At the joint meeting of the Parliamentary Committees, when talking about the depreciation of GEL, the President of the National Bank of Georgia, Giorgi Kadagidze, stated: "The depreciation was not caused by monetary reasons; that is, the growth of the amount of money in the economy. We brought the growth of the reserve money to zero. The main reason for this depreciation is the decrease in the currency influx, nothing more."

FactCheck verified the accuracy of Giorgi Kadagidze’s statement.

Georgia uses a floating exchange rate which means that the exchange rate of the national currency is determined by a demand-supply mechanism. GEL depreciates when the amount of the national currency in the economy increases faster than that of USD or the amount of USD decreases whilst the amount of GEL stays the same. The President of the National Bank of Georgia elaborates upon this second point when stating that the main reason for the depreciation of GEL is the decrease in the influx of USD when the amount of GEL in the economy stays the same.

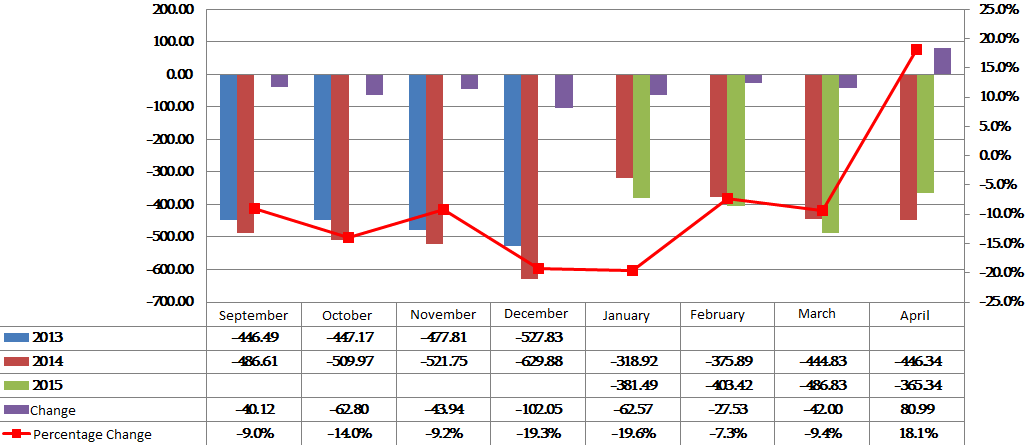

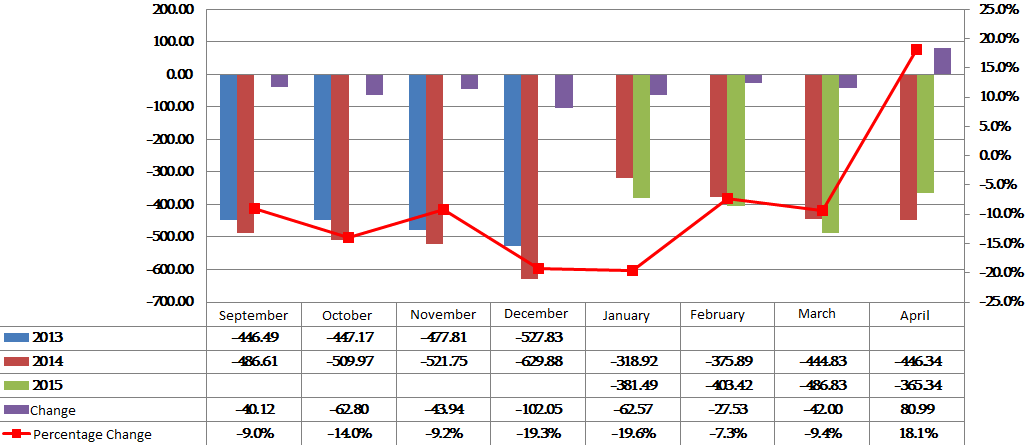

The main sources of the influx of USD into the country include foreign investments, revenues from international tourism, export of production and the personal transfers of people working abroad. As Chart 1 illustrates, the deficit of the trade balance from September 2014 to March 2015 has the trend of growth as compared to the same period of the previous years. The growth of the trade balance deficit means a decrease in the influx of USD which negatively influences the exchange rate of the national currency.

Chart 1: External Trade Balance of Georgia (USD million)

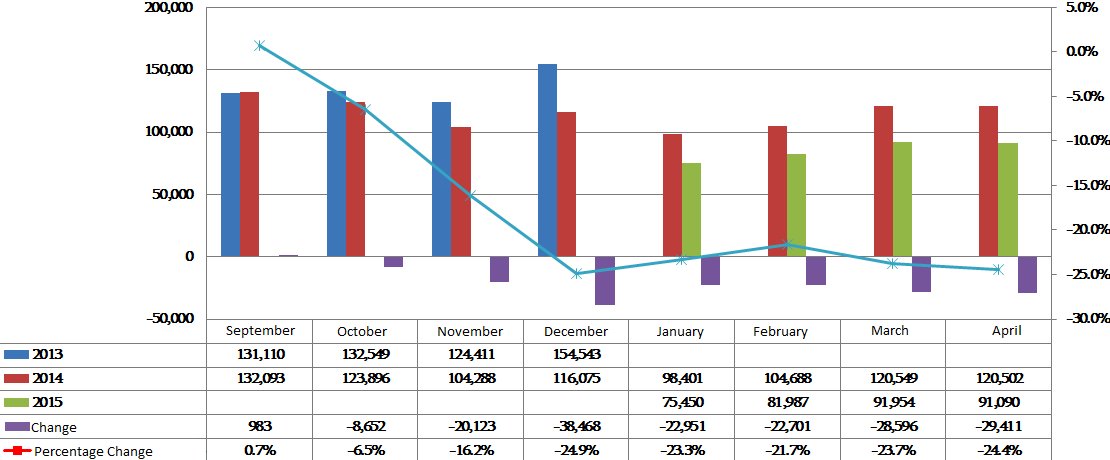

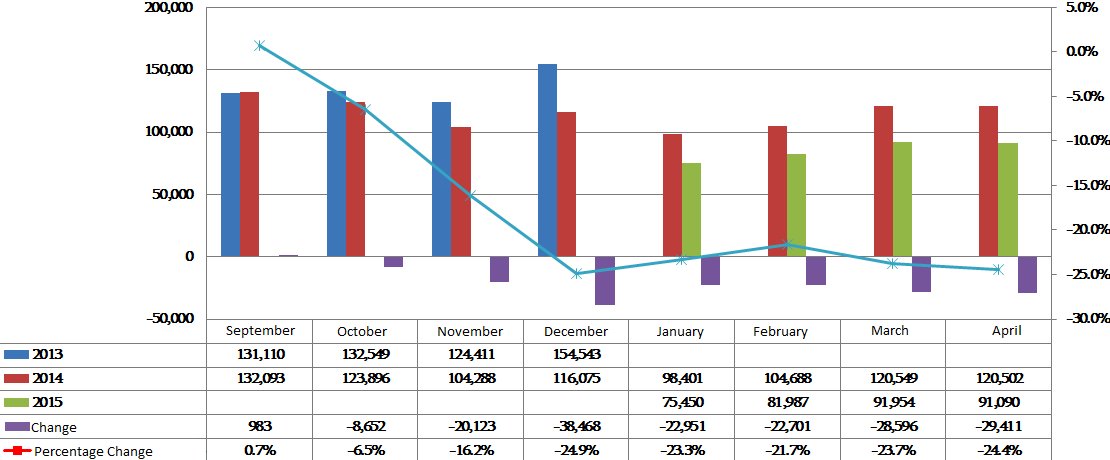

Another important component when analysing the influx of USD into the country comprises money transfers from abroad. A decrease in the influx of money transfers was recorded from October 2014 to April 2015. Transfers dropped by a total of USD 171 million in the aforementioned seven months.

Chart 2: Money Transfers from Abroad

Another important component when analysing the influx of USD into the country comprises money transfers from abroad. A decrease in the influx of money transfers was recorded from October 2014 to April 2015. Transfers dropped by a total of USD 171 million in the aforementioned seven months.

Chart 2: Money Transfers from Abroad

There is a more or less different situation concerning the revenues from international tourism. There was no decrease in this component in 2014. The revenues increased by USD 6 million (1.6%) in the fourth quarter of 2014 and amounted to USD 392 million. However, the trend of a decrease in the growth rate was noticeable. The growth rate of revenues was five times less than in the last quarter of 2013 and amounted to 1.6%. Revenues from international tourism dropped by 3.9% in the first quarter of 2015 as compared to the same period of the previous year.

Another component of the influx of foreign currency comprises foreign investments. Foreign direct investments decreased by 34% (USD 90 million) in the first quarter of 2015 as compared to the same period of the previous year. As for the last quarter of 2014, the amount of foreign direct investments equalled USD 349.2 million, increasing by 53.9% as compared to the same period of the previous year. Investments were not the cause of the first wave of the depreciation of GEL; however, their amount was not enough to relieve the pressure of other factors upon GEL. Investments also dropped at the beginning of 2015.

Another aspect, as pointed out by the President of the National Bank of Georgia, was the changes in the amount of reserve money (cash issued by the National Bank of Georgia). Reserve money includes the national currency in circulation (GEL) and the deposits of commercial banks. Deposits of commercial banks include mandatory reserves and the sums on correspondent accounts. Mandatory reserves and sums are in both GEL and USD. In terms of monetary policy, it is important to note how the amount of GEL in the reserve money changes because the depreciation of GEL is caused only by the growth of its amount and not because of the growth of USD.

The amount of reserve money equalled GEL 4,478 million at the end of May 2015 which was 11% more as compared to 31 October 2014 (depreciation started in November 2014). However, the 11% growth was mainly due to the growth of USD deposits in the reserve money – due to the depreciation of GEL the amount of deposits in USD grew significantly. If we take the amount of GEL in the reserve money, its amount increased by a mere 3.2% (GEL 87 million) from the end of October 2014 to the end of May 2015. In his statement, Giorgi Kadagidze meant this indicator specifically. In addition, the amount of broad money (M2) in the economy increased by only 1.3% from October 2014 to May 2015. The lesser growth of M2 as compared to reserve money is mainly due to the decrease of credits in the economy.

Despite the fact that the amount of GEL in the economy did not increase significantly from October 2014 to May 2015, in certain periods of time (December 2015 and April 2015) it kept increasing sharply but dropped again in the following months. The amount of reserve money in GEL increased by 16.5% (GEL 450 million) in December 2014 and by 11% (GEL 290 million) in April 2015. Given the decrease in the influx of USD, even a short-term sharp growth of the amount of GEL negatively influenced the exchange rate of the national currency. In these periods of time, the over-supply of GEL and, hence, its depreciation was also influenced by the deficit spending of the budget. The deficit of the overall budget (including financial assets) amounted to GEL 290 million in December 2014 and GEL 117 million in April 2015.

Conclusion

An analysis of the influx of foreign currency into the country found that the growth of the external trade deficit amounted to USD 208 million in the last quarter of 2014 and USD 132 million in the first quarter of 2015. The amount of money transfers from abroad decreased by USD 171 million in the past seven months. The growth rate of visitors also dropped at the end of 2014 as well as at the beginning of 2015 as compared to the same periods of the previous year. This indicator had a positive trend only in May and June. Foreign direct investments did not decrease in 2014; however, their growth failed to balance the deficit of USD. The amount of investments also dropped in the first quarter of 2015.

The amount of reserve money increased by 11% from October 2014 to May 2015. However, if we take only the GEL component of the reserve money (which influences the exchange rate) its growth was merely 3.2%. Despite the fact that the overall amount of GEL did not increase significantly, the amount of reserve money in GEL increased by 16.5% in December 2014 and 11% in April 2015. Given the decrease in the influx of USD, even a sharp short-term growth of the amount of GEL negatively influenced the exchange rate of the national currency. In these periods of time, the over-supply of GEL and, hence, its depreciation was also influenced by the deficit spending of the budget.

The growth of broad money (M2) has practically been nullified. It increased by just 1.3% from October 2014 to May 2015 which, given the positive economic growth, is a normal indicator.

Overall, it should be pointed out that the depreciation of GEL did not have a monetary reason (growth of the amount of GEL in the economy). The main reason is the decrease in the influx of USD. Even though an even hasher monetary policy (sharp reduction of the amount of GEL in circulation) would have had a positive influence upon the GEL exchange rate, it would have caused a recession of the economy. It should also be noted that tightening the monetary policy, in certain periods of time, was further hindered by the deficit spending of the state budget.

FactCheck concludes that Giorgi Kadagidze’s statement is MOSTLY TRUE.

Editor's Note: The initial version of the article was published on 7 July 2015. After this we were contacted by the National Bank of Georgia and made aware of a certain flaw in our study. Namely, we had studied the changes in the reserve money including the deposits in USD whilst for monetary reasons it is more justified to assess the changes in the GEL component of the reserve money only. Hence, the amount of reserve money has increased by 3.2% (and not 11%), which is a low indicator. Taking the aforementioned factor into account, the article was corrected and the verdict changed accordingly as well.

There is a more or less different situation concerning the revenues from international tourism. There was no decrease in this component in 2014. The revenues increased by USD 6 million (1.6%) in the fourth quarter of 2014 and amounted to USD 392 million. However, the trend of a decrease in the growth rate was noticeable. The growth rate of revenues was five times less than in the last quarter of 2013 and amounted to 1.6%. Revenues from international tourism dropped by 3.9% in the first quarter of 2015 as compared to the same period of the previous year.

Another component of the influx of foreign currency comprises foreign investments. Foreign direct investments decreased by 34% (USD 90 million) in the first quarter of 2015 as compared to the same period of the previous year. As for the last quarter of 2014, the amount of foreign direct investments equalled USD 349.2 million, increasing by 53.9% as compared to the same period of the previous year. Investments were not the cause of the first wave of the depreciation of GEL; however, their amount was not enough to relieve the pressure of other factors upon GEL. Investments also dropped at the beginning of 2015.

Another aspect, as pointed out by the President of the National Bank of Georgia, was the changes in the amount of reserve money (cash issued by the National Bank of Georgia). Reserve money includes the national currency in circulation (GEL) and the deposits of commercial banks. Deposits of commercial banks include mandatory reserves and the sums on correspondent accounts. Mandatory reserves and sums are in both GEL and USD. In terms of monetary policy, it is important to note how the amount of GEL in the reserve money changes because the depreciation of GEL is caused only by the growth of its amount and not because of the growth of USD.

The amount of reserve money equalled GEL 4,478 million at the end of May 2015 which was 11% more as compared to 31 October 2014 (depreciation started in November 2014). However, the 11% growth was mainly due to the growth of USD deposits in the reserve money – due to the depreciation of GEL the amount of deposits in USD grew significantly. If we take the amount of GEL in the reserve money, its amount increased by a mere 3.2% (GEL 87 million) from the end of October 2014 to the end of May 2015. In his statement, Giorgi Kadagidze meant this indicator specifically. In addition, the amount of broad money (M2) in the economy increased by only 1.3% from October 2014 to May 2015. The lesser growth of M2 as compared to reserve money is mainly due to the decrease of credits in the economy.

Despite the fact that the amount of GEL in the economy did not increase significantly from October 2014 to May 2015, in certain periods of time (December 2015 and April 2015) it kept increasing sharply but dropped again in the following months. The amount of reserve money in GEL increased by 16.5% (GEL 450 million) in December 2014 and by 11% (GEL 290 million) in April 2015. Given the decrease in the influx of USD, even a short-term sharp growth of the amount of GEL negatively influenced the exchange rate of the national currency. In these periods of time, the over-supply of GEL and, hence, its depreciation was also influenced by the deficit spending of the budget. The deficit of the overall budget (including financial assets) amounted to GEL 290 million in December 2014 and GEL 117 million in April 2015.

Conclusion

An analysis of the influx of foreign currency into the country found that the growth of the external trade deficit amounted to USD 208 million in the last quarter of 2014 and USD 132 million in the first quarter of 2015. The amount of money transfers from abroad decreased by USD 171 million in the past seven months. The growth rate of visitors also dropped at the end of 2014 as well as at the beginning of 2015 as compared to the same periods of the previous year. This indicator had a positive trend only in May and June. Foreign direct investments did not decrease in 2014; however, their growth failed to balance the deficit of USD. The amount of investments also dropped in the first quarter of 2015.

The amount of reserve money increased by 11% from October 2014 to May 2015. However, if we take only the GEL component of the reserve money (which influences the exchange rate) its growth was merely 3.2%. Despite the fact that the overall amount of GEL did not increase significantly, the amount of reserve money in GEL increased by 16.5% in December 2014 and 11% in April 2015. Given the decrease in the influx of USD, even a sharp short-term growth of the amount of GEL negatively influenced the exchange rate of the national currency. In these periods of time, the over-supply of GEL and, hence, its depreciation was also influenced by the deficit spending of the budget.

The growth of broad money (M2) has practically been nullified. It increased by just 1.3% from October 2014 to May 2015 which, given the positive economic growth, is a normal indicator.

Overall, it should be pointed out that the depreciation of GEL did not have a monetary reason (growth of the amount of GEL in the economy). The main reason is the decrease in the influx of USD. Even though an even hasher monetary policy (sharp reduction of the amount of GEL in circulation) would have had a positive influence upon the GEL exchange rate, it would have caused a recession of the economy. It should also be noted that tightening the monetary policy, in certain periods of time, was further hindered by the deficit spending of the state budget.

FactCheck concludes that Giorgi Kadagidze’s statement is MOSTLY TRUE.

Editor's Note: The initial version of the article was published on 7 July 2015. After this we were contacted by the National Bank of Georgia and made aware of a certain flaw in our study. Namely, we had studied the changes in the reserve money including the deposits in USD whilst for monetary reasons it is more justified to assess the changes in the GEL component of the reserve money only. Hence, the amount of reserve money has increased by 3.2% (and not 11%), which is a low indicator. Taking the aforementioned factor into account, the article was corrected and the verdict changed accordingly as well.

Another important component when analysing the influx of USD into the country comprises money transfers from abroad. A decrease in the influx of money transfers was recorded from October 2014 to April 2015. Transfers dropped by a total of USD 171 million in the aforementioned seven months.

Chart 2: Money Transfers from Abroad

Another important component when analysing the influx of USD into the country comprises money transfers from abroad. A decrease in the influx of money transfers was recorded from October 2014 to April 2015. Transfers dropped by a total of USD 171 million in the aforementioned seven months.

Chart 2: Money Transfers from Abroad

There is a more or less different situation concerning the revenues from international tourism. There was no decrease in this component in 2014. The revenues increased by USD 6 million (1.6%) in the fourth quarter of 2014 and amounted to USD 392 million. However, the trend of a decrease in the growth rate was noticeable. The growth rate of revenues was five times less than in the last quarter of 2013 and amounted to 1.6%. Revenues from international tourism dropped by 3.9% in the first quarter of 2015 as compared to the same period of the previous year.

Another component of the influx of foreign currency comprises foreign investments. Foreign direct investments decreased by 34% (USD 90 million) in the first quarter of 2015 as compared to the same period of the previous year. As for the last quarter of 2014, the amount of foreign direct investments equalled USD 349.2 million, increasing by 53.9% as compared to the same period of the previous year. Investments were not the cause of the first wave of the depreciation of GEL; however, their amount was not enough to relieve the pressure of other factors upon GEL. Investments also dropped at the beginning of 2015.

Another aspect, as pointed out by the President of the National Bank of Georgia, was the changes in the amount of reserve money (cash issued by the National Bank of Georgia). Reserve money includes the national currency in circulation (GEL) and the deposits of commercial banks. Deposits of commercial banks include mandatory reserves and the sums on correspondent accounts. Mandatory reserves and sums are in both GEL and USD. In terms of monetary policy, it is important to note how the amount of GEL in the reserve money changes because the depreciation of GEL is caused only by the growth of its amount and not because of the growth of USD.

The amount of reserve money equalled GEL 4,478 million at the end of May 2015 which was 11% more as compared to 31 October 2014 (depreciation started in November 2014). However, the 11% growth was mainly due to the growth of USD deposits in the reserve money – due to the depreciation of GEL the amount of deposits in USD grew significantly. If we take the amount of GEL in the reserve money, its amount increased by a mere 3.2% (GEL 87 million) from the end of October 2014 to the end of May 2015. In his statement, Giorgi Kadagidze meant this indicator specifically. In addition, the amount of broad money (M2) in the economy increased by only 1.3% from October 2014 to May 2015. The lesser growth of M2 as compared to reserve money is mainly due to the decrease of credits in the economy.

Despite the fact that the amount of GEL in the economy did not increase significantly from October 2014 to May 2015, in certain periods of time (December 2015 and April 2015) it kept increasing sharply but dropped again in the following months. The amount of reserve money in GEL increased by 16.5% (GEL 450 million) in December 2014 and by 11% (GEL 290 million) in April 2015. Given the decrease in the influx of USD, even a short-term sharp growth of the amount of GEL negatively influenced the exchange rate of the national currency. In these periods of time, the over-supply of GEL and, hence, its depreciation was also influenced by the deficit spending of the budget. The deficit of the overall budget (including financial assets) amounted to GEL 290 million in December 2014 and GEL 117 million in April 2015.

Conclusion

An analysis of the influx of foreign currency into the country found that the growth of the external trade deficit amounted to USD 208 million in the last quarter of 2014 and USD 132 million in the first quarter of 2015. The amount of money transfers from abroad decreased by USD 171 million in the past seven months. The growth rate of visitors also dropped at the end of 2014 as well as at the beginning of 2015 as compared to the same periods of the previous year. This indicator had a positive trend only in May and June. Foreign direct investments did not decrease in 2014; however, their growth failed to balance the deficit of USD. The amount of investments also dropped in the first quarter of 2015.

The amount of reserve money increased by 11% from October 2014 to May 2015. However, if we take only the GEL component of the reserve money (which influences the exchange rate) its growth was merely 3.2%. Despite the fact that the overall amount of GEL did not increase significantly, the amount of reserve money in GEL increased by 16.5% in December 2014 and 11% in April 2015. Given the decrease in the influx of USD, even a sharp short-term growth of the amount of GEL negatively influenced the exchange rate of the national currency. In these periods of time, the over-supply of GEL and, hence, its depreciation was also influenced by the deficit spending of the budget.

The growth of broad money (M2) has practically been nullified. It increased by just 1.3% from October 2014 to May 2015 which, given the positive economic growth, is a normal indicator.

Overall, it should be pointed out that the depreciation of GEL did not have a monetary reason (growth of the amount of GEL in the economy). The main reason is the decrease in the influx of USD. Even though an even hasher monetary policy (sharp reduction of the amount of GEL in circulation) would have had a positive influence upon the GEL exchange rate, it would have caused a recession of the economy. It should also be noted that tightening the monetary policy, in certain periods of time, was further hindered by the deficit spending of the state budget.

FactCheck concludes that Giorgi Kadagidze’s statement is MOSTLY TRUE.

Editor's Note: The initial version of the article was published on 7 July 2015. After this we were contacted by the National Bank of Georgia and made aware of a certain flaw in our study. Namely, we had studied the changes in the reserve money including the deposits in USD whilst for monetary reasons it is more justified to assess the changes in the GEL component of the reserve money only. Hence, the amount of reserve money has increased by 3.2% (and not 11%), which is a low indicator. Taking the aforementioned factor into account, the article was corrected and the verdict changed accordingly as well.

There is a more or less different situation concerning the revenues from international tourism. There was no decrease in this component in 2014. The revenues increased by USD 6 million (1.6%) in the fourth quarter of 2014 and amounted to USD 392 million. However, the trend of a decrease in the growth rate was noticeable. The growth rate of revenues was five times less than in the last quarter of 2013 and amounted to 1.6%. Revenues from international tourism dropped by 3.9% in the first quarter of 2015 as compared to the same period of the previous year.

Another component of the influx of foreign currency comprises foreign investments. Foreign direct investments decreased by 34% (USD 90 million) in the first quarter of 2015 as compared to the same period of the previous year. As for the last quarter of 2014, the amount of foreign direct investments equalled USD 349.2 million, increasing by 53.9% as compared to the same period of the previous year. Investments were not the cause of the first wave of the depreciation of GEL; however, their amount was not enough to relieve the pressure of other factors upon GEL. Investments also dropped at the beginning of 2015.

Another aspect, as pointed out by the President of the National Bank of Georgia, was the changes in the amount of reserve money (cash issued by the National Bank of Georgia). Reserve money includes the national currency in circulation (GEL) and the deposits of commercial banks. Deposits of commercial banks include mandatory reserves and the sums on correspondent accounts. Mandatory reserves and sums are in both GEL and USD. In terms of monetary policy, it is important to note how the amount of GEL in the reserve money changes because the depreciation of GEL is caused only by the growth of its amount and not because of the growth of USD.

The amount of reserve money equalled GEL 4,478 million at the end of May 2015 which was 11% more as compared to 31 October 2014 (depreciation started in November 2014). However, the 11% growth was mainly due to the growth of USD deposits in the reserve money – due to the depreciation of GEL the amount of deposits in USD grew significantly. If we take the amount of GEL in the reserve money, its amount increased by a mere 3.2% (GEL 87 million) from the end of October 2014 to the end of May 2015. In his statement, Giorgi Kadagidze meant this indicator specifically. In addition, the amount of broad money (M2) in the economy increased by only 1.3% from October 2014 to May 2015. The lesser growth of M2 as compared to reserve money is mainly due to the decrease of credits in the economy.

Despite the fact that the amount of GEL in the economy did not increase significantly from October 2014 to May 2015, in certain periods of time (December 2015 and April 2015) it kept increasing sharply but dropped again in the following months. The amount of reserve money in GEL increased by 16.5% (GEL 450 million) in December 2014 and by 11% (GEL 290 million) in April 2015. Given the decrease in the influx of USD, even a short-term sharp growth of the amount of GEL negatively influenced the exchange rate of the national currency. In these periods of time, the over-supply of GEL and, hence, its depreciation was also influenced by the deficit spending of the budget. The deficit of the overall budget (including financial assets) amounted to GEL 290 million in December 2014 and GEL 117 million in April 2015.

Conclusion

An analysis of the influx of foreign currency into the country found that the growth of the external trade deficit amounted to USD 208 million in the last quarter of 2014 and USD 132 million in the first quarter of 2015. The amount of money transfers from abroad decreased by USD 171 million in the past seven months. The growth rate of visitors also dropped at the end of 2014 as well as at the beginning of 2015 as compared to the same periods of the previous year. This indicator had a positive trend only in May and June. Foreign direct investments did not decrease in 2014; however, their growth failed to balance the deficit of USD. The amount of investments also dropped in the first quarter of 2015.

The amount of reserve money increased by 11% from October 2014 to May 2015. However, if we take only the GEL component of the reserve money (which influences the exchange rate) its growth was merely 3.2%. Despite the fact that the overall amount of GEL did not increase significantly, the amount of reserve money in GEL increased by 16.5% in December 2014 and 11% in April 2015. Given the decrease in the influx of USD, even a sharp short-term growth of the amount of GEL negatively influenced the exchange rate of the national currency. In these periods of time, the over-supply of GEL and, hence, its depreciation was also influenced by the deficit spending of the budget.

The growth of broad money (M2) has practically been nullified. It increased by just 1.3% from October 2014 to May 2015 which, given the positive economic growth, is a normal indicator.

Overall, it should be pointed out that the depreciation of GEL did not have a monetary reason (growth of the amount of GEL in the economy). The main reason is the decrease in the influx of USD. Even though an even hasher monetary policy (sharp reduction of the amount of GEL in circulation) would have had a positive influence upon the GEL exchange rate, it would have caused a recession of the economy. It should also be noted that tightening the monetary policy, in certain periods of time, was further hindered by the deficit spending of the state budget.

FactCheck concludes that Giorgi Kadagidze’s statement is MOSTLY TRUE.

Editor's Note: The initial version of the article was published on 7 July 2015. After this we were contacted by the National Bank of Georgia and made aware of a certain flaw in our study. Namely, we had studied the changes in the reserve money including the deposits in USD whilst for monetary reasons it is more justified to assess the changes in the GEL component of the reserve money only. Hence, the amount of reserve money has increased by 3.2% (and not 11%), which is a low indicator. Taking the aforementioned factor into account, the article was corrected and the verdict changed accordingly as well.

Tags: