Roman Gotsiridze: “Investments have declined by USD 500 million, marking one of the lowest figures in recent times.”

Verdict: FactCheck concludes that Roman Gotsiridze’s statement is TRUE.

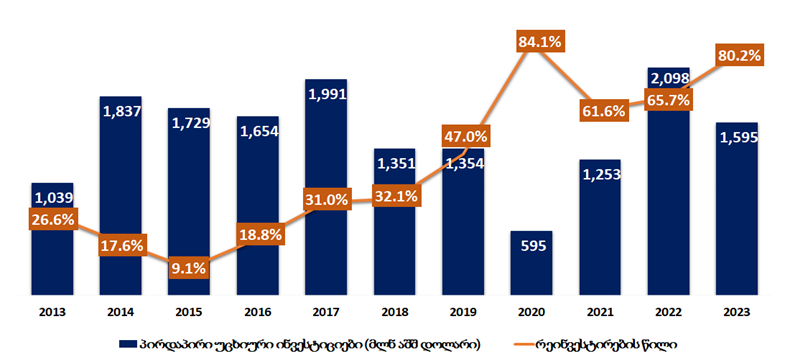

The volume of foreign direct investments decreased by USD 500 million to USD 1.6 billion in 2023 as compared to the value of 2022. The reinvestment rate constituted 80.2%.

In addition to the monetary decline, the ratio of investment to the GDP also decreased, reaching one of the lowest points in the recent 20 years.

Total investment, the proportion of the volume of new investments due to debt obligations in the figure, and the ratio to GDP all decreased in 2023; only the reinvestment rate expanded. Considering the downward trend in the statistics, FactCheck concludes that Roman Gotsiridze’s statement is TRUE.

Analysis

Roman Gotsiridze, a member of the Eurooptimists parliamentary group, claimed during his speech regarding investments on 3 April: “Foreign direct investments totalled USD 1.6 billion in the previous year – a figure USD 500 million lower than that of the year before. Notably, USD 1.3 billion of the aforementioned figure was reinvestment where local production firms put money that they received from an investment back into that or another investment. New investments from outside sources marked USD 300 million. This is one of the worst figures in recent times, excluding 2020, the year of the pandemic.”

Foreign direct investments, which totalled USD 2.1 billion in 2022, decreased by USD 500 million to USD 1.6 billion in 2023 according to the data from the National Statistics Office. GeoStat assessed that debt obligations were the primary reason for the lower investments causing a contraction of USD 857 million.

Investments consist of two aspects: foreign direct investments (new funds) and reinvestments. The reinvestment rate reached 80.2% in 2023. It is worth mentioning that the 80% mark has been exceeded twice since 2013 when the relevant statistics began to be recorded – in 2020 and 2023.

Graph 1: Foreign Direct Investments

Source: National Statistics Office of Georgia

Georgia made several adjustments to its Tax Code to encourage reinvestment in 2017, transitioning to the so-called Estonian model. As a result, reinvested profits were exempted from the 15% profit tax. However, to balance out the potential losses, the excise tax on fuel and diesel doubled (it increased from GEL 250 to GEL 500 for a tonne of fuel and it increased from GEL 150 to GEL 400 for a tonne of diesel).

The reinvestment rate in Georgia amounted to 18% between 2013 and 2016 prior to the tax reform. However, the aforementioned rate doubled after the reform, reaching 37% between 2017 and 2019, before the pandemic. Subsequently, it further expanded to 73% in the years spanning 2020 and 2023.

Reinvestment is typically considered a positive occurrence as profits being reinvested back into the economy leads to increased economic activity within the country. However, the concern arises when the rate of new investments remains low.

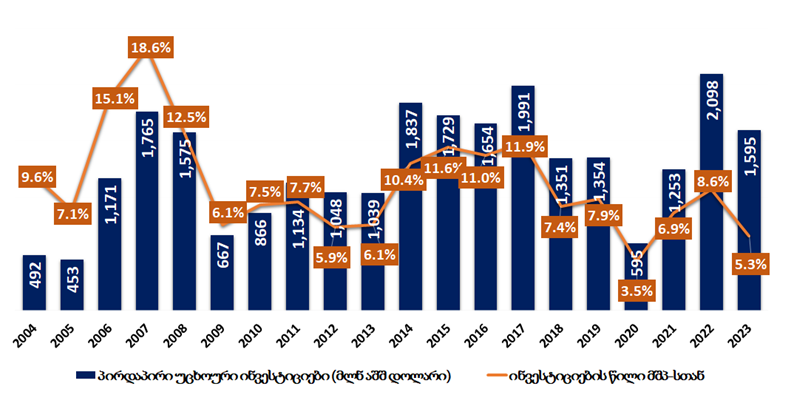

Another measure of investments is its ratio to the GDP. Despite reaching the historical record high in monetary terms in 2022, the ratio of investments to the GDP was the record monetary high in 2022 in independent Georgia’s history, as it totalled 8.6% which is 3.3 percentage points lower as compared to 2017 and ten percentage points lower as compared to 2007. Furthermore, the FDI to GDP ratio decreased by 5.3% in 2023, marking the second-lowest figure in the recent 20 years.

Graph 2: Ratio of Foreign Direct Investments to the GDP

Source: World Bank

Notably, transit projects, such as the Baku-Supsa and Baku-Tbilisi-Ceyhan pipelines, the South or Shah Deniz gas field and the Baku-Tbilisi-Kars railway, have represented a substantial portion of the investments in Georgia. Notably, the volume of investments tends to decline following the completion of each of these projects, only to increase again prior to the start of the next one.

The years spanning 2014 to 2017 marked the most successful during the Georgian Dream political party’s governance in terms of investment with an average annual FDI volume of USD 1.8 billion. However, FDI decreased to USD 1.350 billion in 2018-2019 but subsequently totalled USD 1.650 in 2021-2023. Despite the expansion following the pandemic, the average annual monetary value of investments has not returned to the initial figure and constituted even less in relation to the GDP. Additionally, the volume of new investments has also decreased.

Total investment, the proportion of the volume of new investments due to debt obligations in the figure, and the ratio to GDP all decreased in 2023; only the reinvestment rate expanded. Considering the downward trend in the statistics, FactCheck concludes that Roman Gotsiridze’s statement is TRUE.