On 30 January 2015, in terms of FactCheck’s Check Your Fact service, our reader, Sandro Arsoshvili, asked us to verify the accuracy of a statement made by the Prime Minister of Georgia, Irakli Gharibashvili.

According to the statement, the main reason for the depreciation of GEL is the global strengthening of USD. It also points out that despite the on-going global processes GEL is still one of the strongest currencies with regard to USD. The Prime Minister also points out that despite the depreciation of the national currency, Georgia’s financial stability is not at risk and the depreciation will not cause a significant rise in prices.

FactCheck verified the accuracy of the aforementioned statement.

In 2014, USD did, indeed, strengthen globally due to the high growth rate of the US economy and stricter monetary policies. The strengthening of USD had different effects upon different currencies as a currency exchange rate is influenced by various factors such as the monetary policy of the country and the condition of its economy.

RUB, UAH (Ukrainian hryvnia) and BYR (Belorussian rouble) saw the biggest depreciation with regard to USD. The conflict between Russia and Ukraine and the subsequent sanctions against Russia brought the country to economic crisis which influenced RUB as well. The situation in Russia had a negative effect upon its trading partners, including Belarus. The crisis in Russia and the global decrease in oil prices also caused the Kazakhstani KZT (tenge) to depreciate by 19%.

EUR depreciated by 20% with regard to USD and this was facilitated by the monetary policy of the European Central Bank. The depreciation of EUR causes the prices of European goods to decrease and facilitates the growth of export. Hence, in order to facilitate the growth of the European economy and export, the monetary policy of the European Central Bank was aimed to depreciate EUR.

It should be pointed out that a number of countries, including the Czech Republic, Hungary, Croatia and Bulgaria, have their national currencies tied to EUR. Hence, the depreciation of EUR with regard to USD influenced the currencies of these countries as well.

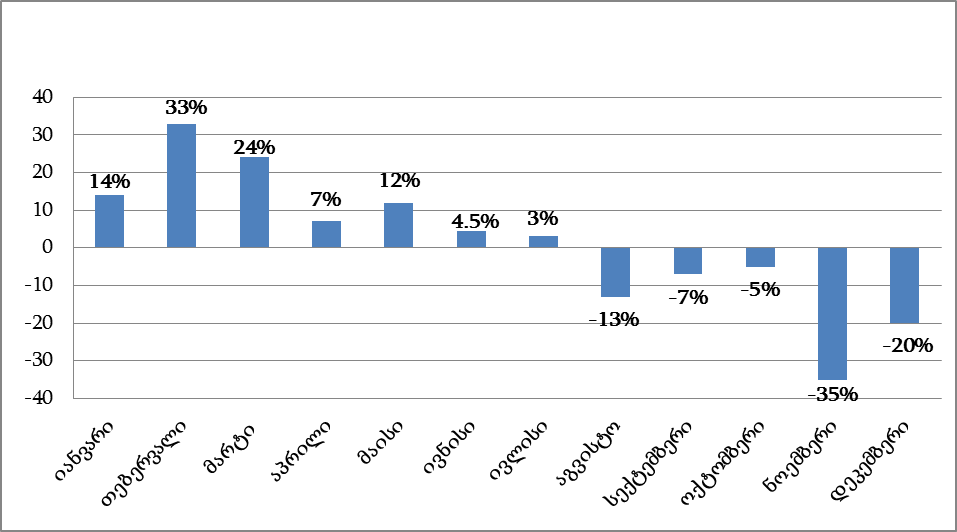

Chart 1: Changes in various currencies of the world with regard to USD (27.01.2014 – 27.01.2015)

Source: http://www.xe.com/currencytables/?from=USD&date=2015-01-27

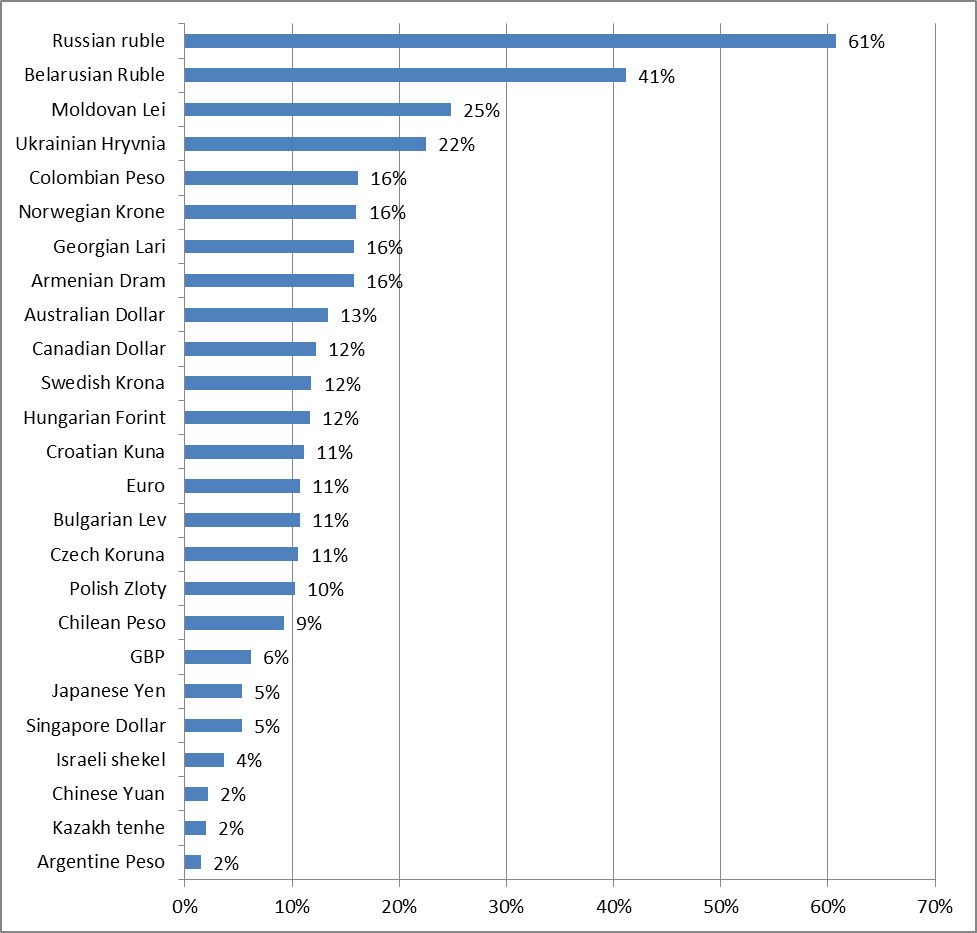

The information about the various currencies of the world, published by the Government of Georgia, does not specify the period of changes it describes; however, the numbers given in the published table correspond to the annual changes of the currencies with regard to USD. Hence, FactCheck looked into the exchange rates of the various currencies of the world during the past year. According to our study, GEL is one of the currencies which depreciated the least with regard to USD. It should be pointed out that the depreciation of GEL started from November 2014. FactCheck compared the changes in the various currencies of the world from November to January. GEL depreciated by 16% from November to the end of January and held the 5th to last position after the Russian, Belorussian, Moldovan and Ukrainian national currencies.

Chart 2: Changes in the various currencies of the world from November to January

Source: http://www.xe.com/currencytables/?from=USD&date=2015-01-27

Georgia has a floating exchange rate which means that the changes in the rate depend upon the ratio of GEL to USD and the supply and demand. Export of goods and services, foreign investments and money transfers are the main sources of foreign currency for Georgia. These sources have been declining since August 2014 and this has influenced the national currency. This was combined with the deficit spending of the State Budget of Georgia which increased the amount of GEL in the economy and caused a further depreciation of the currency. Hence, the depreciation of GEL was not only due to the global strengthening of USD.

As for the financial stability of the country, the International Monetary Fund published a report about Georgia’s financial stability as of October 2014. The report stated that the depreciation of GEL was the biggest threat to the financial stability of the country. Due to the high dollarisation of loans, the depreciation of GEL represents the biggest threat to the financial system of the country as the majority of long-term loans are in USD. The depreciation of GEL with regard to USD makes the loans more expensive for holders and hence increases the risk of insolvency. In addition, the depreciation of GEL increases the country’s external debts and makes it more expensive to service them. It should be noted that the amount of loans given to residents equalled USD 3.8 billion as of 1 November 2014 which, given the exchange rate at that moment (1.75), was GEL 6.6 billion. GEL depreciated by 4.7% with regard to USD from November to December which made the loans GEL 317 million more expensive in just a month. The country’s external debt also became more expensive. The amount of external debt was equal to USD 4.2 billion by the end of 2014 which, given the exchange rate at that moment (1.86), amounted to GEL 7.8 billion. GEL depreciated by 8.7% from December to February which increased the debt by GEL 677 million.

The National Bank of Georgia was forced to sell its official foreign currency reserves in order to support the exchange rate of GEL beginning in November 2013. Due to the selling of USD and the decline in the influx of USD from abroad, Georgia’s official foreign currency reserves decreased by 17% (USD 483 million) from November 2013 to January 2015. Foreign currency reserves are one of the significant factors for a country’s financial stability.

As we know, the growth rate of the Georgian economy decreased in 2013 and 2014. The tightened monetary policy, aimed to support the stabilisation of the national currency, will have a negative influence upon the country’s economic growth in the future. Hence, given the aforementioned factors, we can assume that the risks to Georgia’s financial stability have also increased.

As for the part of the statement that the depreciation of GEL will not cause prices to increase, FactCheck wrote about the issue earlier in the year. It should be taken into account that Georgia is dependent upon imports and the depreciation of its currency will make imported production more expensive. Prices have already started to rise due to the depreciation of GEL. Kaztransgaz stated the depreciation of GEL as the main reason for making natural gas more expensive for legal entities. The rising cost of natural gas for legal entities will, of course, influence the prices of local production. However, it should also be noted that there has been no significant increase in prices since November 2014 (when GEL started to depreciate).

Conclusion

Despite the fact that GEL depreciated less than some other currencies, stating that it is among the strongest currencies is incorrect as the changes in currency exchange rates were caused by different reasons in different countries. In addition, GEL started to depreciate with high rates from November 2014 and depreciated by 16% in just two months which is due more to internal factors than the global strengthening of USD. The risks to Georgia’s financial stability also increased at the end of 2014. As for prices, given the fact that Georgia is an import-dependant country, the depreciation of GEL causes the cost of imported goods to increase. The trend of a growth in prices is already visible; however, there has been no significant increase of prices so far.

Time will show how the situation develops in the future. At this stage, FactCheck limits itself to the analysis of the on-going trends and leaves the Prime Minister’s statement WITHOUT VERDICT.

"The financial stability of our country is not at risk. The depreciation of GEL will not cause a significant rise in prices."

18/02/2015

Without verdict

The verification of the application can not be evaluated