FactCheck concludes that Mikheil Saakashvili’s statement is a LIE.

Resume: State budget figures are given in the national currency because payments (revenues) as well as spending budget funds (expenses) are carried out in the national currency. Therefore, figures for different periods should be compared in GEL given that there is no legitimate ground to convert these amounts into USD. The calculation of state budget figures in a foreign currency is incorrect and not objective for comparison.

In 2003-2012, Georgia’s state budget GEL denominated revenues increased by 558.9%; that is, by a factor of 6.6 whilst incomes have increased by 55.4% or by a factor of 1.6 from 2012 to today. It is not appropriate to make a comparison of these two periods because of the difference in the number of years in each period. Of additional note is the so-called base effect (2004 and several subsequent years) when the budget is so small that any kind of growth produces a high percentage figure.

Calculating state budget revenues in USD is inappropriate. However, even when using this methodology, the numbers given in the former President’s statement do not correspond to actual figures. In 2003-2012, USD denominated state budget revenues increased by 756.3% whilst revenues have increased by 3.2% from 2012 to today.

Analysis

On air on Rustavi 2’s talk show, Archevani, the former President of Georgia, Mikheil Saakashvili, discussed his presidency and the current situation. The former President stated that the state budget increased tenfold in his time whilst it had decreased under the Georgian Dream by 8% in USD.

Georgia’s national currency is GEL which is the country’s only legal tender for its entire territory. Therefore, state finances are calculated in the national currency – in GEL. In addition, the calculation of revenues in a foreign currency for different years is not objective because it does not take the currency exchange rate into account.

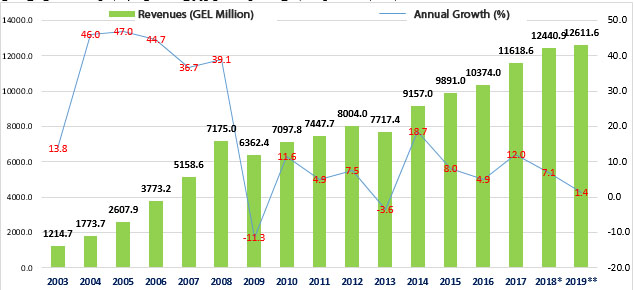

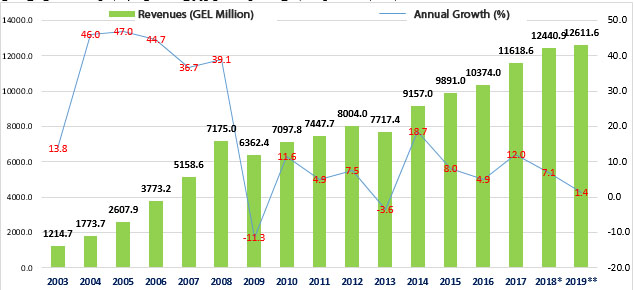

In 2004, state budget revenues increased by 46% as compared to the previous year and reached GEL 1,773.7 million. In the period of 2003-2012, only 2009 showed a decrease in state budget revenues by 11.3% as compared to the previous year which was caused by the post-war economic recession. In 2003-2012, budget revenues increased by 558.9% which makes for growth by a factor of 6.6. State budget revenues decreased by 3.6% in 2013 as compared to the previous year whilst the plan for 2013’s state budget revenues foresaw growth in this component. However, the budget revenues fulfillment figure lagged behind the planned amount by GEL 708.1 million. Since 2012 to today, state budget revenues have increased by 55.4% which accounts for an increase by a factor of 1.6. In 2012, state budget revenues amounted to GEL 8,004 million whilst the figure is GEL 12,440.9 million in accordance with the updated plan for this year. The draft state budget for 2019 shows revenues 1.4% higher (GEL 12,611.6) as compared to the plan for this year. Even though the growth margin was higher under the previous government as compared to the last years, this is because of the size of the budget. This is the so-called base effect (2004 and several years afterwards) when the budget is so small that any kind of growth produces high percentage figures. In 2003, the state budget was GEL 1,214.7 million whilst the starting figure for comparing the numbers during the Georgian Dream’s tenure in power is substantially higher. The budget revenues for 2012 comprised GEL 8,004 million. In addition, it is not objective to compare the periods named in Mikheil Saakashvili’s statement because these periods are unequal (nine years and six years).

Graph 1: State Budget Revenues (GEL Million, %)

Source: Ministry of Finance of Georgia

The main source of state budget revenues is tax income. Therefore, any alteration of a country’s tax system and changes in tax rates directly affect budget revenues. Therefore, FactCheck’s analysis for 2012-2018 takes into account that taxes were not increased (except the periodically rising excise tax rate) and the types and rates of taxes were the same for this period as they were in 2008-2012. Of note is that the profit tax reform resulted in a decrease of budget tax incomes after reducing the taxable base. There were 21 types of taxes before 2008. Taxes being equal, the growth in budget revenues is related to economic growth and improvements in administering taxes.

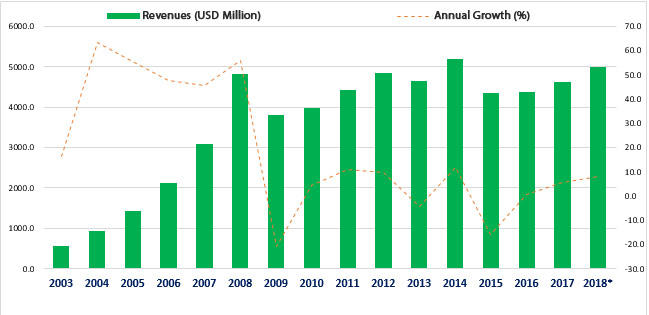

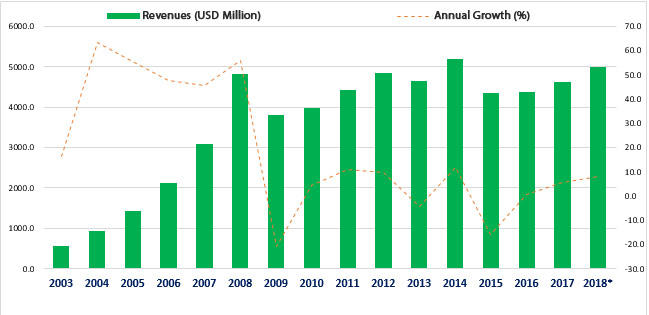

Even though the denomination and comparison of budget revenues in a foreign currency is incorrect, we can also see state budget revenues in USD (using the average currency exchange rate of the same year). In 2003, state budget revenues were USD 566.1 million whilst this figure increased to USD 4,847.2 million in 2012. Therefore, the USD denominated state budget incomes increased by 756.3% which is a factor of 8.6. For the period from 2012 up until the present day, USD denominated budget revenues have increased by 3.2%.

Graph 2: State Budget Revenues (USD Million, %)[1]

Source: Ministry of Finance of Georgia

The main source of state budget revenues is tax income. Therefore, any alteration of a country’s tax system and changes in tax rates directly affect budget revenues. Therefore, FactCheck’s analysis for 2012-2018 takes into account that taxes were not increased (except the periodically rising excise tax rate) and the types and rates of taxes were the same for this period as they were in 2008-2012. Of note is that the profit tax reform resulted in a decrease of budget tax incomes after reducing the taxable base. There were 21 types of taxes before 2008. Taxes being equal, the growth in budget revenues is related to economic growth and improvements in administering taxes.

Even though the denomination and comparison of budget revenues in a foreign currency is incorrect, we can also see state budget revenues in USD (using the average currency exchange rate of the same year). In 2003, state budget revenues were USD 566.1 million whilst this figure increased to USD 4,847.2 million in 2012. Therefore, the USD denominated state budget incomes increased by 756.3% which is a factor of 8.6. For the period from 2012 up until the present day, USD denominated budget revenues have increased by 3.2%.

Graph 2: State Budget Revenues (USD Million, %)[1]

Source: Ministry of Finance of Georgia, National Bank of Georgia

[1] This is not an appropriate approach for assessing the existing situation and is used only to verify the numbers given in the statement.

Source: Ministry of Finance of Georgia, National Bank of Georgia

[1] This is not an appropriate approach for assessing the existing situation and is used only to verify the numbers given in the statement.

Source: Ministry of Finance of Georgia

The main source of state budget revenues is tax income. Therefore, any alteration of a country’s tax system and changes in tax rates directly affect budget revenues. Therefore, FactCheck’s analysis for 2012-2018 takes into account that taxes were not increased (except the periodically rising excise tax rate) and the types and rates of taxes were the same for this period as they were in 2008-2012. Of note is that the profit tax reform resulted in a decrease of budget tax incomes after reducing the taxable base. There were 21 types of taxes before 2008. Taxes being equal, the growth in budget revenues is related to economic growth and improvements in administering taxes.

Even though the denomination and comparison of budget revenues in a foreign currency is incorrect, we can also see state budget revenues in USD (using the average currency exchange rate of the same year). In 2003, state budget revenues were USD 566.1 million whilst this figure increased to USD 4,847.2 million in 2012. Therefore, the USD denominated state budget incomes increased by 756.3% which is a factor of 8.6. For the period from 2012 up until the present day, USD denominated budget revenues have increased by 3.2%.

Graph 2: State Budget Revenues (USD Million, %)[1]

Source: Ministry of Finance of Georgia

The main source of state budget revenues is tax income. Therefore, any alteration of a country’s tax system and changes in tax rates directly affect budget revenues. Therefore, FactCheck’s analysis for 2012-2018 takes into account that taxes were not increased (except the periodically rising excise tax rate) and the types and rates of taxes were the same for this period as they were in 2008-2012. Of note is that the profit tax reform resulted in a decrease of budget tax incomes after reducing the taxable base. There were 21 types of taxes before 2008. Taxes being equal, the growth in budget revenues is related to economic growth and improvements in administering taxes.

Even though the denomination and comparison of budget revenues in a foreign currency is incorrect, we can also see state budget revenues in USD (using the average currency exchange rate of the same year). In 2003, state budget revenues were USD 566.1 million whilst this figure increased to USD 4,847.2 million in 2012. Therefore, the USD denominated state budget incomes increased by 756.3% which is a factor of 8.6. For the period from 2012 up until the present day, USD denominated budget revenues have increased by 3.2%.

Graph 2: State Budget Revenues (USD Million, %)[1]

Source: Ministry of Finance of Georgia, National Bank of Georgia

[1] This is not an appropriate approach for assessing the existing situation and is used only to verify the numbers given in the statement.

Source: Ministry of Finance of Georgia, National Bank of Georgia

[1] This is not an appropriate approach for assessing the existing situation and is used only to verify the numbers given in the statement.

Tags: