Resume: There is an indirect correlation between jobs and the growth of bank deposits. Bank deposits are influenced by other factors which include actively depositing privately owned cash (which is not covered by the statistical data) into savings. According to the information provided by the National Bank of Georgia, one of the reasons behind the growth of deposits is that a part of the currently deposited money was previously owned by the population and was statistically compiled only after being deposited. On the other hand, Irakli Kobakhidze’s figures correspond to the total sum of the deposits of physical and legal persons which is irrelevant whilst analysing the population’s income level. Only the statistics of the deposits of physical persons should be taken into account. The figures of 2015 and 2019 are used for the comparison (supposedly, interactive statistics of the National Bank).

Therefore, in his statement Irakli Kobakhidze uses a wrong indicator (the total savings of physical and legal persons instead of the savings of only physical persons) and exaggerates the absolute figure of the savings, on the one hand, and ignores other reasons (including purely technical reasons such as replacing cash with bank deposits) behind the growth of savings, on the other hand, and asserts that the growth is fully linked to employment which is a claim contradicting the reality.

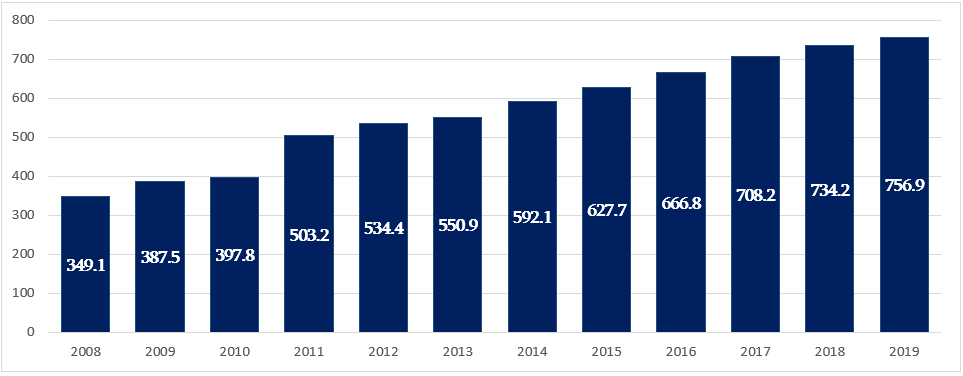

In regard to employment, 222,000 jobs have been created in business sector since 2012 which is close to the 250,000 mentioned by Mr Kobakhidze. However, in the case of deposits the former Speaker of the Parliament takes a different timespan (2015-2019). Using one indicator to explain another as part of a single claim and selecting a different time period for each of them is preposterous and the logic behind the data analysis remains vague. At the same time, only 129,200 jobs were created in the business sector in 2015-2019 and not 250,000. Of further note is that the number of jobs in the business sector does not equate with the same number of employed individuals. A working-age person can occupy two or more jobs. This is why in spite of job growth in the business sector, the number of employed persons in the country is being decreased.

Given all of the aforementioned, we can conclude that based on FactCheck’s methodology, Irakli Kobakhidze’s statement is HALF TRUE. [1]

Analysis

On 27 October 2020, on air on TV Rustavi 2, the Georgian Dream Executive Secretary, Irakli Kobakhidze, stated: “Over 250,000 jobs have been created which is indicated by the volume of bank deposits. Our citizens had GEL 4.4 billion in banks deposits in total and today they have GEL 9.5 billion.”

Since 2012, 222,000 jobs have indeed been created in the business sector. However, only 129,200 jobs were created in the business sector in 2015-2019. Of note is that jobs in the business sector have been growing annually. In addition, the number of jobs in the business sector does not equate with the same number of employed individuals. A working-age person can occupy two or more jobs. This is why in spite of job growth in the business sector, the number of employed persons in the country is being decreased.

Graph 1: Number of Jobs in Business Sector (Thousand Persons), 2008-2019

Source: National Statistics Office of Georgia

Irakli Kobakhidze highlights growing prosperity as a result of job creation which together with other indicators is also somehow reflected on the growth of deposits. However, this is not a direct correlation and other factors might also influence the deposit growth. FactCheck contacted the National Bank of Georgia for further clarification. According to the information of the National Bank of Georgia, deposits in 2012-2019 increased by 150% (excluding changes in the USD/GEL exchange rate). The fact that the deposit growth rate is ahead, the economy and the income growth rate are explained by increased savings and the development of the banking system. The banking system undergoes multipronged development. Banking products are becoming more diverse and an increasing number of people and organisations use these products. Payment systems are also more sophisticated and settlements are increasingly made in electronic form and, therefore, both legal and physical persons have less need to use cash. In other words, part of the money which is currently deposited was previous owned by the population and was statistically compiled only after being deposited.

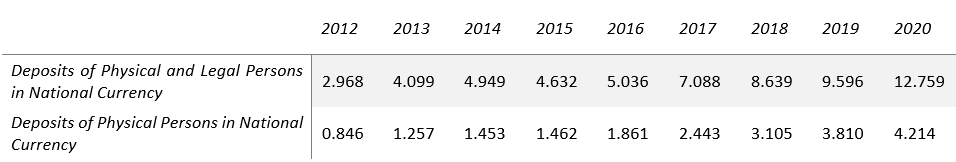

On the other hand, Irakli Kobakhidze’s figures correspond to the total sum of the deposits of physical and legal persons which is irrelevant whilst analysing the population’s income level and only the statistics of the deposits of physical persons should be taken into account. The figures of 2015 and 2019 are used for the comparison (supposedly, interactive statistics of the National Bank).

Table 1: Deposits of Physical and Legal Persons in National Currency, GEL Billion, Balances

Source: National Bank of Georgia

As of 2019, the total deposits of physical and legal persons increased by nearly 107% as compared to 2015 and by 223% as compared to 2012. The deposits of physical persons increased by nearly 160% in 2019 as compared to 2015 and by nearly 350% as compared to 2012. As of 2020’s data, the volume of deposits of physical persons amounts to GEL 4.2 billion whilst that figure was GEL 1.4 billion and GEL 846 million in 2015 and 2012, respectively.

[1] HALF TRUE – the statement is partially accurate, although some details are absent and several issues are out of context.