The issue of foreign direct investments (FDI) has always been a matter of serious discussion for Georgia. For developing and transitional economies like Georgia, which need resources and the experience of investors to gain ground on the international market and develop and expand their economies, FDI bears critical importance. FDI facilitates not only the inflow of foreign capital per se but helps deepening humanitarian ties, technological sophistication and gaining experience which is vital for a country’s development. Foreign direct investment implies a resident of one country owning a share in a foreign-based enterprise and carrying out different types of economic operations related to that enterprise. An investor is considered to be a direct one if he has at least a 10% ownership stake in a foreign-based enterprise’s shares or the equivalent of such participation. shares or the equivalent of such participation.

Amid the COVID-19 pandemic and respective restrictions, the economic situation, including investments, faced strong uncertainty in 2020-2021. As a result, investment volume in Georgia decreased significantly, particularly in 2020. However, the sharp drop in foreign direct investments was a clear trend and a serious problem even prior to the pandemic. It is unfortunate that the country failed to implement a number of investment projects, including the Anaklia sea-port, the Namakhani HPP and other HPPs of strategic importance. This, apart from inflicting clear economic losses, harmed Georgia’s investment climate and image.

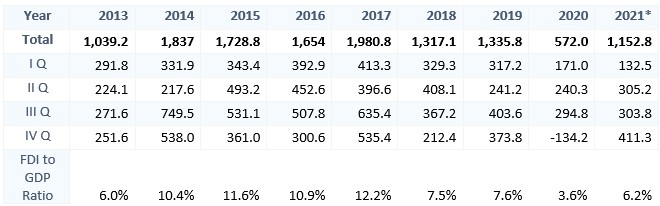

In 2021, the total volume of foreign direct investments to Georgia was USD 1.152 billion which constituted 101.5% growth as compared to 2020 and a 13.6% decrease as compared to 2019, respectively. In 2020, the total FDI was USD 572 million which was 57.1% less as compared to 2019. Of note is that in the fourth quarter of 2020, the FDI figure was negative, meaning that outgoing investment flows exceeded incoming investment flows. This was the first time since 1995 (as part of the existing statistics) when the quarterly FDI was negative.

Table 1: Foreign Direct Investment Quarterly Dynamic in 2013-2021

Source: National Statistics Office of Georgia

Together with absolute figures it is also very important to analyse the FDI to GDP ratio, since a specific absolute figure can be very large vis-à-vis a smaller economy and very small vis-à-vis a large economy. In 2020, the investments to the GDP ratio was 3.6% which is the lowest figure since 2001. In the fourth quarter of 2021, there was a relatively higher growth of FDI and at its expense, the FDI to the GDP ratio reached 6.2%. FDI growth is certainly something that should be welcomed, particularly in light of the pandemic, although 6.2% is the lowest figure since 2013.

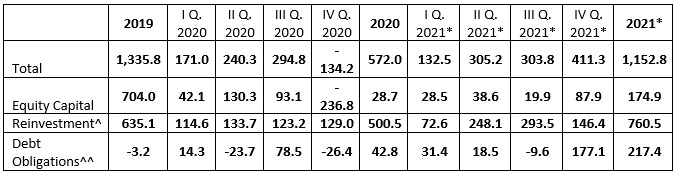

Foreign direct investments consist of three major components: equity capital of investors, reinvestments and debt obligations. In the course of 2020, equity capital volume dropped to a minimum and only amounted to USD 28.7 million (5% of total investments). The reinvestment volume increased further in 2021 statistics and reached USD 760 million which accounted for 66% of total investments whilst equity capital volume in the same period amounted to USD 174.9 million (15.1% of FDI). The reinvestment figure was also high in 2019 when it accounted for 47.5% of total investments. However, a larger share of reinvestment in FDI structure indicates a lower figure of new investments which is a negative occurrence for a country like Georgia.

Table 2: Foreign Direct Investments by Components in 2019-2021

Source: National Statistics Office of Georgia

In 2020, the financial sector accounted for 70% of total investments (USD 404 million) and two large sectors that followed were mining (USD 98.7 million, 17.2% of total FDI) and real estate (USD 90.3 million, 15.8% of total FDI).

For 2021, investment in financial sector increased by nearly USD 39 million, although investments in this sector accounted for 39% of the total FDI this time. Investments in the field of energy increased significantly and reached USD 157 million. As compared to 2020, investments in the field of processing industry increased by USD 107 million to USD 143 million.

In 2020, investment volumes were negative in the fields of agriculture and fishery, energy as well as hotels and restaurants whilst in 2021 such fields were mining industry and communication.

In 2021, the UK was the largest investor country (USD 596 million) followed by the Netherlands (USD 125 million). The picture was also similar in 2020 when the UK invested USD 302 million and the Netherlands invested USD 200.6 million.

It should also be highlighted that in the past years, FDI was coming from off-shore zones such as Panama, the Marshal Islands, etc. These countries also benefit from a preferential taxation system. Generally, it is a common practice in the world when business representatives carry out their work through off-shore registered entities which brings a number of benefits to them such as tax evasion, reduced transparency (information on off-shore based companies is not included in the public register), etc. It is assumed that Georgian nationals are behind the investment flows from off-shore locations to Georgia; that is, technically they are categorised as foreign investment which naturally is far from truth. In 2020, in the case of Panama alone, USD 209 million was withdrawn from Panama which substantially affected investment figures.