease. The ratio will be 7.3% in 2019. Labour remuneration constituted 4.3% of the GDP in 2017 whilst it will be 4.1% this year. In regard to 2019, FactCheck previously wrote that the 3.9% milestone in the government’s programme had already been achieved and that there was no need for the government’s additional efforts. In accordance with the draft 2019 budget, the consolidated budget labour remuneration to GDP ratio is 3.9%. In nominal figures, labour remuneration in the 2018 state budget is GEL 1.710 billion whilst it will be GEL 1,763.8 million according to the 2019 draft state budget. In accordance with the Law of Georgia on Labour Remuneration in Public Institutions, the basic nominal remuneration[2] in the 2019 draft state budget will be GEL 1,000, similar to what it is in this

year’s budget.

[1]

Changes in non-financial assets – growth plus decrease (negative figure).

[2] The basic amount of labour remuneration legally determined by the state budget of a given year. Labour remuneration for a specific post/position is calculated by multiplying the basic amount of labour remuneration by the coefficient determined by the appendix of the Law of Georgia on Labour Remuneration in Public Institutions.