Verdict: FactCheck concludes that Roman Gotsiridze’s statement is FALSE.

Resume: In the last years, GEL depreciation has become a serious problem. The depreciation of the national currency exchange rate entails a number of negative consequences. This increases GEL denominated foreign debt and the debt service burden for those individuals who have income in GEL and obligations in a foreign currency as well as also having the potential to increase inflation.

The focus of his statement is more relevant in regard to disposable income instead of real income. Disposable income is the difference between income and obligatory expenses. GEL depreciation affects disposable income because people who have loans in USD, for example, have their obligations increased as a result of GEL depreciation and they have less money to cover their other needs and wants. However, even in this case, GEL depreciation could not have caused a 60% drop in disposable income. On the other hand, this impact does not affect the entire population because not everyone has loans in USD.

FactCheck’s verdict is mostly based on Roman Gotsiridze’s quotation – “people have lost real income.” Real income is a specific economic term. Real figures are based on different economic data, excluding the inflation factor. Mr Gotsiridze links real incomes entirely to the GEL exchange rate (it dropped by nearly 60%) which is clearly a wrong approach. At the same time, real incomes (as claimed by the politician) have not decreased by 60% but, instead, they have been growing since 2012.

Analysis

At a session of the Parliament of Georgia, United National Movement member, Roman Gotsiridze, stated: “As a result of GEL depreciation, people have lost 60% of their real income.”

In the last years, GEL depreciation has become a serious problem. The depreciation of the national currency exchange rate entails a number of negative consequences. This increases GEL denominated foreign debt and the debt service burden for those individuals who have income in GEL and obligations in a foreign currency as well as also having the potential to increase inflation (especially for an import-dependent economy).

Within the context of our analysis, we have to look at real income and disposable income. Roman Gotsiridze speaks about real income when, in fact, it would be more relevant to discuss disposable income in this context. Disposable income is the different between incomes and obligatory expenses. For instance, if a citizen had an income of GEL 1,000 whilst his debt is GEL 100, his disposable income will be GEL 900 and can be spent as desired.

GEL depreciation directly affects the disposable income for those people who have loans in USD and incomes in GEL. For instance, if a person has a debt of USD 100 and GEL depreciated against USD from 1.5 to 2.5, the person’s GEL denominated debt will increase from GEL 150 to GEL 250 whilst his disposable income will decrease from GEL 850 to GEL 750.

If Roman Gotsiridze had spoken about disposable income specifically in regard to the GEL exchange rate, his statement could have been much more relevant. However, in this case, too, the GEL exchange rate’s depreciation could not have resulted in a decrease of disposable income in the same amount (in contrast to theoretical cases when a citizen was paying half of his income for his debt service before the GEL depreciation). This is easily demonstrated by the inflow when GEL depreciated by 65% and disposable income also decreased by nearly 65%. If we again look at the aforementioned example where GEL dropped by 65%, this means that disposable income decreased by 12%, from GEL 850 to GEL 750.

FactCheck’s verdict is mostly based on the MP’s quotation: “People have lost real income.” Real income is a specific economic term. Real figures are based on different economic data, excluding the factor of inflation. Mr Gotsiridze links the real figure entirely to the GEL exchange rate which is clearly a very blatant manipulation. The GEL exchange rate is one of many factors affecting inflation.

Given the fact that GEL is the legal tender in Georgia, people’s expenses are mostly denominated in GEL as well as the average nominal salary is calculated in GEL. Therefore, whilst assessing the trends in changes of income (salary, pension), there is no ground to convert figures to USD. Changes in GEL purchasing power are directly proportional to the depreciation of the GEL exchange rate (in this case against USD).

The currency exchange rate is related to real figures which means that imported goods are becoming more expensive. However, inflation figures reflect this connection. Annual inflation reflects the impact of an increase or decrease in the prices of goods and services based on changes in the exchange rate. In order to verify the statement, a more accurate analysis would be to look at people’s real incomes (considering the CPI[1]) and real GDP figures.

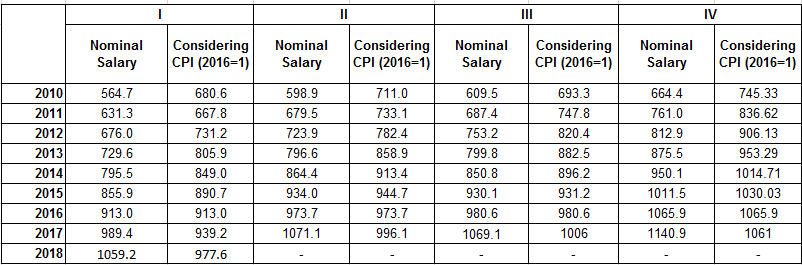

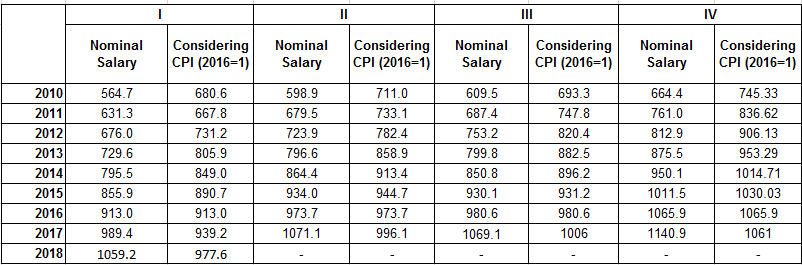

Table 1: Average Monthly Salary of Hired Labour (GEL)

Source: National Statistics Office of Georgia

In order to compare incomes in different periods, it is appropriate to use figures adjusted to the Consumer Price Index instead of income converted to a foreign currency. Table 1 shows the amounts of nominal salaries in 2010-2018 and demonstrates what would have been the nominal salaries of other years as compared to 2016. As we see, the real average salary has a tendency of growth and has not decreased by 60%.

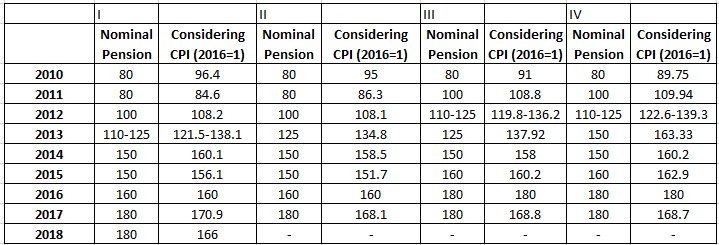

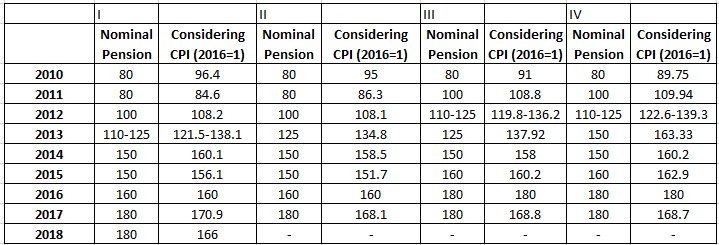

Table 2: Old Age Pension in 2010-2018

Source: National Statistics Office of Georgia

In order to compare incomes in different periods, it is appropriate to use figures adjusted to the Consumer Price Index instead of income converted to a foreign currency. Table 1 shows the amounts of nominal salaries in 2010-2018 and demonstrates what would have been the nominal salaries of other years as compared to 2016. As we see, the real average salary has a tendency of growth and has not decreased by 60%.

Table 2: Old Age Pension in 2010-2018

Source: National Statistics Office of Georgia

In the case of pension, it is once again wrong to convert it to a foreign currency and make subsequent comparisons. Here as well, we should take the inflation level into account and observe the change in the real pension. Of note is that the nominal pension has been unchanged for a period of time (for instance, from QIV of 2013 including QII of 2015, it is GEL 150). As a result, the amount of nominal pension decreased (in the case of a nominal GEL 150 pension, it decreased from real GEL 163.33 to GEL 151.7) as compared to the fixation period. Afterwards, both the nominal pension (from GEL 150 to GEL 160) and the real pension (from GEL 151.7 to GEL 160.2) has been gradually increasing. This cycle is repeated after each growth in the nominal pension. From QIII of 2014 (the initial period of the depreciation of the GEL exchange rate) including QI of 2018, the real pension increased marginally (GEL 8) although this still constitutes a growth.

In order to better understand the meaning of a real pension, it will be useful to look at a specific case. For instance, the real pension of QIII of 2012 – GEL 125 – matches with GEL 136.2 in 2016 (what a pensioner could buy in September 2012 with GEL 124, he needed GEL 136.2 to buy the same things in September 2016). The nominal pension in 2016 exceeds this figure (GEL 136.2) by GEL 43.8 and constitutes GEL 180.

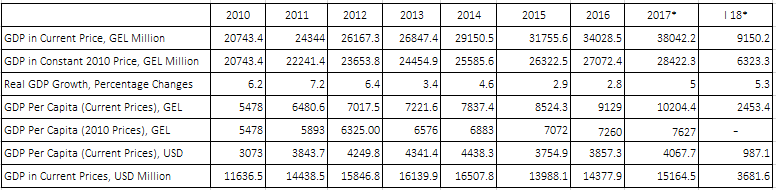

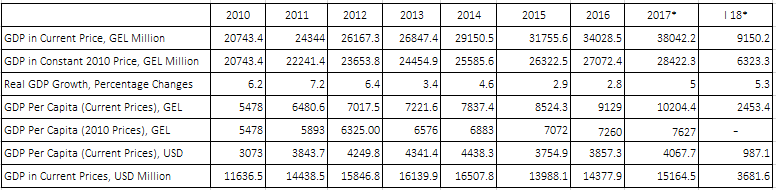

Table 3: Trends of Changes in Gross Domestic Product

Source: National Statistics Office of Georgia

In the case of pension, it is once again wrong to convert it to a foreign currency and make subsequent comparisons. Here as well, we should take the inflation level into account and observe the change in the real pension. Of note is that the nominal pension has been unchanged for a period of time (for instance, from QIV of 2013 including QII of 2015, it is GEL 150). As a result, the amount of nominal pension decreased (in the case of a nominal GEL 150 pension, it decreased from real GEL 163.33 to GEL 151.7) as compared to the fixation period. Afterwards, both the nominal pension (from GEL 150 to GEL 160) and the real pension (from GEL 151.7 to GEL 160.2) has been gradually increasing. This cycle is repeated after each growth in the nominal pension. From QIII of 2014 (the initial period of the depreciation of the GEL exchange rate) including QI of 2018, the real pension increased marginally (GEL 8) although this still constitutes a growth.

In order to better understand the meaning of a real pension, it will be useful to look at a specific case. For instance, the real pension of QIII of 2012 – GEL 125 – matches with GEL 136.2 in 2016 (what a pensioner could buy in September 2012 with GEL 124, he needed GEL 136.2 to buy the same things in September 2016). The nominal pension in 2016 exceeds this figure (GEL 136.2) by GEL 43.8 and constitutes GEL 180.

Table 3: Trends of Changes in Gross Domestic Product

Source: National Statistics Office of Georgia

As illustrated by Table 3, the economic growth rate has been positive since 2010. Since 2014, USD denominated real GDP has decreased. This figure is often indicated to prove that the country is getting poorer. However, the decrease in USD denominated GDP is caused by the sharp depreciation of the official GEL exchange rate. In order to measure real changes it is appropriate to base an analysis upon the GDP in constant prices. The real GDP per capita in GEL had a tendency of growth in 2010-2017 and amounted to GEL 7,627 as of 2017.

[1] CPI is a measure that examines the weighted average of prices on goods and services purchased by consumers as compared to the starting period.

Source: National Statistics Office of Georgia

As illustrated by Table 3, the economic growth rate has been positive since 2010. Since 2014, USD denominated real GDP has decreased. This figure is often indicated to prove that the country is getting poorer. However, the decrease in USD denominated GDP is caused by the sharp depreciation of the official GEL exchange rate. In order to measure real changes it is appropriate to base an analysis upon the GDP in constant prices. The real GDP per capita in GEL had a tendency of growth in 2010-2017 and amounted to GEL 7,627 as of 2017.

[1] CPI is a measure that examines the weighted average of prices on goods and services purchased by consumers as compared to the starting period.

Source: National Statistics Office of Georgia

In order to compare incomes in different periods, it is appropriate to use figures adjusted to the Consumer Price Index instead of income converted to a foreign currency. Table 1 shows the amounts of nominal salaries in 2010-2018 and demonstrates what would have been the nominal salaries of other years as compared to 2016. As we see, the real average salary has a tendency of growth and has not decreased by 60%.

Table 2: Old Age Pension in 2010-2018

Source: National Statistics Office of Georgia

In order to compare incomes in different periods, it is appropriate to use figures adjusted to the Consumer Price Index instead of income converted to a foreign currency. Table 1 shows the amounts of nominal salaries in 2010-2018 and demonstrates what would have been the nominal salaries of other years as compared to 2016. As we see, the real average salary has a tendency of growth and has not decreased by 60%.

Table 2: Old Age Pension in 2010-2018

Source: National Statistics Office of Georgia

In the case of pension, it is once again wrong to convert it to a foreign currency and make subsequent comparisons. Here as well, we should take the inflation level into account and observe the change in the real pension. Of note is that the nominal pension has been unchanged for a period of time (for instance, from QIV of 2013 including QII of 2015, it is GEL 150). As a result, the amount of nominal pension decreased (in the case of a nominal GEL 150 pension, it decreased from real GEL 163.33 to GEL 151.7) as compared to the fixation period. Afterwards, both the nominal pension (from GEL 150 to GEL 160) and the real pension (from GEL 151.7 to GEL 160.2) has been gradually increasing. This cycle is repeated after each growth in the nominal pension. From QIII of 2014 (the initial period of the depreciation of the GEL exchange rate) including QI of 2018, the real pension increased marginally (GEL 8) although this still constitutes a growth.

In order to better understand the meaning of a real pension, it will be useful to look at a specific case. For instance, the real pension of QIII of 2012 – GEL 125 – matches with GEL 136.2 in 2016 (what a pensioner could buy in September 2012 with GEL 124, he needed GEL 136.2 to buy the same things in September 2016). The nominal pension in 2016 exceeds this figure (GEL 136.2) by GEL 43.8 and constitutes GEL 180.

Table 3: Trends of Changes in Gross Domestic Product

Source: National Statistics Office of Georgia

In the case of pension, it is once again wrong to convert it to a foreign currency and make subsequent comparisons. Here as well, we should take the inflation level into account and observe the change in the real pension. Of note is that the nominal pension has been unchanged for a period of time (for instance, from QIV of 2013 including QII of 2015, it is GEL 150). As a result, the amount of nominal pension decreased (in the case of a nominal GEL 150 pension, it decreased from real GEL 163.33 to GEL 151.7) as compared to the fixation period. Afterwards, both the nominal pension (from GEL 150 to GEL 160) and the real pension (from GEL 151.7 to GEL 160.2) has been gradually increasing. This cycle is repeated after each growth in the nominal pension. From QIII of 2014 (the initial period of the depreciation of the GEL exchange rate) including QI of 2018, the real pension increased marginally (GEL 8) although this still constitutes a growth.

In order to better understand the meaning of a real pension, it will be useful to look at a specific case. For instance, the real pension of QIII of 2012 – GEL 125 – matches with GEL 136.2 in 2016 (what a pensioner could buy in September 2012 with GEL 124, he needed GEL 136.2 to buy the same things in September 2016). The nominal pension in 2016 exceeds this figure (GEL 136.2) by GEL 43.8 and constitutes GEL 180.

Table 3: Trends of Changes in Gross Domestic Product

Source: National Statistics Office of Georgia

As illustrated by Table 3, the economic growth rate has been positive since 2010. Since 2014, USD denominated real GDP has decreased. This figure is often indicated to prove that the country is getting poorer. However, the decrease in USD denominated GDP is caused by the sharp depreciation of the official GEL exchange rate. In order to measure real changes it is appropriate to base an analysis upon the GDP in constant prices. The real GDP per capita in GEL had a tendency of growth in 2010-2017 and amounted to GEL 7,627 as of 2017.

[1] CPI is a measure that examines the weighted average of prices on goods and services purchased by consumers as compared to the starting period.

Source: National Statistics Office of Georgia

As illustrated by Table 3, the economic growth rate has been positive since 2010. Since 2014, USD denominated real GDP has decreased. This figure is often indicated to prove that the country is getting poorer. However, the decrease in USD denominated GDP is caused by the sharp depreciation of the official GEL exchange rate. In order to measure real changes it is appropriate to base an analysis upon the GDP in constant prices. The real GDP per capita in GEL had a tendency of growth in 2010-2017 and amounted to GEL 7,627 as of 2017.

[1] CPI is a measure that examines the weighted average of prices on goods and services purchased by consumers as compared to the starting period.

Tags: