At the plenary session held on 25 July 2013, Mikheil Machavariani, Member of Parliamentary Minority, stated that the number of unreturned loans had increased by 38 % in comparison with the last year.

Mikheil Machavariani made this statement in the course of a discussion on the draft law introducing amendments and additions to the Law on Enforcement Proceedings. Presented draft law proposed a suspension of enforcement proceedings on mortgaged property for 6 months and the deputy was severely opposing its approval. In his speech the deputy appealed to his colleagues to reflect upon the harmful effects this decision could inflict on banking and financial sectors.

FactCheck decided to check the accuracy and relevance of MP’s statement.

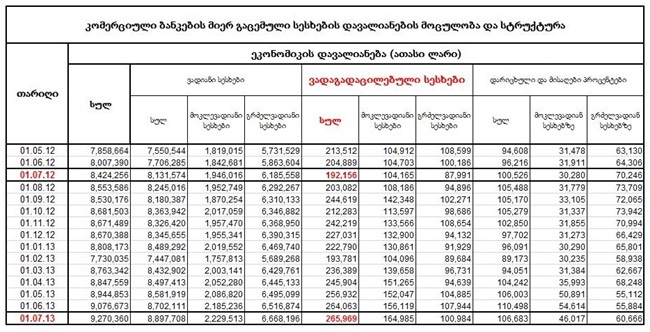

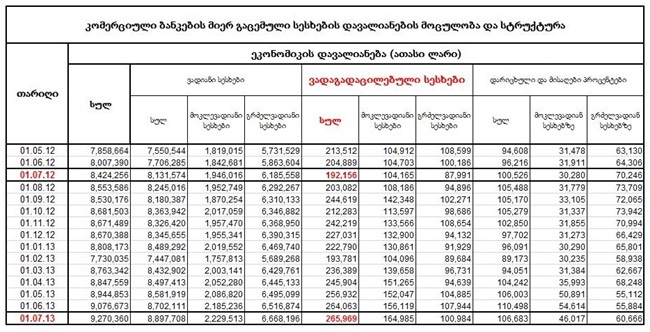

For this purpose we retrieved statistical data from the website of the National Bank of Georgia, as collecting statistical data on such matters falls within the National bank responsibility (see the Excel document Loans, Granted by the Commercial Banks (excluding interbank loans; stocks) with the code L3.5 in the subcategory Monetary and Financial statistics).

Firstly, it is to be noted, that the term unreturned loans is not being used by the National Bank. It utilizes the term ‘overdue loans’ conveying the same meaning. However, FactCheck gives little importance to the terminological inaccuracy, as it produces no alteration of meaning in the statement.

As shown in the abovementioned document, total loans consist of three components: loans with fixed maturities, overdue loans and accrued interests.

As of 1 July 2013, overdue loans amounted roughly to 266 million GEL, whereas by 1 July 2012 the same indicator was roughly at 192 million GEL. Hence, on 1 July of this year we witnessed a growth of 38% as compared to 1 July of the previous year.

As of 1 July 2013, overdue loans amounted roughly to 266 million GEL, whereas by 1 July 2012 the same indicator was roughly at 192 million GEL. Hence, on 1 July of this year we witnessed a growth of 38% as compared to 1 July of the previous year.

For the sake of forming a comprehensive analysis, it is to be taken into account that this year we also observed an increase of total loans and a corresponding increase of overdue loans. It should be noted herewith that the share of overdue loans in the total loans has remained nearly unchanged and varied, this year, as well as last year, from 2 to 3%. In the table below we can see the share of overdue loans in total loans for the years 2011-2013.

For the sake of forming a comprehensive analysis, it is to be taken into account that this year we also observed an increase of total loans and a corresponding increase of overdue loans. It should be noted herewith that the share of overdue loans in the total loans has remained nearly unchanged and varied, this year, as well as last year, from 2 to 3%. In the table below we can see the share of overdue loans in total loans for the years 2011-2013.

As in the statement of the deputy rise in overdue loans was linked to the economic recession, we find it reasonable to discuss the matter in the context of economic recession.

Although the amount of overdue loans has increased, this increase cannot be taken as a manifestation of economic recession as its share in total loans has remained unchanged and within 2-3 %. This figure is considered by the National Bank of Georgia to be within the acceptable margins. It is also to be emphasized that the National Bank of Georgia primarily pays attention to the increase in the share of overdue loans in total loans and not to a sheer numerical growth of overdue loans.

Conclusion

In comparison with the same period of the previous year the amount of overdue loans has indeed gone up by 38.4 %. However, its share in total loans has remained unchanged and stayed within the acceptable margins (2-3%) according to the National Bank of Georgia. Therefore, this cannot be considered as a proper demonstration of economic recession. Bearing in mind all of the aforementioned, the context of MP’s statement is not entirely relevant, even though the numbers indicated in the statement are correct.

Accordingly, we rate Mikheil Machavariani’s statement: “This year the number of unreturned loans has gone up by 38 % as compared to the previous year” as MOSTLY TRUE.

As in the statement of the deputy rise in overdue loans was linked to the economic recession, we find it reasonable to discuss the matter in the context of economic recession.

Although the amount of overdue loans has increased, this increase cannot be taken as a manifestation of economic recession as its share in total loans has remained unchanged and within 2-3 %. This figure is considered by the National Bank of Georgia to be within the acceptable margins. It is also to be emphasized that the National Bank of Georgia primarily pays attention to the increase in the share of overdue loans in total loans and not to a sheer numerical growth of overdue loans.

Conclusion

In comparison with the same period of the previous year the amount of overdue loans has indeed gone up by 38.4 %. However, its share in total loans has remained unchanged and stayed within the acceptable margins (2-3%) according to the National Bank of Georgia. Therefore, this cannot be considered as a proper demonstration of economic recession. Bearing in mind all of the aforementioned, the context of MP’s statement is not entirely relevant, even though the numbers indicated in the statement are correct.

Accordingly, we rate Mikheil Machavariani’s statement: “This year the number of unreturned loans has gone up by 38 % as compared to the previous year” as MOSTLY TRUE.

As of 1 July 2013, overdue loans amounted roughly to 266 million GEL, whereas by 1 July 2012 the same indicator was roughly at 192 million GEL. Hence, on 1 July of this year we witnessed a growth of 38% as compared to 1 July of the previous year.

As of 1 July 2013, overdue loans amounted roughly to 266 million GEL, whereas by 1 July 2012 the same indicator was roughly at 192 million GEL. Hence, on 1 July of this year we witnessed a growth of 38% as compared to 1 July of the previous year.

For the sake of forming a comprehensive analysis, it is to be taken into account that this year we also observed an increase of total loans and a corresponding increase of overdue loans. It should be noted herewith that the share of overdue loans in the total loans has remained nearly unchanged and varied, this year, as well as last year, from 2 to 3%. In the table below we can see the share of overdue loans in total loans for the years 2011-2013.

For the sake of forming a comprehensive analysis, it is to be taken into account that this year we also observed an increase of total loans and a corresponding increase of overdue loans. It should be noted herewith that the share of overdue loans in the total loans has remained nearly unchanged and varied, this year, as well as last year, from 2 to 3%. In the table below we can see the share of overdue loans in total loans for the years 2011-2013.

As in the statement of the deputy rise in overdue loans was linked to the economic recession, we find it reasonable to discuss the matter in the context of economic recession.

Although the amount of overdue loans has increased, this increase cannot be taken as a manifestation of economic recession as its share in total loans has remained unchanged and within 2-3 %. This figure is considered by the National Bank of Georgia to be within the acceptable margins. It is also to be emphasized that the National Bank of Georgia primarily pays attention to the increase in the share of overdue loans in total loans and not to a sheer numerical growth of overdue loans.

Conclusion

In comparison with the same period of the previous year the amount of overdue loans has indeed gone up by 38.4 %. However, its share in total loans has remained unchanged and stayed within the acceptable margins (2-3%) according to the National Bank of Georgia. Therefore, this cannot be considered as a proper demonstration of economic recession. Bearing in mind all of the aforementioned, the context of MP’s statement is not entirely relevant, even though the numbers indicated in the statement are correct.

Accordingly, we rate Mikheil Machavariani’s statement: “This year the number of unreturned loans has gone up by 38 % as compared to the previous year” as MOSTLY TRUE.

As in the statement of the deputy rise in overdue loans was linked to the economic recession, we find it reasonable to discuss the matter in the context of economic recession.

Although the amount of overdue loans has increased, this increase cannot be taken as a manifestation of economic recession as its share in total loans has remained unchanged and within 2-3 %. This figure is considered by the National Bank of Georgia to be within the acceptable margins. It is also to be emphasized that the National Bank of Georgia primarily pays attention to the increase in the share of overdue loans in total loans and not to a sheer numerical growth of overdue loans.

Conclusion

In comparison with the same period of the previous year the amount of overdue loans has indeed gone up by 38.4 %. However, its share in total loans has remained unchanged and stayed within the acceptable margins (2-3%) according to the National Bank of Georgia. Therefore, this cannot be considered as a proper demonstration of economic recession. Bearing in mind all of the aforementioned, the context of MP’s statement is not entirely relevant, even though the numbers indicated in the statement are correct.

Accordingly, we rate Mikheil Machavariani’s statement: “This year the number of unreturned loans has gone up by 38 % as compared to the previous year” as MOSTLY TRUE.