At a session of the Parliamentary Minority factions, European Georgia – Movement for Freedom member, Irakli Abesadze, stated: “You have doubled the domestic debt. The Georgian Dream government added approximately GEL 1.5 billion to the domestic debt. This year, for the first six months, you took GEL 12 million more in debt than was officially planned. On the other hand, you failed to take approximately USD 200 million of the foreign debt which normally is supposed to be spent on infrastructure… I’m talking about foreign debt, which was doubled in total, whilst the foreign debt to GDP ratio increased by 10% and the total debt now constitutes 45% of our economy.”

FactCheck took interest in the accuracy of the statement.

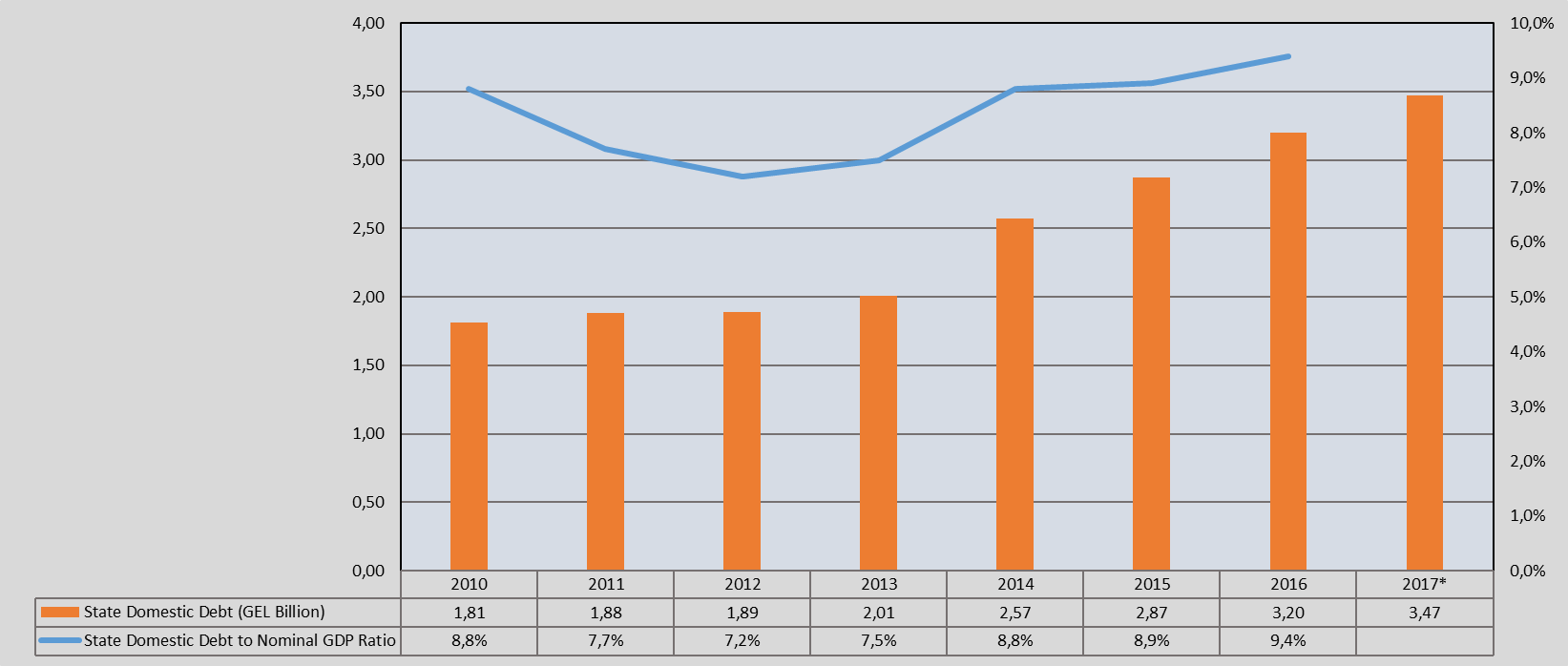

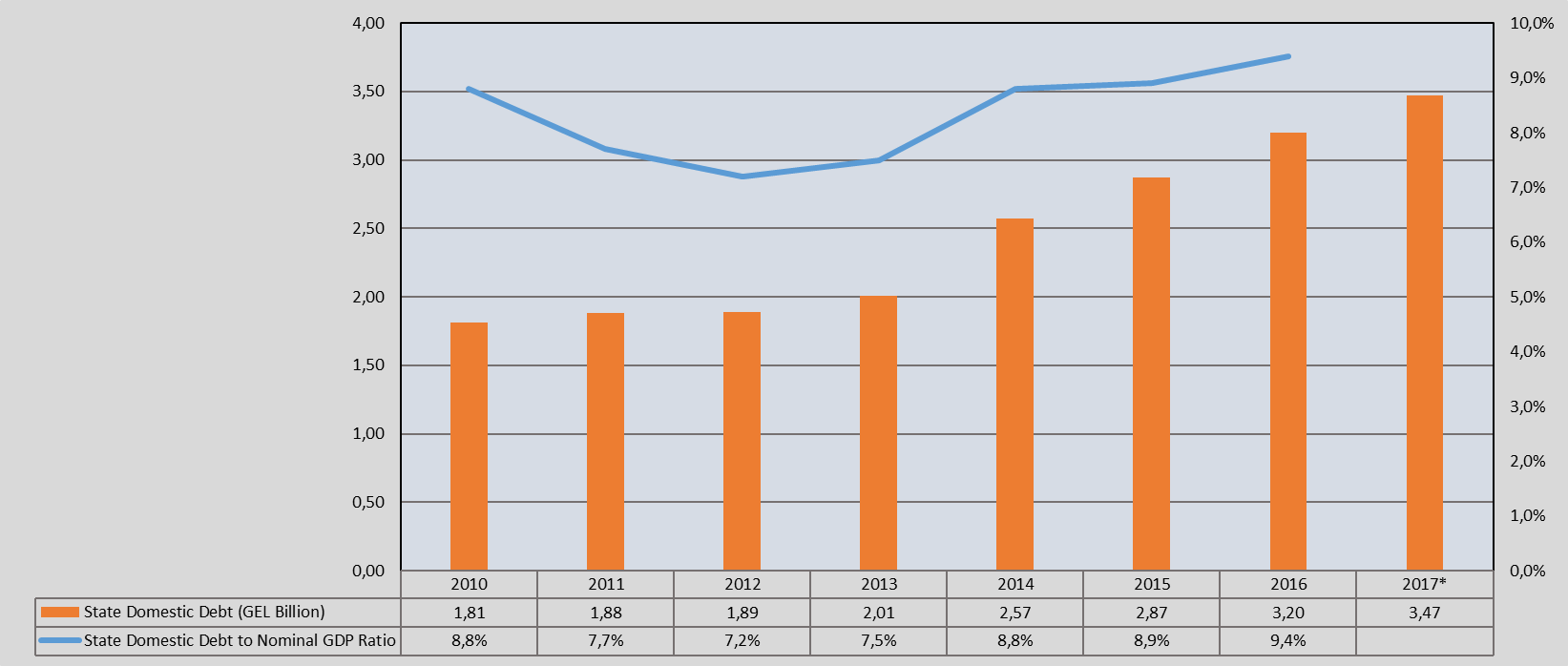

Georgia’s domestic debt was GEL 1.89 billion (7.2% of the country’s GDP) by the end of 2012 whilst it increased to GEL 3.47 billion by the end of August 2017. Therefore, the state domestic debt increased by approximately GEL 1.58 billion (by 83.6%). Together with absolute numbers, the domestic debt to nominal GDP ratio increased from 7.2% to 9.4%.

Graph 1: Georgia’s Domestic Debt (2010-2017)

Source: Ministry of Finance of Georgia

According to the 2017 State Budget Six Month Fulfillment Report, the growth figure of domestic financial obligations this year constitutes GEL 264.6 million which is GEL 11.9 million more as compared to the planned amount. At the same time, the growth figure of foreign financial obligations lags behind the planned amount by GEL 210.4 million. Of this amount, which Georgia failed to take, only 28.3% comprises funds of long-term preferential loans whilst the remaining 71.7% comprises budget support loans. Of important note is that for the first six months of 2017, the budget balance increased by GEL 291.6 million (the amount of incomes to budget exceeded the amount of expenses). Therefore, there was no need to take budget support loans.

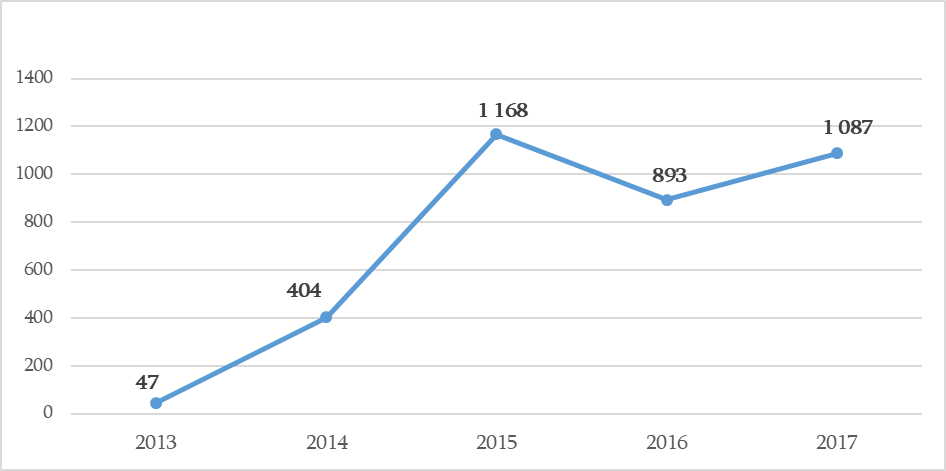

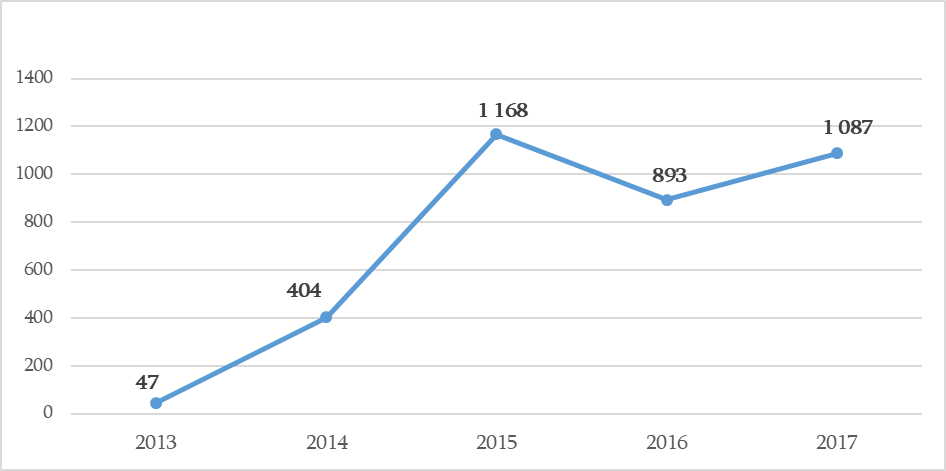

Graph 2: Foreign and Total State Debt Change Trend (2010-2017)

Source: Ministry of Finance of Georgia

According to the 2017 State Budget Six Month Fulfillment Report, the growth figure of domestic financial obligations this year constitutes GEL 264.6 million which is GEL 11.9 million more as compared to the planned amount. At the same time, the growth figure of foreign financial obligations lags behind the planned amount by GEL 210.4 million. Of this amount, which Georgia failed to take, only 28.3% comprises funds of long-term preferential loans whilst the remaining 71.7% comprises budget support loans. Of important note is that for the first six months of 2017, the budget balance increased by GEL 291.6 million (the amount of incomes to budget exceeded the amount of expenses). Therefore, there was no need to take budget support loans.

Graph 2: Foreign and Total State Debt Change Trend (2010-2017)

Source: Ministry of Finance of Georgia

In 2012, the state foreign debt was GEL 7.22 billion whilst the total state debt constituted GEL 9.11 billion. As of 2017, these figures increased to GEL 12 billion (by 66.3%) and GEL 15.5 billion (69.9%). However, the widely used method to analyse the amount of debt is the debt to nominal GDP ratio. As of 2016, the state foreign debt and the total state debt to nominal GDP ratio increased by 7.6 and 9.7 percentage points respectively as compared to 2012 and now constitute 35.2% and 44.64%, respectively.

At the same time, in the process of analysing the foreign debt volume, we have to take into account that obligations are denominated in foreign currency. Therefore, the national currency exchange rate affects both the changes in the foreign debt figure denominated in GEL and the foreign debt to GDP ratio. The tendency of growth for the GEL denominated foreign debt is largely stipulated by the depreciation of the GEL exchange rate. The USD denominated foreign debt increased by only USD 54 million in the period of 2012-2016 whilst the GEL denominated foreign debt increased by GEL 589 million. Georgia’s nominal GDP increased by 29.63% in 2012-2016. Therefore, if the GEL exchange rate had remained constant, theoretically, the foreign debt to GDP ratio would have decreased.

Conclusion

In the period between 2012 to August 2017, Georgia’s domestic and foreign debts in absolute numbers increased by 83.6% and 66.3%, respectively. The domestic debt to GDP ratio increased from 7.2% to 9.4% in 2012-2016 whilst the state foreign debt to nominal GDP ratio increased from 27.6% to 35.2%. However, changes in the national currency exchange rate significantly affect both the foreign debt and the foreign debt to GDP ratio figures. Had this factor been excluded, the growth of foreign debt in absolute numbers would have been negligible whilst the foreign debt to nominal GDP ratio would have reduced, taking into account the economic growth rate.

In regard to 2017 state budget fulfillment figures, according to the January-June budget fulfillment report, the growth of domestic obligations exceeds the planned amount by GEL 11.9 million with the gap between what was borrowed and what was supposed to be borrowed constituting GEL 210 million. However, of this GEL 210 million which Georgia has not yet taken, only 28.3% comprises long-term investment loan funds whilst the remaining 71.7% constitutes budget support loans.

FactCheck concludes that Irakli Abesadze’s statement is MOSTLY TRUE.

Source: Ministry of Finance of Georgia

In 2012, the state foreign debt was GEL 7.22 billion whilst the total state debt constituted GEL 9.11 billion. As of 2017, these figures increased to GEL 12 billion (by 66.3%) and GEL 15.5 billion (69.9%). However, the widely used method to analyse the amount of debt is the debt to nominal GDP ratio. As of 2016, the state foreign debt and the total state debt to nominal GDP ratio increased by 7.6 and 9.7 percentage points respectively as compared to 2012 and now constitute 35.2% and 44.64%, respectively.

At the same time, in the process of analysing the foreign debt volume, we have to take into account that obligations are denominated in foreign currency. Therefore, the national currency exchange rate affects both the changes in the foreign debt figure denominated in GEL and the foreign debt to GDP ratio. The tendency of growth for the GEL denominated foreign debt is largely stipulated by the depreciation of the GEL exchange rate. The USD denominated foreign debt increased by only USD 54 million in the period of 2012-2016 whilst the GEL denominated foreign debt increased by GEL 589 million. Georgia’s nominal GDP increased by 29.63% in 2012-2016. Therefore, if the GEL exchange rate had remained constant, theoretically, the foreign debt to GDP ratio would have decreased.

Conclusion

In the period between 2012 to August 2017, Georgia’s domestic and foreign debts in absolute numbers increased by 83.6% and 66.3%, respectively. The domestic debt to GDP ratio increased from 7.2% to 9.4% in 2012-2016 whilst the state foreign debt to nominal GDP ratio increased from 27.6% to 35.2%. However, changes in the national currency exchange rate significantly affect both the foreign debt and the foreign debt to GDP ratio figures. Had this factor been excluded, the growth of foreign debt in absolute numbers would have been negligible whilst the foreign debt to nominal GDP ratio would have reduced, taking into account the economic growth rate.

In regard to 2017 state budget fulfillment figures, according to the January-June budget fulfillment report, the growth of domestic obligations exceeds the planned amount by GEL 11.9 million with the gap between what was borrowed and what was supposed to be borrowed constituting GEL 210 million. However, of this GEL 210 million which Georgia has not yet taken, only 28.3% comprises long-term investment loan funds whilst the remaining 71.7% constitutes budget support loans.

FactCheck concludes that Irakli Abesadze’s statement is MOSTLY TRUE.

Source: Ministry of Finance of Georgia

According to the 2017 State Budget Six Month Fulfillment Report, the growth figure of domestic financial obligations this year constitutes GEL 264.6 million which is GEL 11.9 million more as compared to the planned amount. At the same time, the growth figure of foreign financial obligations lags behind the planned amount by GEL 210.4 million. Of this amount, which Georgia failed to take, only 28.3% comprises funds of long-term preferential loans whilst the remaining 71.7% comprises budget support loans. Of important note is that for the first six months of 2017, the budget balance increased by GEL 291.6 million (the amount of incomes to budget exceeded the amount of expenses). Therefore, there was no need to take budget support loans.

Graph 2: Foreign and Total State Debt Change Trend (2010-2017)

Source: Ministry of Finance of Georgia

According to the 2017 State Budget Six Month Fulfillment Report, the growth figure of domestic financial obligations this year constitutes GEL 264.6 million which is GEL 11.9 million more as compared to the planned amount. At the same time, the growth figure of foreign financial obligations lags behind the planned amount by GEL 210.4 million. Of this amount, which Georgia failed to take, only 28.3% comprises funds of long-term preferential loans whilst the remaining 71.7% comprises budget support loans. Of important note is that for the first six months of 2017, the budget balance increased by GEL 291.6 million (the amount of incomes to budget exceeded the amount of expenses). Therefore, there was no need to take budget support loans.

Graph 2: Foreign and Total State Debt Change Trend (2010-2017)

Source: Ministry of Finance of Georgia

In 2012, the state foreign debt was GEL 7.22 billion whilst the total state debt constituted GEL 9.11 billion. As of 2017, these figures increased to GEL 12 billion (by 66.3%) and GEL 15.5 billion (69.9%). However, the widely used method to analyse the amount of debt is the debt to nominal GDP ratio. As of 2016, the state foreign debt and the total state debt to nominal GDP ratio increased by 7.6 and 9.7 percentage points respectively as compared to 2012 and now constitute 35.2% and 44.64%, respectively.

At the same time, in the process of analysing the foreign debt volume, we have to take into account that obligations are denominated in foreign currency. Therefore, the national currency exchange rate affects both the changes in the foreign debt figure denominated in GEL and the foreign debt to GDP ratio. The tendency of growth for the GEL denominated foreign debt is largely stipulated by the depreciation of the GEL exchange rate. The USD denominated foreign debt increased by only USD 54 million in the period of 2012-2016 whilst the GEL denominated foreign debt increased by GEL 589 million. Georgia’s nominal GDP increased by 29.63% in 2012-2016. Therefore, if the GEL exchange rate had remained constant, theoretically, the foreign debt to GDP ratio would have decreased.

Conclusion

In the period between 2012 to August 2017, Georgia’s domestic and foreign debts in absolute numbers increased by 83.6% and 66.3%, respectively. The domestic debt to GDP ratio increased from 7.2% to 9.4% in 2012-2016 whilst the state foreign debt to nominal GDP ratio increased from 27.6% to 35.2%. However, changes in the national currency exchange rate significantly affect both the foreign debt and the foreign debt to GDP ratio figures. Had this factor been excluded, the growth of foreign debt in absolute numbers would have been negligible whilst the foreign debt to nominal GDP ratio would have reduced, taking into account the economic growth rate.

In regard to 2017 state budget fulfillment figures, according to the January-June budget fulfillment report, the growth of domestic obligations exceeds the planned amount by GEL 11.9 million with the gap between what was borrowed and what was supposed to be borrowed constituting GEL 210 million. However, of this GEL 210 million which Georgia has not yet taken, only 28.3% comprises long-term investment loan funds whilst the remaining 71.7% constitutes budget support loans.

FactCheck concludes that Irakli Abesadze’s statement is MOSTLY TRUE.

Source: Ministry of Finance of Georgia

In 2012, the state foreign debt was GEL 7.22 billion whilst the total state debt constituted GEL 9.11 billion. As of 2017, these figures increased to GEL 12 billion (by 66.3%) and GEL 15.5 billion (69.9%). However, the widely used method to analyse the amount of debt is the debt to nominal GDP ratio. As of 2016, the state foreign debt and the total state debt to nominal GDP ratio increased by 7.6 and 9.7 percentage points respectively as compared to 2012 and now constitute 35.2% and 44.64%, respectively.

At the same time, in the process of analysing the foreign debt volume, we have to take into account that obligations are denominated in foreign currency. Therefore, the national currency exchange rate affects both the changes in the foreign debt figure denominated in GEL and the foreign debt to GDP ratio. The tendency of growth for the GEL denominated foreign debt is largely stipulated by the depreciation of the GEL exchange rate. The USD denominated foreign debt increased by only USD 54 million in the period of 2012-2016 whilst the GEL denominated foreign debt increased by GEL 589 million. Georgia’s nominal GDP increased by 29.63% in 2012-2016. Therefore, if the GEL exchange rate had remained constant, theoretically, the foreign debt to GDP ratio would have decreased.

Conclusion

In the period between 2012 to August 2017, Georgia’s domestic and foreign debts in absolute numbers increased by 83.6% and 66.3%, respectively. The domestic debt to GDP ratio increased from 7.2% to 9.4% in 2012-2016 whilst the state foreign debt to nominal GDP ratio increased from 27.6% to 35.2%. However, changes in the national currency exchange rate significantly affect both the foreign debt and the foreign debt to GDP ratio figures. Had this factor been excluded, the growth of foreign debt in absolute numbers would have been negligible whilst the foreign debt to nominal GDP ratio would have reduced, taking into account the economic growth rate.

In regard to 2017 state budget fulfillment figures, according to the January-June budget fulfillment report, the growth of domestic obligations exceeds the planned amount by GEL 11.9 million with the gap between what was borrowed and what was supposed to be borrowed constituting GEL 210 million. However, of this GEL 210 million which Georgia has not yet taken, only 28.3% comprises long-term investment loan funds whilst the remaining 71.7% constitutes budget support loans.

FactCheck concludes that Irakli Abesadze’s statement is MOSTLY TRUE.