The National Bank's international reserves reached USD 5 billion by the end of 2023. However, despite the increase in funds, they fell below the adequacy ratio. This information, along with relevant statistics, is included in a review published by the International Monetary Fund.

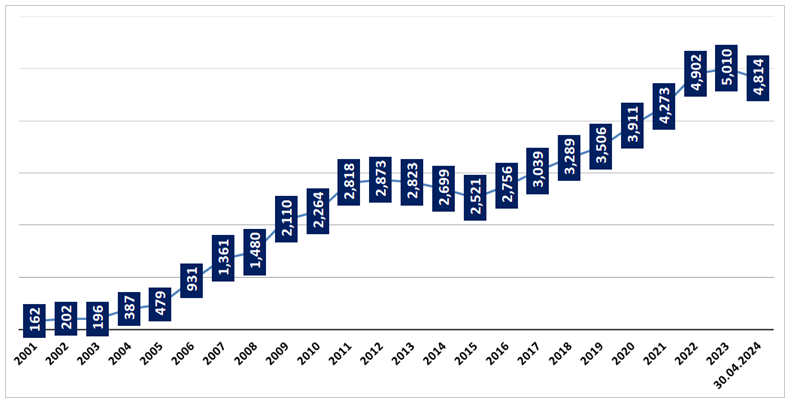

As of 30 April 2024, the National Bank held USD 4.8 billion in international reserves. This is a decrease of USD 195 million as compared to the beginning of the year and USD 325 million less than the same period last year. The reserves reached their peak in July-August of the previous year, exceeding USD 5.4 billion in both cases which is USD 600 million more than the current amount.

Structurally, out of the USD 4.8 billion in reserves, almost USD 3 billion is in securities, nearly USD 900 million is in deposits and cash foreign currency, USD 450 million is in special drawing rights and USD 529 million is in gold. From 2001 to April 2024, the National Bank did not hold any reserves in gold.

The National Bank maintains international reserves denominated in foreign currency to prevent the impact of external shocks, ensure liquidity and facilitate foreign currency payments for the Government of Georgia during financial crises. Reserve management is one of the functions of the National Bank (Organic Law on the National Bank of Georgia, Article 3).

At the time of the GEL emissions in October 1995, international reserves amounted to USD 171 million. During the currency crises of 1998-1999, they fell below USD 100 million several times. From 2004 to 2012, they increased sharply from USD 196 million (2003) to USD 2.9 billion.

In 2020, during the largest economic decline since the early 1990s, the National Bank had to sell a total of USD 873 million in foreign currency auctions. However, due to the mobilisation of grants and a significant increase in external debt, the volume of reserves still increased from USD 3.5 billion to USD 3.9 billion. The peak of USD 5.4 billion was reached in July-August 2023.

Chart 1: International Reserves as of 31.12 (in USD millions)

Source: National Bank

The National Bank primarily trades reserves on the BMatch platform at currency auctions where it accumulates or sells them. In recent years, BMatch has been preferred for currency purchases. In the last four months, the NBG purchased USD 287 million on this platform and almost USD 1.3 billion in 2023.

The absolute amount of reserves alone does not provide enough information to assess whether it is sufficient to deal with shocks. As the economy grows, reserves need to grow as well. USD 4.8 billion would have been a good figure five or even three years ago but it is no longer enough today.

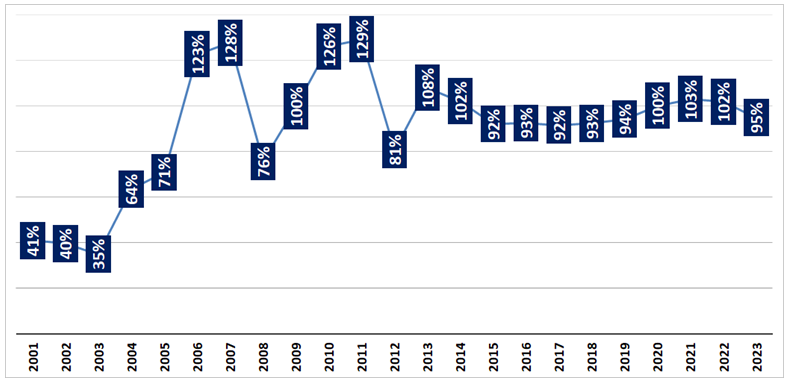

The adequacy of reserves is assessed using the International Monetary Fund's methodology calculated by the formula: ARA Metric = 5% * exports + 5% * broad money + 30% * short-term debt + 15% * other liabilities. It is preferable for the adequacy ratio to be within 100%-150%. The reserves first fell within this range in 2006 and remained in the adequacy zone until 2014 except for 2008 and 2012. In 2015, the volume of reserves fell below the minimum 100% threshold and it was not until 2020 that they returned to the adequacy zone. However, the volume decreased to 95% in 2023.

Chart 2: Reserve Adequacy Ratio

Source: International Monetary Fund

Another measure of reserve adequacy is the import coverage ratio. The volume of reserves should exceed the projected import figure for the next three months. In this case, according to this methodology, the reserves are in the adequacy zone and the coefficient is 3.5.

Unlike price stability, maintaining the exchange rate is not a direct task of the National Bank. However, spending reserves to mitigate shock effects is an accepted practice. Last September, when the NBG President amended an order and postponed the mandatory sanctioning of Georgian citizens until a court's conviction came into force, the NBG had to sell USD 65 million in three interventions to calm the panic. In May of this year, to reduce the panic caused by the adoption of the "Russian law" and the announced sanctions, they sold USD 109 million. The National Bank will publish May data on reserve volumes on 7 June.

The current level of the reserve adequacy ratio will be known later. It is below the recommended threshold of 95% but this cannot be considered catastrophic.

The main reason for the GEL fluctuations in May was negative expectations caused by the adoption of the "Russian law" and the announcement of sanctions. It is impossible to say exactly what will happen if the sanctions are actually implemented. It is possible that signs of panic will reappear and the National Bank will have to spend reserves again. However, it should be noted that on 28 May, out of USD 60 million, USD 49 million were sold, meaning the demand was not high which suggests that the shock effect has passed at this stage.

Spending reserves is justified when one-time factors affect the exchange rate. In the case of fundamental factors, such as reduced inflows or capital outflows, interventions will only have a temporary effect.

FactCheck cannot speculate on whether or not the GEL exchange rate will change or if a depreciation trend starts or if the National Bank will try to artificially support the rate by spending reserves. However, even if the volume of reserves remains at the current level, as the economy grows, it will gradually move further away from the adequacy threshold.