On 18 September 2013, presidential candidate Davit Bakradze declared in an interview with Tabula magazine: “We are the political party whose governance in its nine years made a tenfold increase in the budget, a 7-8% growth in the national economy and a reduction of taxes. We can bring all these back to this country. .. We didn’t manage to solve the major social issues such as unemployment, for instance, but we did achieve a threefold increase of the Gross National Product and a tenfold increase of pensions.”

FactCheck found the presidential candidate’s statement to be of interest and checked its accuracy based on the information provided by the National Statistics Office and the Ministry of Finance.

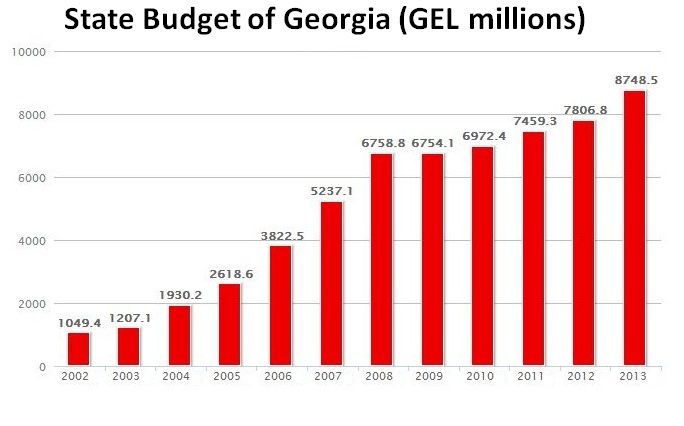

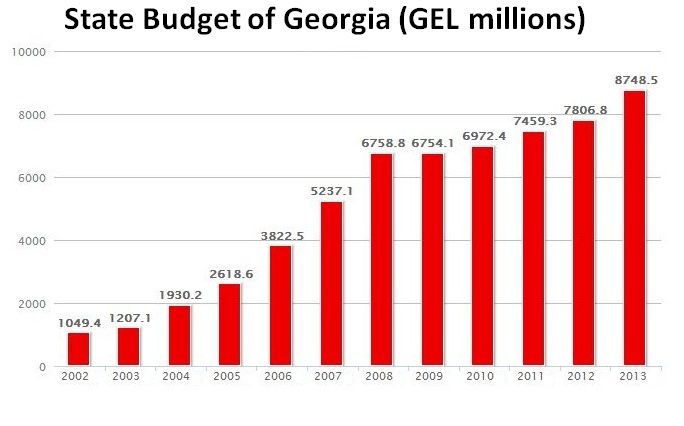

If the presidential candidate was referring to budgetary revenues when mentioning the growth of the budget, this indicator does not see a tenfold increase in 2012 as compared to the year 2004. As shown in the chart below, state budget revenues of Georgia amounted to GEL 933.3 million while in 2012 state budget revenues stood at a little over 7 billion which is roughly 7.5 times more than in 2003.

If the presidential candidate was referring to budgetary revenues when mentioning the growth of the budget, this indicator does not see a tenfold increase in 2012 as compared to the year 2004. As shown in the chart below, state budget revenues of Georgia amounted to GEL 933.3 million while in 2012 state budget revenues stood at a little over 7 billion which is roughly 7.5 times more than in 2003.

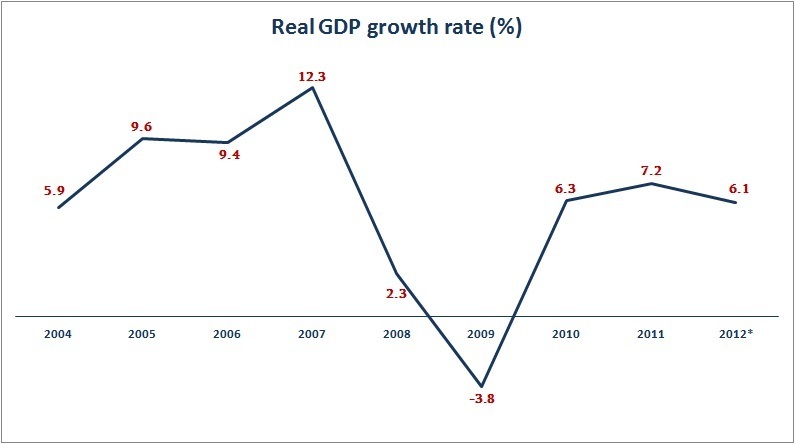

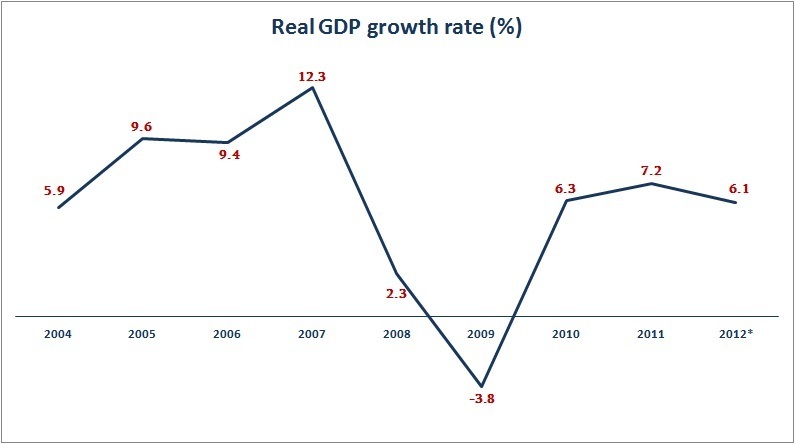

Real Gross Domestic Product Growth Rate

Over the last nine years (from 2004 to 2012) the Real GDP growth rate (same as the economic growth) was on average at 6.1% which is fairly close to the number indicated by the presidential candidate. The chart and graph below depict the Real GDP growth rates in the period while the United National Movement (UNM) was in power.

Real Gross Domestic Product Growth Rate

Over the last nine years (from 2004 to 2012) the Real GDP growth rate (same as the economic growth) was on average at 6.1% which is fairly close to the number indicated by the presidential candidate. The chart and graph below depict the Real GDP growth rates in the period while the United National Movement (UNM) was in power.

Reduction of Taxes

Following the reforms implemented in the taxation system of Georgia in 2005, the majority of taxes have been abolished. Prior to 2005, there were 21 types of taxes while today they have been cut down to six.

Reduction of Taxes

Following the reforms implemented in the taxation system of Georgia in 2005, the majority of taxes have been abolished. Prior to 2005, there were 21 types of taxes while today they have been cut down to six.

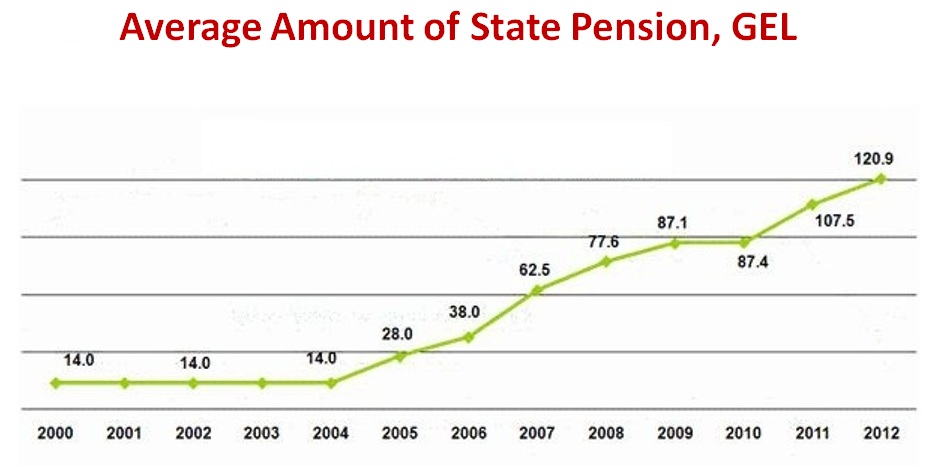

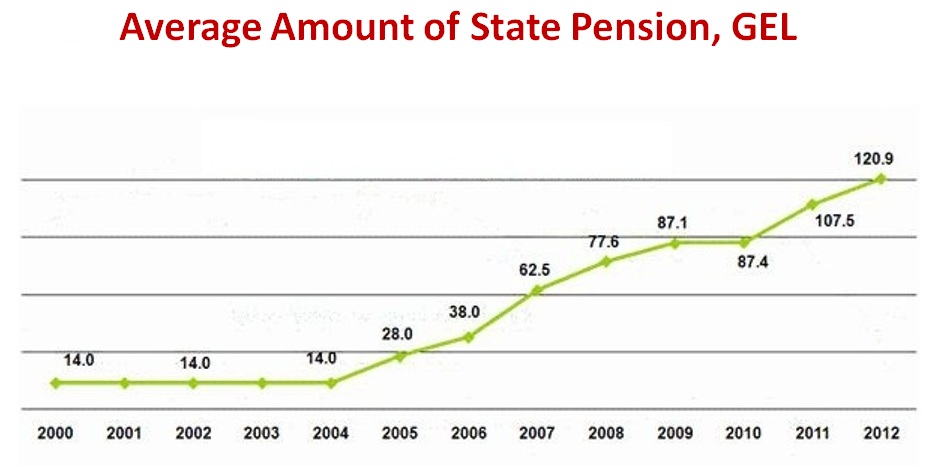

Pension

Prior to the UNM’s coming into the government (2004) the pension amounted to GEL 14 while in 2012 its amount was GEL 120. Thus, pensions have become 8.5 times bigger. The table below shows the size of pensions over the past 13 years.

Pension

Prior to the UNM’s coming into the government (2004) the pension amounted to GEL 14 while in 2012 its amount was GEL 120. Thus, pensions have become 8.5 times bigger. The table below shows the size of pensions over the past 13 years.

Conclusion

It was ascertained through our inquiry that:

Conclusion

It was ascertained through our inquiry that:

The Budget

Georgian state budget allocations [budgetary money designated for a specific approved expenditure] amounted to GEL 7,806.8 million which is roughly 6.5 times higher than the same indicator of 2003 (GEL 1,207.1 million) If the presidential candidate was referring to budgetary revenues when mentioning the growth of the budget, this indicator does not see a tenfold increase in 2012 as compared to the year 2004. As shown in the chart below, state budget revenues of Georgia amounted to GEL 933.3 million while in 2012 state budget revenues stood at a little over 7 billion which is roughly 7.5 times more than in 2003.

If the presidential candidate was referring to budgetary revenues when mentioning the growth of the budget, this indicator does not see a tenfold increase in 2012 as compared to the year 2004. As shown in the chart below, state budget revenues of Georgia amounted to GEL 933.3 million while in 2012 state budget revenues stood at a little over 7 billion which is roughly 7.5 times more than in 2003.

Real Gross Domestic Product Growth Rate

Over the last nine years (from 2004 to 2012) the Real GDP growth rate (same as the economic growth) was on average at 6.1% which is fairly close to the number indicated by the presidential candidate. The chart and graph below depict the Real GDP growth rates in the period while the United National Movement (UNM) was in power.

Real Gross Domestic Product Growth Rate

Over the last nine years (from 2004 to 2012) the Real GDP growth rate (same as the economic growth) was on average at 6.1% which is fairly close to the number indicated by the presidential candidate. The chart and graph below depict the Real GDP growth rates in the period while the United National Movement (UNM) was in power.

Reduction of Taxes

Following the reforms implemented in the taxation system of Georgia in 2005, the majority of taxes have been abolished. Prior to 2005, there were 21 types of taxes while today they have been cut down to six.

Reduction of Taxes

Following the reforms implemented in the taxation system of Georgia in 2005, the majority of taxes have been abolished. Prior to 2005, there were 21 types of taxes while today they have been cut down to six.

- Value Added Tax (VAT) – (from 20% down to 18%)

- Income Tax – (20%)

- Profit Tax (from 20% down to 15%)

- Excise Tax (rate varies)

- Property Tax

- Import Duties

Pension

Prior to the UNM’s coming into the government (2004) the pension amounted to GEL 14 while in 2012 its amount was GEL 120. Thus, pensions have become 8.5 times bigger. The table below shows the size of pensions over the past 13 years.

Pension

Prior to the UNM’s coming into the government (2004) the pension amounted to GEL 14 while in 2012 its amount was GEL 120. Thus, pensions have become 8.5 times bigger. The table below shows the size of pensions over the past 13 years.

Conclusion

It was ascertained through our inquiry that:

Conclusion

It was ascertained through our inquiry that:

- The state budget allocations have seen a 6.5-fold increase and the revenues -7.5 which means that none of these indicators has grown tenfold as claimed by the presidential candidate.

- The Real GDP growth rate was on average at 6.1% and not at 7-8% as is argued by the candidate.

- Taxes were reduced (only six of 21 types of taxes remain) and certain kinds of tax rates have been lowered.

- Gross National Income (as well as Gross National Product) increased threefold.

- An 8.5-fold increase was observed in the size of the pension and not a tenfold one as maintained in the candidate’s statement.