Resume: The questions addressed to the Prime Minister of Georgia during his parliamentary hearing were about labour remuneration in the public sector. However, Mamuka Bakhtadze did not speak about the public sector as a whole and instead focused upon the common budget’s indicators which are part of the public sector. In this context, the Prime Minister reiterated the figure – the labour remuneration to GDP ratio being 3.9% – which had already been achieved when he was elected as the Prime Minister and the Government of Georgia has not made additional efforts to reduce it. On the contrary, given the volume of the nominal GDP, the nominal figure of the planned amount of labour remuneration in the 2019 common budget increased by GEL 69 million and the labour remuneration to GDP ratio became 3.92%. Therefore, neither at the time of the promise nor in the following period was the ambitious task of reducing the 3.9% ratio even on the table.

In turn, according to 2019’s estimates, the common budget’s labour remuneration to GDP ratio is 3.92% whilst the consolidated budget’s (which includes LEPLs and NNLEs) labour remuneration to GDP ratio is 4.9%. At the same time, the consolidated budget includes only part of the public sector, which is state administration, whilst public corporations and indicators of state and municipal enterprises are not included in the public finance statistics and the number of employees and, therefore, their labour remuneration expenses are not available. If we had known that indicator, perhaps the total amount of expenses would have been higher. Of note is that the existence of state enterprises in some cases involves carrying out public administration functions and foreign loans taken by the state budget for investment projects in the last years are re-issued to state enterprises.

Analysis

During the hearing of the Prime Minister as a part of the interpellation format in the Parliament of Georgia, the discussion touched upon labour remuneration in the public sector. Mamuka Bakhtadze was asked about labour remuneration in the entire public sector and the Prime Minister answered as follows: “We have taken an obligation to have the most ambitious task – to cut the expenses of government bodies to a maximum possible extent and I have taken a political obligation to make it 3.9% of the GDP.”

In this statement, the Prime Minister speaks about the common budget’s indicators which only include the state budget’s spending institutions, self-governance bodies and the labour remuneration of bodies of autonomous republics. However, the questions asked by the MPs referred to the whole public sector and not only the common budget which is only one of the parts of the public sector. In turn, the public sector, apart from the common budget, includes LEPLs and NNLEs as well as state and municipal enterprises.

Last year, when the Parliament of Georgia approved the Prime Minister and the government programme, one of the chapters of the programme contained the “concept of a small government.” In accordance with the clarification provided in the same programme (and as stated by Mamuka Bakhtadze), this meant having the common budget’s labour remuneration expenses to gross domestic product (GDP) ratio at 3.9%. However, the promise given by the Prime Minister had already been fulfilled at that moment and did not require further efforts.

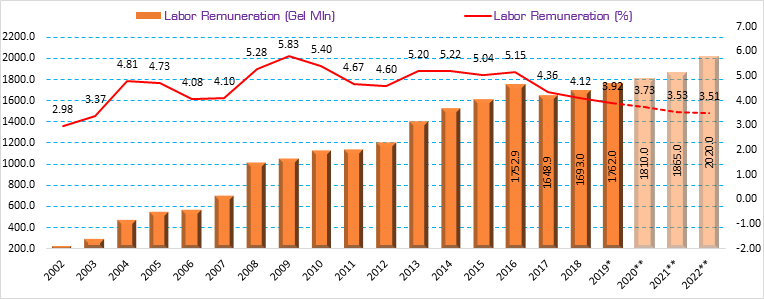

In accordance with 2019’s plan, the common budget’s labour remuneration constitutes GEL 1,762 million which is GEL 69 million more as compared to the nominal figure of the last year. In regard to the common budget’s labour remuneration ratio, the labour remuneration to GDP ratio was 4.12% in 2016 whilst it is 0.2 of a percentage point less and planned at 3.92% in accordance with 2019’s plan.

Graph 1: Common Budget’s Labour Remuneration (GEL Million, %)

Source: Ministry of Finance of Georgia

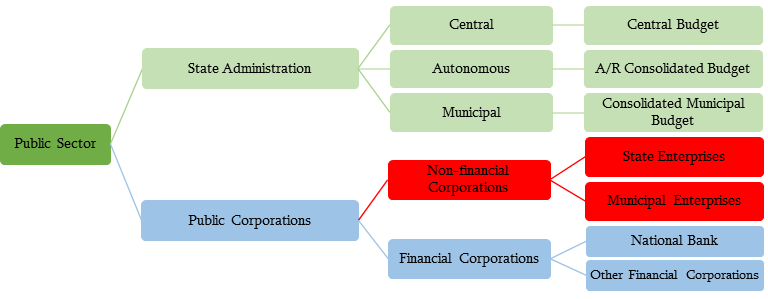

As mentioned previously, the common budget’s labour remuneration does not include the whole public sector because the public sector incorporates state administration[1] and public corporations.[2] Since 2019, the country’s consolidated budget document has been drafted which covers state administration although it does not include public corporations (state/municipal enterprises, etc.). Therefore, the entire public sector’s indicators are not available (parts highlighted in red in Graph 2).

Graph 2: Structure of the Public Sector

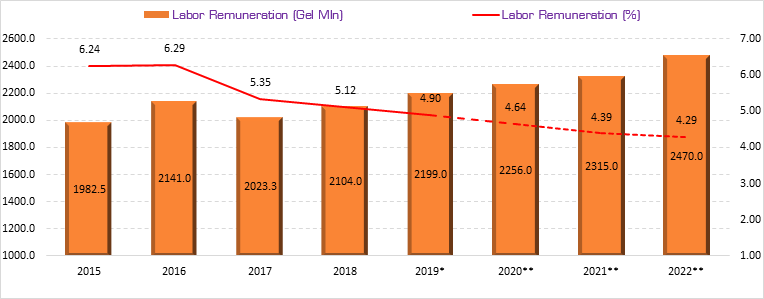

The graph illustrates that the country’s consolidated budget includes more parts of the public sector as compared to the common budget. In particular, the country’s consolidated budget, together with all three levels of the budget, covers LEPLs and NNLEs at all three levels. Therefore, it would be more appropriate to analyse labour remuneration figures vis-à-vis the country’s consolidated budget (given the question asked to the Prime Minister). In accordance with 2019’s plan, labour remuneration in the country’s consolidated budget is GEL 2,199 million whilst it was GEL 2,104 million in the previous year. In 2018, the labour remuneration to GDP ratio was 5.12% whilst it is cut by 0.22 of a percentage point and amounts to 4.9% in accordance with 2019.

Graph 3: Consolidated Budget’s Labour Remuneration (GEL Million, %)

Source: Ministry of Finance of Georgia

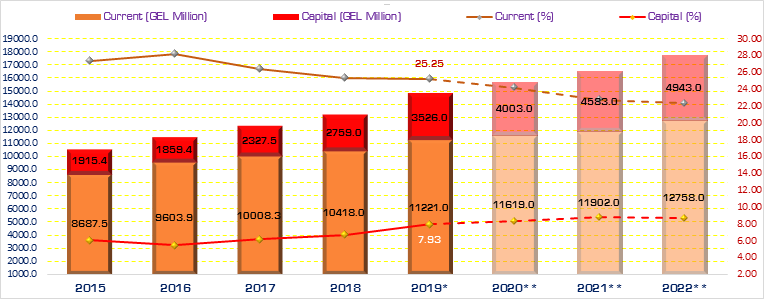

Although the Prime Minister means labour remuneration whilst speaking about expenses, of interest is to take a look at the current and capital expenses of the country’s consolidated budget.

Graph 4: Consolidated Budget’s Total Expenses (GEL Million, %)

Source: Ministry of Finance of Georgia

In accordance with 2019’s plan, the total expenses of the country’s consolidated budget are GEL 14,747 million. Of that amount, current expenses are GEL 11,211 million and capital expenses constitute GEL 3,526 million. In total, the expenses to GDP ratio is estimated to be 33.18% by 2019 which is 1.1 percentage points more as compared to 2018’s figure. It is estimated that as compared to 2018, the current expenses will be 0.12 of a percentage point less at 25.2% whilst capital expenses will be 1.22 percentage points more at 7.93%.