On 25 June 2016, on air on Rustavi 2, United National Movement member, Mikheil Machavariani, stated: "The amount of unpaid bank loans is GEL 355 million. This means that people are so impoverished that there is no money, there is no economy and their incomes have decreased."

FactCheck took interest in the accuracy of the statement.

In unpaid loans, Mikheil Machavariani is referring to non-performing loans. As of 1 June 2016, the amount of non-performing loans was GEL 361 million whilst the GEL 355 million as mentioned by Mr Machavariani is the amount of non-performing loans registered in May 2016. At the end of 2012, the amount of non-performing loans was GEL 223 million.

At the same time, according to Decree N51/04 issued by the President of the National Bank of Georgia on 17 June 2014, a non-performing loan is defined as "a loan for which the

debtor has not made his scheduled

payments (or part of the payments) on the principal amount or the interest for more than 30 days after the date of agreed payment." Therefore, the total amount of loans under this category cannot be considered only as unpaid loans to banks because it comprises the total sum of all loans whose scheduled payments became delayed for at least 30 days. However, the growth in the volume of overdue loans can truly be considered as an indicator of negative trends in the economy.

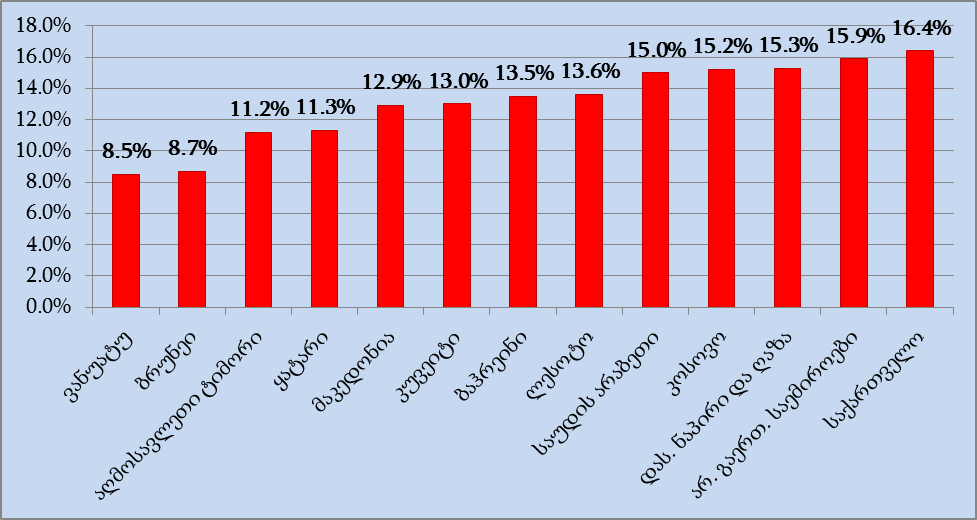

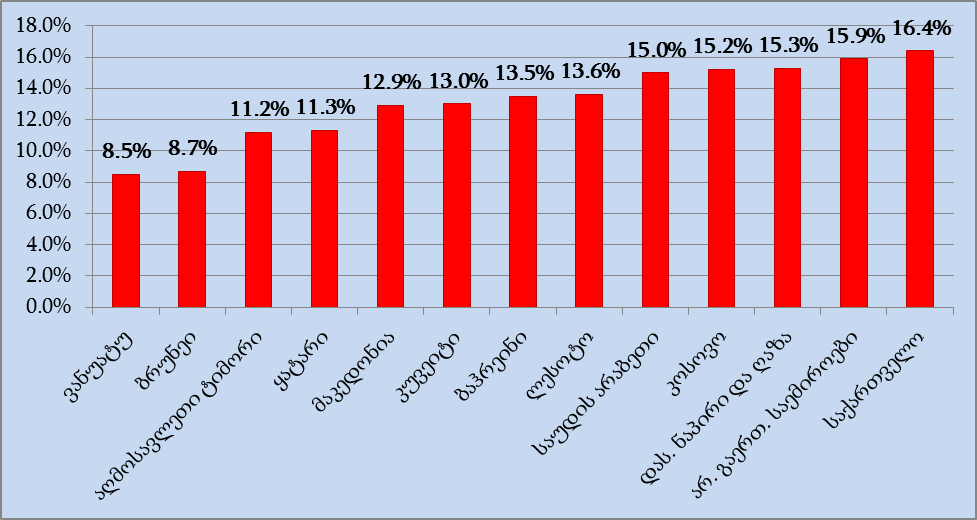

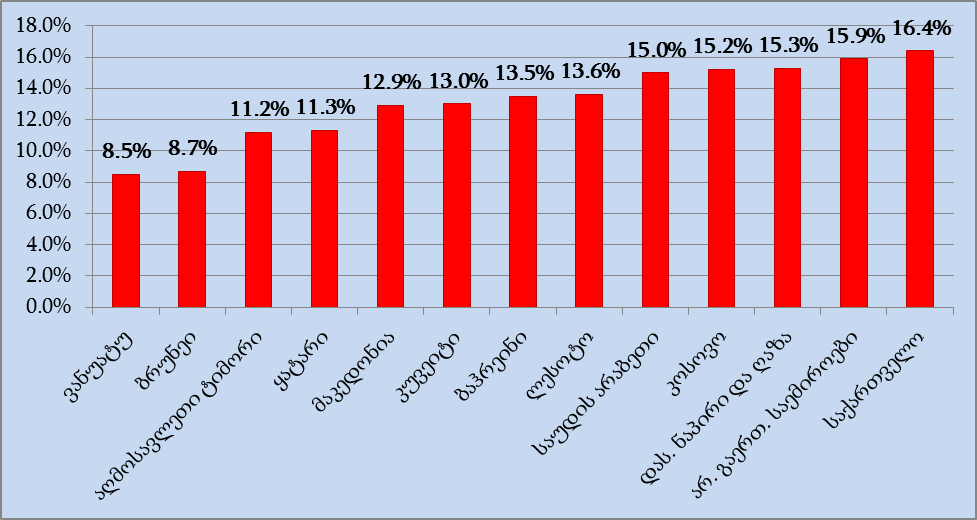

To assess the problem in regard to overdue loans, we have to take into account the ratio of such loans in the total amount of loans in the country’s economy (see Graph 1) instead of taking the amount of overdue loans in absolute numbers (GEL millions). If the total amount of issued loans is on the rise, it is expected that the absolute amount of overdue loans will increase as well. This process itself is not an indicator of a problem if the ratio of overdue loans to total loans does not increase.

Graph 1: Ratio of Overdue Loans

Source: National Bank of Georgia

Source: National Bank of Georgia

As illustrated by the graph, after the second half of 2008 against the backdrop of the world financial crisis and the events taking place in Georgia, the ratio of overdue loans increased significantly and peaked in the second half of 2009. Afterwards, the ratio of overdue loans started to decrease although it stayed at more than 3% until the end of 2010. In the period of 2011-2016, the ratio of overdue loans in the total amount of loans fluctuated between 2% and 3% and showed a visible trend of decrease.

Of note is that since the end of 2014, as a result of the GEL depreciation, the service of loans issued in a foreign currency became more expensive because most borrowers receive their income in the national currency. The above graph illustrates that the ratio of overdue loans increased in the case of loans denominated in a foreign currency. However, this difference did not cause a sharp rise in the total sum.

Mikheil Machavariani argues that the failure to meet loan obligations is because the incomes of the population have decreased. Table 1 and Table 2 present data about the changes in the average nominal salary and the per capita Gross Domestic Product. As illustrated by the data of the National Statistics Office of Georgia, both the average nominal salary and the GDP per capita have a tendency of growth.

Table 1: Average Nominal Salary

|

I Q |

II Q |

III Q |

IV Q |

| Salary |

Pace of Growth |

Salary |

Pace of Growth |

Salary |

Pace of Growth |

Salary |

Pace of Growth |

| 2011 |

631 |

11.8% |

679 |

13.5% |

687 |

12.8% |

761 |

14.5% |

| 2012 |

676 |

7.1% |

724 |

6.5% |

753 |

9.6% |

813 |

6.8% |

| 2013 |

730 |

7.9% |

797 |

10.0% |

800 |

6.2% |

875 |

7.7% |

| 2014 |

795 |

9.0% |

864 |

8.5% |

851 |

6.4% |

950 |

8.5% |

| 2015 |

856 |

7.6% |

934 |

8.1% |

930 |

9.3% |

1,011 |

6.5% |

| 2016 |

913 |

6.7% |

- |

- |

- |

- |

- |

- |

Source: National Statistics Office of Georgia

Table 2: GDP per capita

[1]

|

2011 |

2012 |

2013 |

2014 |

2015 |

2015I Q |

2016

I Q |

| GDP per capita (current prices) |

5,447 |

5,818 |

5,988 |

6,492 |

8,534 |

1,856 |

1,976 |

| Real GDP per capita (2010 prices) GEL |

4,977 |

5,259 |

5,454 |

5,698 |

7,081 |

1,492 |

1,528 |

Source: National Statistics Office of Georgia

Conclusion

The amount of overdue loans (GEL 355 million) mentioned by Mikheil Machavariani does correspond to the amount of overdue loans registered in May 2016. The growth in the volume of overdue loans indeed indicates negative economic trends but only in the case when it does not rise in absolute numbers and when the ratio of overdue loans to the total amount of issued loans increases (in %). The ratio of overdue loans in the total amount of loans in the country’s economy has been fluctuating between 2% and 3% and shows a trend of decrease.

According to the National Statistics Office of Georgia, the statement about the decrease in the incomes of the population is not confirmed. In the period of 2013-2016, the GDP per capita and the average nominal salary have been rising. This happened in spite of the fact that the economic growth rate of the Georgian economy was much slower in 2013-2016 as compared to 2010-2012.

FactCheck concludes that Mikheil Machavariani’s statement is

MOSTLY FALSE.

___________________________

[1] The data for 2015-2016 is based on the results of the 2014 universal population census whilst the data for 2010-2014 is based upon the results of 2002 universal population census. Therefore, the data for 2010-2014 is subject to adjustment.

Source: National Bank of Georgia

As illustrated by the graph, after the second half of 2008 against the backdrop of the world financial crisis and the events taking place in Georgia, the ratio of overdue loans increased significantly and peaked in the second half of 2009. Afterwards, the ratio of overdue loans started to decrease although it stayed at more than 3% until the end of 2010. In the period of 2011-2016, the ratio of overdue loans in the total amount of loans fluctuated between 2% and 3% and showed a visible trend of decrease.

Of note is that since the end of 2014, as a result of the GEL depreciation, the service of loans issued in a foreign currency became more expensive because most borrowers receive their income in the national currency. The above graph illustrates that the ratio of overdue loans increased in the case of loans denominated in a foreign currency. However, this difference did not cause a sharp rise in the total sum.

Mikheil Machavariani argues that the failure to meet loan obligations is because the incomes of the population have decreased. Table 1 and Table 2 present data about the changes in the average nominal salary and the per capita Gross Domestic Product. As illustrated by the data of the National Statistics Office of Georgia, both the average nominal salary and the GDP per capita have a tendency of growth.

Table 1: Average Nominal Salary

Source: National Bank of Georgia

As illustrated by the graph, after the second half of 2008 against the backdrop of the world financial crisis and the events taking place in Georgia, the ratio of overdue loans increased significantly and peaked in the second half of 2009. Afterwards, the ratio of overdue loans started to decrease although it stayed at more than 3% until the end of 2010. In the period of 2011-2016, the ratio of overdue loans in the total amount of loans fluctuated between 2% and 3% and showed a visible trend of decrease.

Of note is that since the end of 2014, as a result of the GEL depreciation, the service of loans issued in a foreign currency became more expensive because most borrowers receive their income in the national currency. The above graph illustrates that the ratio of overdue loans increased in the case of loans denominated in a foreign currency. However, this difference did not cause a sharp rise in the total sum.

Mikheil Machavariani argues that the failure to meet loan obligations is because the incomes of the population have decreased. Table 1 and Table 2 present data about the changes in the average nominal salary and the per capita Gross Domestic Product. As illustrated by the data of the National Statistics Office of Georgia, both the average nominal salary and the GDP per capita have a tendency of growth.

Table 1: Average Nominal Salary

Source: National Bank of Georgia

As illustrated by the graph, after the second half of 2008 against the backdrop of the world financial crisis and the events taking place in Georgia, the ratio of overdue loans increased significantly and peaked in the second half of 2009. Afterwards, the ratio of overdue loans started to decrease although it stayed at more than 3% until the end of 2010. In the period of 2011-2016, the ratio of overdue loans in the total amount of loans fluctuated between 2% and 3% and showed a visible trend of decrease.

Of note is that since the end of 2014, as a result of the GEL depreciation, the service of loans issued in a foreign currency became more expensive because most borrowers receive their income in the national currency. The above graph illustrates that the ratio of overdue loans increased in the case of loans denominated in a foreign currency. However, this difference did not cause a sharp rise in the total sum.

Mikheil Machavariani argues that the failure to meet loan obligations is because the incomes of the population have decreased. Table 1 and Table 2 present data about the changes in the average nominal salary and the per capita Gross Domestic Product. As illustrated by the data of the National Statistics Office of Georgia, both the average nominal salary and the GDP per capita have a tendency of growth.

Table 1: Average Nominal Salary

Source: National Bank of Georgia

As illustrated by the graph, after the second half of 2008 against the backdrop of the world financial crisis and the events taking place in Georgia, the ratio of overdue loans increased significantly and peaked in the second half of 2009. Afterwards, the ratio of overdue loans started to decrease although it stayed at more than 3% until the end of 2010. In the period of 2011-2016, the ratio of overdue loans in the total amount of loans fluctuated between 2% and 3% and showed a visible trend of decrease.

Of note is that since the end of 2014, as a result of the GEL depreciation, the service of loans issued in a foreign currency became more expensive because most borrowers receive their income in the national currency. The above graph illustrates that the ratio of overdue loans increased in the case of loans denominated in a foreign currency. However, this difference did not cause a sharp rise in the total sum.

Mikheil Machavariani argues that the failure to meet loan obligations is because the incomes of the population have decreased. Table 1 and Table 2 present data about the changes in the average nominal salary and the per capita Gross Domestic Product. As illustrated by the data of the National Statistics Office of Georgia, both the average nominal salary and the GDP per capita have a tendency of growth.

Table 1: Average Nominal Salary