For the first time since 2018 and for the second time in the history of independent Georgia, the current account of the third quarter of 2022 went into surplus. The surplus amounted to USD 400 million whilst the surplus to the GDP ratio reached 5.9%.

A current account is a constituent part of the balance of payments, reflecting the turnover of cash flow to and from a country. If incomes and savings of resident individuals exceed their consumption, the difference is offset by foreign sources; particularly, by capital transfers, foreign investments and external debt.

The current account incorporates goods and services as well as primary income flow (income flow between resident and non-resident institutional units which includes: labour remuneration and investment revenues) and secondary income flow (current transfers between resident and non-residents of a country). This means that the current account deficit shows the difference between a country’s trade balance and incomes.

Since 1995, Georgia’s foreign trade in goods has always been in a deficit. Georgia’s consumption regularly exceeded production and as a result import was always higher as compared to export. Barring some exceptions, the foreign trade turnover has been increasing annually, although the trade balance has continued to stay negative given the growth of import as well as export.

Since foreign trade accounts for a significant portion of the total balance of payments, the trade deficit often puts the total current deficit into deficit as well.

As opposed to trade in goods, trade in services is usually in surplus. Non-residents coming to Georgia (for instance, tourists), spend more money in the country as compared to Georgian nationals spending abroad. In 2022, further gains in trade in services contributed to send the total current account of the third quarter into surplus.

Similar to tourism, money transfers are also in surplus. The volume of remittances from abroad to Georgia exceeds the volume of money transferred abroad from Georgia.

In the third quarter of 2021, the current account deficit was USD 412 million whilst it was USD 574 million and USD 38 million, respectively, in the third quarter of 2020 and 2019, further respectively. The current account deficit in 2020 and 2021 almost doubled as compared to 2018-2019 and reached nearly USD 2 billion. The growth of the deficit is largely attributable to the poor performance of the tourist seasons which were heavily affected by the pandemic and COVID-regulations.

According to the calculations of the National Bank of Georgia, travel revenues in 2018 were USD 2.7 billion, shrinking slightly to USD 2.6 billion in 2019 and dropping sharply to USD 361 million in 2020. Recovery started in 2021 when travel revenues exceeded USD 1.1. billion and rose to over USD 2.2. billion in the first three quarters of 2022 which is 198% more as compared to the same period of 2021, 554% more as compared to the same period of 2020 and 6% more as compared to January-September 2019.

The National Bank of Georgia’s study indicates that the negative foreign trade balance increased by 15.7% to USD 1.2 billion (GEL 3.3 billion) in the third quarter of 2022 as compared to the same period of the previous year. At the same time, export in goods increased by 50.8% in a year whilst imports increased by 36.3%.

Rising prices on transport and fuels, especially on oil, made import to Georgia expensive which was counter-balanced by the appreciation of GEL exchange rate to a certain extent.

Of note is that the National Bank of Georgia employs a methodology which is different from the National Statistical Office of Georgia when it comes to foreign trade (according to the National Bank of Georgia’s methodology, if a resident individual sells a product to non-resident individual on the territory of Georgia, this is categorised as export). In accordance with the National Statistics Office of Georgia, export increased by 40.5% and import increased by 32.3% in the same period. The methodology is different in regard to the tourism sector as well. As reported by the Georgian National Tourism Administration, revenues from international travels in the first three quarters of 2022 exceeded USD 2.5 billion.

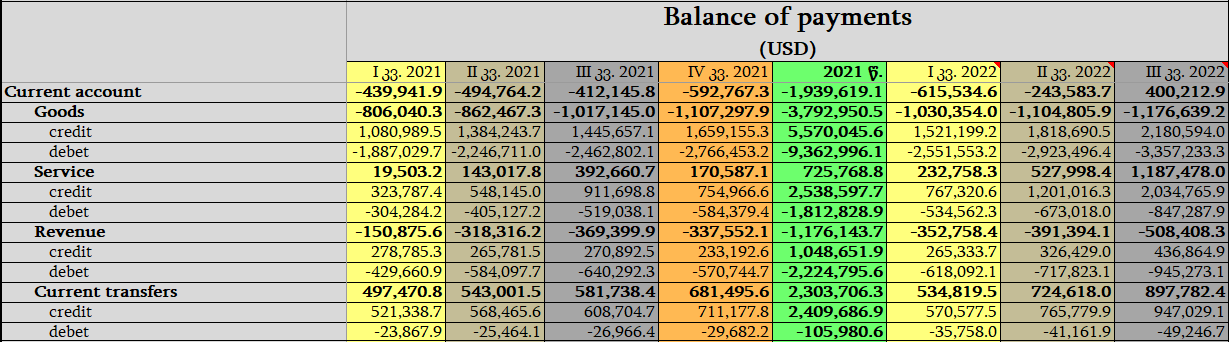

Table 1: Georgia’s Balance of Payments

Source: National Bank of Georgia

The biggest component of the current account in the third quarter was service which is precipitated by the growth of the export of travel services. Its recovery started in the second quarter of 2021 and reached USD 1.4 billion (GEL 3.9 billion) in the third quarter of 2022 which is 22.3% more as compared to the pre-pandemic figure in the third quarter of 2019.

Transfers were traditionally in a surplus in the current account and its credit increased by 56% to USD 947 million. Net transfers from the private sector increased by 60.2% to USD 901 million.

The rapid growth of remittances significantly affected transfers since remittances in the third quarter of 2022 increased by 64.9% to USD 1.027 billion as compared to the same period of the previous year whilst net remittances (remittances excluding money transfers from Georgia) increased by 73.8% to USD 938 million. In turn, remittances surged mostly at the expense of Russia. In July-September 2021, USD 116 million was transferred from Russia to Georgia whilst this figure increased by 231% in July-September 2022 and reached USD 385 million.

Net foreign direct investments in the third quarter of 2022 amounted to USD 687 million which is 10.1% of the quarterly GDP.

A detailed list of what was growing and what was decreasing in the past three years is shown in the table. A more detailed catalogue can be accessed here.

The National Bank of Georgia is going to publish fourth quarter and total 2022 data in March 2023.

The current account deficit cannot be perceived as outright negative whilst the current account surplus should not be viewed as outright positive. The United States of America, which is the number-one economy in the world, is also the number-one importer and its trade deficit reached USD 651 billion in 2020. If the trade balance improves at the expense of export growth or the production of import-substituting products on local market, this would be a positive occurrence, although the reason behind the decrease in imports could be the shrinking purchasing power of the population. At the same time, the growth in deficit-offsetting transfers can be because of rising migration owing to social problems, something which is a problem. However, if the growth in transfers happens because of the rising number of tourists or large sums of money spent by tourists in Georgia, this will be indicative of a healthier economy.