Roman Gotsiridze: “The country’s [external] debt exceeded 100% of the GDP and reaches 120-125 whilst four years ago it was 80% of the GDP.”

Verdict: FactCheck concludes that Roman Gotsiridze’s statement is MOSTLY TRUE.

Resume:

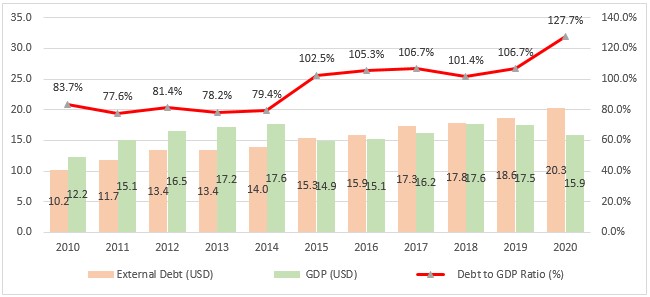

Roman Gotsiridze is referring to the statistics of the total external debt whose figures are published by the National Bank of Georgia. The total external debt statistics include data about the country’s financial obligations vis-à-vis foreigners. As of 2020, Georgia’s total external debt amounts to USD 20.3 billion which constitutes 127.7% of the country’s GDP. As compared to 2019, the absolute figure of the debt increased by 8.8% whilst the debt to GDP ratio rose by 21 percentage points. The total debt accounted for 79.4% of the GDP in 2014; that is, six years ago instead of four years as claimed by Mr Gotsiridze. In 2015-2019, the debt to GDP figure fluctuated around 105% on average.

When speaking about the increasing debt to GDP ratio, it is important is to take the GEL to USD exchange rate fluctuation into account. In the past years, the growth of the external debt is largely because of the recalculation of the already accumulated debt at a new exchange rate. This is most evident if we take a look at 2015 when the absolute figure of the foreign debt increased by 9% in the aftermath of the sharp depreciation of GEL vis-à-vis USD whilst the debt to GDP ratio skyrocketed by 29%. The 2018 case is also important when the debt’s absolute figure increased by 3% after a slight appreciation of GEL vis-à-vis USD whilst the debt to GDP ratio decreased by 5%.

Analysis

United National Movement member, Roman Gotsiridze, stated (12:00): “The country’s [external] debt exceeded 100% of the GDP and reaches 120-125 whilst four years ago it was 80% of the GDP.”

Roman Gotsiridze is referring to the statistics of the total external debt whose figures are published by the National Bank of Georgia. The total external debt statistics include data about the country’s financial obligations vis-à-vis foreigners. This means that the total public external debt at the moment is an unpaid sum of factual unconditional obligations which obliges a resident of the country to pay an underlying amount or/and accrued interest to a non-resident at some point in the future. Therefore, any obligation which has to be paid to a non-resident in the future is part of the country’s total public external debt. The total external debt comprises the foreign obligations of the government, the National Bank, commercial banks, non-bank financial corporations, non-financial corporations and the intercompany loans of foreign investors.

As of 2020, Georgia’s total external debt amounts of USD 20.3 billion which constitutes 127.7% of the country’s GDP. As compared to 2019, the absolute figure of the debt increased by 8.8% whilst the debt to the GDP ratio rose by 21 percentage points. The total debt accounted for 79.4% of the GDP in 2014; that is, six years ago instead of four years as claimed by Roman Gotsiridze. In 2015-2019, the debt to the GDP figure fluctuated around 105% on average.

Graph 1: Georgia’s External Loan Dynamic in 2010-2020 [1]

Source: National Bank of Georgia

However, when referring to the growth of debt, an important aspect to consider is the fluctuation of the GEL to USD exchange rate. In particular, as result of changes in the currency exchange at the end of a reporting period, a new exchange rate is applied for the calculation of not only the added debt in a period (the debt taken in one year) but the balance figure of the debt previously accumulated (the unpaid part of the debt taken in the past). This debt-related problem universally affects both macroeconomic and microeconomics. As a result of the depreciation of GEL, many people suffered from paying more for their foreign currency loans even though they did not take on any additional debt. In the past years, the growth of the external debt happened largely because of the recalculation of the already accumulated debt at a new exchange rate. This is most evident if we take a look at 2015 when the absolute figure of the foreign debt (USD-denominated) increased by 9% in the aftermath of the sharp depreciation of GEL vis-à-vis USD whilst the debt to GDP ratio skyrocketed by 29%. The 2018 case is also important when the debt’s absolute figure increased by 3% after a slight appreciation of GEL vis-à-vis USD whilst the debt to GDP ratio decreased by 5%.

[1] The GDP figure in the graph should not be understood only as a USD-calculated GDP analysis in time. In the given case, only the debt to the GDP ratio is subject to analysis in time. The GDP in USD is given for technical reason only – to get the debt to the GDP ratio. Since both the numerator and the denominator are in an identical currency, using this approach in this case is valid and does not distort the existing picture as opposed to other cases when the trend of GDP changes in time is assessed by USD-converted figures.

![“The country’s [external] debt exceeded 100% of the GDP and reaches 120-125 whilst four years ago it was 80% of the GDP.”](https://factcheck.ge/storage/files/320x180/dfa12480-c1c3-11ea-a80c-83fa08fc2841.jpg)