Verdict: Kakha Okriashvili’s statement is FALSE.

Resume: Figures in Kakha Okriashvili’s statement are mostly factually accurate although the data are wrongly interpreted.

Specifically, the World Bank’s information, which Kakha Okriashvili uses in the first part of his statement, has limitations related to content and technical characteristics. The World Bank calculates the number of individual loan agreements concluded with commercial banks per 1,000 adults and not the number of debtors. Therefore, the aforementioned indicator cannot adequately show the number of debtors. In addition, the World Bank’s data do not include the aforementioned indicator for each country. The list incorporates only 70 countries. Georgia is ranked 3rd (after Singapore and Turkey) in the list and not in the world as claimed by the MP.

In the second part of his statement, Kakha Okriashvili used the ratio of bank interest income to total salary to highlight the financial burden owed to commercial banks. The use of this indicator to emphasise a financial burden is inappropriate. The estimated amount of salary in the indicator does not equal the total income of a country’s population but, in fact, is less. In addition, the indicator shows the labour remuneration of all employed individuals and not only those in debt. On the other hand, the total amount of funds spent on interest rate service includes the obligations of legal entities as well as individuals. At the same time, the total income from interest rate service which banks receive from individuals is 14.3% of the total labour remuneration instead of 30% as claimed by the MP. The aforementioned indicator shows the obligations to commercial banks alone and does not include obligations to every loan-granting organisation. However, the MP only emphasised the obligations toward commercial banks in his statement.

Analysis

Georgian Dream member, Kakha Okriashvili, in his speech before the Parliament of Georgia, stated that of every 1,000 persons in Georgia, 700 of them have bank loans and Georgia ranks second in the world in accordance with the over indebtedness index. The MP added that nearly 30% of the population’s total annual income is spent on servicing bank interest rate payments.

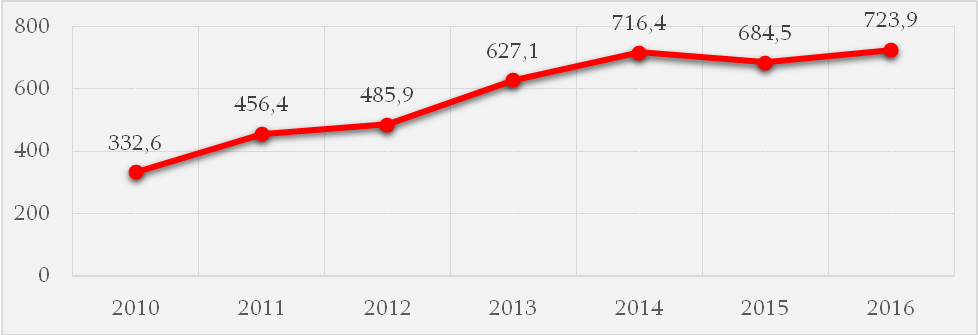

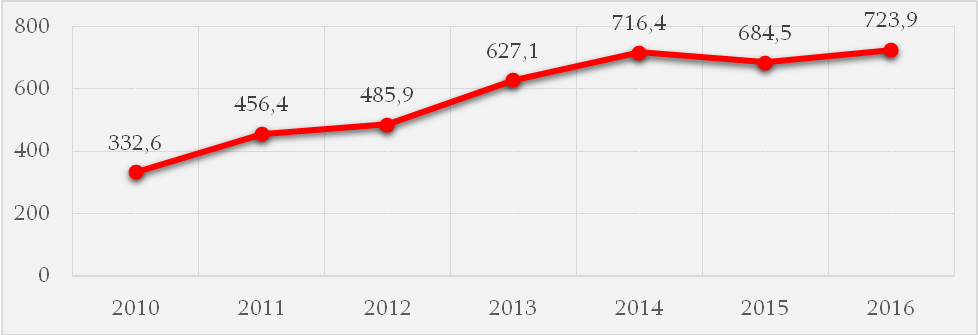

The World Bank publishes data of debtors in different countries per 1,000 adults. In the first part of his statement, Kakha Okriashvili speaks about this indicator. In accordance with the World Bank’s information, of every 1,000 persons in Georgia, 724 individuals had commercial bank loans in 2016 (updated data are not available) which is highest figure throughout the accounting period. This indicator showed a constant growth in 2010-2014. In 2015, the figure decreased to 685 persons in contrast to the previous year. The figure increased again in 2016.

Of note is the inappropriateness of using this indicator to measure over indebtedness figures in different countries owing to its technical limitations. The World Bank calculates this indicator by the number of loan agreements concluded by citizens. Therefore, the figure reflects the number of bank loan agreements per 1,000 individuals and not the actual number of debtors. Hence, the number of commercial bank debtors per 1,000 persons is lower as compared to what the figure shows. The aforementioned limitation is clearly illustrated by the Singapore case where there are 1,233 loan agreements per 1,000 individuals.

In the World Bank’s data, Georgia is ranked 3rd after Singapore (1,233) and Turkey (804) in terms of the number of debtors to commercial banks. Of note is that the World Bank uses the data of only 70 countries for this indicator. Therefore, a discussion on Georgia’s position in the world ranking based on this aforementioned indicator is irrelevant.

In addition, the growth of bank loan consumer numbers does not necessarily mean that this is a negative trend. Increased access to financial resources is a part of a healthy economic process. It is of paramount importance that a debtor pays his dues.

Graph 1: Number of Commercial Bank Debtors in Georgia per 1,000 adult

Source: World Bank

In the second part of his statement, Kakha Okriashvili spoke about the ratio of interest rate service expenditures to the population’s total annual income. Interest rate service is money which commercial banks receive as an interest rate income from the loans they issue. In accordance with the National Bank of Georgia’s information, the total interest income of commercial banks was GEL 2.76 billion at the end of 2017 whilst other incomes associated with debt service (commissions, penalties, etc.) increased that figure to GEL 3.13 billion. Of note is that the aforementioned figure constitutes a sum and includes funds from legal entities as well whilst interest income from individuals amounts to GEL 1.58 billion.

The total income which the politician emphasised in his speech is the amount of labour remuneration generated in Georgia in a specific year. In accordance with the information of the National Statistics Office of Georgia, this figure was GEL 11.03 billion in 2017. The ratio of bank interest income to total income was 25% last year and 28.4% if also including the non-interest income. Despite this, the given ratio does not appropriately describe the volume and burden of interest income. On the one hand, the total income of a population is higher as compared to labour remuneration only. On the other hand, the aforementioned figure (labour remuneration generated in the country) shows the total labour remuneration of all employed people in Georgia and not exclusively the salaries of those people who have debts to financial institutions. At the same time, the total interest income includes the obligations of legal entities as well whilst interest income from individuals alone (GEL 1.58 billion) is only 14.3% of the total annual labour remuneration. Of note is that these figures only include obligations to commercial banks and do not include obligations to other loan-granting organisations. Therefore, they show the population’s obligations in a reduced form, although Kakha Okriashvili’s statement made emphasis on the debts of citizens to commercial banks.

In general, whilst speaking about the existence of over indebtedness, there is no internationally recognised definition or universal formula for its measurement. Therefore, it is unclear on what the MP’s claim is based. One of the criteria of over indebtedness could be the ratio of domestic household (individuals) loans to the GDP as well as the amount of overdue loans (the part of those obligations which are unfulfilled by the borrower as prescribed by the loan agreement).

In accordance with the National Bank of Georgia’s data, the total amount of loans issued for Georgia’s residents (both legal entities and individuals) by commercial banks amounted to GEL 21.4 billion in 2017. Of that amount, GEL 11.8 billion was issued to individuals. The total amount of loans issued for individuals has been constantly growing throughout the accounting period.

Graph 2: Ratio of Total Commercial Bank Loans Issued to Domestic Households and Georgian Residents to GDP

Source: World Bank

In the second part of his statement, Kakha Okriashvili spoke about the ratio of interest rate service expenditures to the population’s total annual income. Interest rate service is money which commercial banks receive as an interest rate income from the loans they issue. In accordance with the National Bank of Georgia’s information, the total interest income of commercial banks was GEL 2.76 billion at the end of 2017 whilst other incomes associated with debt service (commissions, penalties, etc.) increased that figure to GEL 3.13 billion. Of note is that the aforementioned figure constitutes a sum and includes funds from legal entities as well whilst interest income from individuals amounts to GEL 1.58 billion.

The total income which the politician emphasised in his speech is the amount of labour remuneration generated in Georgia in a specific year. In accordance with the information of the National Statistics Office of Georgia, this figure was GEL 11.03 billion in 2017. The ratio of bank interest income to total income was 25% last year and 28.4% if also including the non-interest income. Despite this, the given ratio does not appropriately describe the volume and burden of interest income. On the one hand, the total income of a population is higher as compared to labour remuneration only. On the other hand, the aforementioned figure (labour remuneration generated in the country) shows the total labour remuneration of all employed people in Georgia and not exclusively the salaries of those people who have debts to financial institutions. At the same time, the total interest income includes the obligations of legal entities as well whilst interest income from individuals alone (GEL 1.58 billion) is only 14.3% of the total annual labour remuneration. Of note is that these figures only include obligations to commercial banks and do not include obligations to other loan-granting organisations. Therefore, they show the population’s obligations in a reduced form, although Kakha Okriashvili’s statement made emphasis on the debts of citizens to commercial banks.

In general, whilst speaking about the existence of over indebtedness, there is no internationally recognised definition or universal formula for its measurement. Therefore, it is unclear on what the MP’s claim is based. One of the criteria of over indebtedness could be the ratio of domestic household (individuals) loans to the GDP as well as the amount of overdue loans (the part of those obligations which are unfulfilled by the borrower as prescribed by the loan agreement).

In accordance with the National Bank of Georgia’s data, the total amount of loans issued for Georgia’s residents (both legal entities and individuals) by commercial banks amounted to GEL 21.4 billion in 2017. Of that amount, GEL 11.8 billion was issued to individuals. The total amount of loans issued for individuals has been constantly growing throughout the accounting period.

Graph 2: Ratio of Total Commercial Bank Loans Issued to Domestic Households and Georgian Residents to GDP

Source: National Bank of Georgia

Together with the amount of loans issued for individuals, the ratio of loans to the GDP showed a constant growth in the period of 2011-2017. In 2017, the ratio of commercial bank loans for individuals to the GDP was 31% of the then GDP. This figure is lower as compared to Georgia’s neighbour countries. The ratio of domestic household debt to the GDP is within the margins of 15%-16% in Armenia and Russia whilst it is 17.5% in the case of Turkey. The general tendency indicates that the aforementioned ratio is much higher in economically developed countries and lower in less developed economies. For instance, the ratio of domestic household debt to the GDP exceeds 100% in countries such as Switzerland, the Netherlands and Norway whilst it is less than 10% in Argentina, Egypt and Kazakhstan.

In regard to the volume of overdue loans, the total amount of overdue loans in Georgia was GEL 378 million as of April 2018 and constituted 1.65% of the total amount of loans. In light of the absolute growth of overdue loans in the last years and which is natural considering the increased amount of issued loans, its share in the total amount of loans is characterised by a sharp tendency of decrease.

Source: National Bank of Georgia

Together with the amount of loans issued for individuals, the ratio of loans to the GDP showed a constant growth in the period of 2011-2017. In 2017, the ratio of commercial bank loans for individuals to the GDP was 31% of the then GDP. This figure is lower as compared to Georgia’s neighbour countries. The ratio of domestic household debt to the GDP is within the margins of 15%-16% in Armenia and Russia whilst it is 17.5% in the case of Turkey. The general tendency indicates that the aforementioned ratio is much higher in economically developed countries and lower in less developed economies. For instance, the ratio of domestic household debt to the GDP exceeds 100% in countries such as Switzerland, the Netherlands and Norway whilst it is less than 10% in Argentina, Egypt and Kazakhstan.

In regard to the volume of overdue loans, the total amount of overdue loans in Georgia was GEL 378 million as of April 2018 and constituted 1.65% of the total amount of loans. In light of the absolute growth of overdue loans in the last years and which is natural considering the increased amount of issued loans, its share in the total amount of loans is characterised by a sharp tendency of decrease.

Source: World Bank

In the second part of his statement, Kakha Okriashvili spoke about the ratio of interest rate service expenditures to the population’s total annual income. Interest rate service is money which commercial banks receive as an interest rate income from the loans they issue. In accordance with the National Bank of Georgia’s information, the total interest income of commercial banks was GEL 2.76 billion at the end of 2017 whilst other incomes associated with debt service (commissions, penalties, etc.) increased that figure to GEL 3.13 billion. Of note is that the aforementioned figure constitutes a sum and includes funds from legal entities as well whilst interest income from individuals amounts to GEL 1.58 billion.

The total income which the politician emphasised in his speech is the amount of labour remuneration generated in Georgia in a specific year. In accordance with the information of the National Statistics Office of Georgia, this figure was GEL 11.03 billion in 2017. The ratio of bank interest income to total income was 25% last year and 28.4% if also including the non-interest income. Despite this, the given ratio does not appropriately describe the volume and burden of interest income. On the one hand, the total income of a population is higher as compared to labour remuneration only. On the other hand, the aforementioned figure (labour remuneration generated in the country) shows the total labour remuneration of all employed people in Georgia and not exclusively the salaries of those people who have debts to financial institutions. At the same time, the total interest income includes the obligations of legal entities as well whilst interest income from individuals alone (GEL 1.58 billion) is only 14.3% of the total annual labour remuneration. Of note is that these figures only include obligations to commercial banks and do not include obligations to other loan-granting organisations. Therefore, they show the population’s obligations in a reduced form, although Kakha Okriashvili’s statement made emphasis on the debts of citizens to commercial banks.

In general, whilst speaking about the existence of over indebtedness, there is no internationally recognised definition or universal formula for its measurement. Therefore, it is unclear on what the MP’s claim is based. One of the criteria of over indebtedness could be the ratio of domestic household (individuals) loans to the GDP as well as the amount of overdue loans (the part of those obligations which are unfulfilled by the borrower as prescribed by the loan agreement).

In accordance with the National Bank of Georgia’s data, the total amount of loans issued for Georgia’s residents (both legal entities and individuals) by commercial banks amounted to GEL 21.4 billion in 2017. Of that amount, GEL 11.8 billion was issued to individuals. The total amount of loans issued for individuals has been constantly growing throughout the accounting period.

Graph 2: Ratio of Total Commercial Bank Loans Issued to Domestic Households and Georgian Residents to GDP

Source: World Bank

In the second part of his statement, Kakha Okriashvili spoke about the ratio of interest rate service expenditures to the population’s total annual income. Interest rate service is money which commercial banks receive as an interest rate income from the loans they issue. In accordance with the National Bank of Georgia’s information, the total interest income of commercial banks was GEL 2.76 billion at the end of 2017 whilst other incomes associated with debt service (commissions, penalties, etc.) increased that figure to GEL 3.13 billion. Of note is that the aforementioned figure constitutes a sum and includes funds from legal entities as well whilst interest income from individuals amounts to GEL 1.58 billion.

The total income which the politician emphasised in his speech is the amount of labour remuneration generated in Georgia in a specific year. In accordance with the information of the National Statistics Office of Georgia, this figure was GEL 11.03 billion in 2017. The ratio of bank interest income to total income was 25% last year and 28.4% if also including the non-interest income. Despite this, the given ratio does not appropriately describe the volume and burden of interest income. On the one hand, the total income of a population is higher as compared to labour remuneration only. On the other hand, the aforementioned figure (labour remuneration generated in the country) shows the total labour remuneration of all employed people in Georgia and not exclusively the salaries of those people who have debts to financial institutions. At the same time, the total interest income includes the obligations of legal entities as well whilst interest income from individuals alone (GEL 1.58 billion) is only 14.3% of the total annual labour remuneration. Of note is that these figures only include obligations to commercial banks and do not include obligations to other loan-granting organisations. Therefore, they show the population’s obligations in a reduced form, although Kakha Okriashvili’s statement made emphasis on the debts of citizens to commercial banks.

In general, whilst speaking about the existence of over indebtedness, there is no internationally recognised definition or universal formula for its measurement. Therefore, it is unclear on what the MP’s claim is based. One of the criteria of over indebtedness could be the ratio of domestic household (individuals) loans to the GDP as well as the amount of overdue loans (the part of those obligations which are unfulfilled by the borrower as prescribed by the loan agreement).

In accordance with the National Bank of Georgia’s data, the total amount of loans issued for Georgia’s residents (both legal entities and individuals) by commercial banks amounted to GEL 21.4 billion in 2017. Of that amount, GEL 11.8 billion was issued to individuals. The total amount of loans issued for individuals has been constantly growing throughout the accounting period.

Graph 2: Ratio of Total Commercial Bank Loans Issued to Domestic Households and Georgian Residents to GDP

Source: National Bank of Georgia

Together with the amount of loans issued for individuals, the ratio of loans to the GDP showed a constant growth in the period of 2011-2017. In 2017, the ratio of commercial bank loans for individuals to the GDP was 31% of the then GDP. This figure is lower as compared to Georgia’s neighbour countries. The ratio of domestic household debt to the GDP is within the margins of 15%-16% in Armenia and Russia whilst it is 17.5% in the case of Turkey. The general tendency indicates that the aforementioned ratio is much higher in economically developed countries and lower in less developed economies. For instance, the ratio of domestic household debt to the GDP exceeds 100% in countries such as Switzerland, the Netherlands and Norway whilst it is less than 10% in Argentina, Egypt and Kazakhstan.

In regard to the volume of overdue loans, the total amount of overdue loans in Georgia was GEL 378 million as of April 2018 and constituted 1.65% of the total amount of loans. In light of the absolute growth of overdue loans in the last years and which is natural considering the increased amount of issued loans, its share in the total amount of loans is characterised by a sharp tendency of decrease.

Source: National Bank of Georgia

Together with the amount of loans issued for individuals, the ratio of loans to the GDP showed a constant growth in the period of 2011-2017. In 2017, the ratio of commercial bank loans for individuals to the GDP was 31% of the then GDP. This figure is lower as compared to Georgia’s neighbour countries. The ratio of domestic household debt to the GDP is within the margins of 15%-16% in Armenia and Russia whilst it is 17.5% in the case of Turkey. The general tendency indicates that the aforementioned ratio is much higher in economically developed countries and lower in less developed economies. For instance, the ratio of domestic household debt to the GDP exceeds 100% in countries such as Switzerland, the Netherlands and Norway whilst it is less than 10% in Argentina, Egypt and Kazakhstan.

In regard to the volume of overdue loans, the total amount of overdue loans in Georgia was GEL 378 million as of April 2018 and constituted 1.65% of the total amount of loans. In light of the absolute growth of overdue loans in the last years and which is natural considering the increased amount of issued loans, its share in the total amount of loans is characterised by a sharp tendency of decrease.

Tags: