During his speech at the Parliament of Georgia, the Prime Minister of Georgia, Irakli Gharibashvili, stated that the external debt’s growth exceeded the economy’s growth from 2008 to 2012 and that 2013 was the only year when Georgia’s external debt decreased.

FactCheck verified the accuracy of the aforementioned statement.

A country’s external debt is its residents’ debt to other countries. Further, external debt is the sum of the debt’s basic amount plus the interest rate and includes not only the state’s external debt but that of the private sector as well. According to the National Bank of Georgia’s data, the country’s external debt amounted to USD 13,460 million at the end of 2014. Of this amount, USD 4,250 million (31.5%) was the government’s debt.

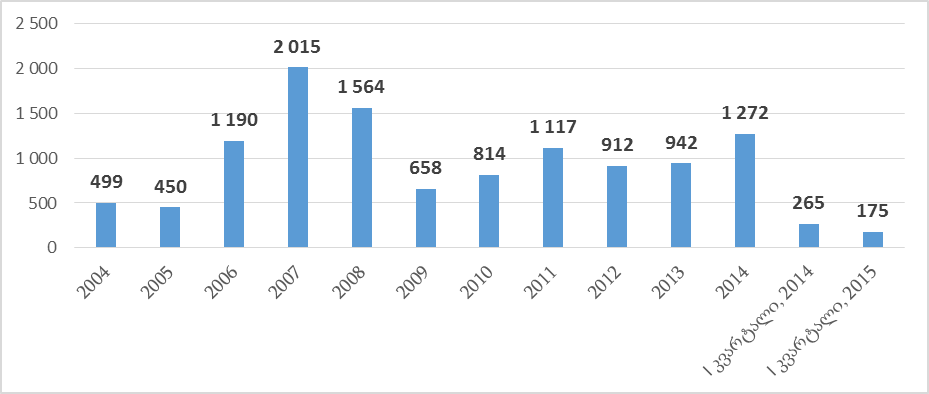

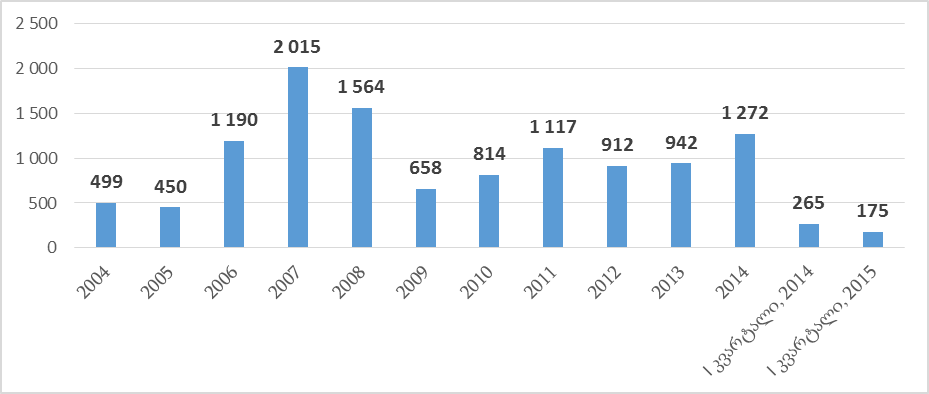

The external debt’s growth rate was indeed very high from 2008 to 2012 and exceeded the GDP’s growth rate (see Chart 1). Countries with developing economies take external debt as a first step towards funding their economic growth. Hence, the external debt’s growth rate can be higher than the GDP’s growth rate from the start. The external debt’s growth cannot be assessed negatively per se as it includes the government’s debt as well as the private sector’s debt and, hence, part of the money invested in the country by foreigners. The external debt’s growth in the private sector also means that the country’s economic activity is on the rise which positively influences the economy. It is essential for the external debt not to increase to a level that will cause a risk to a country’s financial stability.

Chart 1: Dynamics of Georgia’s External Debt and GDP from 2008 to 2014

Sources: National Bank of Georgia, National Statistics Office of Georgia

As the chart makes clear, the external debt’s growth rate significantly exceeded the economy’s growth rate in 2008 and 2009. In this period, Georgia’s economic growth rate decreased significantly due to the 2008 August war and the global financial crisis. In addition, the country was forced to take a large amount of external debt in order to deal with these crises.

The external debt’s growth in 2009 and 2010 was partly due to the influx of foreign direct investments (FDI). The amount of FDI decreased in 2012 and 2013.

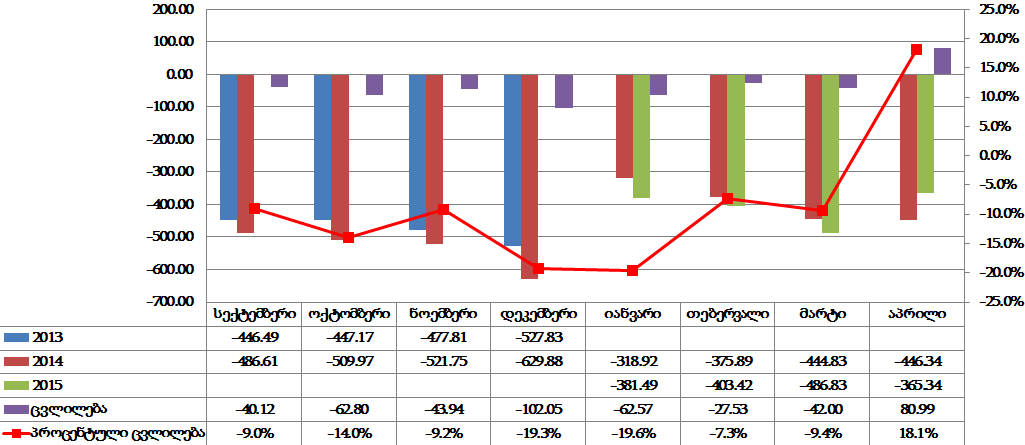

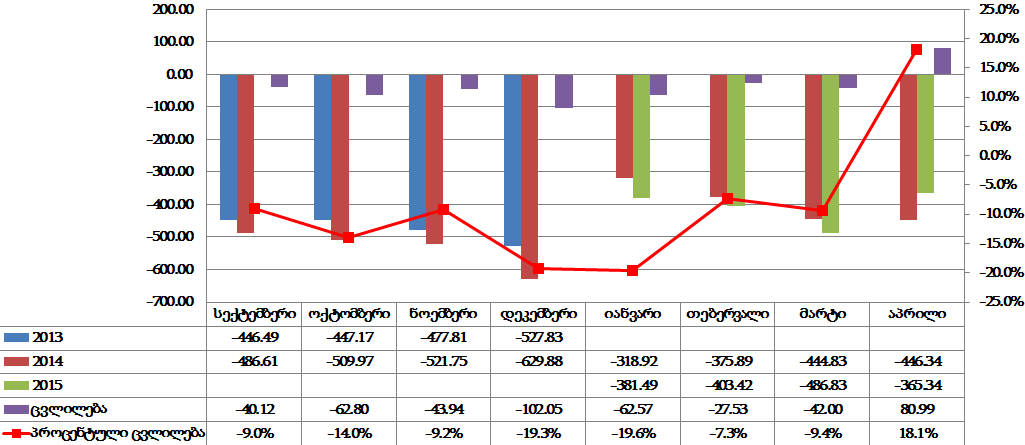

Chart 2: Overall External Debt, Government Debt and FDI Growth

Sources: National Bank of Georgia, National Statistics Office of Georgia

As the chart makes clear, the external debt’s growth rate significantly exceeded the economy’s growth rate in 2008 and 2009. In this period, Georgia’s economic growth rate decreased significantly due to the 2008 August war and the global financial crisis. In addition, the country was forced to take a large amount of external debt in order to deal with these crises.

The external debt’s growth in 2009 and 2010 was partly due to the influx of foreign direct investments (FDI). The amount of FDI decreased in 2012 and 2013.

Chart 2: Overall External Debt, Government Debt and FDI Growth

Source: National Bank of Georgia

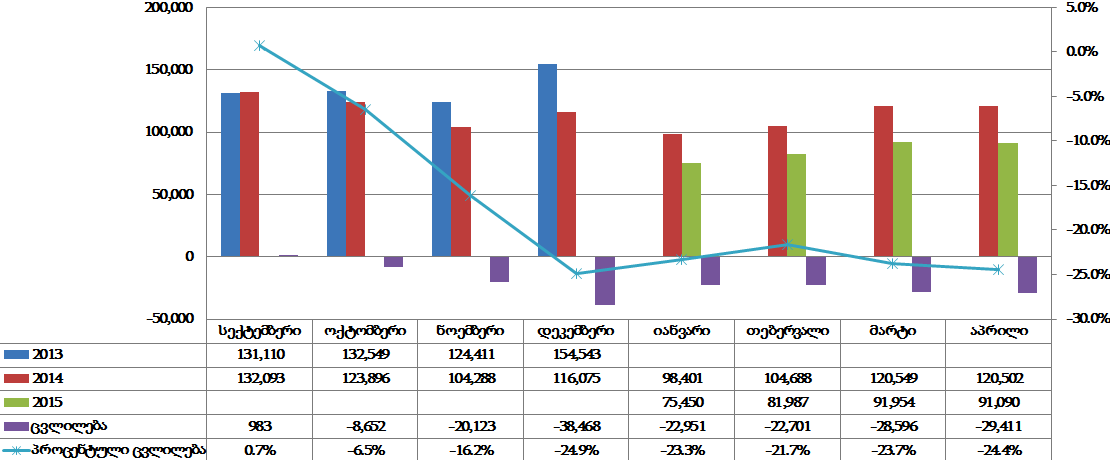

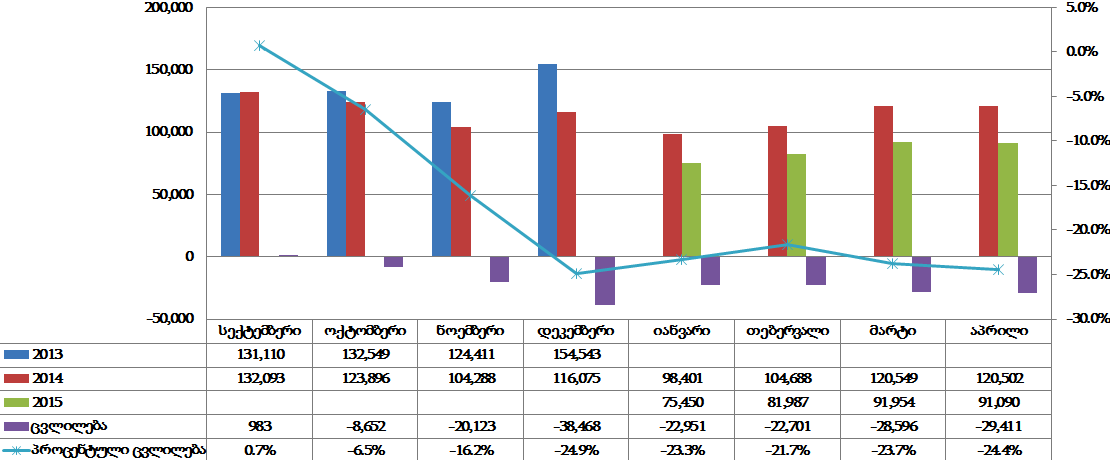

It is important to consider the rate of growth with regard to the GDP and exports, and not the nominal indicators of debt, in order to assess the actual amount of external debt. External debt is taken in foreign currencies which means that it requires foreign currencies to repay it as well. Export is one of the main sources for acquiring foreign currency. If we look at the share of external debt with regard to exports, we see that the exports of goods and services amounted to GEL 7,092 million in 2014 according to the data of the National Bank of Georgia. Hence, the percentage share of the external debt with regard to exports amounted to 190% (see Chart 2).

Chart 3: External Debt with Regard to GDP and Exports

Source: National Bank of Georgia

It is important to consider the rate of growth with regard to the GDP and exports, and not the nominal indicators of debt, in order to assess the actual amount of external debt. External debt is taken in foreign currencies which means that it requires foreign currencies to repay it as well. Export is one of the main sources for acquiring foreign currency. If we look at the share of external debt with regard to exports, we see that the exports of goods and services amounted to GEL 7,092 million in 2014 according to the data of the National Bank of Georgia. Hence, the percentage share of the external debt with regard to exports amounted to 190% (see Chart 2).

Chart 3: External Debt with Regard to GDP and Exports

Source: National Bank of Georgia

External debt with regard to export and the GDP increased from 2007 to 2009 but dropped again from 2010 to 2014.

If we compare the growth rates of the external debt and exports it becomes clear that the growth of exports was higher than that of the external debt, except in 2008 and 2009. This means that the country managed to attract currency resources in order to fund the external debt. Today, the lower economic growth and the trend of a reduction in exports negatively influence the country’s creditworthiness which has worsened Georgia’s positions in international credit ratings.

Georgia’s overall external debt amounted to USD 13,232 million in 2013 (USD 11 million less than in 2012; however, the amount of debt with regard to the GDP had increased due to the depreciation of GEL). Of this, the government’s debt dropped by USD 61 million as compared to 2012 and the National Bank of Georgia’s debt decreased by USD 244 million whilst the private sector’s debt increased by USD 294 million in 2013 as compared to 2012.

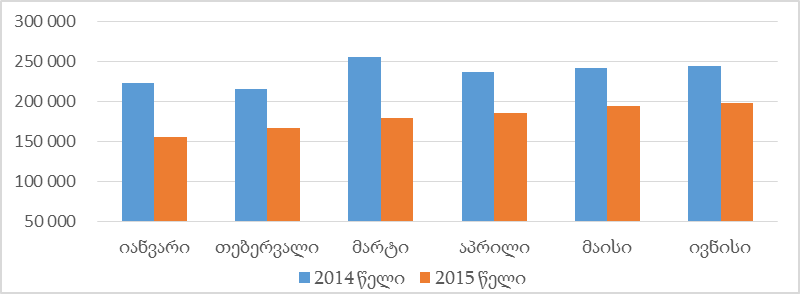

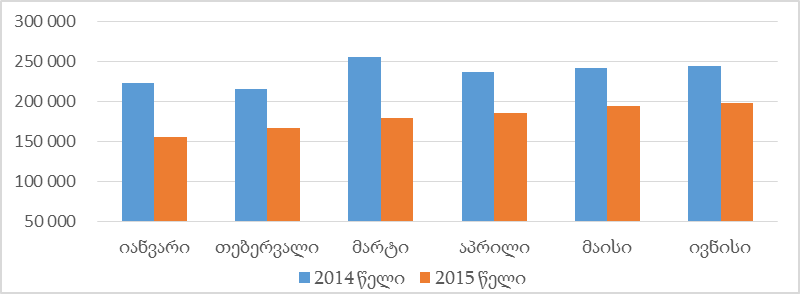

The Prime Minister’s statement that 2013 was the only year when the external debt decreased is inaccurate. Georgia’s overall external debt dropped by USD 9 million in 2000 as compared to the previous year, the government’s debt decreased by USD 39 million and the National Bank of Georgia’s debt went down by USD 44 million whilst the private sector’s debt increased by USD 74 million. The government’s external debt had a trend of decrease from 2004 to 2006 as well. Hence, 2013 was not the only year when the external debt decreased (see Chart 4).

Chart 4: Growth Rate of Overall and Government External Debts from 2004 to 2014

Source: National Bank of Georgia

External debt with regard to export and the GDP increased from 2007 to 2009 but dropped again from 2010 to 2014.

If we compare the growth rates of the external debt and exports it becomes clear that the growth of exports was higher than that of the external debt, except in 2008 and 2009. This means that the country managed to attract currency resources in order to fund the external debt. Today, the lower economic growth and the trend of a reduction in exports negatively influence the country’s creditworthiness which has worsened Georgia’s positions in international credit ratings.

Georgia’s overall external debt amounted to USD 13,232 million in 2013 (USD 11 million less than in 2012; however, the amount of debt with regard to the GDP had increased due to the depreciation of GEL). Of this, the government’s debt dropped by USD 61 million as compared to 2012 and the National Bank of Georgia’s debt decreased by USD 244 million whilst the private sector’s debt increased by USD 294 million in 2013 as compared to 2012.

The Prime Minister’s statement that 2013 was the only year when the external debt decreased is inaccurate. Georgia’s overall external debt dropped by USD 9 million in 2000 as compared to the previous year, the government’s debt decreased by USD 39 million and the National Bank of Georgia’s debt went down by USD 44 million whilst the private sector’s debt increased by USD 74 million. The government’s external debt had a trend of decrease from 2004 to 2006 as well. Hence, 2013 was not the only year when the external debt decreased (see Chart 4).

Chart 4: Growth Rate of Overall and Government External Debts from 2004 to 2014

Source: National Bank of Georgia

Georgia’s overall external debt increased by USD 228 million in 2014. This includes the growth of the government’s debt by USD 65 million and the decrease in the National Bank of Georgia’s debt by USD 86 million. Hence, it is unclear why the Prime Minister speaks about 2013’s data when 2014’s figures are already available and show the opposite trend. In addition, it should be pointed out that the decrease in the government’s debt in 2013 was not the result of a pre-planned policy but was mainly due to the failure to use up allocated credits. The government implemented the annual foreign credit attraction plan by 82% but failed to use up about GEL 130 million (USD 75 million) of credits. This sum was mainly allocated for infrastructural projects. In the case of having used this money, both the government debt and the country’s overall external debt would have increased in 2013.

Conclusion

The growth rate of Georgia’s external debt did indeed exceed the economy’s growth rate from 2008 to 2012 whilst it was lower than the economy’s growth rate in 2013 and 2014 despite the fact that the economic growth rate also decreased.

In addition, Georgia’s overall external debt decreased by USD 11 million whilst the government’s debt dropped by USD 61 million. However, it should be pointed out that 2013 is not the only year when the external debt (both the government’s debt as well as the overall external debt) went down. The overall external debt decreased slightly in 2000 as well. In addition, despite the fact that the external debt in absolute terms went down in 2013, it increased with regard to the GDP due to the depreciation of GEL.

The Prime Minister speaks about 2013’s data in the spring of 2015 despite the fact that 2014’s data are already available. Georgia’s overall external debt increased by USD 228 million in 2014 although the drop in the country’s external debt which occurred in 2013 was not the result of a pre-planned policy. The government failed to use up the allocated foreign credits and so the external debt did not increase due to this fact. The failure to use the aforementioned credits negatively influenced the development rate of the country’s infrastructure and the influx of foreign currencies.

FactCheck concludes that Irakli Gharibashvili’s statement is MOSTLY FALSE.

Source: National Bank of Georgia

Georgia’s overall external debt increased by USD 228 million in 2014. This includes the growth of the government’s debt by USD 65 million and the decrease in the National Bank of Georgia’s debt by USD 86 million. Hence, it is unclear why the Prime Minister speaks about 2013’s data when 2014’s figures are already available and show the opposite trend. In addition, it should be pointed out that the decrease in the government’s debt in 2013 was not the result of a pre-planned policy but was mainly due to the failure to use up allocated credits. The government implemented the annual foreign credit attraction plan by 82% but failed to use up about GEL 130 million (USD 75 million) of credits. This sum was mainly allocated for infrastructural projects. In the case of having used this money, both the government debt and the country’s overall external debt would have increased in 2013.

Conclusion

The growth rate of Georgia’s external debt did indeed exceed the economy’s growth rate from 2008 to 2012 whilst it was lower than the economy’s growth rate in 2013 and 2014 despite the fact that the economic growth rate also decreased.

In addition, Georgia’s overall external debt decreased by USD 11 million whilst the government’s debt dropped by USD 61 million. However, it should be pointed out that 2013 is not the only year when the external debt (both the government’s debt as well as the overall external debt) went down. The overall external debt decreased slightly in 2000 as well. In addition, despite the fact that the external debt in absolute terms went down in 2013, it increased with regard to the GDP due to the depreciation of GEL.

The Prime Minister speaks about 2013’s data in the spring of 2015 despite the fact that 2014’s data are already available. Georgia’s overall external debt increased by USD 228 million in 2014 although the drop in the country’s external debt which occurred in 2013 was not the result of a pre-planned policy. The government failed to use up the allocated foreign credits and so the external debt did not increase due to this fact. The failure to use the aforementioned credits negatively influenced the development rate of the country’s infrastructure and the influx of foreign currencies.

FactCheck concludes that Irakli Gharibashvili’s statement is MOSTLY FALSE.

Sources: National Bank of Georgia, National Statistics Office of Georgia

As the chart makes clear, the external debt’s growth rate significantly exceeded the economy’s growth rate in 2008 and 2009. In this period, Georgia’s economic growth rate decreased significantly due to the 2008 August war and the global financial crisis. In addition, the country was forced to take a large amount of external debt in order to deal with these crises.

The external debt’s growth in 2009 and 2010 was partly due to the influx of foreign direct investments (FDI). The amount of FDI decreased in 2012 and 2013.

Chart 2: Overall External Debt, Government Debt and FDI Growth

Sources: National Bank of Georgia, National Statistics Office of Georgia

As the chart makes clear, the external debt’s growth rate significantly exceeded the economy’s growth rate in 2008 and 2009. In this period, Georgia’s economic growth rate decreased significantly due to the 2008 August war and the global financial crisis. In addition, the country was forced to take a large amount of external debt in order to deal with these crises.

The external debt’s growth in 2009 and 2010 was partly due to the influx of foreign direct investments (FDI). The amount of FDI decreased in 2012 and 2013.

Chart 2: Overall External Debt, Government Debt and FDI Growth

Source: National Bank of Georgia

It is important to consider the rate of growth with regard to the GDP and exports, and not the nominal indicators of debt, in order to assess the actual amount of external debt. External debt is taken in foreign currencies which means that it requires foreign currencies to repay it as well. Export is one of the main sources for acquiring foreign currency. If we look at the share of external debt with regard to exports, we see that the exports of goods and services amounted to GEL 7,092 million in 2014 according to the data of the National Bank of Georgia. Hence, the percentage share of the external debt with regard to exports amounted to 190% (see Chart 2).

Chart 3: External Debt with Regard to GDP and Exports

Source: National Bank of Georgia

It is important to consider the rate of growth with regard to the GDP and exports, and not the nominal indicators of debt, in order to assess the actual amount of external debt. External debt is taken in foreign currencies which means that it requires foreign currencies to repay it as well. Export is one of the main sources for acquiring foreign currency. If we look at the share of external debt with regard to exports, we see that the exports of goods and services amounted to GEL 7,092 million in 2014 according to the data of the National Bank of Georgia. Hence, the percentage share of the external debt with regard to exports amounted to 190% (see Chart 2).

Chart 3: External Debt with Regard to GDP and Exports

Source: National Bank of Georgia

External debt with regard to export and the GDP increased from 2007 to 2009 but dropped again from 2010 to 2014.

If we compare the growth rates of the external debt and exports it becomes clear that the growth of exports was higher than that of the external debt, except in 2008 and 2009. This means that the country managed to attract currency resources in order to fund the external debt. Today, the lower economic growth and the trend of a reduction in exports negatively influence the country’s creditworthiness which has worsened Georgia’s positions in international credit ratings.

Georgia’s overall external debt amounted to USD 13,232 million in 2013 (USD 11 million less than in 2012; however, the amount of debt with regard to the GDP had increased due to the depreciation of GEL). Of this, the government’s debt dropped by USD 61 million as compared to 2012 and the National Bank of Georgia’s debt decreased by USD 244 million whilst the private sector’s debt increased by USD 294 million in 2013 as compared to 2012.

The Prime Minister’s statement that 2013 was the only year when the external debt decreased is inaccurate. Georgia’s overall external debt dropped by USD 9 million in 2000 as compared to the previous year, the government’s debt decreased by USD 39 million and the National Bank of Georgia’s debt went down by USD 44 million whilst the private sector’s debt increased by USD 74 million. The government’s external debt had a trend of decrease from 2004 to 2006 as well. Hence, 2013 was not the only year when the external debt decreased (see Chart 4).

Chart 4: Growth Rate of Overall and Government External Debts from 2004 to 2014

Source: National Bank of Georgia

External debt with regard to export and the GDP increased from 2007 to 2009 but dropped again from 2010 to 2014.

If we compare the growth rates of the external debt and exports it becomes clear that the growth of exports was higher than that of the external debt, except in 2008 and 2009. This means that the country managed to attract currency resources in order to fund the external debt. Today, the lower economic growth and the trend of a reduction in exports negatively influence the country’s creditworthiness which has worsened Georgia’s positions in international credit ratings.

Georgia’s overall external debt amounted to USD 13,232 million in 2013 (USD 11 million less than in 2012; however, the amount of debt with regard to the GDP had increased due to the depreciation of GEL). Of this, the government’s debt dropped by USD 61 million as compared to 2012 and the National Bank of Georgia’s debt decreased by USD 244 million whilst the private sector’s debt increased by USD 294 million in 2013 as compared to 2012.

The Prime Minister’s statement that 2013 was the only year when the external debt decreased is inaccurate. Georgia’s overall external debt dropped by USD 9 million in 2000 as compared to the previous year, the government’s debt decreased by USD 39 million and the National Bank of Georgia’s debt went down by USD 44 million whilst the private sector’s debt increased by USD 74 million. The government’s external debt had a trend of decrease from 2004 to 2006 as well. Hence, 2013 was not the only year when the external debt decreased (see Chart 4).

Chart 4: Growth Rate of Overall and Government External Debts from 2004 to 2014

Source: National Bank of Georgia

Georgia’s overall external debt increased by USD 228 million in 2014. This includes the growth of the government’s debt by USD 65 million and the decrease in the National Bank of Georgia’s debt by USD 86 million. Hence, it is unclear why the Prime Minister speaks about 2013’s data when 2014’s figures are already available and show the opposite trend. In addition, it should be pointed out that the decrease in the government’s debt in 2013 was not the result of a pre-planned policy but was mainly due to the failure to use up allocated credits. The government implemented the annual foreign credit attraction plan by 82% but failed to use up about GEL 130 million (USD 75 million) of credits. This sum was mainly allocated for infrastructural projects. In the case of having used this money, both the government debt and the country’s overall external debt would have increased in 2013.

Conclusion

The growth rate of Georgia’s external debt did indeed exceed the economy’s growth rate from 2008 to 2012 whilst it was lower than the economy’s growth rate in 2013 and 2014 despite the fact that the economic growth rate also decreased.

In addition, Georgia’s overall external debt decreased by USD 11 million whilst the government’s debt dropped by USD 61 million. However, it should be pointed out that 2013 is not the only year when the external debt (both the government’s debt as well as the overall external debt) went down. The overall external debt decreased slightly in 2000 as well. In addition, despite the fact that the external debt in absolute terms went down in 2013, it increased with regard to the GDP due to the depreciation of GEL.

The Prime Minister speaks about 2013’s data in the spring of 2015 despite the fact that 2014’s data are already available. Georgia’s overall external debt increased by USD 228 million in 2014 although the drop in the country’s external debt which occurred in 2013 was not the result of a pre-planned policy. The government failed to use up the allocated foreign credits and so the external debt did not increase due to this fact. The failure to use the aforementioned credits negatively influenced the development rate of the country’s infrastructure and the influx of foreign currencies.

FactCheck concludes that Irakli Gharibashvili’s statement is MOSTLY FALSE.

Source: National Bank of Georgia

Georgia’s overall external debt increased by USD 228 million in 2014. This includes the growth of the government’s debt by USD 65 million and the decrease in the National Bank of Georgia’s debt by USD 86 million. Hence, it is unclear why the Prime Minister speaks about 2013’s data when 2014’s figures are already available and show the opposite trend. In addition, it should be pointed out that the decrease in the government’s debt in 2013 was not the result of a pre-planned policy but was mainly due to the failure to use up allocated credits. The government implemented the annual foreign credit attraction plan by 82% but failed to use up about GEL 130 million (USD 75 million) of credits. This sum was mainly allocated for infrastructural projects. In the case of having used this money, both the government debt and the country’s overall external debt would have increased in 2013.

Conclusion

The growth rate of Georgia’s external debt did indeed exceed the economy’s growth rate from 2008 to 2012 whilst it was lower than the economy’s growth rate in 2013 and 2014 despite the fact that the economic growth rate also decreased.

In addition, Georgia’s overall external debt decreased by USD 11 million whilst the government’s debt dropped by USD 61 million. However, it should be pointed out that 2013 is not the only year when the external debt (both the government’s debt as well as the overall external debt) went down. The overall external debt decreased slightly in 2000 as well. In addition, despite the fact that the external debt in absolute terms went down in 2013, it increased with regard to the GDP due to the depreciation of GEL.

The Prime Minister speaks about 2013’s data in the spring of 2015 despite the fact that 2014’s data are already available. Georgia’s overall external debt increased by USD 228 million in 2014 although the drop in the country’s external debt which occurred in 2013 was not the result of a pre-planned policy. The government failed to use up the allocated foreign credits and so the external debt did not increase due to this fact. The failure to use the aforementioned credits negatively influenced the development rate of the country’s infrastructure and the influx of foreign currencies.

FactCheck concludes that Irakli Gharibashvili’s statement is MOSTLY FALSE.

Tags: