On 28 December 2015, in his address before the Parliament of Georgia, Giorgi Kvirikashvili emphasised that as compared to the currencies of Georgia’s 13-14 main trade partner countries, the devaluation (depreciation) of GEL is one of the lowest and subjective factors (government involvement) were minimal in the national currency’s depreciation.

FactCheck verified the accuracy of the statement.

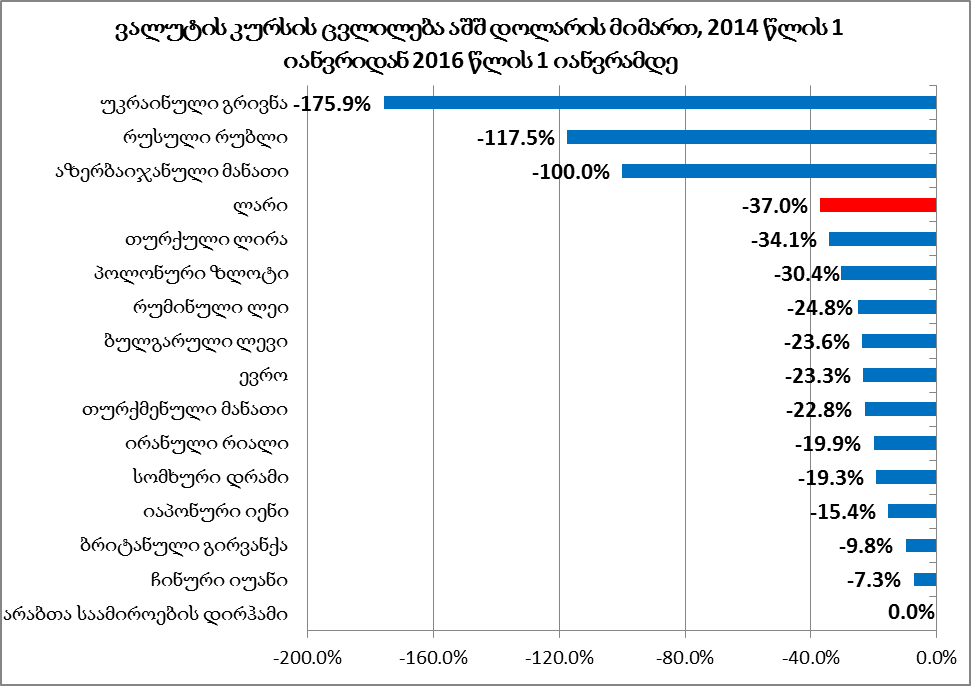

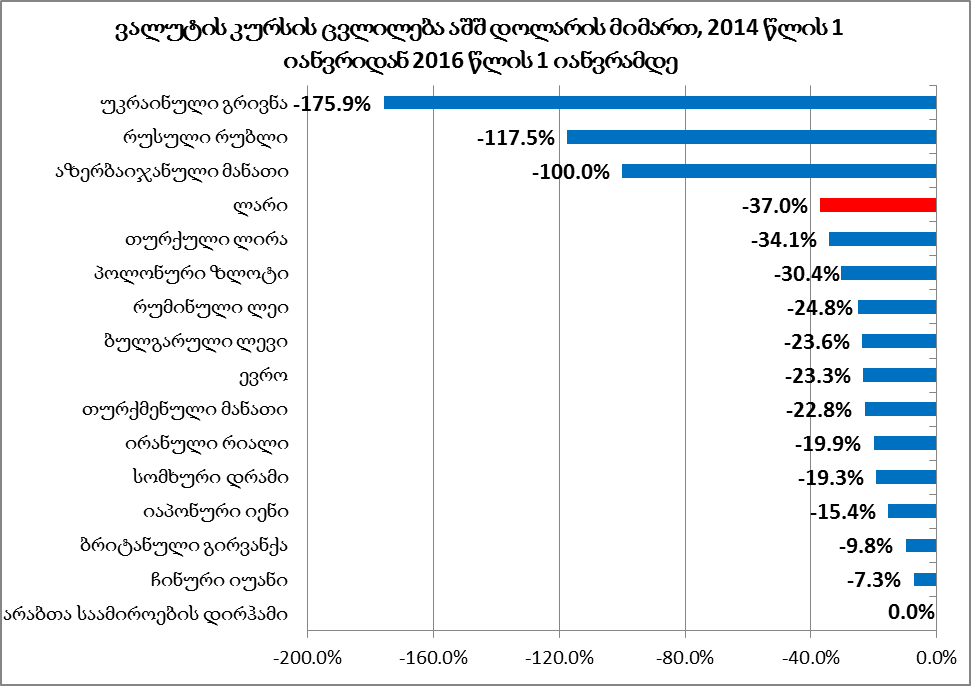

GEL started to depreciate in November 2014 when the USD to GEL exchange rate was 1:1.75. At the end of the last few months of 2015, the USD to GEL exchange rate remained stable at 1:2.4. In some of our trade partner countries, the depreciation of their national currencies started much earlier than in Georgia. Therefore, in order to make a comparison to the depreciation of GEL, it would be expedient to analyse the exchange rate fluctuation in the last two years (2014-2015).

An analysis of currency fluctuation in Georgia’s top 15 trade partner countries illustrated that the currencies of only three countries (Ukraine, Russia and Azerbaijan) depreciated more against USD than GEL. Of note is that of these three countries, there is a war in one of them (Ukraine), the second one suffers from strict international sanctions (Russia) and the third one (Azerbaijan) had its currency flows from oil export drastically reduced due to a sharp decrease in oil prices. Azerbaijan had to abandon the fixed exchange rate in favour of the so-called "floating" exchange rate.

The principal cause behind the depreciation of GEL is the drop in the USD flow into the country such as, for example, the decrease in export and the decreased amount of remittances. From October 2015 until December 2015, export income dropped by USD 793 million and remittances fell by USD 405 million. Indeed, there were no subjective factors such as the negative role of the government involved in the drop in remittances.

A dwindling economic growth rate together with a worsened economic situation in Georgia’s export market countries also affected the fall in Georgia’s exports. Apart from its effect on exports, the economic growth rate is one of the determinants of the national currency’s exchange rate. The bigger the economic growth rate, the bigger the demand on the national currency and it starts to appreciate all things being equal. The drop in Georgia’s economic growth rate was caused by subjective factors (government’s negative role), too. It has already been three years since Georgia rejected an economic policy aimed at high economic growth. It was replaced with a policy of inclusive growth which means that the priority is not a high economic growth rate but the involvement of every strata of the population in the generation of economic wealth. Largely, instead of an accumulation of wealth, emphasis is made upon the redistribution of wealth. The changes in the country’s economic policy were reflected in everyday practice: the tax liberalisation process was halted, regulations become stricter, the country’s budget prioritises social issues and targeted assistance programmes were replaced by universal programmes. In order to fund the increased budget expenditures, domestic borrowing swelled. All of these do not encourage a high economic growth rate. External factors also played a certain role in Georgia’s decreased economic growth rate. However, it is wrong to place the greatest emphasis upon them (see FactCheck’s article). Of those regulations which became more severe, the imposition of a strict visa regime and the limitation of selling land to foreign citizens have to be mentioned specifically. The strict visa regime, in fact, was kept in place from September 2014 to May 2015 and hampered the entrance of tourists into Georgia. The drop in tourism in turn means a drop in currency incomes (see FactCheck’s articles on this topic: link 1 and link 2).

After a simplification of the visa regulations and an intensive advertising to attract tourists, the number of tourists started to grow from the second half of 2015 and, in total, the number of tourists increased by 2.2% in 2015. According to the data of January-September, tourism revenues have also increased by USD 113 million. However, that was not enough to compensate for the gaps in the other components of currency flows.

At the end of 2014 and throughout 2015, a high deficit spending of the budget had a negative impact upon the GEL exchange rate. In February, April and August of last year, the budget deficit was funded at the expense of decreasing state deposits which increased the amount of GEL in circulation and negatively affected the GEL exchange rate (see FactCheck’s articles on this topic: link 1 and link 2).

To cut budget expenditures, the Government of Georgia announced in February 2015 that it would "tighten its belts" and thereby help the national currency. That promise was not fulfilled – the administrative expenses of the Government of Georgia did not decrease by 12% or GEL 240 million as was promised. Additionally, the Government of Georgia failed to attract the promised USD 300 million as a result of privatisation. However, due to increased budget revenues, the government managed to lower the domestic borrowing pace which helped stabilise the GEL exchange rate (initially, it was scheduled to borrow GEL 600 million in 2015). Further additionally, in the 2016 budget, the Government of Georgia decided to borrow only GEL 200 million.

The currency exchange rate is significantly affected by the expectation among the population in this regard. Mostly, there were negative expectations about the GEL exchange rate which was largely caused by blaming the National Bank of Georgia for a deliberate depreciation of GEL. Members of the Government of Georgia were also involved in this campaign and changed their rhetoric only at the end of the year which was reflected in coordinated activities and harmonious statements of both the Government of Georgia and the National Bank of Georgia.

Throughout the last few months of 2015, the GEL exchange rate has become stable at 2.4 against the USD. This is caused by the drop in imports (import is the source of outflow of USD from the country) and a strict monetary policy. The National Bank of Georgia raised the refinance rate from 4% to 8%. Additionally, after November 2014, the National Bank of Georgia sold USD 367 million at currency auctions.

Conclusion

An analysis of currency fluctuation in Georgia’s top 15 trade partner countries illustrated that the currencies of only three countries depreciated more against USD than GEL. These countries are Ukraine, Russia and Azerbaijan. Therefore, instead of having one of the lowest rates of currency depreciation, Georgia, in fact, had one of the highest. However, the inflow of foreign currencies to Georgia dropped mostly from Azerbaijan and Russia and, therefore, played a significant role in the depreciation of GEL.

The principal cause behind the depreciation of GEL is indeed a combination of external factors. However, the domestic factor, which is the negative contribution of the Government of Georgia in this process, is also noteworthy. Only currencies of those countries which are involved in war, suffer strict international sanctions or are negatively affected by the slumping oil prices depreciated more than GEL. A falling economic growth rate, deficit budget spending, the imposition of stricter regulations, a discrediting of the National Bank of Georgia and hampering the Bank’s activities also contributed to the depreciation of GEL.

Therefore, FactCheck concludes that Giorgi Kvirikashvili’s statement that the depreciation of GEL is one of the lowest as compared to the currencies of Georgia’s main trading partners and the government’s role in the depreciation of GEL is minimal is MOSTLY FALSE.

The principal cause behind the depreciation of GEL is the drop in the USD flow into the country such as, for example, the decrease in export and the decreased amount of remittances. From October 2015 until December 2015, export income dropped by USD 793 million and remittances fell by USD 405 million. Indeed, there were no subjective factors such as the negative role of the government involved in the drop in remittances.

A dwindling economic growth rate together with a worsened economic situation in Georgia’s export market countries also affected the fall in Georgia’s exports. Apart from its effect on exports, the economic growth rate is one of the determinants of the national currency’s exchange rate. The bigger the economic growth rate, the bigger the demand on the national currency and it starts to appreciate all things being equal. The drop in Georgia’s economic growth rate was caused by subjective factors (government’s negative role), too. It has already been three years since Georgia rejected an economic policy aimed at high economic growth. It was replaced with a policy of inclusive growth which means that the priority is not a high economic growth rate but the involvement of every strata of the population in the generation of economic wealth. Largely, instead of an accumulation of wealth, emphasis is made upon the redistribution of wealth. The changes in the country’s economic policy were reflected in everyday practice: the tax liberalisation process was halted, regulations become stricter, the country’s budget prioritises social issues and targeted assistance programmes were replaced by universal programmes. In order to fund the increased budget expenditures, domestic borrowing swelled. All of these do not encourage a high economic growth rate. External factors also played a certain role in Georgia’s decreased economic growth rate. However, it is wrong to place the greatest emphasis upon them (see FactCheck’s article). Of those regulations which became more severe, the imposition of a strict visa regime and the limitation of selling land to foreign citizens have to be mentioned specifically. The strict visa regime, in fact, was kept in place from September 2014 to May 2015 and hampered the entrance of tourists into Georgia. The drop in tourism in turn means a drop in currency incomes (see FactCheck’s articles on this topic: link 1 and link 2).

After a simplification of the visa regulations and an intensive advertising to attract tourists, the number of tourists started to grow from the second half of 2015 and, in total, the number of tourists increased by 2.2% in 2015. According to the data of January-September, tourism revenues have also increased by USD 113 million. However, that was not enough to compensate for the gaps in the other components of currency flows.

At the end of 2014 and throughout 2015, a high deficit spending of the budget had a negative impact upon the GEL exchange rate. In February, April and August of last year, the budget deficit was funded at the expense of decreasing state deposits which increased the amount of GEL in circulation and negatively affected the GEL exchange rate (see FactCheck’s articles on this topic: link 1 and link 2).

To cut budget expenditures, the Government of Georgia announced in February 2015 that it would "tighten its belts" and thereby help the national currency. That promise was not fulfilled – the administrative expenses of the Government of Georgia did not decrease by 12% or GEL 240 million as was promised. Additionally, the Government of Georgia failed to attract the promised USD 300 million as a result of privatisation. However, due to increased budget revenues, the government managed to lower the domestic borrowing pace which helped stabilise the GEL exchange rate (initially, it was scheduled to borrow GEL 600 million in 2015). Further additionally, in the 2016 budget, the Government of Georgia decided to borrow only GEL 200 million.

The currency exchange rate is significantly affected by the expectation among the population in this regard. Mostly, there were negative expectations about the GEL exchange rate which was largely caused by blaming the National Bank of Georgia for a deliberate depreciation of GEL. Members of the Government of Georgia were also involved in this campaign and changed their rhetoric only at the end of the year which was reflected in coordinated activities and harmonious statements of both the Government of Georgia and the National Bank of Georgia.

Throughout the last few months of 2015, the GEL exchange rate has become stable at 2.4 against the USD. This is caused by the drop in imports (import is the source of outflow of USD from the country) and a strict monetary policy. The National Bank of Georgia raised the refinance rate from 4% to 8%. Additionally, after November 2014, the National Bank of Georgia sold USD 367 million at currency auctions.

Conclusion

An analysis of currency fluctuation in Georgia’s top 15 trade partner countries illustrated that the currencies of only three countries depreciated more against USD than GEL. These countries are Ukraine, Russia and Azerbaijan. Therefore, instead of having one of the lowest rates of currency depreciation, Georgia, in fact, had one of the highest. However, the inflow of foreign currencies to Georgia dropped mostly from Azerbaijan and Russia and, therefore, played a significant role in the depreciation of GEL.

The principal cause behind the depreciation of GEL is indeed a combination of external factors. However, the domestic factor, which is the negative contribution of the Government of Georgia in this process, is also noteworthy. Only currencies of those countries which are involved in war, suffer strict international sanctions or are negatively affected by the slumping oil prices depreciated more than GEL. A falling economic growth rate, deficit budget spending, the imposition of stricter regulations, a discrediting of the National Bank of Georgia and hampering the Bank’s activities also contributed to the depreciation of GEL.

Therefore, FactCheck concludes that Giorgi Kvirikashvili’s statement that the depreciation of GEL is one of the lowest as compared to the currencies of Georgia’s main trading partners and the government’s role in the depreciation of GEL is minimal is MOSTLY FALSE.

The principal cause behind the depreciation of GEL is the drop in the USD flow into the country such as, for example, the decrease in export and the decreased amount of remittances. From October 2015 until December 2015, export income dropped by USD 793 million and remittances fell by USD 405 million. Indeed, there were no subjective factors such as the negative role of the government involved in the drop in remittances.

A dwindling economic growth rate together with a worsened economic situation in Georgia’s export market countries also affected the fall in Georgia’s exports. Apart from its effect on exports, the economic growth rate is one of the determinants of the national currency’s exchange rate. The bigger the economic growth rate, the bigger the demand on the national currency and it starts to appreciate all things being equal. The drop in Georgia’s economic growth rate was caused by subjective factors (government’s negative role), too. It has already been three years since Georgia rejected an economic policy aimed at high economic growth. It was replaced with a policy of inclusive growth which means that the priority is not a high economic growth rate but the involvement of every strata of the population in the generation of economic wealth. Largely, instead of an accumulation of wealth, emphasis is made upon the redistribution of wealth. The changes in the country’s economic policy were reflected in everyday practice: the tax liberalisation process was halted, regulations become stricter, the country’s budget prioritises social issues and targeted assistance programmes were replaced by universal programmes. In order to fund the increased budget expenditures, domestic borrowing swelled. All of these do not encourage a high economic growth rate. External factors also played a certain role in Georgia’s decreased economic growth rate. However, it is wrong to place the greatest emphasis upon them (see FactCheck’s article). Of those regulations which became more severe, the imposition of a strict visa regime and the limitation of selling land to foreign citizens have to be mentioned specifically. The strict visa regime, in fact, was kept in place from September 2014 to May 2015 and hampered the entrance of tourists into Georgia. The drop in tourism in turn means a drop in currency incomes (see FactCheck’s articles on this topic: link 1 and link 2).

After a simplification of the visa regulations and an intensive advertising to attract tourists, the number of tourists started to grow from the second half of 2015 and, in total, the number of tourists increased by 2.2% in 2015. According to the data of January-September, tourism revenues have also increased by USD 113 million. However, that was not enough to compensate for the gaps in the other components of currency flows.

At the end of 2014 and throughout 2015, a high deficit spending of the budget had a negative impact upon the GEL exchange rate. In February, April and August of last year, the budget deficit was funded at the expense of decreasing state deposits which increased the amount of GEL in circulation and negatively affected the GEL exchange rate (see FactCheck’s articles on this topic: link 1 and link 2).

To cut budget expenditures, the Government of Georgia announced in February 2015 that it would "tighten its belts" and thereby help the national currency. That promise was not fulfilled – the administrative expenses of the Government of Georgia did not decrease by 12% or GEL 240 million as was promised. Additionally, the Government of Georgia failed to attract the promised USD 300 million as a result of privatisation. However, due to increased budget revenues, the government managed to lower the domestic borrowing pace which helped stabilise the GEL exchange rate (initially, it was scheduled to borrow GEL 600 million in 2015). Further additionally, in the 2016 budget, the Government of Georgia decided to borrow only GEL 200 million.

The currency exchange rate is significantly affected by the expectation among the population in this regard. Mostly, there were negative expectations about the GEL exchange rate which was largely caused by blaming the National Bank of Georgia for a deliberate depreciation of GEL. Members of the Government of Georgia were also involved in this campaign and changed their rhetoric only at the end of the year which was reflected in coordinated activities and harmonious statements of both the Government of Georgia and the National Bank of Georgia.

Throughout the last few months of 2015, the GEL exchange rate has become stable at 2.4 against the USD. This is caused by the drop in imports (import is the source of outflow of USD from the country) and a strict monetary policy. The National Bank of Georgia raised the refinance rate from 4% to 8%. Additionally, after November 2014, the National Bank of Georgia sold USD 367 million at currency auctions.

Conclusion

An analysis of currency fluctuation in Georgia’s top 15 trade partner countries illustrated that the currencies of only three countries depreciated more against USD than GEL. These countries are Ukraine, Russia and Azerbaijan. Therefore, instead of having one of the lowest rates of currency depreciation, Georgia, in fact, had one of the highest. However, the inflow of foreign currencies to Georgia dropped mostly from Azerbaijan and Russia and, therefore, played a significant role in the depreciation of GEL.

The principal cause behind the depreciation of GEL is indeed a combination of external factors. However, the domestic factor, which is the negative contribution of the Government of Georgia in this process, is also noteworthy. Only currencies of those countries which are involved in war, suffer strict international sanctions or are negatively affected by the slumping oil prices depreciated more than GEL. A falling economic growth rate, deficit budget spending, the imposition of stricter regulations, a discrediting of the National Bank of Georgia and hampering the Bank’s activities also contributed to the depreciation of GEL.

Therefore, FactCheck concludes that Giorgi Kvirikashvili’s statement that the depreciation of GEL is one of the lowest as compared to the currencies of Georgia’s main trading partners and the government’s role in the depreciation of GEL is minimal is MOSTLY FALSE.

The principal cause behind the depreciation of GEL is the drop in the USD flow into the country such as, for example, the decrease in export and the decreased amount of remittances. From October 2015 until December 2015, export income dropped by USD 793 million and remittances fell by USD 405 million. Indeed, there were no subjective factors such as the negative role of the government involved in the drop in remittances.

A dwindling economic growth rate together with a worsened economic situation in Georgia’s export market countries also affected the fall in Georgia’s exports. Apart from its effect on exports, the economic growth rate is one of the determinants of the national currency’s exchange rate. The bigger the economic growth rate, the bigger the demand on the national currency and it starts to appreciate all things being equal. The drop in Georgia’s economic growth rate was caused by subjective factors (government’s negative role), too. It has already been three years since Georgia rejected an economic policy aimed at high economic growth. It was replaced with a policy of inclusive growth which means that the priority is not a high economic growth rate but the involvement of every strata of the population in the generation of economic wealth. Largely, instead of an accumulation of wealth, emphasis is made upon the redistribution of wealth. The changes in the country’s economic policy were reflected in everyday practice: the tax liberalisation process was halted, regulations become stricter, the country’s budget prioritises social issues and targeted assistance programmes were replaced by universal programmes. In order to fund the increased budget expenditures, domestic borrowing swelled. All of these do not encourage a high economic growth rate. External factors also played a certain role in Georgia’s decreased economic growth rate. However, it is wrong to place the greatest emphasis upon them (see FactCheck’s article). Of those regulations which became more severe, the imposition of a strict visa regime and the limitation of selling land to foreign citizens have to be mentioned specifically. The strict visa regime, in fact, was kept in place from September 2014 to May 2015 and hampered the entrance of tourists into Georgia. The drop in tourism in turn means a drop in currency incomes (see FactCheck’s articles on this topic: link 1 and link 2).

After a simplification of the visa regulations and an intensive advertising to attract tourists, the number of tourists started to grow from the second half of 2015 and, in total, the number of tourists increased by 2.2% in 2015. According to the data of January-September, tourism revenues have also increased by USD 113 million. However, that was not enough to compensate for the gaps in the other components of currency flows.

At the end of 2014 and throughout 2015, a high deficit spending of the budget had a negative impact upon the GEL exchange rate. In February, April and August of last year, the budget deficit was funded at the expense of decreasing state deposits which increased the amount of GEL in circulation and negatively affected the GEL exchange rate (see FactCheck’s articles on this topic: link 1 and link 2).

To cut budget expenditures, the Government of Georgia announced in February 2015 that it would "tighten its belts" and thereby help the national currency. That promise was not fulfilled – the administrative expenses of the Government of Georgia did not decrease by 12% or GEL 240 million as was promised. Additionally, the Government of Georgia failed to attract the promised USD 300 million as a result of privatisation. However, due to increased budget revenues, the government managed to lower the domestic borrowing pace which helped stabilise the GEL exchange rate (initially, it was scheduled to borrow GEL 600 million in 2015). Further additionally, in the 2016 budget, the Government of Georgia decided to borrow only GEL 200 million.

The currency exchange rate is significantly affected by the expectation among the population in this regard. Mostly, there were negative expectations about the GEL exchange rate which was largely caused by blaming the National Bank of Georgia for a deliberate depreciation of GEL. Members of the Government of Georgia were also involved in this campaign and changed their rhetoric only at the end of the year which was reflected in coordinated activities and harmonious statements of both the Government of Georgia and the National Bank of Georgia.

Throughout the last few months of 2015, the GEL exchange rate has become stable at 2.4 against the USD. This is caused by the drop in imports (import is the source of outflow of USD from the country) and a strict monetary policy. The National Bank of Georgia raised the refinance rate from 4% to 8%. Additionally, after November 2014, the National Bank of Georgia sold USD 367 million at currency auctions.

Conclusion

An analysis of currency fluctuation in Georgia’s top 15 trade partner countries illustrated that the currencies of only three countries depreciated more against USD than GEL. These countries are Ukraine, Russia and Azerbaijan. Therefore, instead of having one of the lowest rates of currency depreciation, Georgia, in fact, had one of the highest. However, the inflow of foreign currencies to Georgia dropped mostly from Azerbaijan and Russia and, therefore, played a significant role in the depreciation of GEL.

The principal cause behind the depreciation of GEL is indeed a combination of external factors. However, the domestic factor, which is the negative contribution of the Government of Georgia in this process, is also noteworthy. Only currencies of those countries which are involved in war, suffer strict international sanctions or are negatively affected by the slumping oil prices depreciated more than GEL. A falling economic growth rate, deficit budget spending, the imposition of stricter regulations, a discrediting of the National Bank of Georgia and hampering the Bank’s activities also contributed to the depreciation of GEL.

Therefore, FactCheck concludes that Giorgi Kvirikashvili’s statement that the depreciation of GEL is one of the lowest as compared to the currencies of Georgia’s main trading partners and the government’s role in the depreciation of GEL is minimal is MOSTLY FALSE.

Tags: