Verdict: FactCheck concludes that Roman Gotsiridze’s statement is

HALF TRUE.

Resume: In accordance with Roman Gotsiridze’s statement, the former Minister of Finance of Georgia, Nodar Khaduri, gave GEL 300 million to commercial banks whilst the Government of Georgia gave the banks an additional GEL 1 billion from the budget balance. Two years ago, the National Bank of Georgia increased refinancing loans from GEL 200 million to GEL 2 billion. In total, nearly GEL 3 billion of national resources were allocated to commercial banks which are forced to provide expensive loans to the Government of Georgia or citizens.

In 2014-2015, part of the state budget funds accumulated in the form of domestic debt (a total of GEL 272.8 million) was “lent” to commercial banks by issuing bonds. The expediency of this decision raises certain questions, especially given the fact that funds already marginal for the scale of Georgia’s economy have been distributed among several banks. In the following years, the Government of Georgia discontinued this programme which perhaps indicates that the government acknowledged its inexpediency. Therefore, the MP’s criticism in that particular part of his statement is legitimate although the figures are bloated.

In another part of his statement about delivering the budget balance to commercial banks, the MP refers to the start of depositing the state budget balance in commercial banks. This process was launched in July 2017. As of 2018, GEL 850 million has been deposited in the accounts of commercial banks. Of note is that the inflows and the outflows of the state budget do not usually match each other. Therefore, it is unclear why the State Treasury’s decision to use free funds for getting profit should be viewed in a negative context. At the same time, the part of the statement that banks are “forced” to lend these funds is also vague. Budget funds are deposited after having an auction and it is not mandatory for the banks to take part in an auction. Therefore, if a bank decides that additional funds are not necessary at the given moment or the “price” (interest rate) for getting additional funds is too high, it can abstain from obtaining those funds.

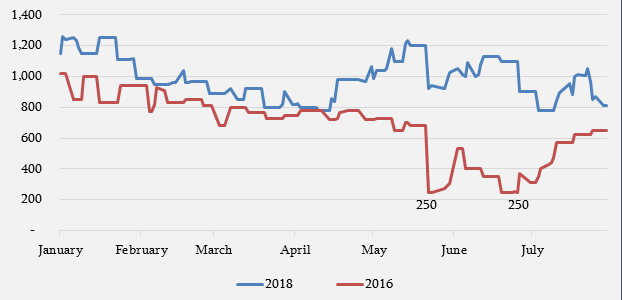

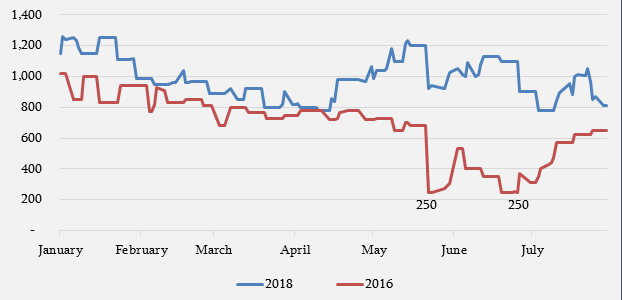

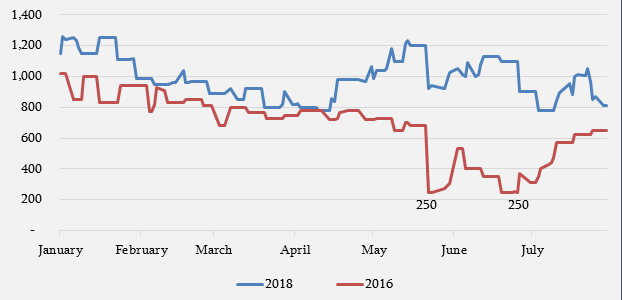

The third part of Roman Gotsiridze’s statement is about the difference between the volume of refinancing loans provided by the National Bank of Georgia to commercial banks in 2016 and in 2018. Throughout 2016, the average volume of refinancing loans

[1] amounted to GEL 857 million whilst this figure increased to GEL 1,166 million in 2017. As of the first six months of 2018, the amount of refinancing loans is GEL 1,007 million whilst it was GEL 710 million in the first six months of 2016. At the same time, the maximum amount of refinancing loans was GEL 1,260 million instead of GEL 2 billion as stated by the MP. Of note is that that whilst comparing the figures of 2016 and 2018, the MP gives a lesser figure for 2016 and substantially bloats the figure for 2018 because the actual figure for 2018 is 1.6 times lower as compared to what is claimed in Roman Gotsiridze’s statement. This comparison lacks objective ground given the different economic situations in 2016 and 2018.

Analysis

Parliament of Georgia member, Roman Gotsiridze,

stated: “Khaduri gave GEL 300 million to commercial banks. You (Government of Georgia) gave them GEL 1 billion of the budget balance. You accumulate domestic debt and give funds to commercial banks. The amount of refinancing loans was GEL 200 million two years ago and the National Bank has increased them up to GEL 2 billion. Nearly GEL 3 billion of national resources was allocated to commercial banks which are forced to either provide expensive loans to the Government of Georgia or to citizens. After that, you state there is a problem of excessive debt.”

In 2014, the Government of Georgia

initiated the Economy Long Term Supply Programme which envisioned that part of the funds from the accumulated state debt has to be deposited in commercial banks through the issuing of bonds. The then Minister of Finance, Nodar Khaduri,

believed that the aforementioned programme would have enabled banks to use those funds to provide long-term supplies to the economy. This practice was kept for only two years and GEL 172.8 million and GEL 99.99 million treasury bonds of different maturity were issued in 2014 and 2015, respectively. The table below shows that the total amount of budget funds deposited in commercial banks for the aforementioned purpose was GEL 272.8 million by the end of 2015. Of note is that the justification of the programme’s expediency was somewhat vague and the achievement of the stated goal was dubious. The Government of Georgia most likely acknowledged these factors which is proven by its decision to discontinue the programme.

Table 1: Economy Long Term Supply Programme (GEL thousand)

|

2014 |

2015 |

2016 |

2017 |

2018 |

| Movement of Funds |

172,835 |

99,996 |

-87,831 |

-49,998 |

0 |

| Total Balance |

172,835 |

272,831 |

185,000 |

135,002 |

135,002 |

Source: State Treasury of the Ministry of Finance

In regard to depositing the state budget balance to the accounts of commercial banks, the State Treasury

started to deposit free available funds in commercial banks beginning from July 2017 in order to increase the efficiency of state finance management and obtain additional income as a part of the state finance management reform. Budget funds are deposited in the accounts of commercial banks through an auction for the duration of three months with interest rates accrued from these deposits.

Table 2: Budget Funds Deposited in Commercial Banks (GEL million)

|

2017 |

2018 |

| VII |

VIII |

IX |

X |

XI |

XII |

I |

II |

III |

IV |

V |

VI |

| Incoming Funds |

200 |

250 |

50 |

200 |

220 |

0 |

230 |

220 |

200 |

250 |

665 |

620 |

| Outgoing Funds |

0 |

0 |

0 |

200 |

250 |

50 |

200 |

220 |

0 |

170 |

655 |

510 |

| Total Amount of Funds Deposited in Commercial Banks |

200 |

450 |

500 |

500 |

470 |

420 |

450 |

450 |

650 |

730 |

740 |

850 |

Source: State Treasury of the Ministry of Finance

As illustrated by the table, the amount of funds deposited by the State Treasury in commercial banks has been increasing concomitantly (in a single period of time) for the entire period and equals GEL 850 million as of 2018. The total turnover of funds deposited in the accounts of commercial banks amounted to GEL 920 million and GEL 2,185 million in 2017 and 2018, respectively.

The National Bank of Georgia uses refinancing loans to provide short-term liquidity to the banking sector when needed. The aim of this refinancing monetary instrument is to manage the short-term interest rate at the interbank market. The amount of funds that the National Bank is going to provide to the market depends on a number of factors, including government transactions, cash in circulation, interventions at the currency market and the emission of government and National Bank securities. For instance, the emission of securities, government income (collection of taxes) and the increased amount of cash in circulation reduces the liquidity of a financial system and pressures refinancing loans to increase whilst government expenses have the opposite effect – they increase liquidity and pressure refinancing loans to decrease.

In regard to the volume of refinancing loans in 2016-2018, the average volume of refinancing loans was GEL 857 million throughout 2016 whilst this amount reached GEL 1,166 billion in 2017. As of the first six months of 2018, the average volume of refinancing loans is GEL 1,007 million whilst this amount was GEL 710 million in the same period of 2016. As for the figures named by the MP, of necessary note is that whilst the minimum amount of refinancing loans was GEL 250 million in 2016, refinancing loans have never reached the GEL 2 billion mark. As of 2018, the highest amount of refinancing loans (GEL 1,260 million) was registered on 4 January 2018 whilst the highest amount of refinancing loans in 2017 was GEL 1,632 million and registered on 19 April 2017.

Graph 1: Amount of Refinancing Loans in 2016-2018

Source: National Bank of Georgia

Source: National Bank of Georgia

Of additional note is that whilst comparing the two periods, the MP, on the one hand, takes the lowest figure of 2016 and decreases it even further in his statement whilst, on the other hand, he names another figure for 2018 which is 1.6 times higher as compared to the actual highest figure registered in 2018. Given the different economic situations in 2016 and 2018, the aforementioned comparison lacks objective ground given the fact that the factors affecting the volumes of refinancing loans are quite volatile even in short-term periods, let alone a two-year time span.

[1] A refinancing loan is a monetary policy instrument through which the National Bank of Georgia supplies short liquidity to the country’s banking system with appropriate collateral.

Source: National Bank of Georgia

Of additional note is that whilst comparing the two periods, the MP, on the one hand, takes the lowest figure of 2016 and decreases it even further in his statement whilst, on the other hand, he names another figure for 2018 which is 1.6 times higher as compared to the actual highest figure registered in 2018. Given the different economic situations in 2016 and 2018, the aforementioned comparison lacks objective ground given the fact that the factors affecting the volumes of refinancing loans are quite volatile even in short-term periods, let alone a two-year time span.

[1] A refinancing loan is a monetary policy instrument through which the National Bank of Georgia supplies short liquidity to the country’s banking system with appropriate collateral.

Source: National Bank of Georgia

Of additional note is that whilst comparing the two periods, the MP, on the one hand, takes the lowest figure of 2016 and decreases it even further in his statement whilst, on the other hand, he names another figure for 2018 which is 1.6 times higher as compared to the actual highest figure registered in 2018. Given the different economic situations in 2016 and 2018, the aforementioned comparison lacks objective ground given the fact that the factors affecting the volumes of refinancing loans are quite volatile even in short-term periods, let alone a two-year time span.

[1] A refinancing loan is a monetary policy instrument through which the National Bank of Georgia supplies short liquidity to the country’s banking system with appropriate collateral.

Source: National Bank of Georgia

Of additional note is that whilst comparing the two periods, the MP, on the one hand, takes the lowest figure of 2016 and decreases it even further in his statement whilst, on the other hand, he names another figure for 2018 which is 1.6 times higher as compared to the actual highest figure registered in 2018. Given the different economic situations in 2016 and 2018, the aforementioned comparison lacks objective ground given the fact that the factors affecting the volumes of refinancing loans are quite volatile even in short-term periods, let alone a two-year time span.

[1] A refinancing loan is a monetary policy instrument through which the National Bank of Georgia supplies short liquidity to the country’s banking system with appropriate collateral.

Source: National Bank of Georgia

Of additional note is that whilst comparing the two periods, the MP, on the one hand, takes the lowest figure of 2016 and decreases it even further in his statement whilst, on the other hand, he names another figure for 2018 which is 1.6 times higher as compared to the actual highest figure registered in 2018. Given the different economic situations in 2016 and 2018, the aforementioned comparison lacks objective ground given the fact that the factors affecting the volumes of refinancing loans are quite volatile even in short-term periods, let alone a two-year time span.

[1] A refinancing loan is a monetary policy instrument through which the National Bank of Georgia supplies short liquidity to the country’s banking system with appropriate collateral.