Resume: Interest rates on loan resources are characterised by a general trend of decline. Certain differences, however, are visible depending on the borrower and the loan currency. In particular, interest rates on loans issued to individuals in the national currency decrease much more slowly as compared to loans issued to individuals in a foreign currency or in the case of a loan issued to legal entities in any currency. At the same time, the interest rate change amplitude (the difference between the highest and lowest values in a certain period of time) is higher in the case of individuals as compared to legal entities.

In regard to the market, certain commercial banks do indeed have an offer of loans in GEL (including business loans, mortgage loans) which have a fixed interest rate “starting from 7%.” Eventually, given the risks associated with different borrowers and multiple other factors, the interest rate increases and is, in fact, determined on a case by case basis. Therefore, in order to see a trend, it is appropriate to discuss weighted average interest rates on factually approved loans instead of discussing figures advertised in a specific marketing offer.

In regard to a comparison of the aforementioned periods, the weighted average interest rate on loans in GEL constituted 16.6% as of the first quarter of 2019. In the same quarter of the last year of the previous government’s rule, the same figure was at 22.6%. In terms of mortgage loans taken separately (given the figures in his statement, presumably the Prime Minister referred to this indicator), the interest rate was 15.1% in the first quarter of 2012 whilst it decreased to 10.1% as of 2019.

Therefore, interest rates on loans have neither decreased on a named scale nor are they at the 7% mark as of today.

Analysis

In his speech before the Parliament of Georgia, the Prime Minister of Georgia, Mamuka Bakhtadze, stated that there are offers on the market to issue loans in GEL for a 7% interest rate. In the same statement, the Prime Minister noted that loan interest rates were at 21% under the previous government and they have been decreased three-fold.

The interest rate is the “price” for those funds which a creditor gives a debtor for temporary use in exchange for the promise to have them back. The loan interest rate is the “price” which a borrower pays to the intermediary body/loan institute (bank, micro-finance organisation, etc.). Usually, the interest rate differs in terms of the loan product (consumer loan, mortgage loan), the loan term (short-term or long-term), the loan currency and a number of other factors. Therefore, the Prime Minister’s statement lacks information as to which interest rates he means because the figures in his statement also lack context without this information. In regard to the market, certain commercial banks do indeed have an offer of loans in GEL (including business loans, mortgage loans) which have a fixed interest rate “starting from 7%.” Eventually, given the risks associated with different borrowers and multiple other factors, the interest rate increases and is, in fact, determined on a case by case basis. Therefore, in order to see a trend, it is appropriate to discuss the weighted average interest rates on factually approved loans instead of discussing figures advertised in a specific marketing offer. The National Bank of Georgia publishes comparable data in regard to interest rates.

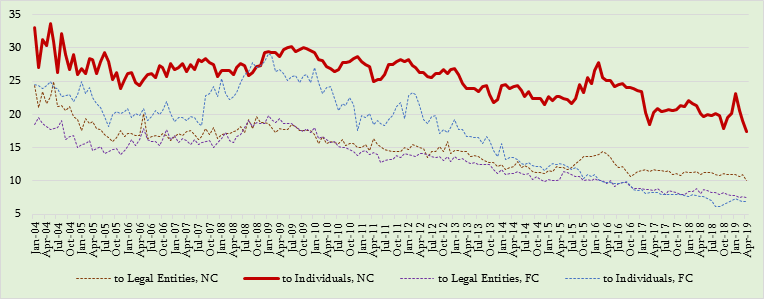

Graph 1: Loan Interest Rates in 2004-2019

Source: National Bank of Georgia

As illustrated by the graph, loan resources are characterised by a general trend of decline both under the incumbent and previous governments. At the same time, certain differences in the rate of decrease, however, are visible depending on the borrower and the loan currency. In particular, interest rates on loans issued to individuals in the national currency decrease much more slowly as compared to loans issued to individuals in a foreign currency or in the case of loans issued to legal entities in any currency. At the same time, the interest rate change amplitude (the difference between the highest and lowest values in a certain period of time) is higher in the case of individuals as compared to legal entities.

Of note is that in parallel with keeping the trend of decline on loans issued in a foreign currency, a short-term hike in interest rates on GEL-denominated loans has been visible since 2015. This was stipulated by an increased demand on GEL-denominated loans which itself was caused by a sharp depreciation of the GEL exchange rate and altered expectations. After the short-term growth, however, the interest rate has returned to a trend of decline.

In regard to a comparison of the aforementioned periods, the weighted average interest rate on loans in GEL constituted 16.6% as of the first quarter of 2019. In the same quarter of the last year of the previous government’s rule, the same figure was at 22.6%. In terms of mortgage loans taken separately (given the figures in his statement, presumably the Prime Minister referred to this indicator), the interest rate was 15.1% in the first quarter of 2012 whilst it decreased to 10.1% as of 2019.