The chairperson of the International Chamber of Commerce, Fady Asli, stated the following in regard to the imposition of a ban on land sale to foreigners: “If the law on forbidding land sales to foreigners is adopted, it will result in decreased prices for agricultural land. This will affect Georgia’s pockets and limit the banks’ ability to lend money to farmers because most of the banks are owned by foreigners with foreign capital. Therefore, they would not be able to use land as their loan collateral. International financial institutions will also be deprived of the opportunity to fund the agricultural sector. Hence, the adoption of this law has its price and the Government of Georgia has to decide whether or not they are happy to pay this price.”

FactCheck took interest in the accuracy of the statement.

The Government of Georgia has been actively discussing the possibility of banning the sale of agricultural land to foreigners at the constitutional level. At the present moment, the specifics of the proposed amendment are unknown although the Parliament of Georgia has suspended Point B of Subsection A of Article 4 of the Law of Georgia on Ownership of Agricultural Land before the aforementioned amendment is enacted in the Constitution of Georgia. Point B decrees that a foreigner, a foreign-registered legal entity or a legal entity registered in Georgia by a foreigner are allowed to own agricultural land. By suspending this part of the law, the Parliament of Georgia has effectively reinstated the ban which came into force on 28 June 2013 and which was subsequently declared as unconstitutional.

Agricultural land plots constitute an economic good which is of a naturally limited quantity. The price of agricultural land plots, similar to any other asset, is determined by the interaction of demand-supply market forces. The imposition of a ban on selling agricultural land to foreigners will inevitably result in a decreased number of potential buyers and a decreased demand which, all things being equal, will reduce the market price of agricultural land.

In regard to statistical data about the fluctuation of prices before and after the imposition of the ban, none of the government agencies or authoritative organisations is working to produce this information. The only option is the Public Register’s real estate registration databases. However, because of certain peculiarities (the difficulty in the identification of interrelated counter-agents, the absence of currency and area on some contracts, etc.) associated with these data as well as a large number of contracts concluded for symbolic prices, this deprives us of the opportunity to see the real picture emanating as a result of the changes.

Because of the nature of the ban, not only sales and purchases will be affected, but other economic interactions, too. Specifically, if the ban on ownership of land includes financial institutions whose shares are owned by a foreigner, these organisations will be unable to seize the agricultural land plot which was envisaged as collateral in the case of a failure to fulfil loan obligations. Therefore, the access of land owners to loans will become limited because a financial institution will not issue a loan for collateral which cannot be seized if a counter agent fails to fulfil his loan obligations. The limitation of access to loans in turn will negatively affect business development opportunities because of the scarcity of financial means. The imposition of the ban will inhibit the development of stakeholders in agriculture because it will be difficult to find an investor/partner whilst the attraction of foreign investments in the aforementioned field will become practically impossible.

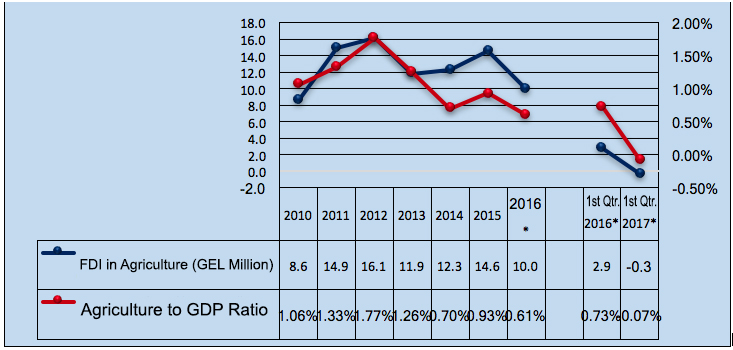

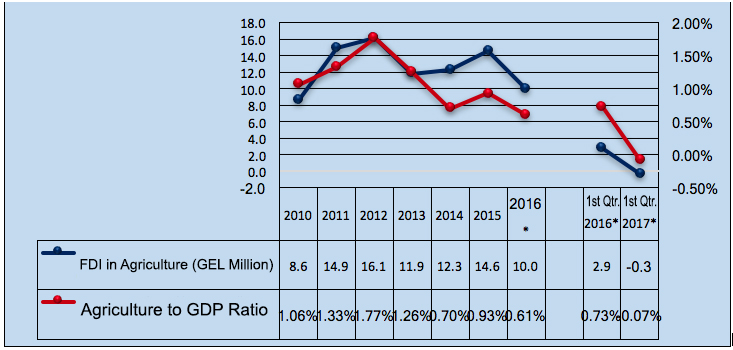

Graph 1: Foreign Direct Investments in Agriculture

Source: National Statistics Office of Georgia

Graph 1 depicts the trend of foreign direct investments in agriculture and the agriculture to GDP ratio. It would not be appropriate to assert that all changes happened because of the limitation of property rights. However, the graph illustrates that as compared to the previous period both absolute and relative figures deteriorate when the ownership limitations are enforced.

Conclusion

The limitation of agricultural land ownership rights to foreign citizens and legal entities registered in Georgia as well as foreign-registered legal entities will undeniably result in a decreased demand on this resource which, all things being equal, causes a drop in the price of land. An incomplete summarisation of data, registration and processing renders an observation on practical changes impossible.

If the aforementioned ban includes financial institutions, apart from the expected decline in the market price of agricultural land, the risk of land ownership will also increase and the ability of players in the agricultural sector to take loans will decrease. Credit organisations, whose shares are owned by foreigners, will not be able to issue loans with the agricultural land as collateral. Moreover, the attraction of foreign investments in the agricultural sector will become practically impossible. Taking into account all of the aforementioned, it is absolutely fair to assert that the planned change does have its price.

Therefore, FactCheck concludes that Fady Asli’s statement is TRUE.

Source: National Statistics Office of Georgia

Graph 1 depicts the trend of foreign direct investments in agriculture and the agriculture to GDP ratio. It would not be appropriate to assert that all changes happened because of the limitation of property rights. However, the graph illustrates that as compared to the previous period both absolute and relative figures deteriorate when the ownership limitations are enforced.

Conclusion

The limitation of agricultural land ownership rights to foreign citizens and legal entities registered in Georgia as well as foreign-registered legal entities will undeniably result in a decreased demand on this resource which, all things being equal, causes a drop in the price of land. An incomplete summarisation of data, registration and processing renders an observation on practical changes impossible.

If the aforementioned ban includes financial institutions, apart from the expected decline in the market price of agricultural land, the risk of land ownership will also increase and the ability of players in the agricultural sector to take loans will decrease. Credit organisations, whose shares are owned by foreigners, will not be able to issue loans with the agricultural land as collateral. Moreover, the attraction of foreign investments in the agricultural sector will become practically impossible. Taking into account all of the aforementioned, it is absolutely fair to assert that the planned change does have its price.

Therefore, FactCheck concludes that Fady Asli’s statement is TRUE.

Source: National Statistics Office of Georgia

Graph 1 depicts the trend of foreign direct investments in agriculture and the agriculture to GDP ratio. It would not be appropriate to assert that all changes happened because of the limitation of property rights. However, the graph illustrates that as compared to the previous period both absolute and relative figures deteriorate when the ownership limitations are enforced.

Conclusion

The limitation of agricultural land ownership rights to foreign citizens and legal entities registered in Georgia as well as foreign-registered legal entities will undeniably result in a decreased demand on this resource which, all things being equal, causes a drop in the price of land. An incomplete summarisation of data, registration and processing renders an observation on practical changes impossible.

If the aforementioned ban includes financial institutions, apart from the expected decline in the market price of agricultural land, the risk of land ownership will also increase and the ability of players in the agricultural sector to take loans will decrease. Credit organisations, whose shares are owned by foreigners, will not be able to issue loans with the agricultural land as collateral. Moreover, the attraction of foreign investments in the agricultural sector will become practically impossible. Taking into account all of the aforementioned, it is absolutely fair to assert that the planned change does have its price.

Therefore, FactCheck concludes that Fady Asli’s statement is TRUE.

Source: National Statistics Office of Georgia

Graph 1 depicts the trend of foreign direct investments in agriculture and the agriculture to GDP ratio. It would not be appropriate to assert that all changes happened because of the limitation of property rights. However, the graph illustrates that as compared to the previous period both absolute and relative figures deteriorate when the ownership limitations are enforced.

Conclusion

The limitation of agricultural land ownership rights to foreign citizens and legal entities registered in Georgia as well as foreign-registered legal entities will undeniably result in a decreased demand on this resource which, all things being equal, causes a drop in the price of land. An incomplete summarisation of data, registration and processing renders an observation on practical changes impossible.

If the aforementioned ban includes financial institutions, apart from the expected decline in the market price of agricultural land, the risk of land ownership will also increase and the ability of players in the agricultural sector to take loans will decrease. Credit organisations, whose shares are owned by foreigners, will not be able to issue loans with the agricultural land as collateral. Moreover, the attraction of foreign investments in the agricultural sector will become practically impossible. Taking into account all of the aforementioned, it is absolutely fair to assert that the planned change does have its price.

Therefore, FactCheck concludes that Fady Asli’s statement is TRUE.

Tags: