In August 2015, a discussion was held between the representatives of the Ministry of Finance of Georgia and commercial banks. According to the statement of the Ministry of Finance of Georgia, the influence of the budget upon the currency flows in 2015 is positive and hence the dynamics of income and expenditure have only a positive influence upon the GEL exchange rate.

FactCheck verified the accuracy of the aforementioned statement.

GEL started to depreciate at the end of November 2014. The deficit spending of the budget, along with the decrease in currency influxes, also had an influence upon the depreciation. FactCheck wrote about this issue earlier as well (Link 1, Link 2). The depreciation of the national currency has also continued in 2015. The main reason for the depreciation was the decrease in revenues from currency sources (exports, tourism, money transfers).

The national currency’s exchange rate relies upon the ratio of GEL to USD in the country’s economy. The dynamics of the amount of money in the economy are controlled by the National Bank of Georgia by using its monetary policy tools; however, the state’s fiscal policy has a certain influence upon the amount of money in the economy. When a state budget is deficient, it means that the state releases more money into the economy than it receives in the form of taxes and other income. Hence, the deficit spending of the budget facilitates the growth of the amount of GEL in the national economy.

The deficit of the 2015 state budget is planned to be GEL 1.2 billion which is quite a formidable number. The growth of state budget spending is an encouraging factor for a country’s demand. Georgia is an import-dependent country and about 70% of its domestic consumption comes from imported goods. Hence, stimulating demand in the country creates a growth in the demand on imports which, given the decrease in exports, causes the trade balance to worsen, effectively increasing pressure upon GEL. In order to decrease the pressure upon the GEL exchange rate, the government decided to lower its budget spending. The Law on Budget was amended in July 2015 but spending was not decreased even then. FactCheck wrote about this issue earlier as well (Link 3).

According to the data of the first two quarters of 2015, the income part of the state budget has been implemented with excess. The excess implementation is due to the changes in the GEL exchange rate and unplanned income. The 2015 state budget was planned on a 1.8 exchange rate whilst the actual exchange rate varied from 2.2 to 2.28 from January to June 2015. Due to the depreciation of GEL, the value of the imported goods and the VAT on them increased which, in its turn, increased the income of the state budget as well.

The changes in the exchange rate also had their influence upon currency incomes. The budget’s actual currency income in GEL exceeded the forecast amount. The budget’s currency income consists mainly of foreign loans and grants whilst currency spending is mainly connected with servicing foreign debts. According to the Ministry of Finance of Georgia’s data, the income from foreign loans and grants amounted to USD 304.1 million from January to July 2015 whilst the amount of money spent on servicing the external debt equalled USD 164.1 million. Hence, the budget’s income in foreign currency exceeded the expenditure by USD 140 million.

Despite the fact that the currency incomes in GEL were higher than planned, the external debts were not used up to their full potential. The external debt increased by GEL 81 million instead of GEL 110 million (73.6% of the initial plan) in the first quarter of 2015. In the case of the 1.8 exchange rate provided for by the initial version of the budget, about USD 61 million in external debt should have been added to the state budget whilst the actual amount was USD 31.5 million which constitutes 52% of the plan. Similarly, a total of USD 215 million was received in the second quarter instead of USD 269 million which is 80% of the initial plan.

Source: Ministry of Finance of Georgia

We had a surplus budget in the first quarter[1] of the year with this amount equalling GEL 73.5 million instead of GEL 128 million as initially planned. The deficit of the budget in the second quarter was planned to be GEL 584 million; however, it actually amounted to GEL 166 million. In addition, it should be pointed out that leftover amounts of money were accumulating on the account of the budget throughout the year. The amount of money accumulated on the account of the state budget increased by GEL 389 million in the second quarter of 2015 and amounted to GEL 823 million. Of this amount, about GEL 273 million was placed in commercial banks in the form of deposits. The remainder amounted to GEL 728 million at the end of August.

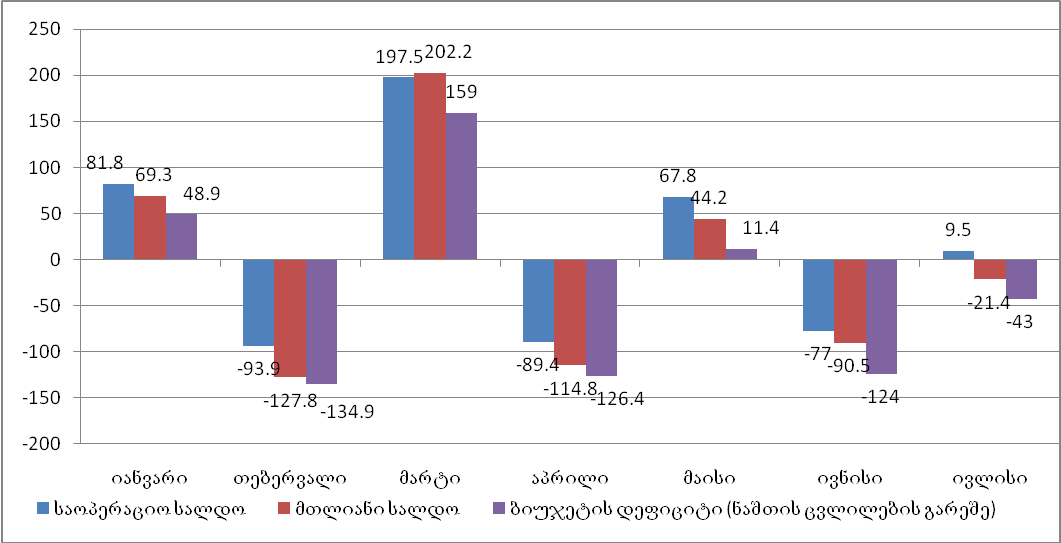

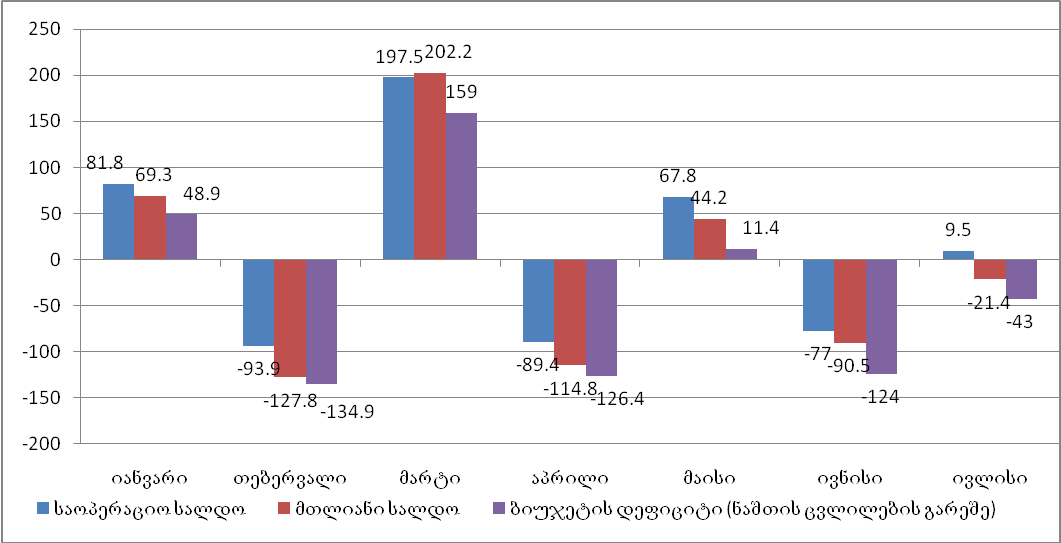

It is interesting to see what the budget deficit was like by months. As the chart makes clear, January, March and May saw surplus amounts. In February, the budget deficit increased by GEL 135 million whilst in April it amounted to GEL 126 million. June (GEL 124 million), July (GEL 43 million) and August (GEL 90 million) were also deficient.

Chart 1: Operational and Overall Balances of the State Budget and the Budget Deficit by Months

Source: State Treasury

It appears that despite the fact that the budget deficit in the first two quarters is lower than planned, there still was deficit spending in the past several months and the deficit was quite high in some of these months. In such cases, the deficit was financed at the expense of the decrease in the budget balance. This directly facilitates the growth of the amount of GEL in circulation and the depreciation of its exchange rate.

Conclusion

A total of USD 140 million more in foreign currency incomes was added to the state budget from January to June 2015 than was spent. In addition, leftover amounts of money were accumulating on the account of the budget throughout the year. Despite this, the influence of the budget upon the national currency’s exchange rate still cannot be deemed to be positive. The budget deficit was quite high in certain months and financed at the expense of the decrease in the overall budget balance which facilitated the increase of the amount of GEL in circulation.

As of today, the state’s fiscal policy is expansive which means an increase of state spending at the expense of the deficit. Despite the amendments to the Law on Budget, budget spending has practically not been decreased. The 2015 state budget’s deficit is planned to be GEL 1.2 billion which is quite a formidable number. The growth of state spending stimulates demand. Georgia is an import-dependent country which means that the growth of domestic demand causes a demand upon imported production and foreign currency to increase which, in its turn, puts additional pressure upon the national currency.

FactCheck concludes that the statement of the Ministry of Finance of Georgia is HALF TRUE.

[1] Sum of overall balance and the changes in financial assets (without changes in leftover amounts).

Source: State Treasury

It appears that despite the fact that the budget deficit in the first two quarters is lower than planned, there still was deficit spending in the past several months and the deficit was quite high in some of these months. In such cases, the deficit was financed at the expense of the decrease in the budget balance. This directly facilitates the growth of the amount of GEL in circulation and the depreciation of its exchange rate.

Conclusion

A total of USD 140 million more in foreign currency incomes was added to the state budget from January to June 2015 than was spent. In addition, leftover amounts of money were accumulating on the account of the budget throughout the year. Despite this, the influence of the budget upon the national currency’s exchange rate still cannot be deemed to be positive. The budget deficit was quite high in certain months and financed at the expense of the decrease in the overall budget balance which facilitated the increase of the amount of GEL in circulation.

As of today, the state’s fiscal policy is expansive which means an increase of state spending at the expense of the deficit. Despite the amendments to the Law on Budget, budget spending has practically not been decreased. The 2015 state budget’s deficit is planned to be GEL 1.2 billion which is quite a formidable number. The growth of state spending stimulates demand. Georgia is an import-dependent country which means that the growth of domestic demand causes a demand upon imported production and foreign currency to increase which, in its turn, puts additional pressure upon the national currency.

FactCheck concludes that the statement of the Ministry of Finance of Georgia is HALF TRUE.

[1] Sum of overall balance and the changes in financial assets (without changes in leftover amounts).

| GEL Million | 1st Quarter | 2nd Quarter | ||

| Fact | Implementation in % | Fact | Implementation in % | |

| Receipts | 2,265.00 | 103.0% | 4,793.00 | 105.7% |

| Income | 1,951.00 | 104.3% | 3,827.00 | 103.7% |

| Tax Revenues | 1,828.00 | 102.7% | 3,581.00 | 102.2% |

| Grants | 58.20 | 130.5% | 100.40 | 110.9% |

| Other Revenues | 64.50 | 141.8% | 146.00 | 151.1% |

| Decrease in Non-Financial Assets | 63.20 | 601.9% | 136.60 | 525.4% |

| Decrease in Financial Assets | 10.60 | 126.2% | 38.70 | 54.5% |

| Growth of Obligations | 279.70 | 90.2% | 791.40 | 100.9% |

| Growth of Domestic Obligations | 198.60 | 99.3% | 295.00 | 98.3% |

| Growth of External Obligations | 81.20 | 73.7% | 496.20 | 102.4% |

Source: State Treasury

It appears that despite the fact that the budget deficit in the first two quarters is lower than planned, there still was deficit spending in the past several months and the deficit was quite high in some of these months. In such cases, the deficit was financed at the expense of the decrease in the budget balance. This directly facilitates the growth of the amount of GEL in circulation and the depreciation of its exchange rate.

Conclusion

A total of USD 140 million more in foreign currency incomes was added to the state budget from January to June 2015 than was spent. In addition, leftover amounts of money were accumulating on the account of the budget throughout the year. Despite this, the influence of the budget upon the national currency’s exchange rate still cannot be deemed to be positive. The budget deficit was quite high in certain months and financed at the expense of the decrease in the overall budget balance which facilitated the increase of the amount of GEL in circulation.

As of today, the state’s fiscal policy is expansive which means an increase of state spending at the expense of the deficit. Despite the amendments to the Law on Budget, budget spending has practically not been decreased. The 2015 state budget’s deficit is planned to be GEL 1.2 billion which is quite a formidable number. The growth of state spending stimulates demand. Georgia is an import-dependent country which means that the growth of domestic demand causes a demand upon imported production and foreign currency to increase which, in its turn, puts additional pressure upon the national currency.

FactCheck concludes that the statement of the Ministry of Finance of Georgia is HALF TRUE.

[1] Sum of overall balance and the changes in financial assets (without changes in leftover amounts).

Source: State Treasury

It appears that despite the fact that the budget deficit in the first two quarters is lower than planned, there still was deficit spending in the past several months and the deficit was quite high in some of these months. In such cases, the deficit was financed at the expense of the decrease in the budget balance. This directly facilitates the growth of the amount of GEL in circulation and the depreciation of its exchange rate.

Conclusion

A total of USD 140 million more in foreign currency incomes was added to the state budget from January to June 2015 than was spent. In addition, leftover amounts of money were accumulating on the account of the budget throughout the year. Despite this, the influence of the budget upon the national currency’s exchange rate still cannot be deemed to be positive. The budget deficit was quite high in certain months and financed at the expense of the decrease in the overall budget balance which facilitated the increase of the amount of GEL in circulation.

As of today, the state’s fiscal policy is expansive which means an increase of state spending at the expense of the deficit. Despite the amendments to the Law on Budget, budget spending has practically not been decreased. The 2015 state budget’s deficit is planned to be GEL 1.2 billion which is quite a formidable number. The growth of state spending stimulates demand. Georgia is an import-dependent country which means that the growth of domestic demand causes a demand upon imported production and foreign currency to increase which, in its turn, puts additional pressure upon the national currency.

FactCheck concludes that the statement of the Ministry of Finance of Georgia is HALF TRUE.

[1] Sum of overall balance and the changes in financial assets (without changes in leftover amounts).

Tags: