Since 10 June 2023, the Government of Georgia has introduced a temporary – for the duration of five months – import tax on imported flour (GEL 200 per tonne). The reason behind this decision was to enhance the competitiveness of Georgian flour and support its sales on the local market.

This decision was preceded by the following events – from September 2021, Russia imposed a floating customs mechanism for wheat export which made the import of wheat to Georgia unprofitable for wheat importers since local flour was not competitive against imported flour because of the latter’s cheaper price and the zero customs tax on flour import. This resulted in a decrease in wheat import, although it sparked a sharp growth in flour imports. If in 2020 wheat import amounted to 491,000 tonnes, it decreased to 367,000 tonnes in 2021 and to a further 184,000 tonnes in 2022. In two years, the total decrease was 307,000 tonnes whilst local production increased by merely 55,000 tonnes – from 102,000 tonnes to 157,000 tonnes. The difference was offset by flour imports as the latter’s volume in the same period increased from 11,000 tonnes to 182,000 tonnes.

The decrease in wheat imports and the entrance of cheap flour caused the shutdown of a large number of mills and created problems for local farmers to sell wheat. As one of the solutions, farmers and flour mill representatives demanded the imposition of a counter-balancing customs duty on the import of Russian flour but pledged to guarantee maintaining the price of bread and purchasing the remaining wheat crop.

As mentioned earlier, the government imposed a tax on imported flour for a period of five months. However, on 2 October 2023 it was announced that the tax duration was extended until 1 March 2024 and the amount of the tax was also increased. Instead of GEL 200 GEL per tonne, it amounted to GEL 250. An import tax was also imposed on barley and bran - GEL 100 per tonne.

Below we will discuss how this decision affected the import and the price of flour and wheat. Since the tax was introduced in June and September’s data (import) have not yet been published, we will review the May-August period.

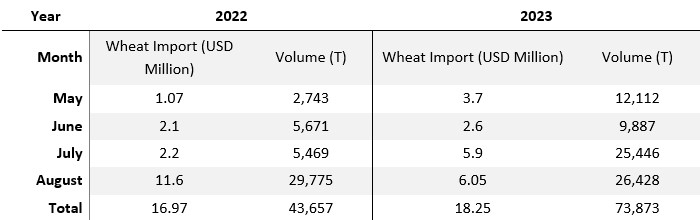

Table 1: Wheat Import in 2022-2023 (May-August)

Source: External Trade Portal

As illustrated by the data, as early as July, one month after the introduction of the tax, the import of wheat had already doubled in terms of value whilst the increase in quantity is even more impressive as it increased 2.5 times. In annual terms, the total rate of wheat imports for the four months of the current year as compared to 2022 has increased by 7.7% in terms of value and the increase in amount is 69.2% which is precipitated by the prices of wheat getting cheaper (in 2022 – USD 389 per one tonne of wheat, in 2023 – USD 247).

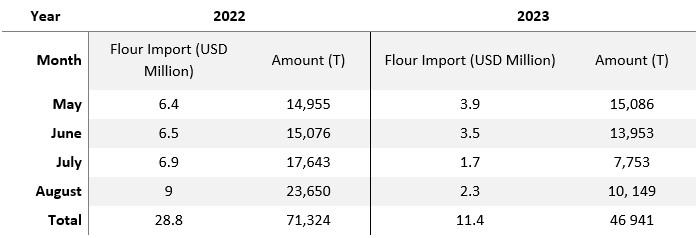

In regard to the import of wheat flour, it started to decrease in the reporting period from June but then increased again in August. As for the same period of the previous year, the import of flour decreased 2.5 times and 1.5 times, respectively, in terms of value and quantity.

Table 2: Wheat Flour Import in 2022-2023 (May-August)

Source: External Trade Portal

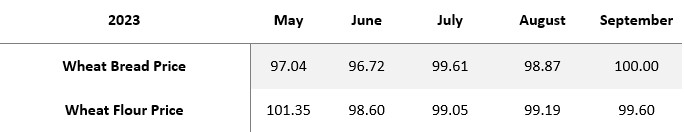

As mentioned earlier, one of the conditions for the imposition of customs tax was keeping bread prices unchanged. According to the detailed price index, the prices of bread and flour in June decreased by 3.28% and 1.40% as compared to the previous months. The price of bread continued to decrease in July and August by 0.39% and 1.13%, respectively. In September, the price of bread remained unchanged at the August level. In the case of wheat flour, the price continued to decrease for the entire period.

Table 3: Detailed Price Index for Wheat Bread and Flour (Previous Month = 100)

Source: National Statistics Office of Georgia

In regard to price changes in annual terms, there is a clear trend of decrease in both wheat flour and bread prices in June to September 2023 as compared to the same period of the previous.

Table 4: Detailed Price Index for Wheat Bread and Flour (Previous Year = 100)

Source: National Statistics Office of Georgia

To summarise, it can be said that the import tax imposed on bread flour led to an increase in the import of wheat and a decrease in the import of bread flour, which was the purpose of this decision, and at the same time the flour obtained from the processing of local wheat was supposed to compete with imported flour. However, despite the artificial intervention, wheat farmers still faced difficulties to sell their local wheat (FactCheck cannot discuss whether it was due to the high price or poor quality) and remained dissatisfied with the price of wheat. The government policy envisions increasing the wheat self-sufficiency ratio to 50% in the future. The main benefit of the increase in the wheat yield should be lesser dependence on imported wheat and a higher demand for local wheat. This year we faced another reality - the current year's crop turned out to be uncompetitive and the main goal was not to reduce the dependence on imports but to impose an additional tax on the sale of the existing wheat.

As mentioned earlier, the import tax on wheat was initially introduced for five months whilst it was extended for an additional four months in October. Given the circumstances on the ground, it is assumed that the authorities will keep this tax for a longer period in order to support the competitiveness of local flour and keep bread prices unchanged.