On air on Rustavi 2, the Minister of Economy and Sustainable Development of Georgia, Dimitri Kumsishvili, talked about Georgia’s banking sector and pointed out that the average interest rate for bank loans from 2008 to 2012 was 16.2% whilst it dropped to 12.1% in the period of 2013 to 2015. The amount of loans given to the private sector increased by 90% from GEL 8 billion to GEL 15 billion.

FactCheck verified the accuracy of this statement.

According to the information of the National Bank of Georgia, the average interest rate for commercial loans (those given to legal entities) from 2008 to 2012 was 16.1% (the average of the loans issued in both GEL as well as USD). This number decreased to 12% from 2013 to 2015.

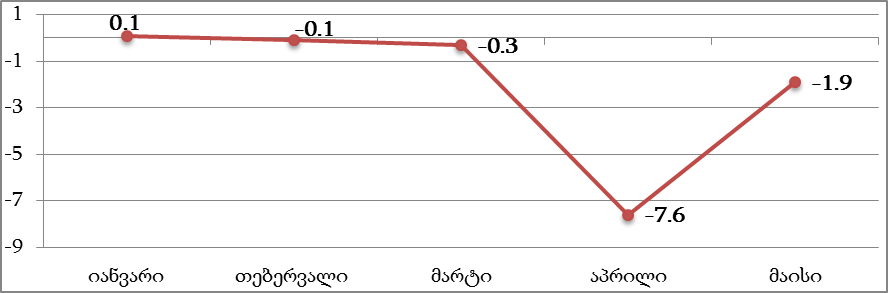

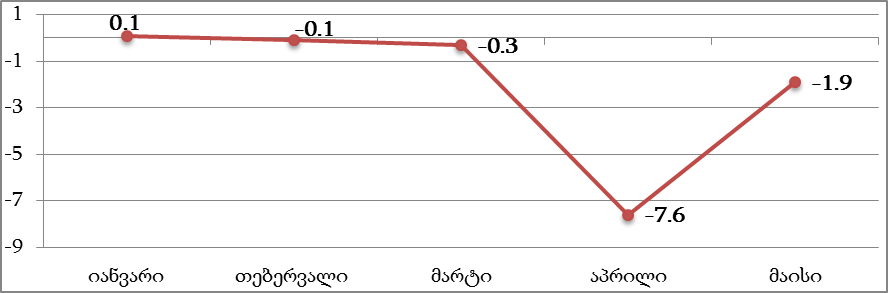

Dimitri Kumsishvili names the numbers correctly; however, he tries to paint a better picture by manipulating the numbers. Specifically, he compares the data of the past five years (from 2008 to 2012) to those of the last three years (from 2013 to 2015). The Minister purposely takes the data of 2008 and 2009 in order to make the average interest rate during the previous government look as high as possible. Along with the Russia-Georgia war, the world experienced a global financial crisis in 2008 and 2009. Hence, given the increased risk factors in the Georgian economy, commercial banks increased their interest rates significantly. The economy came back to a normal pace of development in 2010 and interest rates started to drop once again. If we compare the three years of the incumbent government to the last three years of the previous government (2010-2012), the pace of the decrease in interest rates did slow down. The average interest rate for commercial loans dropped by 3.9% in the period of 2010 to 2012 whilst the rate of decrease was just 2.8% in the period of 2013 to 2015. In addition, interest rates have shown a growth trend since 2014 (which the Minister avoids mentioning). As of April 2016, the average interest rate had increased by 0.65%.

Chart 1: Average Interest Rate for Commercial Loans from 2007 to 2016

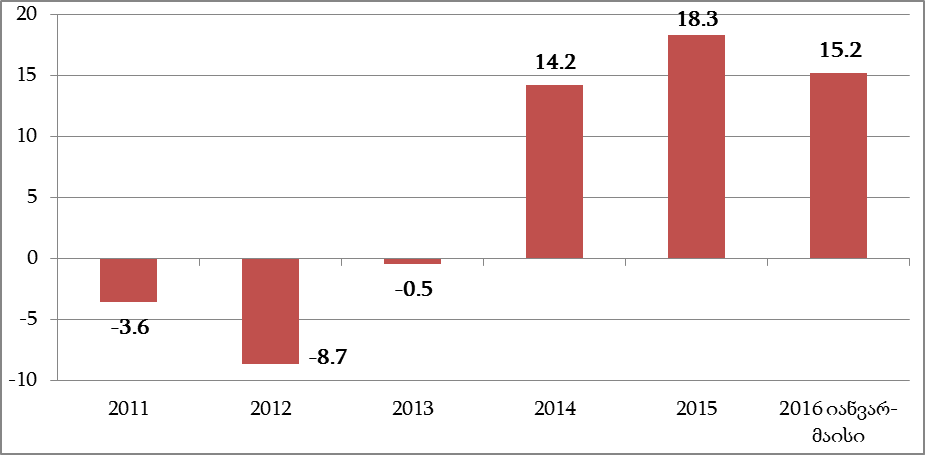

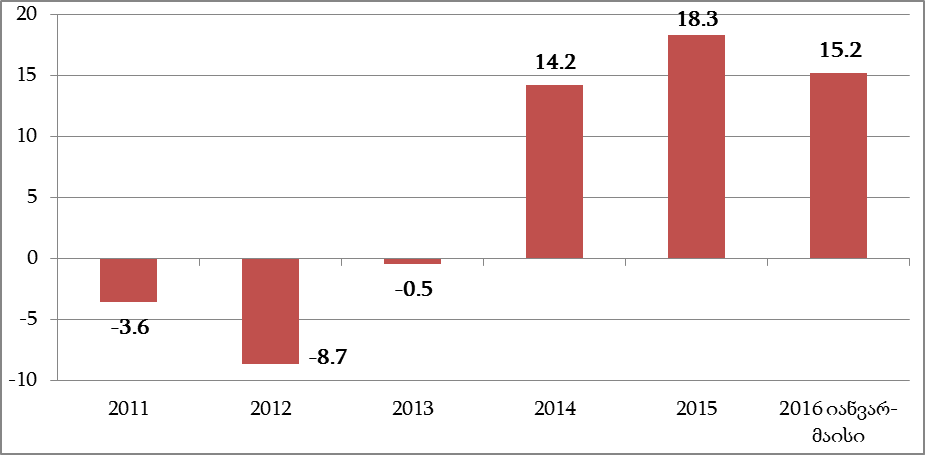

The Minister is referring to loans issued by commercial banks when he mentions private sector loans (however, this also includes consumer loans issued to households). The amount of loans issued by the end of 2015 equalled GEL 15.2 billion whilst this number was down to GEL 8.4 billion in 2012. Hence, the growth amounted to 81%.

Chart 2: Amount of Loans Issued from 2008 to 2016, GEL Million

The Minister is referring to loans issued by commercial banks when he mentions private sector loans (however, this also includes consumer loans issued to households). The amount of loans issued by the end of 2015 equalled GEL 15.2 billion whilst this number was down to GEL 8.4 billion in 2012. Hence, the growth amounted to 81%.

Chart 2: Amount of Loans Issued from 2008 to 2016, GEL Million

Dimitri Kumsishvili also names almost the exact numbers when talking about the amount of loans issued; however, in this case he also tries to manipulate the numbers and show a better picture. The overall amount of loans issued includes loans in GEL as well as those in foreign currencies (mainly USD). When the GEL exchange rate depreciates, the amount of loans issued in USD is greater when converted to GEL. However, this does not mean that the amount of loans issued has increased. In fact, it means the contrary as the loan burden due to the depreciation of GEL increases which is a negative factor for the economy and causes problems for the beneficiaries. Given this background, the Minister tries to regard this as something positive for the country and he uses the increased loan burden, caused by the depreciation of GEL, as an argument for the effectiveness of the Government of Georgia.

The amount of loans issued has increased by GEL 2.7 billion since 2012 whilst loans in foreign currencies, calculated in GEL, have increased by GEL 4.5 billion. If we convert the amount of loans issued in foreign currencies to USD, we see that the amount issued by the end of 2012 was USD 3.6 billion whilst this number had increased to USD 4.35 billion by the end of 2015. The increase is just USD 750 million. Taking the changes in the exchange rate into account, the amount of loans issued increased by GEL 4 billion in 2015 as compared to the level of 2012 which is a 48% increase (as opposed to 90% as stated by the Minister). If we look at the annual growth rate of loans in foreign currencies, it was an average of 15% from 2010 to 2012 whilst it dropped to just 7% in the period of 2013 to 2015. The average amount of loans in GEL increased by about 34.4% annually from 2010 to 2012 whilst later, from 2013 to 2015, the growth rate decreased to 26.6%.

Conclusion

The Minister of Economy and Sustainable Development of Georgia states almost exact numbers about the interest rates and the amounts of loans issued; however, he also tries to present a better picture in using these numbers. It is inappropriate to compare the data of the past three years (2013 to 2015) to those of the previous five years (2008 to 2012), especially given the fact that 2008 and 2009 where crisis years which caused interest rates to increase. It should also be noted that interest rates decreased further from 2010 to 2012 than they did from 2013 to 2015. In addition, interest rates in 2015 and 2016 increased as compared to 2014.

Further, the Minister regards the growth in the amount of loans, caused by the depreciation of GEL, as a positive occurrence. However, the growth in the amounts of loans in foreign currencies calculated in GEL is a problem for the beneficiaries (both private sector and individuals). If we disregard the changes in the GEL exchange rate, the amount of loans issued increased by 48% and not 90% as stated by Mr Kumsishvili. In addition, the growth rate of loans in both GEL and USD decreased as compared to the period of 2010 to 2012.

FactCheck concludes that Dimitri Kumsishvili’s statement is a MANIPULATION OF NUMBERS.

Dimitri Kumsishvili also names almost the exact numbers when talking about the amount of loans issued; however, in this case he also tries to manipulate the numbers and show a better picture. The overall amount of loans issued includes loans in GEL as well as those in foreign currencies (mainly USD). When the GEL exchange rate depreciates, the amount of loans issued in USD is greater when converted to GEL. However, this does not mean that the amount of loans issued has increased. In fact, it means the contrary as the loan burden due to the depreciation of GEL increases which is a negative factor for the economy and causes problems for the beneficiaries. Given this background, the Minister tries to regard this as something positive for the country and he uses the increased loan burden, caused by the depreciation of GEL, as an argument for the effectiveness of the Government of Georgia.

The amount of loans issued has increased by GEL 2.7 billion since 2012 whilst loans in foreign currencies, calculated in GEL, have increased by GEL 4.5 billion. If we convert the amount of loans issued in foreign currencies to USD, we see that the amount issued by the end of 2012 was USD 3.6 billion whilst this number had increased to USD 4.35 billion by the end of 2015. The increase is just USD 750 million. Taking the changes in the exchange rate into account, the amount of loans issued increased by GEL 4 billion in 2015 as compared to the level of 2012 which is a 48% increase (as opposed to 90% as stated by the Minister). If we look at the annual growth rate of loans in foreign currencies, it was an average of 15% from 2010 to 2012 whilst it dropped to just 7% in the period of 2013 to 2015. The average amount of loans in GEL increased by about 34.4% annually from 2010 to 2012 whilst later, from 2013 to 2015, the growth rate decreased to 26.6%.

Conclusion

The Minister of Economy and Sustainable Development of Georgia states almost exact numbers about the interest rates and the amounts of loans issued; however, he also tries to present a better picture in using these numbers. It is inappropriate to compare the data of the past three years (2013 to 2015) to those of the previous five years (2008 to 2012), especially given the fact that 2008 and 2009 where crisis years which caused interest rates to increase. It should also be noted that interest rates decreased further from 2010 to 2012 than they did from 2013 to 2015. In addition, interest rates in 2015 and 2016 increased as compared to 2014.

Further, the Minister regards the growth in the amount of loans, caused by the depreciation of GEL, as a positive occurrence. However, the growth in the amounts of loans in foreign currencies calculated in GEL is a problem for the beneficiaries (both private sector and individuals). If we disregard the changes in the GEL exchange rate, the amount of loans issued increased by 48% and not 90% as stated by Mr Kumsishvili. In addition, the growth rate of loans in both GEL and USD decreased as compared to the period of 2010 to 2012.

FactCheck concludes that Dimitri Kumsishvili’s statement is a MANIPULATION OF NUMBERS.

The Minister is referring to loans issued by commercial banks when he mentions private sector loans (however, this also includes consumer loans issued to households). The amount of loans issued by the end of 2015 equalled GEL 15.2 billion whilst this number was down to GEL 8.4 billion in 2012. Hence, the growth amounted to 81%.

Chart 2: Amount of Loans Issued from 2008 to 2016, GEL Million

The Minister is referring to loans issued by commercial banks when he mentions private sector loans (however, this also includes consumer loans issued to households). The amount of loans issued by the end of 2015 equalled GEL 15.2 billion whilst this number was down to GEL 8.4 billion in 2012. Hence, the growth amounted to 81%.

Chart 2: Amount of Loans Issued from 2008 to 2016, GEL Million

Dimitri Kumsishvili also names almost the exact numbers when talking about the amount of loans issued; however, in this case he also tries to manipulate the numbers and show a better picture. The overall amount of loans issued includes loans in GEL as well as those in foreign currencies (mainly USD). When the GEL exchange rate depreciates, the amount of loans issued in USD is greater when converted to GEL. However, this does not mean that the amount of loans issued has increased. In fact, it means the contrary as the loan burden due to the depreciation of GEL increases which is a negative factor for the economy and causes problems for the beneficiaries. Given this background, the Minister tries to regard this as something positive for the country and he uses the increased loan burden, caused by the depreciation of GEL, as an argument for the effectiveness of the Government of Georgia.

The amount of loans issued has increased by GEL 2.7 billion since 2012 whilst loans in foreign currencies, calculated in GEL, have increased by GEL 4.5 billion. If we convert the amount of loans issued in foreign currencies to USD, we see that the amount issued by the end of 2012 was USD 3.6 billion whilst this number had increased to USD 4.35 billion by the end of 2015. The increase is just USD 750 million. Taking the changes in the exchange rate into account, the amount of loans issued increased by GEL 4 billion in 2015 as compared to the level of 2012 which is a 48% increase (as opposed to 90% as stated by the Minister). If we look at the annual growth rate of loans in foreign currencies, it was an average of 15% from 2010 to 2012 whilst it dropped to just 7% in the period of 2013 to 2015. The average amount of loans in GEL increased by about 34.4% annually from 2010 to 2012 whilst later, from 2013 to 2015, the growth rate decreased to 26.6%.

Conclusion

The Minister of Economy and Sustainable Development of Georgia states almost exact numbers about the interest rates and the amounts of loans issued; however, he also tries to present a better picture in using these numbers. It is inappropriate to compare the data of the past three years (2013 to 2015) to those of the previous five years (2008 to 2012), especially given the fact that 2008 and 2009 where crisis years which caused interest rates to increase. It should also be noted that interest rates decreased further from 2010 to 2012 than they did from 2013 to 2015. In addition, interest rates in 2015 and 2016 increased as compared to 2014.

Further, the Minister regards the growth in the amount of loans, caused by the depreciation of GEL, as a positive occurrence. However, the growth in the amounts of loans in foreign currencies calculated in GEL is a problem for the beneficiaries (both private sector and individuals). If we disregard the changes in the GEL exchange rate, the amount of loans issued increased by 48% and not 90% as stated by Mr Kumsishvili. In addition, the growth rate of loans in both GEL and USD decreased as compared to the period of 2010 to 2012.

FactCheck concludes that Dimitri Kumsishvili’s statement is a MANIPULATION OF NUMBERS.

Dimitri Kumsishvili also names almost the exact numbers when talking about the amount of loans issued; however, in this case he also tries to manipulate the numbers and show a better picture. The overall amount of loans issued includes loans in GEL as well as those in foreign currencies (mainly USD). When the GEL exchange rate depreciates, the amount of loans issued in USD is greater when converted to GEL. However, this does not mean that the amount of loans issued has increased. In fact, it means the contrary as the loan burden due to the depreciation of GEL increases which is a negative factor for the economy and causes problems for the beneficiaries. Given this background, the Minister tries to regard this as something positive for the country and he uses the increased loan burden, caused by the depreciation of GEL, as an argument for the effectiveness of the Government of Georgia.

The amount of loans issued has increased by GEL 2.7 billion since 2012 whilst loans in foreign currencies, calculated in GEL, have increased by GEL 4.5 billion. If we convert the amount of loans issued in foreign currencies to USD, we see that the amount issued by the end of 2012 was USD 3.6 billion whilst this number had increased to USD 4.35 billion by the end of 2015. The increase is just USD 750 million. Taking the changes in the exchange rate into account, the amount of loans issued increased by GEL 4 billion in 2015 as compared to the level of 2012 which is a 48% increase (as opposed to 90% as stated by the Minister). If we look at the annual growth rate of loans in foreign currencies, it was an average of 15% from 2010 to 2012 whilst it dropped to just 7% in the period of 2013 to 2015. The average amount of loans in GEL increased by about 34.4% annually from 2010 to 2012 whilst later, from 2013 to 2015, the growth rate decreased to 26.6%.

Conclusion

The Minister of Economy and Sustainable Development of Georgia states almost exact numbers about the interest rates and the amounts of loans issued; however, he also tries to present a better picture in using these numbers. It is inappropriate to compare the data of the past three years (2013 to 2015) to those of the previous five years (2008 to 2012), especially given the fact that 2008 and 2009 where crisis years which caused interest rates to increase. It should also be noted that interest rates decreased further from 2010 to 2012 than they did from 2013 to 2015. In addition, interest rates in 2015 and 2016 increased as compared to 2014.

Further, the Minister regards the growth in the amount of loans, caused by the depreciation of GEL, as a positive occurrence. However, the growth in the amounts of loans in foreign currencies calculated in GEL is a problem for the beneficiaries (both private sector and individuals). If we disregard the changes in the GEL exchange rate, the amount of loans issued increased by 48% and not 90% as stated by Mr Kumsishvili. In addition, the growth rate of loans in both GEL and USD decreased as compared to the period of 2010 to 2012.

FactCheck concludes that Dimitri Kumsishvili’s statement is a MANIPULATION OF NUMBERS.

Tags: