A member of the United National Movement, Mikheil Machavariani, during his speech about the state of Georgia’s economy on air on Rustavi 2, stated: "It is the fault of these people (the Government of Georgia) that Georgia’s economy has shrunk back to what it was in 2012 if we take export-import indicators. That was the period when there was no trade with Russia and the EU-Georgia Association Agreement has not yet been signed. Export in 2015 was less than export in 2012. Import has also decreased."

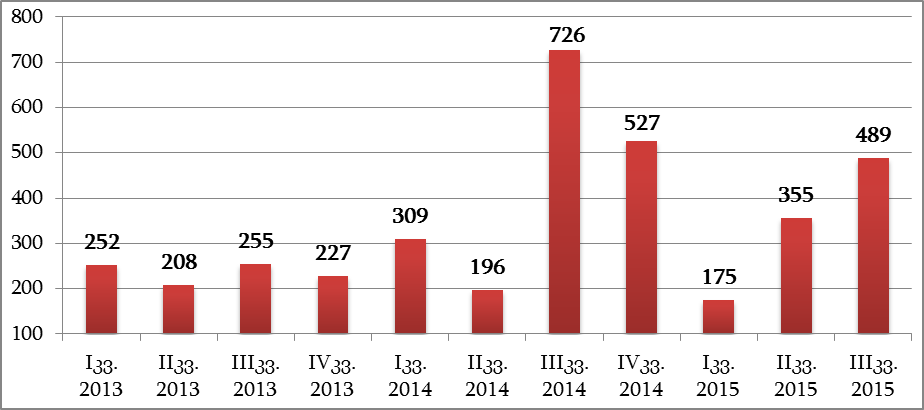

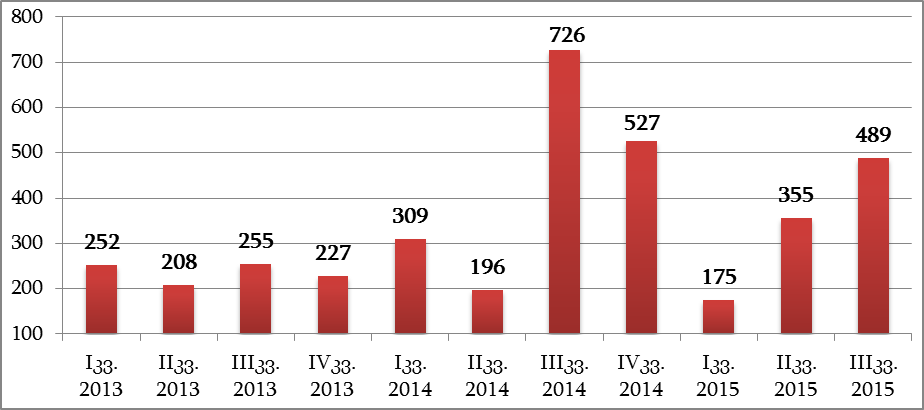

According to the National Statistics Office of Georgia, the amount of export was USD 1,832 million and the amount of import was USD 6,289 million in the first ten months of 2015 which is 24.5% and 10.2% less, respectively, as compared to the same indicators of 2014.

Graph 1: Export and Import Dynamics in 2010-2015

Source: National Statistics Office of Georgia

Export in the first ten months of 2015 was 7.7% less than the export in the same period of 2012 whilst import in the first ten months of 2015 was 6.1% less than the import in the same period of 2012. In light of the sharp depreciation of GEL, the drop in import is a rather expected outcome because the depreciation of the national currency makes imported production more expensive. Of note is the impact of falling oil prices on the world markets. In January-November of 2012, 309,995 tonnes of oil were imported from Azerbaijan with a total price of USD 306 million (USD 987.7 per tonne). In the same period of 2015, the amount of imported oil was 261,379 tonnes with a total price USD 130 million (USD 496.8 per tonne). Therefore, USD 128 million was saved as a result of falling oil prices.

Apart from the negative impact of regional developments upon export, certain positive factors also need to be taken into account. The depreciation of the national currency should have had a positive impact upon the growth of export because the weakening of Georgia’s currency lowered the price of its export production in foreign currency. Of note, too, is the signed free trade agreement with the European Union which increased the competitiveness of Georgian products on European markets. However, it is necessary to add that it will take time before Georgian business fully exploits the opportunities created by the aforementioned treaty. After an economically difficult year in 2012, the economy of the European Union entered a growth phase and increased by 1.3% in 2014 whilst the economic growth rate in 2015 was 1.9% as of the month of October. Thus, the increased total demand on the European market should have been positively reflected upon Georgia’s exports to the EU. Nevertheless, export grew by only USD 11 million (2.3%) in the first ten months of 2015 as compared to the same period of the previous year with a growth of 83.4% as compared to the first 11 months of 2012. Table 1 shows the changes in export with Georgia’s main trading partners.

Table 1: Changes in Export in 2012-2015 (11 Months)

Source: National Statistics Office of Georgia

Export in the first ten months of 2015 was 7.7% less than the export in the same period of 2012 whilst import in the first ten months of 2015 was 6.1% less than the import in the same period of 2012. In light of the sharp depreciation of GEL, the drop in import is a rather expected outcome because the depreciation of the national currency makes imported production more expensive. Of note is the impact of falling oil prices on the world markets. In January-November of 2012, 309,995 tonnes of oil were imported from Azerbaijan with a total price of USD 306 million (USD 987.7 per tonne). In the same period of 2015, the amount of imported oil was 261,379 tonnes with a total price USD 130 million (USD 496.8 per tonne). Therefore, USD 128 million was saved as a result of falling oil prices.

Apart from the negative impact of regional developments upon export, certain positive factors also need to be taken into account. The depreciation of the national currency should have had a positive impact upon the growth of export because the weakening of Georgia’s currency lowered the price of its export production in foreign currency. Of note, too, is the signed free trade agreement with the European Union which increased the competitiveness of Georgian products on European markets. However, it is necessary to add that it will take time before Georgian business fully exploits the opportunities created by the aforementioned treaty. After an economically difficult year in 2012, the economy of the European Union entered a growth phase and increased by 1.3% in 2014 whilst the economic growth rate in 2015 was 1.9% as of the month of October. Thus, the increased total demand on the European market should have been positively reflected upon Georgia’s exports to the EU. Nevertheless, export grew by only USD 11 million (2.3%) in the first ten months of 2015 as compared to the same period of the previous year with a growth of 83.4% as compared to the first 11 months of 2012. Table 1 shows the changes in export with Georgia’s main trading partners.

Table 1: Changes in Export in 2012-2015 (11 Months)

Source: National Statistics Office of Georgia

As illustrated in the table, export to EU member states in 2015 increased by 83% as compared to 2012 against the backdrop of marginal growth in 2014. The situation is quite opposite in regard to post-Soviet countries. Trade with CIS member states dropped by 33%. The biggest decrease is registered in trade with Ukraine. Export to Azerbaijan has also dropped considerably largely due to the decrease in export of second-hand cars. Export to Armenia and Belarus has also fallen. Export to the Russian Federation, on the contrary, increased which can be considered as a base effect because the trade limitations which were in place in 2012 were softened in 2013 and subsequently completely abolished.

On 6 October 2015, the International Monetary Fund (IMF) increased the estimates of member state export growth for 2015. According to the IMF’s prognosis, Georgia’s export was to have fallen by 10.1% in 2015 but in fact decreased by 23.2%. Georgia ranks 157th amongst 175 countries with a 10.1% drop in export although if we take the 23.2% decrease in export into account, Georgia moves down to the 171st place. In 2015, 115 countries had positive indicators of export growth including Uzbekistan with 53%, Tajikistan with 19%, Vietnam with 16%, Turkmenistan with 15%, Bosnia-Herzegovina with 9%, Serbia with 8.4%, Turkey with 3% and Moldova with 2%.

Conclusion

In the first ten months of 2015, the amount of export was USD 1,832 million which is 7.7% less as compared to the same period of 2012 whilst import dropped by 6.1% from USD 6,697 million to USD 6,289 million. Export and import in 2015 also decreased as compared to 2014.

The drop in import was caused by the slow economic growth and the significant depreciation of the national currency from the end of 2014 which in turn was caused by the country’s domestic economic policy together with external factors. Slow economic growth in Georgia’s main trade partner countries also had a negative impact upon Georgia’s export. The depreciation of the national currency, Russia’s decision to abolish the trade ban and the signing of the Deep and Comprehensive Free Trade Agreement with the EU should have had a positive impact upon the growth of Georgia’s export.

A comparison of Georgia’s export growth with those of other countries illustrates that Georgia is at the bottom of world indicators when it comes to the decrease in export which cannot be explained by external factors alone. We are dealing with a worsened environment for the growth of production which is reflected in the significant drop in export under unfavourable external circumstances.

FactCheck concludes that Mikheil Machavariani’s statement is MOSTLY TRUE.

Source: National Statistics Office of Georgia

Export in the first ten months of 2015 was 7.7% less than the export in the same period of 2012 whilst import in the first ten months of 2015 was 6.1% less than the import in the same period of 2012. In light of the sharp depreciation of GEL, the drop in import is a rather expected outcome because the depreciation of the national currency makes imported production more expensive. Of note is the impact of falling oil prices on the world markets. In January-November of 2012, 309,995 tonnes of oil were imported from Azerbaijan with a total price of USD 306 million (USD 987.7 per tonne). In the same period of 2015, the amount of imported oil was 261,379 tonnes with a total price USD 130 million (USD 496.8 per tonne). Therefore, USD 128 million was saved as a result of falling oil prices.

Apart from the negative impact of regional developments upon export, certain positive factors also need to be taken into account. The depreciation of the national currency should have had a positive impact upon the growth of export because the weakening of Georgia’s currency lowered the price of its export production in foreign currency. Of note, too, is the signed free trade agreement with the European Union which increased the competitiveness of Georgian products on European markets. However, it is necessary to add that it will take time before Georgian business fully exploits the opportunities created by the aforementioned treaty. After an economically difficult year in 2012, the economy of the European Union entered a growth phase and increased by 1.3% in 2014 whilst the economic growth rate in 2015 was 1.9% as of the month of October. Thus, the increased total demand on the European market should have been positively reflected upon Georgia’s exports to the EU. Nevertheless, export grew by only USD 11 million (2.3%) in the first ten months of 2015 as compared to the same period of the previous year with a growth of 83.4% as compared to the first 11 months of 2012. Table 1 shows the changes in export with Georgia’s main trading partners.

Table 1: Changes in Export in 2012-2015 (11 Months)

Source: National Statistics Office of Georgia

Export in the first ten months of 2015 was 7.7% less than the export in the same period of 2012 whilst import in the first ten months of 2015 was 6.1% less than the import in the same period of 2012. In light of the sharp depreciation of GEL, the drop in import is a rather expected outcome because the depreciation of the national currency makes imported production more expensive. Of note is the impact of falling oil prices on the world markets. In January-November of 2012, 309,995 tonnes of oil were imported from Azerbaijan with a total price of USD 306 million (USD 987.7 per tonne). In the same period of 2015, the amount of imported oil was 261,379 tonnes with a total price USD 130 million (USD 496.8 per tonne). Therefore, USD 128 million was saved as a result of falling oil prices.

Apart from the negative impact of regional developments upon export, certain positive factors also need to be taken into account. The depreciation of the national currency should have had a positive impact upon the growth of export because the weakening of Georgia’s currency lowered the price of its export production in foreign currency. Of note, too, is the signed free trade agreement with the European Union which increased the competitiveness of Georgian products on European markets. However, it is necessary to add that it will take time before Georgian business fully exploits the opportunities created by the aforementioned treaty. After an economically difficult year in 2012, the economy of the European Union entered a growth phase and increased by 1.3% in 2014 whilst the economic growth rate in 2015 was 1.9% as of the month of October. Thus, the increased total demand on the European market should have been positively reflected upon Georgia’s exports to the EU. Nevertheless, export grew by only USD 11 million (2.3%) in the first ten months of 2015 as compared to the same period of the previous year with a growth of 83.4% as compared to the first 11 months of 2012. Table 1 shows the changes in export with Georgia’s main trading partners.

Table 1: Changes in Export in 2012-2015 (11 Months)

| Territorial Unit | Difference | 2012 (11 Months) | 2015 (11 Months) |

| EU Member States | 83.43% | 326,805 | 599,471 |

| Bulgaria | 197.57% | 66,834 | 198,875 |

| CIS Member States | -32.87% | 1,137,529 | 763,625 |

| Azerbaijan | -60.00% | 578,166 | 231,278 |

| Belarus | -40.79% | 30,151 | 17,852 |

| Russia | 228.50% | 42,954 | 141,105 |

| Armenia | -27.97% | 234,070 | 168,605 |

| Ukraine | -205.74% | 149,000 | 52,341 |

| Turkey | 34.76% | 129,284 | 174,218 |

Tags: