The credit rating agency Fitch has affirmed Georgia’s sovereign rating at the BB level but revised its outlook from positive to stable. Furthermore, the agency predicts that inflation will increase to 4.1%, albeit at a slower rate, whilst the GDP is projected to increase by 5.8% in the current year and 5% per year in 2025 and 2026.

Investment markets of countries are evaluated utilising sovereign ratings, which exhibit information regarding the risk factors and trustworthiness of countries for investors, influencing the volume of direct foreign investments. Eventually, investments affect the GDP and the GDP contributes to social welfare.

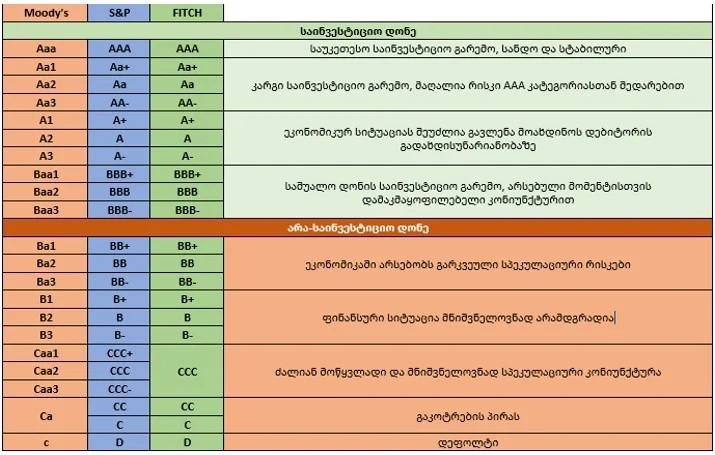

Several international agencies determine credit ratings, three of which lead the field: Fitch, Moody’s and Standard & Poor’s. Whilst each credit agency utilises their independent methodology, there are certain factors that all of them share, including not only economic indicators but also the internal and foreign policies of countries, the events in the region and the environment. Each agency categorises countries into two primary groups – investment and non-investment which then branch out to several categories and subcategories.

Georgia received an evaluation of BB- from Fitch in July 2007 but the rating declined to B+ following the war. The country was once again assessed as BB- in 2011 and only managed to reach BB in 2019.

Fitch improved Georgia’s BB rating outlooks from stable to positive, affirming the same evaluation for the two following periods 1.5 years ago in January 2023. Notably, BB with a positive prediction is the best rating Georgia has ever received from Fitch.

Table 1: Fitch Ratings for Georgia

|

|

Rating |

Outlook |

Rating |

Outlook |

Rating |

Outlook |

|

2007 |

BB- |

Stable |

|

|

|

|

|

2008 |

BB- |

Stable |

B+ |

Negative |

|

|

|

2009 |

B+ |

Negative |

B+ |

Stable |

|

|

|

2010 |

B+ |

Stable |

|

|

|

|

|

2011 |

B+ |

Positive |

BB- |

Stable |

|

|

|

2012 |

BB- |

Stable |

|

|

|

|

|

2013 |

BB- |

Stable |

|

|

|

|

|

2014 |

BB- |

Stable |

BB- |

Positive |

|

|

|

2015 |

BB- |

Stable |

BB- |

Stable |

|

|

|

2016 |

BB- |

Stable |

BB- |

Stable |

|

|

|

2017 |

BB- |

Stable |

BB- |

Stable |

|

|

|

2018 |

BB- |

Positive |

BB- |

Positive |

|

|

|

2019 |

BB |

Stable |

BB |

Stable |

|

|

|

2020 |

BB |

Stable |

BB |

Negative |

BB |

Negative |

|

2021 |

BB |

Negative |

BB |

Stable |

|

|

|

2022 |

BB |

Stable |

BB |

Stable |

|

|

|

2023 |

BB |

Positive |

BB |

Positive |

BB |

Positive |

|

2024 |

BB |

Stable |

|

|

|

|

Source: fitchratings.com

Generally, ratings lower than BBB- are perceived non-investment grade on the aggregated scale. The rating in between BB and BBB- is BB+.

BB is considered a higher level of the non-investment grade category (BB- and BB+ are in this row). Assigning a rating in this subcategory suggests that whilst the overall state of the country is not in a catastrophic condition, default risk is low and the financial system is more-or-less stable, there are still certain speculations and concerns in the economy.

Table 2: Interpreting the Ratings of Moody’s, S&P and Fitch

Source: bankersalmanac.com

Several factors are taken into account whilst measuring the aforementioned ratings. It is crucial to emphasise that the rating has remained at the BB grade due to the acceptable levels of the GDP growth rate, government debt and the budget deficit. However, the outlook was adversely impacted primarily by the internal political instability.

Macroeconomic figures have not massively declined following the Russian-style law, protests and visa regulations as of June 2024. Additionally, sanctions were targeted toward certain individuals rather than the country as a whole.

Fitch maintained the same general rating but decreased the outlook by one level, considering stable economic growth rates and other macroeconomic factors. Whilst a downgrade in rating or outlook generally signals a negative perspective for investors, it may not necessarily prompt them to withdraw investments from the economy. Furthermore, credit ratings shape the overall picture but do not directly determine realised investments. For instance, when Georgia’s rating was BB- from 2014 to 2017, foreign direct investment exceeded the 2023 value both in monetary terms and relative to the GDP. Notably, Georgia’s rating was BB with a positive outlook in 2023, marking the highest rating Georgia has ever received.