On 30 April 2015, at a conference organised by Citizen and Society 2030, a non-governmental organisation, the former Prime Minister of Georgia, Bidzina Ivanishvili, stated that Nodar Javakhishvili was the only person during the presidency of Mr Shevardnadze who fought for the stability of the national currency and managed to achieve it.

FactCheck looked into the accuracy of this statement.

The official status of the National Bank of Georgia is determined by the Constitution of Georgia. According to Point One of Article 95 of the Constitution, "The National Bank of Georgia conducts the monetary policy of the country in order to maintain the stability of prices and facilitate the stable functioning of the financial sector." Hence, the main goal of the National Bank of Georgia is to ensure the stability of prices and not to control the exchange rate of the national currency. Georgia has a floating currency exchange rate which means that the exchange rate is regulated based upon the demand and supply on USD on the currency market.

Nodar Javakhishvili held the position of the President of the National Bank of Georgia from October 1993 to March 1998. The coupon was the main exchange mechanism in Georgia from 29 April 1993 to 6 October 1995. Based upon the decision of the Government of Georgia, it became the only payment mechanism from 3 August 1993. The value of 1 coupon was RUB 1. Given the fact that there was hyperinflation in Russia, the value of USD 1 was about 5,000 coupons.

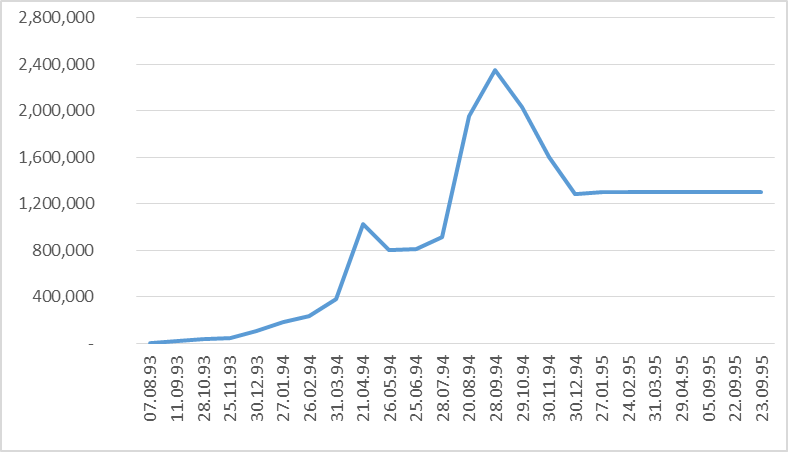

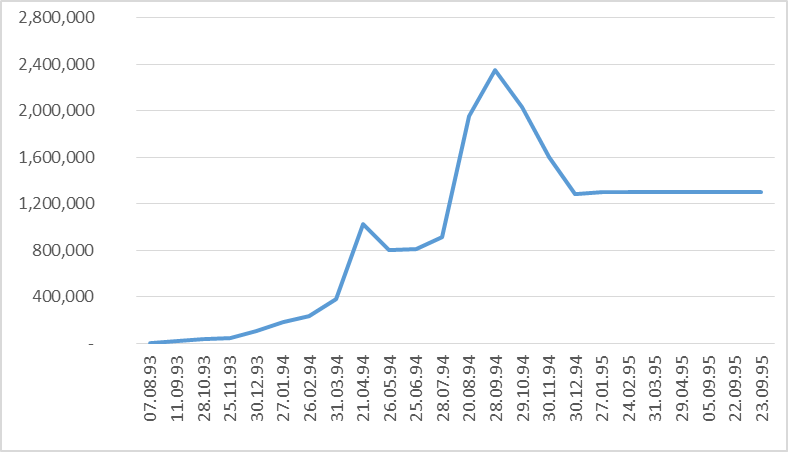

According to the statistical data on the website of the National Bank of Georgia, the value of USD 1 amounted to 5,690 coupons on 7 August 1993. The coupon had depreciated by 1,700% by the end of 1993 and the value of USD 1 reached 102,300 coupons.

Graph 1: Exchange Rate of USD with Regard to the Georgian Coupon from 1993 to 1995

The exchange rate of the coupon with regard to USD 1 had reached 2.4 million by 20 September 1994, depreciating by 42,000% as compared to 7 August 1993. From September 1994, the coupon started to strengthen with regard to USD and held the value of 1.3 million for nine months until 1995 which was mainly due to the USD 27 million allocated by the International Monetary Fund for creating the currency reserves. In total, the coupon saw a 22,800% depreciation with regard to USD from 1993 to 1995.

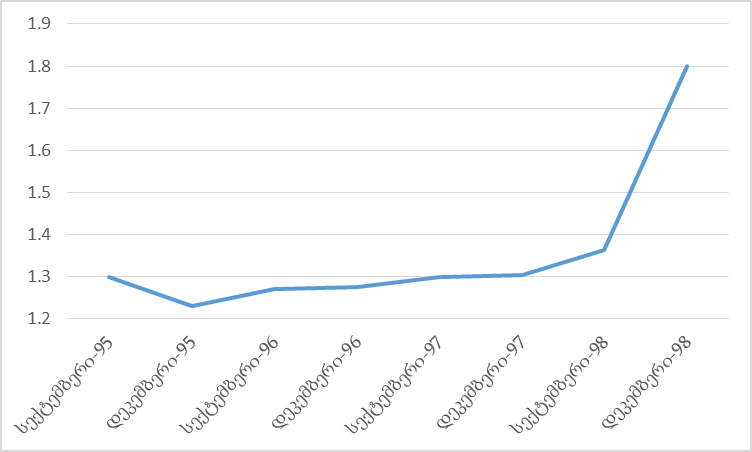

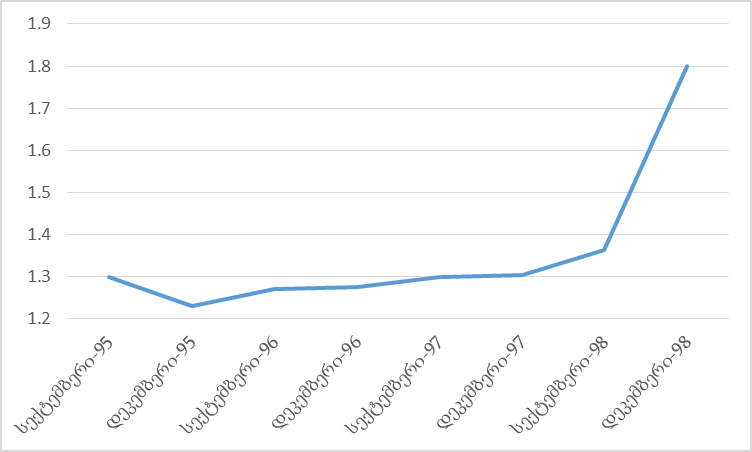

GEL became the official exchange mechanism of Georgia on 25 September 1995 and its exchange rate to USD was set at 1.3 (six zeros off the coupon exchange rate). Due to the currency reserves, the exchange rate of GEL with regard to USD revolved around 1.3 for two years.

Graph 2: Exchange Rate of GEL with Regard to USD from 1995 to 1998

The exchange rate of the coupon with regard to USD 1 had reached 2.4 million by 20 September 1994, depreciating by 42,000% as compared to 7 August 1993. From September 1994, the coupon started to strengthen with regard to USD and held the value of 1.3 million for nine months until 1995 which was mainly due to the USD 27 million allocated by the International Monetary Fund for creating the currency reserves. In total, the coupon saw a 22,800% depreciation with regard to USD from 1993 to 1995.

GEL became the official exchange mechanism of Georgia on 25 September 1995 and its exchange rate to USD was set at 1.3 (six zeros off the coupon exchange rate). Due to the currency reserves, the exchange rate of GEL with regard to USD revolved around 1.3 for two years.

Graph 2: Exchange Rate of GEL with Regard to USD from 1995 to 1998

The exchange rate of GEL with regard to USD depreciated by 39% from the beginning to the end of 1998 and reached 1.8. This depreciation was mainly due to the financial crisis in Asia which greatly affected our region as well. Nodar Javakhishvili held the position of the President of the National Bank of Georgia until March 1998. The exchange rate of GEL with regard to USD was 1.335 at the end of March of that year and had the trend of depreciation.

There was hyperinflation in Georgia from 1993 to 1996. The highest rates of inflation were recorded in 1993 with 7,488% and in 1994 with 6,474%. In September 1996, one year after the introduction of GEL, the annual inflation constituted 49.6%. This indicator went down to 36.3% in January 1997 whilst in January 1998 it decreased even further to 6.7%.

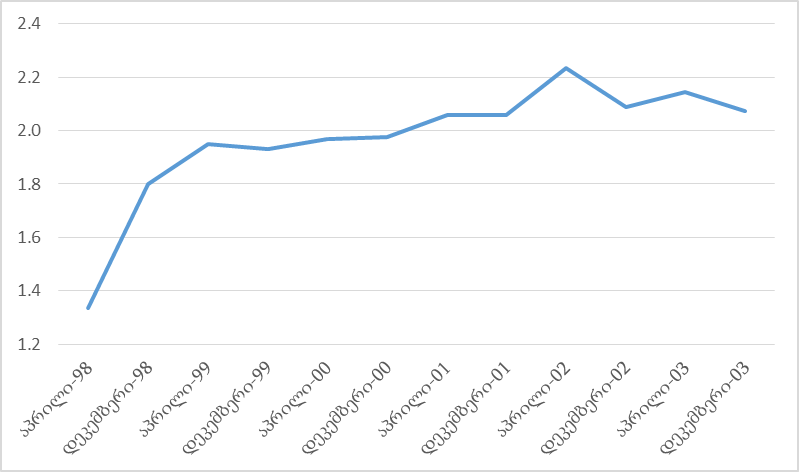

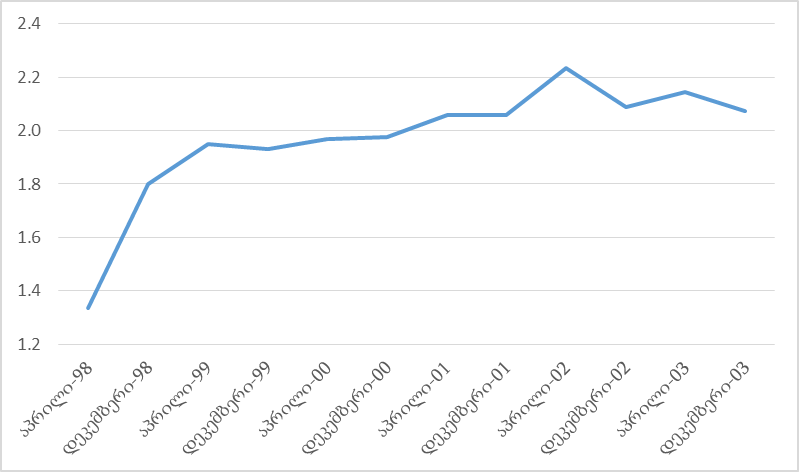

Graph 3: Exchange Rate of GEL with Regard to USD from 1998 to 2003

The exchange rate of GEL with regard to USD depreciated by 39% from the beginning to the end of 1998 and reached 1.8. This depreciation was mainly due to the financial crisis in Asia which greatly affected our region as well. Nodar Javakhishvili held the position of the President of the National Bank of Georgia until March 1998. The exchange rate of GEL with regard to USD was 1.335 at the end of March of that year and had the trend of depreciation.

There was hyperinflation in Georgia from 1993 to 1996. The highest rates of inflation were recorded in 1993 with 7,488% and in 1994 with 6,474%. In September 1996, one year after the introduction of GEL, the annual inflation constituted 49.6%. This indicator went down to 36.3% in January 1997 whilst in January 1998 it decreased even further to 6.7%.

Graph 3: Exchange Rate of GEL with Regard to USD from 1998 to 2003

It should also be noted that the exchange rate of GEL with regard to USD was higher than 2 in the first quarter of 1999. The exchange rate of our national currency was relatively stable from April 1999 to December 2004 and varied from 1.93 to 2.18. Irakli Managadze was the President of the National Bank of Georgia at the time.

Conclusion

According to the Constitution of Georgia, the main goal of the National Bank of Georgia is to maintain the stability of prices, not the exchange rate of the national currency.

The coupon was introduced as the exchange mechanism in Georgia in 1993. In the period when Nodar Javakhishvili was the President of the National Bank of Georgia (from October 1993 to March 1998), the exchange rate of the coupon with regard to USD depreciated by 22,800% from 1993 to 1995. In 1995, during the last nine months of the existence of the coupon, its exchange rate with regard to USD stabilised at 1.3 million which can be attributed to the fact that the International Monetary Fund allocated USD 27 million in order for Georgia to create currency reserves.

GEL was introduced in 1995 and its exchange rate with regard to USD was set at 1.3. The exchange rate of GEL with regard to USD depreciated by 39% from the beginning to the end of 1998 and reached 1.8. The exchange rate of GEL was 1.335 during the presidency of Nodar Javakhishvili; however, the trend of depreciation was already noticeable. There was hyperinflation in Georgia from 1993 to 1996. The highest rates of inflation were recorded in 1993 and 1994. Georgia’s national currency had two-digit inflation rates after the introduction of GEL; however, these figures decreased to 6.7% in January 1998 (in the period when Nodar Javakhishvili was the President of the National Bank of Georgia). The exchange rate was stable from 1999 to 2003 when it varied from 1.93 to 2.16. Irakli Managadze was the President of the National Bank of Georgia at the time.

FactCheck believes that it is incorrect to assess the influence of just one person upon a complex process such as the stability of the national currency. This is a difficult and multi-component process influenced by various factors and institutions and not by specific persons. Hence, in the given case FactCheck limits its study to analysis alone and refrains from giving a verdict to Bidzina Ivanishvili’s statement.

It should also be noted that the exchange rate of GEL with regard to USD was higher than 2 in the first quarter of 1999. The exchange rate of our national currency was relatively stable from April 1999 to December 2004 and varied from 1.93 to 2.18. Irakli Managadze was the President of the National Bank of Georgia at the time.

Conclusion

According to the Constitution of Georgia, the main goal of the National Bank of Georgia is to maintain the stability of prices, not the exchange rate of the national currency.

The coupon was introduced as the exchange mechanism in Georgia in 1993. In the period when Nodar Javakhishvili was the President of the National Bank of Georgia (from October 1993 to March 1998), the exchange rate of the coupon with regard to USD depreciated by 22,800% from 1993 to 1995. In 1995, during the last nine months of the existence of the coupon, its exchange rate with regard to USD stabilised at 1.3 million which can be attributed to the fact that the International Monetary Fund allocated USD 27 million in order for Georgia to create currency reserves.

GEL was introduced in 1995 and its exchange rate with regard to USD was set at 1.3. The exchange rate of GEL with regard to USD depreciated by 39% from the beginning to the end of 1998 and reached 1.8. The exchange rate of GEL was 1.335 during the presidency of Nodar Javakhishvili; however, the trend of depreciation was already noticeable. There was hyperinflation in Georgia from 1993 to 1996. The highest rates of inflation were recorded in 1993 and 1994. Georgia’s national currency had two-digit inflation rates after the introduction of GEL; however, these figures decreased to 6.7% in January 1998 (in the period when Nodar Javakhishvili was the President of the National Bank of Georgia). The exchange rate was stable from 1999 to 2003 when it varied from 1.93 to 2.16. Irakli Managadze was the President of the National Bank of Georgia at the time.

FactCheck believes that it is incorrect to assess the influence of just one person upon a complex process such as the stability of the national currency. This is a difficult and multi-component process influenced by various factors and institutions and not by specific persons. Hence, in the given case FactCheck limits its study to analysis alone and refrains from giving a verdict to Bidzina Ivanishvili’s statement.

The exchange rate of the coupon with regard to USD 1 had reached 2.4 million by 20 September 1994, depreciating by 42,000% as compared to 7 August 1993. From September 1994, the coupon started to strengthen with regard to USD and held the value of 1.3 million for nine months until 1995 which was mainly due to the USD 27 million allocated by the International Monetary Fund for creating the currency reserves. In total, the coupon saw a 22,800% depreciation with regard to USD from 1993 to 1995.

GEL became the official exchange mechanism of Georgia on 25 September 1995 and its exchange rate to USD was set at 1.3 (six zeros off the coupon exchange rate). Due to the currency reserves, the exchange rate of GEL with regard to USD revolved around 1.3 for two years.

Graph 2: Exchange Rate of GEL with Regard to USD from 1995 to 1998

The exchange rate of the coupon with regard to USD 1 had reached 2.4 million by 20 September 1994, depreciating by 42,000% as compared to 7 August 1993. From September 1994, the coupon started to strengthen with regard to USD and held the value of 1.3 million for nine months until 1995 which was mainly due to the USD 27 million allocated by the International Monetary Fund for creating the currency reserves. In total, the coupon saw a 22,800% depreciation with regard to USD from 1993 to 1995.

GEL became the official exchange mechanism of Georgia on 25 September 1995 and its exchange rate to USD was set at 1.3 (six zeros off the coupon exchange rate). Due to the currency reserves, the exchange rate of GEL with regard to USD revolved around 1.3 for two years.

Graph 2: Exchange Rate of GEL with Regard to USD from 1995 to 1998

The exchange rate of GEL with regard to USD depreciated by 39% from the beginning to the end of 1998 and reached 1.8. This depreciation was mainly due to the financial crisis in Asia which greatly affected our region as well. Nodar Javakhishvili held the position of the President of the National Bank of Georgia until March 1998. The exchange rate of GEL with regard to USD was 1.335 at the end of March of that year and had the trend of depreciation.

There was hyperinflation in Georgia from 1993 to 1996. The highest rates of inflation were recorded in 1993 with 7,488% and in 1994 with 6,474%. In September 1996, one year after the introduction of GEL, the annual inflation constituted 49.6%. This indicator went down to 36.3% in January 1997 whilst in January 1998 it decreased even further to 6.7%.

Graph 3: Exchange Rate of GEL with Regard to USD from 1998 to 2003

The exchange rate of GEL with regard to USD depreciated by 39% from the beginning to the end of 1998 and reached 1.8. This depreciation was mainly due to the financial crisis in Asia which greatly affected our region as well. Nodar Javakhishvili held the position of the President of the National Bank of Georgia until March 1998. The exchange rate of GEL with regard to USD was 1.335 at the end of March of that year and had the trend of depreciation.

There was hyperinflation in Georgia from 1993 to 1996. The highest rates of inflation were recorded in 1993 with 7,488% and in 1994 with 6,474%. In September 1996, one year after the introduction of GEL, the annual inflation constituted 49.6%. This indicator went down to 36.3% in January 1997 whilst in January 1998 it decreased even further to 6.7%.

Graph 3: Exchange Rate of GEL with Regard to USD from 1998 to 2003

It should also be noted that the exchange rate of GEL with regard to USD was higher than 2 in the first quarter of 1999. The exchange rate of our national currency was relatively stable from April 1999 to December 2004 and varied from 1.93 to 2.18. Irakli Managadze was the President of the National Bank of Georgia at the time.

Conclusion

According to the Constitution of Georgia, the main goal of the National Bank of Georgia is to maintain the stability of prices, not the exchange rate of the national currency.

The coupon was introduced as the exchange mechanism in Georgia in 1993. In the period when Nodar Javakhishvili was the President of the National Bank of Georgia (from October 1993 to March 1998), the exchange rate of the coupon with regard to USD depreciated by 22,800% from 1993 to 1995. In 1995, during the last nine months of the existence of the coupon, its exchange rate with regard to USD stabilised at 1.3 million which can be attributed to the fact that the International Monetary Fund allocated USD 27 million in order for Georgia to create currency reserves.

GEL was introduced in 1995 and its exchange rate with regard to USD was set at 1.3. The exchange rate of GEL with regard to USD depreciated by 39% from the beginning to the end of 1998 and reached 1.8. The exchange rate of GEL was 1.335 during the presidency of Nodar Javakhishvili; however, the trend of depreciation was already noticeable. There was hyperinflation in Georgia from 1993 to 1996. The highest rates of inflation were recorded in 1993 and 1994. Georgia’s national currency had two-digit inflation rates after the introduction of GEL; however, these figures decreased to 6.7% in January 1998 (in the period when Nodar Javakhishvili was the President of the National Bank of Georgia). The exchange rate was stable from 1999 to 2003 when it varied from 1.93 to 2.16. Irakli Managadze was the President of the National Bank of Georgia at the time.

FactCheck believes that it is incorrect to assess the influence of just one person upon a complex process such as the stability of the national currency. This is a difficult and multi-component process influenced by various factors and institutions and not by specific persons. Hence, in the given case FactCheck limits its study to analysis alone and refrains from giving a verdict to Bidzina Ivanishvili’s statement.

It should also be noted that the exchange rate of GEL with regard to USD was higher than 2 in the first quarter of 1999. The exchange rate of our national currency was relatively stable from April 1999 to December 2004 and varied from 1.93 to 2.18. Irakli Managadze was the President of the National Bank of Georgia at the time.

Conclusion

According to the Constitution of Georgia, the main goal of the National Bank of Georgia is to maintain the stability of prices, not the exchange rate of the national currency.

The coupon was introduced as the exchange mechanism in Georgia in 1993. In the period when Nodar Javakhishvili was the President of the National Bank of Georgia (from October 1993 to March 1998), the exchange rate of the coupon with regard to USD depreciated by 22,800% from 1993 to 1995. In 1995, during the last nine months of the existence of the coupon, its exchange rate with regard to USD stabilised at 1.3 million which can be attributed to the fact that the International Monetary Fund allocated USD 27 million in order for Georgia to create currency reserves.

GEL was introduced in 1995 and its exchange rate with regard to USD was set at 1.3. The exchange rate of GEL with regard to USD depreciated by 39% from the beginning to the end of 1998 and reached 1.8. The exchange rate of GEL was 1.335 during the presidency of Nodar Javakhishvili; however, the trend of depreciation was already noticeable. There was hyperinflation in Georgia from 1993 to 1996. The highest rates of inflation were recorded in 1993 and 1994. Georgia’s national currency had two-digit inflation rates after the introduction of GEL; however, these figures decreased to 6.7% in January 1998 (in the period when Nodar Javakhishvili was the President of the National Bank of Georgia). The exchange rate was stable from 1999 to 2003 when it varied from 1.93 to 2.16. Irakli Managadze was the President of the National Bank of Georgia at the time.

FactCheck believes that it is incorrect to assess the influence of just one person upon a complex process such as the stability of the national currency. This is a difficult and multi-component process influenced by various factors and institutions and not by specific persons. Hence, in the given case FactCheck limits its study to analysis alone and refrains from giving a verdict to Bidzina Ivanishvili’s statement.

Tags: