Resume: The methods, employed by Mamuka Bakhtadze in his statement to compare trend and execution indicators, are incorrect because both of them are measured by relative figures to make fiscal indicators comparable in a time perspective.

Despite the fact that the author of the statement employs the wrong method to compare 2016-2019 capital expenditures, figures from that period attest to the growth trend of such expenditures. In particular, as compared to 2016, the net capital expenditures to GDP ratio increased from 3.02% to 6.9% in 2019. However, dubbing this growth to be a “large-scale” one stems from a subjective assessment. In regard to the execution of capital expenditures, on the one hand there were no eight-month execution figures for 2019 and, on the other hand, in accordance with the current indicators the execution of capital expenditures this year has worsened as compared to the previous year. In addition, in the eight-month periods throughout 2013-2016, the execution of capital expenses was improving but it has been afflicted with a deterioration trend since 2016.

Analysis

After his resignation from the position of Prime Minister, Mamuka Bakhtadze spoke about the Government of Georgia’s fiscal policy at a meeting with media representatives. The former Prime Minister’s talk pertained to the government’s public investments; in particular, capital expenditures. As stated by Mr Bakhtadze: “The massive increase of capital investments is a principle of a new economic model. As compared to 2016, we increased investments in infrastructure by two-thirds (66.67%) whilst in the first eight months of 2019, the budget execution increased by 45% as compared to the same period of the previous year.”

An appraisal of fiscal indicators through time is carried out by using relative figures. This is because such a method eliminates the influence of inflation upon the indicators. Therefore, analysis is based upon a review of the trend of real indicators. In particular, an analysis of current and capital expenditures is based upon the nominal current and capital expenditures to GDP ratio which simultaneously also shows what portion of the economy is occupied by public expenses and their types. In turn, the government’s current expenses incorporate economic classification expenditures of the common budget whilst capital expenditures include non-financial assets. In the case of capital expenditures, net indicators are taken which are the difference between the increase and the decrease of non-financial assets (change in assets).

A growth of capital expenditures is associated with the year 2017. In that year, the common budget’s capital expenditures to GDP ratio was 4.18% which is 1.15 percentage points more as compared to the previous year’s figure. In the same period, the relative figure of current expenses decreased from 26.82% to 25.54%. The growth of capital expenditures continued in 2018-2019 although the decrease trend in the case of current expenses discontinued. As compared to 2016, capital expenditures increased by 3.87 percentage points in 2019 common budget’s plan from 3.02% to 6.9%. However, of note is that there are plans to cut the relative figures of capital expenditures in 2020-2023 whilst current expenses are planned to remain unaltered. In 2020-2023, capital expenditures are planned at 6.57% on average whilst current expenses are planned at 23.49% on average.

Graph 1: Common Budget’s Current Expenses and Capital Expenditures (GEL Million, %)

Source: Government Finance Statistics

In turn, funding for capital expenditures is mostly related to foreign sources; that is, taking foreign debt. However, it is not unusual to channel income from foreign debt to current expenses which is considered to be a wrong fiscal policy. Of note is that since 2016, there has been no such case when the volume of foreign debt exceeded capital expenditures.

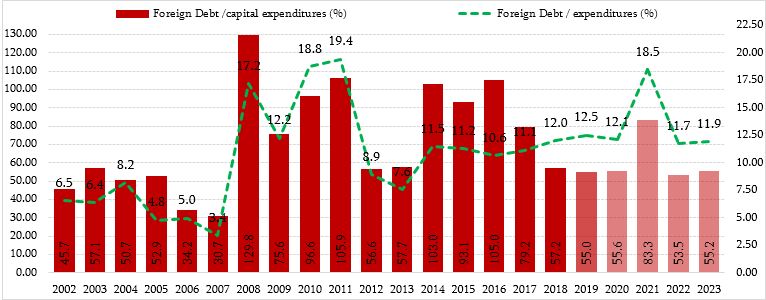

Graph 2: Foreign Debt taken Annually by the Government of Georgia (%)

Source: Government Finance Statistics

The amount of foreign debt taken in 2016 constituted 104.98% of the same year’s capital expenditures, meaning that apart from capital investments it was also spent on current expenses. In accordance with the 2019 common budget plan, the amount of foreign debt is 55.01% of the same year’s planned capital expenditures. However, this is not a confirmation that funds received from foreign sources were fully spent on capital projects.

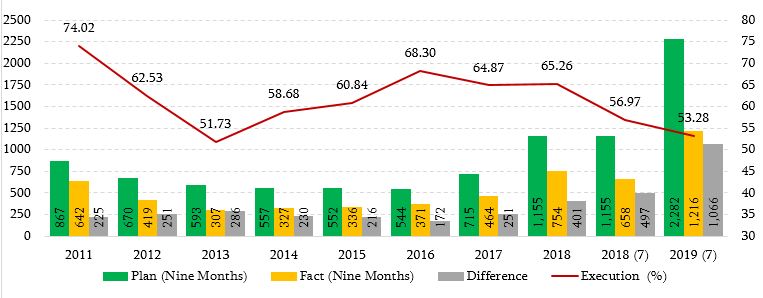

Budget execution figures are published by the State Treasury which does not include monthly data of the execution of common budget payables. Therefore, only state budget execution figures will be discussed in terms of the execution of capital expenditures. However, the budget execution report is based on a nine-month plan. In particular, given the quarterly nature of the budget plan, plans for capital expenditures are drafted in three, six, nine and 12-month periods whilst the execution report is published each month. Therefore, eight-month execution figures were compared to a nine-month plan. Of note is that Mamuka Bakhtadze’s claim about the current execution of the eight-month budget raises some questions because at the moment of his statement, the figures for the eighth month; that is, August, were not yet available (the month had just finished and, therefore, it is less likely that respective information was already processed for the consolidated budget). This figure will be published on 20 September 2019. In addition, whilst speaking about budget execution, Mr Bakhtadze compared the nominal figures of the previous year to the current year’s indicators which is wrong and does not objectively assess the improvement or the deterioration of the execution performance through time. In turn, budget execution is assessed based upon the proportion between the budget plan and budget execution figures. Therefore, his “method” to assess budget execution is wrong.

Graph 3: Nine-Month Plan and Eight-Month Execution Figures of the State Budget’s Capital Expenditures (GEL Million, %)

Source: State Treasury Report

The actual amount of the state budget’s capital expenditures in the first seven months of 2017 was GEL 1,216 million, which constitutes 53.28% of the nine-month plan. The same figure for the previous year was 56.97%. Therefore, the execution performance in 2019 has worsened instead of improved. In regard to the eight-month execution, it was improving in 2013-2016 but has been worsening since 2017.