Resume: In order to partially eradicate the negative consequences of GEL depreciation, the Government of Georgia approved the so-called one-off larisation programme which was active in the period of 17 January to 24 March 2017. This programme allowed citizens to convert their USD denominated loans to GEL with a GEL exchange rate of GEL 0.2 lower than the official figure with the difference being reimbursed as a subsidy from the state budget. The programme covered only those citizens who had taken loans before 1 January 2015 with immobile property as loan collateral.

The Government of Georgia had high hopes for the programme and prognosticated significant benefits. However, the number of programme beneficiaries was lower than initially planned in the end. It is possible to say that the programme was not attractive enough for the majority of borrowers or the Government of Georgia could not properly communicate its message to the public.

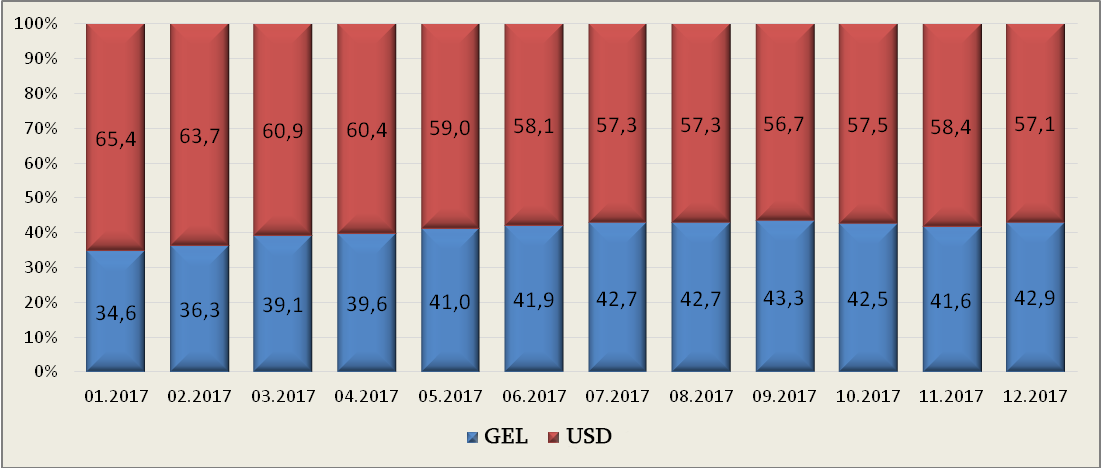

When the changes came into force (January 2017), the total volume of loans issued by commercial banks amounted to GEL 18.9 billion. Of this amount, GEL 6.5 billion (35%) was GEL denominated whilst GEL 12.3 billion (65%) was foreign currency denominated. According to the data of 1 April 2017; that is, by the end of the programme, the total amount of issued loans was GEL 18.3 billion. Of this amount, GEL 7.1 billion (39.1%) was GEL denominated whilst GEL 11.2 billion (60.9%) was foreign currency denominated. Therefore, the dollarisation rate dropped slightly as a result of the programme.

The decreased dollarisation cannot be fully explained by the processes caused by the aforementioned programme. It is natural, however, that artificial interference has had a certain impact upon the changes in the indicators for a specifically given period. Generally, the programme can be characterised as unsuccessful according to factual data. In particular, only 24.2% (GEL 15.7 million) of the total funds (GEL 65 million) allocated for subsidising the loan conversion process was spent. The actual number of beneficiaries is 5,164 whilst the programme could have covered 33,000 borrowers (as stated by the then Minister of Finance). In accordance with the National Bank of Georgia, the programme could have covered 27,000 borrowers. Therefore, only 17-20% of the total number of borrowers deemed loan larisation to be an acceptable solution.

Analysis

European Georgia Movement for Freedom MP, Zurab Tchiaberashvili, on air on the TV broadcast Archevani, stated: “You remember the larisation programme which was to supposedly solve the loan problem. They said that GEL 65 million was to be spent. In fact, upon the programme’s completion, only GEL 15 million was spent.”

In his statement, the MP underscored the unsuccessful nature of the programme. In particular, Mr Tchiaberashvili highlighted that the Government of Georgia had high hopes for the aforementioned initiative and thought that the population would receive a number of benefits by alleviating the pressure on GEL. However, the number of programme beneficiaries was ultimately much lower than initially planned which indeed speaks to the ineffectiveness of the programme.

In the second half 2014, GEL started to devalue vis-à-vis USD and a number of other foreign currencies. In parallel with GEL depreciation, the problem of foreign currency denominated debt service became more pressing for the population. GEL depreciation made debt service more expensive for those individuals who had income in GEL and debt obligations in a foreign currency. High-level currency risks are dangerous not for an individual borrower taken separately, but given their scale, this could threaten the entire financial sector. Therefore, it is in a state’s interest that individuals (because they are less capable to insure against currency volatility) take loans in the same currency as their income.

In order to partially eradicate the negative consequences of GEL depreciation, the Government of Georgia approved the so-called one-off larisation programme. This programme allowed citizens to convert their USD denominated loans to GEL with a GEL exchange rate of GEL 0.2 lower than the official figure with the difference being reimbursed as a subsidy from the state budget. The programme covered only those citizens who had taken loans before 1 January 2015 with immobile property as loan collateral.

When the changes came into force (January 2017), the total volume of loans issued by commercial banks amounted to GEL 18.9 billion. Of this amount, GEL 6.5 billion (35%) was GEL denominated whilst GEL 12.3 billion (65%) was foreign currency denominated.

Graph 1: Trend of Changes in Loan Dollarisation Indicator

Source: National Bank of Georgia

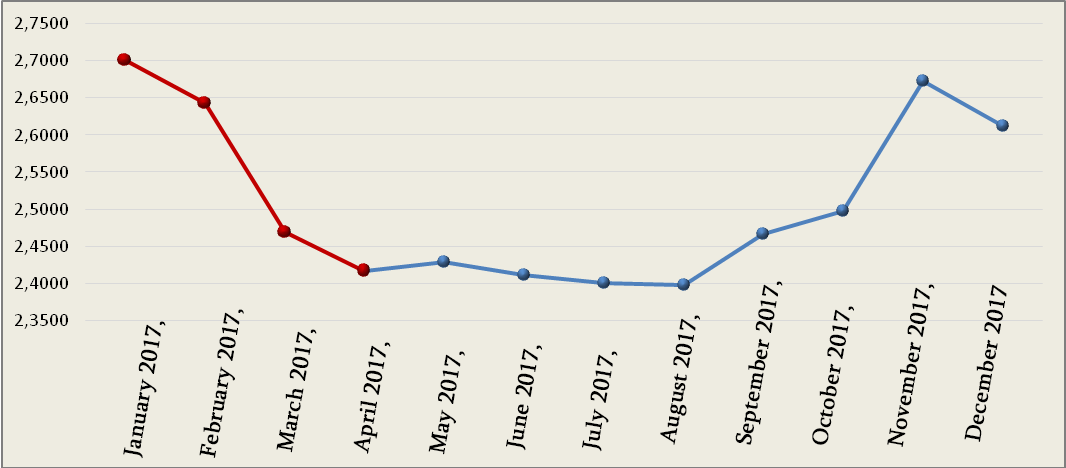

In the course of the larisation programme which started on 17 January and ended on 24 March, there was a trend of growth in the percentage figure of GEL denominated loans. According to the data of 1 April 2017; that is, when the programme ended, the total amount of issued loans was GEL 18.3 billion. Of this amount, GEL 7.1 billion (39.1%) was GEL denominated whilst GEL 11.2 billion (60.9%) was foreign currency denominated. Of note is that the GEL exchange rate has to be taken into account whilst analysing the loan dollarisation indicator because the total volume of loans is given in GEL and the appreciation of the national currency reduces the USD denominated loan value in GEL.

Graph 2: GEL Exchange Rate Dynamics in 2017

Source: National Bank of Georgia

The decreased dollarisation cannot be fully explained by the processes caused by the aforementioned programme. It is natural, however, that artificial interference has had a certain impact upon the changes in the indicators for a specifically given period.

Finally, the programme can be characterised as unsuccessful given the factual data. In particular, only 24.2% (GEL 15.7 million) of the total funds (GEL 65 million) allocated for subsidising the loan conversion process was spent. The actual number of beneficiaries is 5,164 whereas the programme could have covered 33,000 borrowers (as stated by the then Minister of Finance). In accordance with the National Bank of Georgia’s position, the programme could have covered 27,000 borrowers. Therefore, only 17-20% of the total number of borrowers deemed loan larisation to be an acceptable solution.